|

市場調查報告書

商品編碼

1624587

氯:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Chlorine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

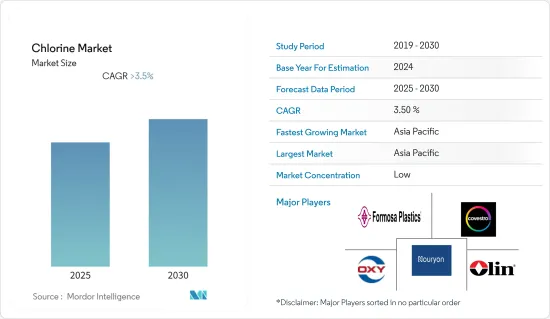

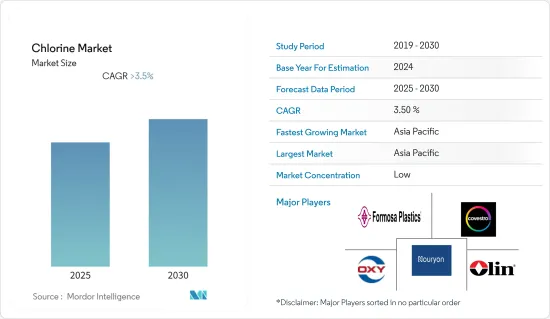

預計氯市場在預測期內的年複合成長率將超過 3.5%。

在 COVID-19 爆發期間,世界許多地區發生了封鎖,製造活動和供應鏈中斷、生產停頓和勞動力供應對染料和顏料市場產生了負面影響。然而,情況在 2021 年開始改善,市場成長軌跡可能會在預測期內恢復。

主要亮點

- 中期來看,醫藥和農化行業需求的增加以及建設產業對PVC需求的增加是市場成長的主要驅動力。

- 然而,政府對氯的使用的嚴格規定預計將阻礙市場成長。

- 污水產業需求的增加可能為該產業創造機會。

- 亞太地區主導全球市場,其中中國和印度的消費量最高。

氯氣市場趨勢

PVC需求增加

- 聚氯乙烯(PVC) 廣泛應用於建築、建築和基礎設施領域。聚合物通常部分或全部用於建築物和公共事業。它實用化屋頂、牆板、密封件、管道系統、塗料和許多其他產品。

- PVC有兩種類型:硬樹脂和軟樹脂。硬質樹脂提供了大部分成長機會,主要最終用途是配件、管道和配件、窗戶、柵欄、屋頂瓦和汽車零件。軟PVC用於薄膜、片材、地板材料、電線電纜覆蓋物、合成革製品、淋浴設備等。 EDC 在金屬清洗、紡織和黏合劑產業中用作溶劑。

- EDC和PVC的製造過程需要大量的氯作為原料。根據 Euro Chlor 的數據,2022 年 6 月歐洲氯產量為 682,760 噸。 2022年6月日均產量為22,759噸,較上季下降5.7%,較2021年6月下降15.3%。

- 灌溉、水和衛生管理、建築、交通、電力和零售等領域的大規模投資仍在繼續。 PVC 透過電線電纜、管道、木質 PVC複合材料和防水膜等多種產品,在這些行業的永續管理中發揮重要作用。

- 2021年3月,中國公佈了五年污水藍圖,目標是新增2,000萬立方公尺/日的污水處理能力。中國也將在未來七年內將必須經過處理才能達到可重複使用標準的污水比例提高到25%。

- 此外,全球不斷成長的「綠色建築」趨勢比以往任何時候都更鼓勵PVC在建築領域的使用。因此,隨著建設活動的增加,聚氯乙烯的使用量預計在預測期內將會增加。

- 聚氯乙烯需求的增加預計將推動氯的需求。這可能有利於預測期內的氯市場。

亞太地區主導市場

- 亞太地區主導全球市場。中國和印度等國家的都市化不斷加快以及對淡水的需求導致氯的使用量增加。

- 印度擁有2.4%的土地和4%的水資源,養活了全球近18%的人口。最近農產品品質的下降引發了人們對農業永續性的嚴重質疑。為了解決這個問題,人們正在努力透過將 PVC 管道引入田間灌溉系統來提高土地生產力和供應鏈效率(同時減少碳足跡)。

- 此外,氯主要用於水處理。在水中添加氯或氯化合物(例如次氯酸鈉)的過程稱為水氯化。此方法用於去除水中的細菌、病毒和其他微生物。氯化對於預防霍亂、痢疾和傷寒等水傳播感染疾病的傳播特別有效。

- 2022年7月,金邊水務局局長羅恩‧納羅宣布,巴辰水質淨化廠第一階段興建已完成66%,預計2023年完工。該處理廠每天處理水量為39萬立方公尺。

- 印度包裝產業是成長最快的產業之一,對所有產業都有直接和間接的影響。由於都市化、人均收入增加和勞動力不斷成長,包裝食品的支出不斷增加。

- 根據印度包裝工業協會(PIAI)統計,過去十年印度的包裝消費量增加了200%,從每人每年4.3公斤增加到8.6公斤。這清楚地表明該市場滲透率不足,並為印度塑膠行業帶來了巨大的商機。

- 總體而言,氯市場儘管受到 2020 年 COVID-19 疫情的影響,但預計在預測期內將出現健康成長。

氯工業概述

氯市場部分分散,由少數參與者主導。這些主要企業包括奧林公司、西方石油公司、科思創公司、台塑公司、諾力昂等。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 製藥和農化產業的需求增加

- 各行業PVC需求增加

- 抑制因素

- 嚴格的政府法規

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 技術簡介

- 進出口趨勢

- 價格趨勢

第5章市場區隔:市場規模(數量/金額)

- 目的

- EDC/PVC

- 異氰酸酯和含氧化合物

- 氯甲烷

- 溶劑和環氧氯丙烷

- 無機化學品

- 其他用途

- 最終用戶產業

- 水處理

- 藥品

- 化學品

- 紙/紙漿

- 塑膠

- 農藥

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ANWIL SA(PKN ORLEN SA)

- Covestro AG

- Ercros SA

- Formosa Plastics Corporation

- Hanwha Solutions/Chemical Corporation

- INEOS

- Kem One

- Nouryon

- Occidental Petroleum Corporation

- Olin Corporation

- Spolchemie

- Tata Chemicals Limited

- Tosoh USA, Inc.

- Westlake Vinnolit GmbH & Co KG

- Vynova Group

第7章 市場機會及未來趨勢

- 污水產業的需求增加

The Chlorine Market is expected to register a CAGR of greater than 3.5% during the forecast period.

During the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, production halts, and labor unavailability negatively impacted the dyes and pigment market. However, in 2021 the conditions started recovering, which will likely restore the market's growth trajectory during the forecast period.

Key Highlights

- Over the medium term, the rising demand from the pharmaceutical and agrochemical industries and the increasing demand for PVC from the construction industry are the major driving factors augmenting the growth of the market studied.

- However, stringent government regulations on the use of chlorine are expected to hinder the market's growth.

- Increasing demand from the wastewater industry may create opportunities in the industry.

- Asia-Pacific dominates the market across the world, with the largest consumption from China and India.

Chlorine Market Trends

Increasing Demand for PVC

- Polyvinyl chloride (PVC) is widely used in construction, building, and infrastructure. Construction and utility parts in buildings are often partly or completely polymeric. This can be implemented as roofing materials, wall panels, seals, piping systems, coatings, and many other products.

- There are two types of PVC, namely, rigid resins and flexible resins. Rigid resins provide most of the growth opportunities, with major end uses being fittings, pipe and fittings, windows, fencing, roof tiles, and automobile parts. Flexible PVC finds outlets in film and sheets, flooring, wire and cable coating, synthetic leather products, and shower curtains. EDC is used as a solvent in the metal cleaning, textile, and adhesives industries.

- A large amount of chlorine is required as a raw material in the manufacturing process of EDC and PVC. According to Euro Chlor, in June 2022, European chlorine production stood at 682,760 tons. The average daily production in June 2022 was 22,759 tons, which was 5.7% lower than in the previous month and 15.3% lower than in June 2021.

- Large investments in sectors, such as irrigation, water and sanitation management, building and construction, transport, power, retail, etc., continue to be made. PVC plays an important role in the sustainable management of these sectors through various products, like wires and cables, pipes, wood PVC composites, and waterproofing membranes.

- In March 2021, China disclosed its five-year wastewater roadmap that targets the development of 20 million m3/d of additional wastewater treatment capacity. China has also raised the proportion of sewage water that must be treated to comply with reusable standards to 25% over the next seven years.

- Also, the growing trend of 'green construction' across the world is encouraging the usage of PVC in the construction sector more than ever. Thus, with the increase in construction activities, the usage of PVC is expected to increase during the forecast period.

- The rising demand for polyvinyl chloride is expected to boost the demand for chlorine. This, in turn, shall benefit the market for chlorine during the forecast period.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global market share. With the growing urbanization and the increasing need for fresh water in countries such as China and India, the usage of chlorine is increasing in the region.

- With 2.4% land and 4% water resources, India supports nearly 18% of the world's population. Lately, the dwindling quality of agricultural products has raised serious questions on the sustainability of the agricultural practice. To counter the problem, efforts have been made to improve the land's productivity and increase the efficiency of the supply chain (while reducing the carbon footprint) by implementing PVC pipes in field irrigation systems.

- Moreover, chlorine is majorly used for water treatment. The process of adding chlorine or chlorine compounds to water, such as sodium hypochlorite, is known as water chlorination. In order to kill bacteria, viruses, and other microbes in water, this method is used. Chlorination is particularly useful in preventing the spread of waterborne diseases like cholera, dysentery, and typhoid.

- In July 2022, the Director General of the Phnom Penh Water Supply Authority, Long Naro, announced that the construction of the 1st phase of the Bak Kheng water treatment plant has reached 66% completion and is likely to finish by 2023. This plant will have the capacity for treating 390,000 cubic meters of water each day.

- The packaging industry in India is one of the fastest-growing industries, with direct or indirect influence on all industries. The spending on packaged foods is increasing due to urbanization, increase in per capita income, and the growing number of workforces.

- According to the Packaging Industry Association of India (PIAI), the packaging consumption in India has increased by 200% in the past decade, rising from 4.3 kg per person per annum (pppa) to 8.6 kg pppa. This clearly indicates that the market is underpenetrated and offers a great business opportunity for the Indian plastics industry.

- Overall, the market for chlorine is projected to witness healthy growth in the country over the forecast period, even though the market remained affected in 2020 due to the COVID-19 outbreak.

Chlorine Industry Overview

The chlorine market is partially fragmented and dominated by very few players. These major players include Olin Corporation, Occidental Petroleum Corporation, Covestro AG, Formosa Plastic Corporation, and Nouryon, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Pharmaceutical and Agrochemical Industries

- 4.1.2 Increasing Demand for PVC from Various Sectors

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

- 4.6 Import and Export Trends

- 4.7 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume and Value)

- 5.1 Application

- 5.1.1 EDC/PVC

- 5.1.2 Isocyanates and Oxygenates

- 5.1.3 Chloromethanes

- 5.1.4 Solvents and Epichlorohydrin

- 5.1.5 Inorganic Chemicals

- 5.1.6 Other Applications

- 5.2 End-user Industry

- 5.2.1 Water Treatment

- 5.2.2 Pharmaceutical

- 5.2.3 Chemicals

- 5.2.4 Paper and Pulp

- 5.2.5 Plastic

- 5.2.6 Pesticides

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ANWIL SA (PKN ORLEN SA)

- 6.4.2 Covestro AG

- 6.4.3 Ercros SA

- 6.4.4 Formosa Plastics Corporation

- 6.4.5 Hanwha Solutions/Chemical Corporation

- 6.4.6 INEOS

- 6.4.7 Kem One

- 6.4.8 Nouryon

- 6.4.9 Occidental Petroleum Corporation

- 6.4.10 Olin Corporation

- 6.4.11 Spolchemie

- 6.4.12 Tata Chemicals Limited

- 6.4.13 Tosoh USA, Inc.

- 6.4.14 Westlake Vinnolit GmbH & Co KG

- 6.4.15 Vynova Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from the Wastewater Industry