|

市場調查報告書

商品編碼

1550509

日本暖通空調:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Japan HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

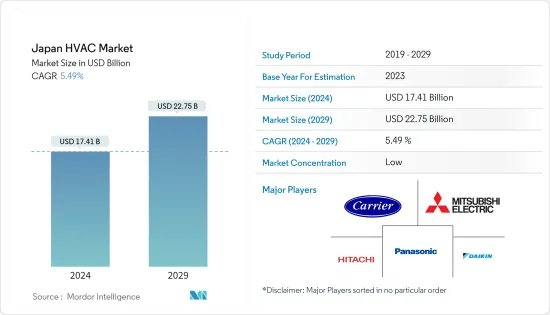

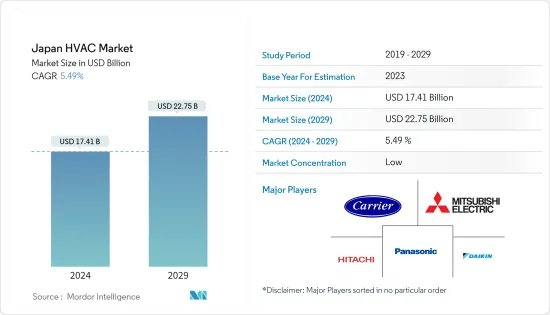

日本暖通空調市場規模預計到 2024 年為 174.1 億美元,預計到 2029 年將達到 227.5 億美元,在預測期內(2024-2029 年)複合年成長率為 5.49%。

主要亮點

- 暖通空調在各種環境中發揮重要作用,包括公寓、獨戶住宅、飯店和高級生活設施等住宅,以及醫院等大中型工業和辦公大樓。 HVAC 系統透過控制溫度和濕度並引入新鮮的室外空氣來幫助創造安全健康的環境。

- 日本暖通空調市場的成長主要受到快速工業化和都市化的推動。工業、商業和住宅建築的快速成長導致了暖通空調市場的巨大需求。

- 在日本,大量人口從農村遷移到都市區,導致住宅、商業建築和工業基礎設施投資增加。在新建築中安裝新的暖通空調設備的需求進一步推動了市場的成長。

- 在日本,資料中心等應用對液體冷卻系統的需求正在增加。該國資料中心的擴建預計將進一步推動對暖通空調設備和服務的需求。例如,2024年1月,亞馬遜網路服務公司計劃在2027年在日本投資152.4億美元,以加強在該地區的資料中心網路。亞馬遜子公司表示,基礎設施擴建將為日本國內生產總值毛額(GDP) 貢獻約 380 億美元。

- 暖通空調服務市場面臨勞動力短缺的顯著挑戰。然而,儘管存在這些障礙,由於製造商和其他服務提供者的積極措施,市場仍然蓬勃發展。

- 日本暖通空調市場較為分散,眾多廠商佔據了較小的市場佔有率。該行業的供應商專注於新產品開發、策略聯盟、收購和業務擴張,以滿足不斷成長的客戶需求,進一步推動市場成長。

- 例如,2024 年 6 月,開利公司宣布推出一種新的基於服務的舒適和能源解決方案模型。開利提供的「冷卻即服務」使客戶能夠獲得更高的性能和一致的付款,而不必面臨系統和設備採購的前期資本支出。這種創新的財務方法使客戶能夠專注於其核心業務,並利用航空公司的全面專業知識來確保舒適度和業務效率。

- 此外,日本的污染程度不斷上升,導致人們越來越重視環保建築。

- 日本的暖通空調市場深受宏觀經濟因素的影響,例如政府法規和鼓勵採用節能設備的新措施。例如,日本的目標是到2030年將溫室氣體排放減少46%,並承諾實現更雄心勃勃的減排50%的目標。

日本暖通空調市場趨勢

暖通空調設備佔據主要市場佔有率

- 對改善室內和室外空氣品質的日益成長的需求是推動日本暖通空調設備擴張的主要因素。人們越來越認知到空氣品質的重要作用,這促使住宅和企業主購買能夠有效過濾和淨化室內空氣並最大限度減少室外排放的暖通空調系統。

- 空氣調節機(AHU) 等通風系統經常用於大型設施,例如購物中心等大量人員經常進出的場所。此類設施必須遵守有關空氣品質和二氧化碳水平的嚴格規定。透過將室外空氣引入室內,空氣調節機可以有效減少大型設施中常用的多個鼓風機的需求。

- 熱泵是重要的暖通空調設備,透過冷凍循環將熱量從寒冷地區轉移到炎熱地區。結果,寒冷地區變冷,炎熱地區變暖。當溫度較低時,熱泵可以從外部環境吸收熱量來溫暖您的家,而當溫度較高時,熱泵可以將您家中的熱量排放室外。熱泵被認為比住宅替代供暖和製冷系統更節能,因為它們可以轉移熱量而不是產生熱量。

- 日本成員國報告也強調了日本熱泵的進展,並強調了旨在到 2050 年實現淨零排放的最新立法。政府已將工業高壓(IHP)和商務用及住宅熱泵熱水器(HPWH)作為脫碳的重要技術制定了具體目標,並正在積極推廣熱泵的使用。

- 空調(AC)市場預計住宅室內空調將出現成長,但要有效實現這一目標,迫切需要加速工業HP和HPWH的普及。因此,該國建設活動的活性化可能會推動暖通空調設備的採用。根據國土交通省統計,2023年日本啟動了約9,580個辦公大樓建設計劃,總占地面積與去年持平。

住宅領域佔據了很大的市場佔有率。

- 隨著人口從農村地區向城市中心遷移的增加,住宅開發正在迅速增加。因此,暖通空調設備的需求也受到直接影響。這些建築物需要有效的冷卻和空氣品管系統來適應不斷成長的城市人口。

- 據國土交通省稱,日本將於 2023 年開始建造約 819,600住宅。預計 2023 會計年度私部門住宅建設投資將增至 17.4 兆日圓。同樣,到 2023 會計年度,日本將建造約 366,800 套獨戶房屋住宅。

- 在日本的住宅領域,對空調和通風系統的需求正在增加。空調和通風系統透過過濾和通風在維持室內空氣品質方面發揮重要作用。空氣污染水平的上升和病毒的傳播正在推動對更先進的暖通空調系統的需求,以改善空氣品質。

- 住宅產業暖通空調設備的定期維護和修理增加了對家用暖通空調服務的需求,因為它確保了暖通空調系統的最佳性能。定期 HVAC 維護和維修的一項重要好處是能夠提高系統的效率。如果沒有適當的維護,系統可能會面臨營運挑戰,從而導致能源使用量增加和長期費用增加。隨著住宅領域對高效率實踐的需求不斷增加,對暖通空調服務的需求也將增加。

- 國內企業正致力於擴大其影響力,以佔領重要的市場佔有率,進一步推動市場成長。例如,大金工業株式會社於2023年8月宣布,將在茨城縣筑波未來市購買土地,建造新的空調製造工廠。這項策略性舉措將增強該公司的本地製造能力,並支持其擴大日本市場佔有率的目標。

日本暖通空調產業概況

日本暖通空調市場分散且由多個參與者組成。公司不斷努力透過推出新產品、擴大業務、進行策略併購、聯盟和合作來擴大市場佔有率。一些主要參與者包括開利公司、大金工業有限公司、三菱電機公司、日立有限公司和松下公司。

- 2024年5月,大金工業株式會社和工業鍋爐製造商三浦宣布了資本和業務聯盟的計畫。我們的目標是為全國工廠提案全面的解決方案,包括暖氣、通風、空調、蒸氣鍋爐、水處理系統。

- 2024 年 5 月,開利公司向日本推出了「Carrier AquaEdge 19DV」系列離心式冷凍,以擴展其大型設施的 HVAC 解決方案。這個新系列「AquaEdge 19DV」是日本流行的模組化冷卻器「Universal Smart X」系列的重要補充。 AquaEdge 19DV 系列專為滿足日本商業客戶的需求而設計,提供最先進且可靠的系統,確保效率和舒適度。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19副作用和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 政府支持法規,包括透過稅額扣抵計劃激勵節能

- 節能設備的需求增加

- 增加建設和維修活動以支持需求

- 市場挑戰

- 節能系統的初始成本較高

第6章 市場細分

- 依零件類型

- 暖通空調設備

- 加熱設備

- 空調/通風設備

- 暖通空調服務

- 暖通空調設備

- 按最終用戶產業

- 住宅

- 商業

- 工業的

第7章 競爭格局

- 公司簡介

- Johnson Controls International PLC

- Carrier Corporation

- Robert Bosch GmbH

- Daikin Industries Ltd

- Midea Group Co. Ltd

- System Air AB

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Danfoss A/S

- Lennox International Inc.

- Hitachi Ltd

- Panasonic Corporation

第8章投資分析

第9章市場的未來

The Japan HVAC Market size is estimated at USD 17.41 billion in 2024, and is expected to reach USD 22.75 billion by 2029, growing at a CAGR of 5.49% during the forecast period (2024-2029).

Key Highlights

- HVAC plays an essential role in various settings, including residential buildings like apartments, single-family homes, hotels, and senior living facilities, as well as in medium-to-large industrial and office structures such as hospitals. HVAC systems help create safe and healthy environments by controlling temperature and humidity and incorporating fresh outdoor air.

- Japan's HVAC market growth is primarily fueled by swift industrialization and urbanization. The surge in industrial, commercial, and residential building construction is leading to a substantial demand for the HVAC market.

- In Japan, a significant number of individuals have relocated from rural to urban areas, resulting in increased investments in housing, commercial construction, and industrial infrastructure. The need to install new HVAC equipment in newly constructed buildings further propels the market growth.

- Japan has been witnessing a demand for liquid cooling systems for applications such as data centers. The increasing expansion of data centers in the country will further drive the demand for HVAC equipment and services. For instance, in January 2024, Amazon Web Services Inc. plans to invest USD 15.24 billion in Japan by 2027 to enhance its local data center network. The expansion of infrastructure is expected to contribute approximately USD 38 billion to Japan's gross domestic product, as stated by the Amazon.com Inc. subsidiary.

- The HVAC services market has seen a notable challenge in the form of a labor shortage. Nevertheless, despite these obstacles, the market has thrived thanks to the proactive measures taken by manufacturers and other service providers.

- The HVAC market in Japan is fragmented, with a large number of players occupying a small market share. Vendors operating in the industry are focusing on new product development, strategic partnership, acquisition, and expansion to meet the rising customer demand, further supporting the market growth.

- For instance, in June 2024, Carrier Corporation announced the launch of a new service-based model for comfort and energy solutions. Carrier's cooling-as-a-service offering enables customers to secure extended performance and consistent payments instead of facing an initial capital expense for system or equipment acquisitions. This innovative financial approach empowers customers to concentrate on their primary operations, leveraging Carrier's comprehensive expertise to ensure comfort and operational effectiveness.

- Additionally, the rising pollution levels in Japan are driving the nation to enhance its emphasis on eco-friendly buildings, potentially opening up numerous opportunities for businesses to invest and grow in the Japanese HVAC market.

- The HVAC market in Japan is highly affected by macroeconomic factors such as government regulations and new initiatives to boost the adoption of energy-efficient equipment. For instance, Japan aims to cut its greenhouse gas emissions by 46% by 2030, steadfastly committed to achieving an even more ambitious 50% reduction.

Japan HVAC Market Trends

HVAC Equipment Holds Significant Market Share

- The increasing need for better indoor and outdoor air quality is a major factor fueling the expansion of HVAC equipment in Japan. Growing recognition of the crucial role of air quality encourages homeowners and business owners to purchase HVAC systems that can effectively filter and purify indoor air and minimize outdoor emissions.

- Ventilation systems, such as air handling units (AHUs), are frequently utilized in spacious establishments that numerous individuals, such as shopping centers, frequently access. These establishments are required to adhere to strict regulations concerning air quality and CO2 levels. By introducing outside air into the rooms, air handling units can effectively decrease the necessity for multiple blower fans typically used in large facilities.

- Heat pumps are essential HVAC equipment that moves heat from a colder area to a hotter area through a refrigeration cycle. This results in cooling the colder area and warming the hotter area. During colder temperatures, a heat pump is able to draw heat from the external environment to warm a home, whereas during hotter temperatures, it can expel heat from the house to the outdoors. Heat pumps are considered more energy-efficient than alternative heating or cooling systems for residential use, considering the capability of heat pumps to transfer heat rather than produce it.

- The Japan Member Country Report also focused on the advancement of heat pumps in Japan, highlighting the latest legislation targeting 2050 net zero. The government is actively promoting the use of heat pumps by setting specific targets for industrial HPs (IHP) and commercial and household heat pump water heaters (HPWH) as crucial technologies for decarbonization.

- Although the air conditioners (AC) market will witness growth in residential room ACs, there is a pressing need for accelerated deployment of industrial HPs and HPWHs to effectively achieve the outlined goals. Thus, the growing construction activities in the country will propel the adoption of HVAC equipment. According to MLIT (Japan), in 2023, Japan initiated approximately 9,580 office construction projects, the total floor area of which remained consistent with the previous year.

Residential Segment Holds Significant Market Share

- The rise in rural populations moving to urban centers has resulted in a surge in the development of residential structures. Consequently, there has been a direct impact on the need for HVAC equipment, as these buildings necessitate effective cooling and air quality management systems to cater to the expanding urban populace.

- According to MLIT Japan, in 2023, approximately 819.6 thousand housing units were initiated in Japan. Residential construction investment by the private sector was forecasted to increase to JPY 17.4 trillion in fiscal year 2023. Similarly, in Japan, construction began on approximately 366.8 thousand detached houses in 2023.

- The demand for air conditioning and ventilation systems in Japan's residential sector is increasing. AC and ventilation systems play a crucial role in preserving indoor air quality using filtration and ventilation. The rising levels of air pollution and the spread of viruses drive the need for more advanced HVAC systems to deliver improved air quality.

- Regular maintenance and repairs of the HVAC equipment in the residential industry guarantee peak performance of HVAC systems, thus increasing demand for HVAC services in the country. One key benefit of routine HVAC upkeep and repairs is the capacity to enhance the system's effectiveness. In the absence of proper maintenance, the system could encounter operational challenges, leading to heightened energy usage and greater expenses over time. With the growing demand for efficient practices in the residential sector, the requirement for HVAC services will also grow.

- The players in the country are focusing on expanding their presence to capture a significant market share, further supporting the market growth. For instance, in August 2023, Daikin Industries Ltd announced that it would purchase land in Tsukubamirai City, Ibaraki Prefecture, Japan, to create a new manufacturing facility for air conditioners. This strategic move will enhance the company's local production capabilities and support its goal of expanding its presence in the Japanese market.

Japan HVAC Industry Overview

The Japanese HVAC market is fragmented and consists of several players. Companies continuously try to increase their market presence by introducing new products, expanding their operations, or entering strategic mergers and acquisitions, partnerships, and collaborations. Some of the major players include Carrier Corporation, Daikin Industries Ltd, Mitsubishi Electric Corporation, Hitachi Ltd, Panasonic Corporation, and many more.

- May 2024: Daikin Industries Ltd and Miura Co. Ltd, an industrial boiler manufacturer, revealed their plans to establish a capital and business alliance. This collaboration aims to offer comprehensive solution proposals encompassing heating, ventilation, air conditioning, steam boilers, and water treatment systems for factories throughout Japan.

- May 2024: Carrier Corporation introduced the Carrier AquaEdge 19DV centrifugal chiller series in Japan, expanding its HVAC solutions for large-scale facilities. This new series, AquaEdge 19DV, will be a valuable addition to the popular Universal Smart X series of modular chillers in Japan. The AquaEdge 19DV series is designed to meet the demands of commercial customers in Japan, providing a cutting-edge and reliable system that guarantees both efficiency and comfort.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs

- 5.1.2 Increasing Demand For Energy Efficient Devices

- 5.1.3 Increased Construction And Retrofit Activity To Aid Demand

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Energy Efficient Systems

6 MARKET SEGMENTATION

- 6.1 By Type of Component

- 6.1.1 HVAC Equipment

- 6.1.1.1 Heating Equipment

- 6.1.1.2 Air Conditioning /Ventilation Equipment

- 6.1.2 HVAC Services

- 6.1.1 HVAC Equipment

- 6.2 By End-user Industry

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Johnson Controls International PLC

- 7.1.2 Carrier Corporation

- 7.1.3 Robert Bosch GmbH

- 7.1.4 Daikin Industries Ltd

- 7.1.5 Midea Group Co. Ltd

- 7.1.6 System Air AB

- 7.1.7 LG Electronics Inc.

- 7.1.8 Mitsubishi Electric Corporation

- 7.1.9 Danfoss A/S

- 7.1.10 Lennox International Inc.

- 7.1.11 Hitachi Ltd

- 7.1.12 Panasonic Corporation