|

市場調查報告書

商品編碼

1550521

智慧車庫門開啟器和控制器:市場佔有率分析、行業趨勢和成長預測(2024-2029)Smart Garage Door Opener And Controller - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

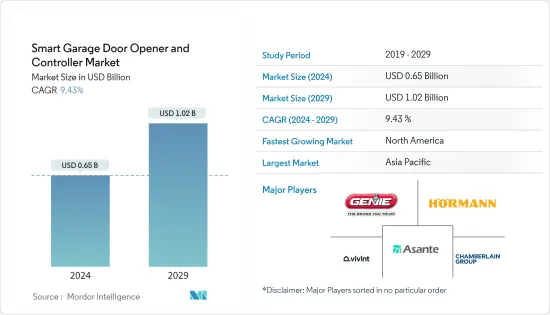

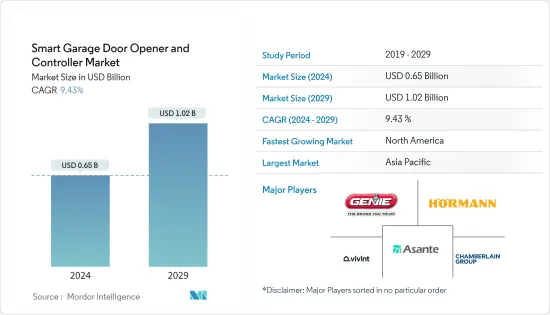

智慧車庫門開啟器和控制器的市場規模預計到2024年為6.5億美元,預計到2029年將達到10.2億美元,在預測期內(2024-2029年)複合年成長率為9.43,預計將成長%。

主要亮點

- 智慧車庫門開啟器和控制器市場正在迅速發展,推出了優先考慮便利性和安全性的先進解決方案。這些智慧型設備利用最新技術,允許用戶使用語音命令和智慧型手機應用程式遠端監控和控制車庫門。這些創新憑藉智慧家庭系統的自動調度和即時狀態通知等功能,正在改變傳統的車庫存取方式。

- 鑑於不斷成長的需求和積極的市場前景,全球供應商正在創新並推出新型智慧車庫門開啟器和控制器,推動市場成長。例如,2024 年 4 月,Nice 推出了 Nice Linear 661 車庫開門器和先進的 Nice GO 行動應用程式。這樣的推出為用戶提供了先進的遠端系統管理功能和預先安裝的備用電池,簡化了零售安裝。由於這些進步,住宅可以輕鬆地將任何車庫遷移到智慧系統,以增加便利性和安心感。

- 智慧車庫門開啟器和控制器通常需要專業安裝,因為它們具有專門的組件和先進的功能。這需要大量資金,給精打細算的消費者和關心投資回報的消費者帶來了挑戰。為了獲得這些智慧型設備的更廣泛接受,製造商和服務供應商面臨著平衡先進技術整合與有競爭力的價格的挑戰。

智慧車庫門開啟器和控制器市場趨勢

住宅行業預計將顯著成長

- 住宅領域自動化和便利性的上升趨勢正在推動智慧車庫開門器和門控制器市場的擴張。隨著消費者尋求簡化生活的解決方案,智慧車庫門開啟器和控制器提供了一種透過智慧型手機操作車庫門的簡單方法,並無縫整合到更廣泛的智慧家庭系統中。此外,智慧車庫門開啟器和控制器可提高能源效率並增加財產價值。由於人們對這些設備優勢的認知不斷增強以及智慧家庭趨勢的不斷發展,智慧車庫門開啟器和控制器的市場預計將大幅成長。

- 住宅的安全意識越來越強,要求系統能夠監控車庫門、提供即時警報並允許遠端控制。智慧車庫門開啟器和控制器通常具有運動偵測、自動關閉和安全攝影機整合等功能,這使得它們對於住宅應用極為重要。隨著住宅擴大採用智慧家庭技術,將智慧車庫門開啟器和控制器整合到集中式智慧家居系統中變得非常重要,從而推動了所研究市場的需求。

- 在競爭激烈的住宅房地產市場中,智慧家庭功能,包括智慧車庫門開啟器和控制器,正在成為一個賣點。具有先進技術功能的智慧家庭可以吸引精通技術的買家並獲得更高的價格,這促使當今的住宅投資於這些升級。據聯邦統計局稱,2023年德國將建造約700萬平方公尺的住宅。

- 智慧車庫門開啟器和控制器為具有增強功能和特性的創新解決方案鋪平了道路。例如,一些公司正在開發智慧車庫門系統,可以與其他連網家庭設備(例如安全系統和視訊門鈴)無縫整合。隨著語音助理變得越來越普遍,人工智慧理解上下文和微妙之處的能力不斷提高,住宅很快就能夠使用複雜的語音命令與智慧車庫門互動。透過這種演變,我們相信可以像與人交談一樣互動,而不僅僅是發出標準命令。

亞太地區預計將佔據主要市場佔有率

- 亞太地區智慧家居產業的快速成長歸功於技術進步和消費者知識的增加。隨著消費者對智慧家庭設備的了解越來越多,他們對提供便利和安全的整合系統越來越感興趣,例如智慧車庫門開啟器和控制器。某些型號的智慧車庫門迎合了使用再生能源來源優先考慮環境的住宅。太陽能選項提供了永續、環保且高效的選項,且不會犧牲性能或連接性。

- 在亞太地區人口稠密的都市區,住宅安全日益受到關注。智慧車庫門開啟器和控制器提供增強的安全功能,對住宅來說變得越來越重要。在財產犯罪嚴重的國家,這種需求非常強勁,推動了智慧車庫門開啟器和控制器解決方案的採用。根據新加坡統計局的數據,新加坡入室盜竊及相關犯罪從前一年的 163 起增加到 2023 年的 191 起。

- 此外,由於知名製造商的進入、強大的分銷網路以及研發方面的大量投資,智慧車庫門開啟器和控制器市場正在不斷成長。智慧車庫門開啟器和控制器的實惠價格和有利的經濟狀況增加了其在亞太地區廣泛客戶群的覆蓋範圍,這也推動了市場擴張。

- 亞太地區多個政府正在推動智慧城市計劃,包括開發智慧住宅。例如,中國和印度的智慧城市計劃旨在將先進技術融入城市生活,包括採用智慧家庭設備。這些重要措施正在為智慧車庫門開啟器和控制器市場的顯著成長創造有利的環境。據 IBEF 稱,截至 2024 年 2 月,印度智慧城市使命的總投資約為 7,200 億盧比(864.3 億美元)。

智慧車庫門開啟器和控制器產業概述

智慧車庫門開啟器和控制器市場擁有多元化的參與者,包括以下主要參與者:Asante Inc.、Hormann Group、Vivint Inc.、Marantec Marienfeld GmbH & Co. KG 和 The Chamberlain Group LLC。這些主要企業利用夥伴關係、合併、創新、投資和收購等策略來擴大其產品範圍並確保持久的競爭優勢。

- 2024 年 6 月,Crestron Home 和 Chamberlain Group (CG) 宣布了一項新的整合,允許住宅直接從 Crestron Home 平台管理 CG 的 myQ 智慧門禁解決方案。 myQ 將任何車庫變成智慧車庫,讓使用者幾乎可以在任何地方打開、關閉和控制車庫門。該應用程式提供即時警報,當您的車庫門打開、您不小心讓它打開等等時,會通知您。

- 2023年10月,張伯倫集團與一家汽車製造商合作推出創新的智慧車庫技術。該公司擁有多個品牌,旨在徹底改變人們進入家用、社區、辦公室和場所的方式。張伯倫集團與本田合作推出了一項名為 myQ 連網型 Garage 的新車載功能。這項新功能允許駕駛員使用汽車儀表板上的顯示器遠端開啟、關閉和監控車庫門。 myQ連網型車庫技術旨在與目前流通的超過 600 萬輛本田和謳歌汽車以及市場上的大多數車庫門開啟器配合使用。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19副作用和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 藍牙、Wi-Fi 和其他無線技術等連接技術的進步

- 擴大智慧家庭科技的採用

- 市場限制因素

- 複雜的安裝和相容性問題

第6章 市場細分

- 按類型

- 無線網路基地

- 基於藍牙

- 基於RFID

- 按用途

- 住宅領域

- 商業領域

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- The Genie Company

- Hormann Group

- Vivint, Inc.

- Asante Inc.

- The Chamberlain Group LLC

- Marantec Marienfeld GmbH & Co. KG

- Nexx Garage

- Raynor Garage Doors Inc.

- Skylinkhome Inc.

- Sommer Drive and Radio Technology GmbH

- Konnected Inc.

- Ryobi Tools Inc.

- Meross Technology Limited

- Craftsman Inc.

- Somfy Inc.

- Tuya Inc.

- Came Inc.

- Ryterna Inc.

- Skyline Security Management LLC

- Automatic Technology Pty Ltd

第8章投資分析

第9章市場的未來

The Smart Garage Door Opener And Controller Market size is estimated at USD 0.65 billion in 2024, and is expected to reach USD 1.02 billion by 2029, growing at a CAGR of 9.43% during the forecast period (2024-2029).

Key Highlights

- The market for smart garage door openers and controllers is advancing swiftly, introducing advanced solutions prioritizing convenience and security. Leveraging the latest technology, these smart devices enable users to monitor and control garage doors remotely, utilizing either voice commands or smartphone applications. These innovations are transforming the conventional approach to garage access by boasting features such as automated scheduling and real-time status notifications with smart home systems.

- In light of rising demand and a positive market outlook, global vendors are innovating and launching new smart garage door openers and controllers, driving market growth. For instance, in April 2024, Nice introduced the Nice Linear 661 Garage Door Opener and the advanced Nice G.O. mobile app. Such introductions equip users with advanced remote management capabilities and a pre-installed battery backup, simplifying dealer installations. Thanks to these advancements, homeowners can easily transition any garage to a smart system, ensuring added convenience and peace of mind.

- Smart garage door openers and controllers, equipped with specialized components and advanced features, often necessitate professional installation. This can lead to a significant financial commitment, posing a challenge for budget-conscious consumers or those wary of their return on investment. To promote broader acceptance of these smart devices, manufacturers and service providers face the challenge of balancing advanced technology integration with competitive pricing.

Smart Garage Door Opener and Controller Market Trends

Residential Sector is Expected to Witness a Significant Growth

- The growing trend of automation and convenience in the residential sector is propelling the expansion of the smart garage opener and door controller market. As consumers seek solutions to simplify their lives, smart garage door openers and controllers provide an easy means to operate garage doors through smartphones, seamlessly integrating into broader smart home systems. Moreover, smart garage door openers and controllers enhance energy efficiency and boost property value. With rising awareness of the advantages of these devices and the growing trend of smart homes, the market for smart garage door openers and controllers is poised for substantial growth.

- Homeowners are becoming more security-conscious, demanding systems that can monitor and provide real-time alerts and control garage doors remotely. Smart garage door openers and controllers often come with features like motion detection, automatic closing, and integration with security cameras, making them crucial in residential use. As homeowners increasingly adopt smart home technologies, integrating smart garage door openers and controllers into a centralized home automation system becomes significant, thus driving the demand for the market studied.

- In the competitive residential real estate market, smart home features, including smart garage door openers and controllers, are becoming selling points. Smart homes with advanced technological features attract tech-savvy buyers and can command higher prices, driving current homeowners to invest in such upgrades. According to the Federal Statistical Office, in 2023, Germany constructed nearly 7 million square meters of residential buildings.

- Smart garage door openers and controllers pave the way for innovative solutions, boasting enhanced capabilities and features. For instance, certain companies are developing smart garage door systems that seamlessly integrate with other connected home devices, such as security systems and video doorbells. As voice assistants become more prevalent and AI enhances its ability to grasp context and subtleties, homeowners will soon engage with smart garage doors using sophisticated voice commands. This evolution will enable interactions that feel more like conversing with a person than merely giving standard commands.

Asia Pacific Is Expected to Hold a Significant Market Share

- The rapid growth of the smart home industry in Asia-Pacific is attributed to advancements in technology and increasing consumer knowledge. As consumers' awareness of smart home devices rises, there is a growing interest in integrated systems that provide convenience and security, such as smart garage door openers and controllers. Some intelligent garage door models cater to homeowners who prioritize the environment using renewable energy sources. Solar-powered choices offer a sustainable, eco-friendly, efficient option without sacrificing performance or connectivity features.

- There is a heightened focus on residential security in densely populated urban areas of Asia-Pacific. Smart garage door openers and controllers offer enhanced security features, becoming increasingly important to homeowners. This demand is robust in countries where property crime is a concern, driving the adoption of smart garage door openers and controller solutions. According to the Singapore Department of Statistics, housebreaking and related crimes in Singapore rose to 191 cases in 2023, up from 163 cases in the previous year.

- Moreover, the smart garage door opener and controller market has experienced growth due to the participation of well-known manufacturers, a robust distribution network, and substantial investments in R&D (research and development). The affordability of smart garage door openers and controllers and favorable economic conditions have increased accessibility for a broader range of customers in the Asia-Pacific region, which has also fueled market expansion.

- Several governments in Asia-Pacific are promoting smart city initiatives, including developing smart residential areas. For instance, China's and India's smart city projects aim to integrate advanced technology into urban living, including adopting smart home devices. These crucial initiatives are creating a favorable environment for the significant growth of the smart garage door opener and controller market. According to IBEF, as of February 2024, the total investments allocated for the Smart City Mission in India amounted to around INR 7,20,000 crore (USD 86.43 billion).

Smart Garage Door Opener And Controller Industry Overview

The smart garage door opener and controller market features a diverse array of players, including significant players such as Asante Inc., Hormann Group, Vivint Inc., Marantec Marienfeld GmbH & Co. KG, and The Chamberlain Group LLC. These key players are leveraging strategies like partnerships, mergers, innovations, investments, and acquisitions to broaden their product offerings and secure a lasting competitive edge.

- In June 2024, Crestron Home and Chamberlain Group (CG) announced a new integration, enabling homeowners to manage CG's myQ smart access solution directly from the Crestron Home platform. With the official myQ driver for Crestron Home OS, users can control myQ-powered garage door and gate openers. myQ transforms any garage into a smart garage, allowing users to open, close, and manage access to their garage door from virtually anywhere. The app offers real-time alerts, notifying users when the garage door opens, if it was inadvertently left open, and even allows scheduling for the door to close at a specific time each night.

- In October 2023, Chamberlain Group partnered with auto manufacturers to introduce innovative smart garage technology. The company owns various brands and aims to revolutionize how people enter their homes, neighborhoods, offices, and establishments. In a joint effort with Honda, Chamberlain Group unveiled its new in-vehicle feature, myQ Connected Garage. This new feature enables drivers to remotely open, close, and monitor the garage doors using vehicle dashboard display screens. The myQ Connected Garage technology is designed to be compatible with over 6 million Honda and Acura vehicles currently in circulation and with most garage door openers available in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advancements in Connectivity like Bluetooth, Wi-Fi, and Other Wireless Technologies

- 5.1.2 The Growing Adoption of Smart Home Technology

- 5.2 Market Restraint

- 5.2.1 Complex Installation and Compatability Issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Wi-Fi Based

- 6.1.2 Bluetooth Based

- 6.1.3 RFID Based

- 6.2 By Application

- 6.2.1 Residential Sector

- 6.2.2 Commercial Sector

- 6.2.3 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 The Genie Company

- 7.1.2 Hormann Group

- 7.1.3 Vivint, Inc.

- 7.1.4 Asante Inc.

- 7.1.5 The Chamberlain Group LLC

- 7.1.6 Marantec Marienfeld GmbH & Co. KG

- 7.1.7 Nexx Garage

- 7.1.8 Raynor Garage Doors Inc.

- 7.1.9 Skylinkhome Inc.

- 7.1.10 Sommer Drive and Radio Technology GmbH

- 7.1.11 Konnected Inc.

- 7.1.12 Ryobi Tools Inc.

- 7.1.13 Meross Technology Limited

- 7.1.14 Craftsman Inc.

- 7.1.15 Somfy Inc.

- 7.1.16 Tuya Inc.

- 7.1.17 Came Inc.

- 7.1.18 Ryterna Inc.

- 7.1.19 Skyline Security Management LLC

- 7.1.20 Automatic Technology Pty Ltd