|

市場調查報告書

商品編碼

1626293

拉丁美洲防爆設備:市場佔有率分析、產業趨勢與成長預測(2025-2030)LA Explosion-Proof Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

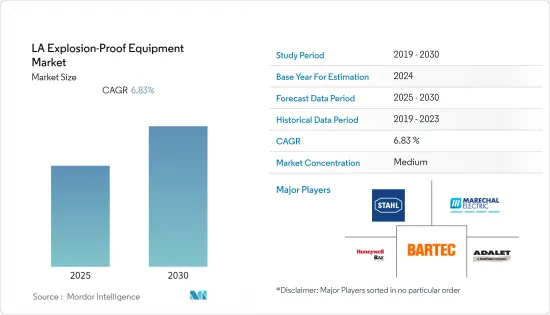

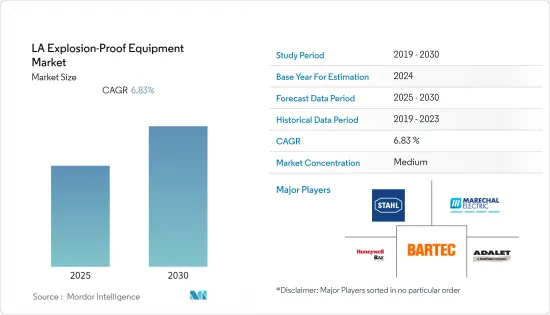

拉丁美洲防爆設備市場預計在預測期內複合年成長率為6.83%

主要亮點

- 防爆設備是指能夠防止爆炸並承受爆炸的電氣和非電氣設備。防爆設備包含能夠承受其中可能發生的某些氣體或蒸氣爆炸的設備。

- 防爆設備應用於多種行業,包括航太和飛機維修場所、建築工地、暖通空調系統、製造和加工設備、採礦領域以及石油和天然氣開採領域。照明、監控、訊號系統等是每個行業中最受歡迎的設備。

- 化學品、有毒油漆和其他易燃粉塵的存在不斷增加,導致各地區製造業極端環境的爆炸次數增加。

- 採礦業經常發生災難性傷害,造成生命、財產損失,甚至死亡。儘管近年來由於危險區域安全設備的使用增加,採礦業的事故有所減少,但仍發生大量火災和爆炸,特別是在製造業。

- 不斷成長的能源需求是推動新礦山和油氣資源探勘需求的主要因素,因此需要安全的設備。

拉丁美洲防爆設備市場趨勢

防爆佔據很大佔有率

- 隨著工業事故和礦井爆炸的增加,監管機構開始實施更嚴格的規定,以確保工人安全並防止空氣損害。石油和頁岩蘊藏量通常發現於北極圈等生態學敏感地區。巴西等國家新石油蘊藏量的發現預計將推動防爆設備市場的發展。

- 環境保護是一個高度優先的問題,各國政府都意識到了這個問題。因此,政府制定了法規,特別是在石油和天然氣探勘行業。

- 當可以在設備上隔離或添加某些部件而不影響設備的整體功能時,首選防爆設備。本質安全設備和增安設備總合佔據防爆市場的大部分。其他主要類型的防爆設備包括氣動設備和光纖設備。

- 高可靠性、易於安裝和維護、減少停機時間和降低成本,以及全球認可的本質安全性,都是有利於採用這些防爆設備的優勢。

- 然而,無法在高功率水平下運作、規劃和設計的複雜性以及某些預防設備相對較高的成本正在阻礙市場成長。

巴西佔主要佔有率

- 國家防爆設備主要監管標準為NR12。此外,Portaria INMETRO Ntuco 179 是一項巴西認證計劃,適用於可燃粉塵、可燃性氣體和蒸氣下爆炸性環境中的所有電氣設備。該法規規定了用於爆炸性環境的電子和電氣設備的合格評定計劃的標準和要求。

- 巴西經濟成長潛力巨大,因其先進的工業化、政治穩定和豐富的原料蘊藏量而成為對投資者特別有吸引力的國家。此外,包括阿根廷、巴西、巴拉圭、烏拉圭和委內瑞拉在內的南美南方共同市場貿易協定加強了南美市場,並為巴西企業開闢了更廣泛的可能性。

- 根據石油、天然氣和生質燃料局預測,2020年巴西石油產量將超過10億桶,平均每天279萬桶。這一數字表明產量增加了 7.78%。此外,2020年天然氣產量將成長9.46%,從408億立方公尺增加到447億立方公尺。

- 此外,巴西國家石油公司未來 10 年的產業計畫可能會在探勘、維護和物流等領域進行高達 741 億美元的重大投資,以及電氣設備和危險佈線場所的安全改進需求不斷增加。

- 該國的可再生能源、生質燃料和生質能源市場正在不斷擴張。預計此類發展將在預測期內推動防爆設備的採用。

拉丁美洲防爆設備產業概況

由於電氣產品製造商的存在,防爆設備市場競爭非常激烈。由於安全要求不斷提高,主要產業企業集中度較高。另外,能源需求的增加是增加自然資源探勘需求的重要因素,間接增加了拉丁美洲地區防爆設備的需求。以下是一些最近的趨勢:

- 2021 年 7 月 - Samcon 推出了 ExCam IPQ1785,這是一款防爆攝影機,可為危險場所的製程監控和監視技術 (CCTV) 提供卓越的影像品質。此防爆攝影機經批准可用於危險區域(粉塵和氣體爆炸危險區域),並且易於安裝和維護。

- 2020 年 8 月 - 由 EIG Global Energy Partners、BP 和西門子管理的巴西私人公司Prumo 與國家電投巴西公司簽署了具有約束力的協議。根據協議,國家電投將首先收購位於里約熱內盧阿庫港的GNA I和GNA II液化天然氣發電計劃33%的股權。

- 2020 年 3 月 - R. STAHL LTD. 與 Elite Control Systems 合作,使兩家公司能夠提供目前市場上最強大、最具彈性的危險區域控制系統。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 行業法規

- COVID-19 對市場的影響

- 市場動態

- 市場促進因素

- 加強有關危險區域和危險物質處理的法規

- 能源需求的增加推動了對新礦山和油氣資源探勘的需求

- 市場挑戰

- 安全法規因地區而異

第5章市場區隔

- 按類型

- 防爆

- 防爆

- 爆炸隔離

- 按區域

- 0區

- 20區

- 1區

- 21區

- 2區

- 22區

- 按最終用戶

- 製藥

- 化學/石化

- 能源/電力

- 礦業

- 食品加工

- 石油和天然氣

- 其他最終用戶

- 按系統

- 供電系統

- 物料輸送

- 馬達

- 自動化系統

- 監控系統

- 其他系統

- 按國家名稱

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

第6章 競爭狀況

- 公司簡介

- R. Stahl

- Marechal Electric Group

- Adalet

- Bartec GmbH

- Rae Systems(Acquired By Honeywell)

- Pepperl+Fuchs

- Intertek Group

- Cordex Instruments

- GM International SRL

- Extronics Ltd

- Pelco

第7章 投資分析

第8章市場的未來

The LA Explosion-Proof Equipment Market is expected to register a CAGR of 6.83% during the forecast period.

Key Highlights

- Explosion-proof equipment is electrical and non-electrical fixtures that can prevent and withstand explosions. An explosion-proof piece of equipment has an apparatus enclosed in a case, capable of withstanding an explosion of a specific gas or vapor that may occur within it.

- Explosion-proof equipment finds its applications in diverse industries, such as aerospace and aircraft maintenance sites, construction sites, HVAC systems, manufacturing and machine processing units, mining fields, and oil and gas extraction fields. Lighting, surveillance, and signaling systems are some of the several most preferred types of equipment across the industries.

- There has been a rise in the number of explosions in the extreme environment of manufacturing industries, across various regions, because of the growing presence of chemicals, toxic paints, and other combustible dust.

- The mining industry has resulted in fatal injuries that have caused damage to life and property and death in some cases. Although the incidents have reduced over the years in the mining sector, owing to the increased use of hazardous location safety equipment, a significant number of fires and explosions are being witnessed, specifically in the manufacturing sector.

- Growing energy requirements is a key factor driving the demand for the exploration of new mines and oil and gas resources, which, in turn, demands safe equipment.

Latin America Explosion Proof Equipment Market Trends

Explosion prevention to hold significant share

- In the wake of increasing industrial accidents and explosions in mines, regulatory bodies are initiating the implementation of stricter regulations to ensure worker safety and also prevent damage to the atmosphere. Oil and shale reserves are generally found in ecologically sensitive areas like the Arctic circle. The Discovery of new oil reserves in countries like Brazil is expected to drive the market for explosion-proof equipment.

- Preservation of the environment is a high priority concern, and the governments are cognizant of the issue. This has resulted in the implementation of government regulations, particularly in the oil and gas exploration industry.

- Explosion prevention equipment is preferred in cases where the isolation or addition of specific parts to the equipment will not affect the total functionality of the equipment and is feasible practically. Intrinsically safe and increased safety equipment collectively account for a majority share of the explosion prevention market. Other major equipments in prevention include pneumatics and fiber optics.

- High reliability, ease of installation and maintenance, lower downtime, and cost are the advantages of the prevention equipment favoring their adoption, in addition to the worldwide recognition of intrinsic safety standards.

- However, the inability to operate at high power levels, planning and design complications and the relatively expensive nature of certain prevention equipment are hindering the growth of the market.

Brazil to hold major share

- The major regulatory standard for explosion-proof equipment in the country is NR12. Further, Portaria INMETRO Nº 179 is the Brazil certification program for all Electrical Equipment for Explosive Atmospheres under Combustible Dust and Flammable Gases and Vapors. This regulation dictates the compliance assessment program's criteria and requirements on electronic and electrical equipment for explosive atmospheres.

- Brazil has enormous economic growth potential and is particularly attractive to investors due to its advanced industrialization, political stability, and huge reserves for raw materials. Furthermore, the South American Mercosur trade agreement, which includes Argentina, Brazil, Paraguay, Uruguay, and Venezuela, strengthens the South American market and opens up the additional wide-ranging potential for the Brazilian business.

- According to the National Agency for Petroleum, Gas, and Biofuels, national oil production in Brazil in 2020 crossed the mark of 1 billion barrels, an average of 2.79 million barrel per day in the year. These numbers indicate a 7.78% increase in production. Besides, the production of natural gas crossed by 9.46%, from 40.8 to 44.7 billion cubic meters in 2020.

- Moreover, Petrobras's business plan for the next decade may lead to significant investments amounting to USD 74.1 billion in areas, like exploration, maintenance, and logistics, driving the demand for safety for electrical equipment and hazardous wiring locations.

- The market studied in the country is witnessing expansions in renewable energy, biofuels, and biopower. Such developments are anticipated to boost the adoption of explosion-proof equipment over the forecast period.

Latin America Explosion Proof Equipment Industry Overview

The degree of competition in the explosion-proof equipment market is high due to the presence of electrical product manufacturers. The firm concentration ratio in major industry verticals is on the higher side due to the increasing demand for safety. Also, the increasing need for energy is a key factor enhancing the demand for the exploration of sources of natural resources, indirectly increasing the demand for Explosion-Proof Equipment in the Latin America Region. Some of the recent developments are:

- July 2021 - SAMCON Launched ExCam IPQ1785, an explosion-proof video camera that provides excellent picture quality for process monitoring and surveillance technologies (CCTV) in hazardous locations. The blast-resistant camera is authorized for hazardous areas (risk zones for dust and gas explosions) and is simple to install and maintain.

- August 2020 - Prumo, a private Brazilian company controlled by E.I.G. Global Energy Partners, bp, and Siemens, signed a binding agreement with SPIC Brasil. Under the agreement, SPIC will initially acquire 33% of the GNA I and GNA II LNG-to-power projects located in Port of Acu, Rio de Janeiro.

- March 2020 - R. STAHL LTD. partnered with Elite Control Systems, enabling both parties the ability to deliver the most robust and resilient hazardous area control systems available on the market today.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Industry Regulations

- 4.5 Impact of COVID-19 on the Market

- 4.6 MARKET Dynamics

- 4.7 Market Drivers

- 4.7.1 Stricter regulations for handling hazardous areas and substances

- 4.7.2 Increasing Energy Requirements Driving the Demand for Exploration of New Mines and Oil and Gas Resources

- 4.8 Market Challenges

- 4.8.1 Varying Safety Regulations Across Different Regions

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Explosion Proof

- 5.1.2 Explosion Prevention

- 5.1.3 Explosion Segregation

- 5.2 Zone

- 5.2.1 Zone 0

- 5.2.2 Zone 20

- 5.2.3 Zone 1

- 5.2.4 Zone 21

- 5.2.5 Zone 2

- 5.2.6 Zone 22

- 5.3 End-User

- 5.3.1 Pharmaceutical

- 5.3.2 Chemical and Petrochemical

- 5.3.3 Energy and Power

- 5.3.4 Mining

- 5.3.5 Food Processing

- 5.3.6 Oil and Gas

- 5.3.7 Other End-Users

- 5.4 System

- 5.4.1 Power Supply System

- 5.4.2 Material Handling

- 5.4.3 Motor

- 5.4.4 Automation System

- 5.4.5 Surveillance System

- 5.4.6 Other Systems

- 5.5 Country

- 5.5.1 Mexico

- 5.5.2 Brazil

- 5.5.3 Argentina

- 5.5.4 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 R. Stahl

- 6.1.2 Marechal Electric Group

- 6.1.3 Adalet

- 6.1.4 Bartec GmbH

- 6.1.5 Rae Systems (Acquired By Honeywell)

- 6.1.6 Pepperl+Fuchs

- 6.1.7 Intertek Group

- 6.1.8 Cordex Instruments

- 6.1.9 G.M. International SRL

- 6.1.10 Extronics Ltd

- 6.1.11 Pelco