|

市場調查報告書

商品編碼

1626295

中東和非洲:聚對苯二甲酸乙二醇酯(PET)樹脂市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Middle-East and Africa Polyethylene Terephthalate (PET) Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

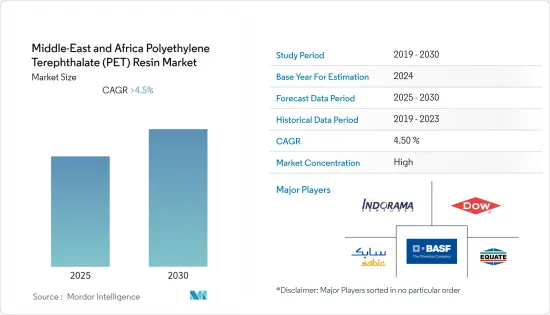

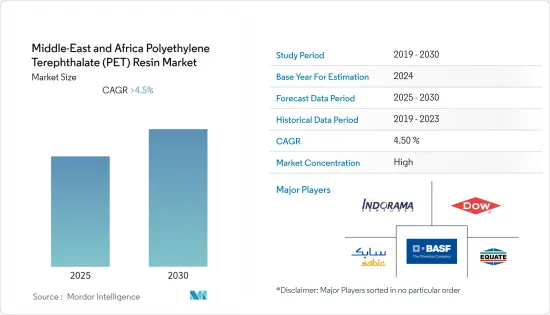

預計中東和非洲聚對苯二甲酸乙二醇酯樹脂市場在預測期內將維持4.5%以上的複合年成長率。

COVID-19對中東和非洲聚對苯二甲酸乙二醇酯樹脂市場的成長產生了負面影響。然而,汽車產業對PET薄膜的需求激增正在推動該產業的成長。

主要亮點

- 食品和飲料行業的成長以及對回收的日益關注預計將在預測期內推動市場發展。

- 有關 PET 使用和增加替代產品使用的嚴格法規可能會阻礙市場成長。

- 生物基 PET 產品的使用日益增加預計將創造未來的市場成長機會。

- 沙烏地阿拉伯在市場上佔據主導地位,預計在預測期內將以最快的複合年成長率發展。

中東和非洲聚對苯二甲酸乙二醇酯(PET)樹脂市場趨勢

食品和飲料行業的需求不斷增加

- PET 是一種塑膠材料,擴大用於食品和飲料行業的包裝。 PET 正在食品包裝應用中取代玻璃,因為它重量極輕,運輸方便且高效,並且具有防碎特性。

- PET 是一種非常堅固的惰性材料,不會與食物產生反應。它能抵抗微生物的攻擊,且不可生物分解。此外,與玻璃不同,PET 極其輕巧、便攜且高效,可重新密封以實現高效的移動水合作用,對環境安全,並且可回收並防止散落。由於其化學惰性和物理特性,特別是其玻璃般的透明度、重量輕和剛性,PET被廣泛用作食品包裝材料。

- PET 在食品和飲料行業的常見用途包括瓶裝水、牛奶、果汁和汽水瓶、番茄醬、花生醬、蛋黃醬、醃菜和果醬罐、三明治盒、桶子、食品容器和罐頭等。

- 在沙烏地阿拉伯,瓶裝水支出佔軟性飲料銷售的最大佔有率,到 2021 年將達到軟性飲料支出的約 55.3%。 2021年,碳酸飲料佔軟性飲料支出的26%以上,成為第二大佔有率。

- 除了包裝之外,PET 還用於食品工業的翻蓋、家常小菜容器和微波爐食品托盤。人口成長、消費者可支配收入和購買力增加、對易於攜帶和軟性食品包裝的需求增加等預計將在預測期內進一步增加對PET的需求。

- 2022年上半年沙烏地阿拉伯食品飲料產業成長6.3%。此外,據沙烏地阿拉伯投資總局 (SAGIA) 稱,未來五年,外出用餐支出將每年增加 6%。沙烏地阿拉伯王國人口到 2022 年將達到約 3,600 萬,目前持有海灣合作理事會最大的國內食品和飲料市場。

沙烏地阿拉伯主導市場

- 沙烏地阿拉伯作為石油生產國,從早期就對其他產業興趣不大。然而,隨著非歐佩克國家在世界上的崛起和主導地位以及油價上漲,沙烏地阿拉伯決定實現投資組合多元化,以使經濟均勻成長。

- 與其他新興經濟體相比,沙烏地阿拉伯的市場開放度和投資機會較低。然而,在第十個發展計畫中,政府正在透過投資多元化領域來改革經濟政策,並試圖吸引私人投資,以創造不依賴石油的多元化經濟。

- 沙烏地阿拉伯的包裝行業正在經歷顯著成長,這主要是由食品製造和加工的增加以及線上食品宅配服務的擴張所推動的。沙烏地阿拉伯的宅配和應用市場也正在快速擴張,2021年市場規模為5.11億美元,預計2026年將以每年10%的速度成長。

- 沙烏地阿拉伯的食品製造和加工產業在過去十年中成長迅速。由於冷凍食品、冷凍加工食品、零嘴零食和巧克力糖果零食市場的不斷擴大,沙烏地阿拉伯的加工食品產業預計將顯著成長。

- 沙烏地阿拉伯的醫療保健產業佔海灣合作理事會地區最大的支出,對更多病床和長期照護中心的需求不斷增加。 2021年醫療領域的病床數為77,224張,高於2019年的72,981張。

- 沙烏地阿拉伯佔波灣合作理事會(GCC) 國家衛生支出的 60%,該部門仍然是沙烏地阿拉伯政府的首要任務。 2022年,衛生社會發展支出368億美元,佔2022年預算的14.4%。

- 該國不斷成長的醫療支出以及多家公立醫院的私有化預計將推動該國對醫療設備的需求,進而推動未來幾年的 PET 市場。

中東和非洲聚對苯二甲酸乙二醇酯(PET)樹脂產業概況

中東和非洲聚對苯二甲酸乙二醇酯(PET)樹脂市場已整合。該市場的主要企業包括(排名不分先後)SABIC、Indorama Ventures Public Company Limited、Equate Petrochemical Company 和BASF SE。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 食品和飲料行業的成長

- 越來越重視回收

- 抑制因素

- 增加替代產品的使用

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 產品類型

- 瓶子

- 薄膜片材

- 其他

- 最終用戶產業

- 飲食

- 車

- 電力/電子

- 醫療保健

- 消費品

- 其他

- 地區

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 卡達

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Alpek SAB de CV

- Bamberger Polymers

- BariQ

- BASF SE

- Dow

- Eastman Chemical Company

- Equate Petrochemical Company

- GAP Polymers

- Indorama Ventures Public Company Limited

- Invista

- KAP Industrial

- SABIC

第7章 市場機會及未來趨勢

- 增加生物基 PET 產品的使用

The Middle-East and Africa Polyethylene Terephthalate Resin Market is expected to register a CAGR of greater than 4.5% during the forecast period.

COVID-19 impacted negatively the Middle East and Africa polyethylene terephthalate resin market growth. However, the surging demand for PET films in the automotive industry has propelled industry growth.

Key Highlights

- The growing food and beverage industry and increasing emphasis on recycling are expected to drive the market during the forecast period.

- Stringent regulations regarding the usage of PET and the increasing usage of alternative products may hinder the market growth.

- Increasing use of bio-based PET products is projected to create future market growth opportunities.

- Saudi Arabia is expected to dominate the market and is also expected to witness the fastest CAGR during the forecast period.

MEA Polyethylene Terephthalate (PET) Resin Market Trends

Increasing Demand from Food and Beverage Industry

- PET is a plastic material that has found increasing applications in the food and beverage industry for packaging purposes. PET has been replacing glass in food packaging applications owing to its extremely lightweight, easy and efficient transportation, and shatterproof features.

- PET is a very strong and inert material that does not react with foods. It is resistant to attacks by microorganisms and will not biologically degrade. Additionally, unlike glass, PET is extremely lightweight, easy and efficient to transport, re-sealable for efficient on-the-go hydration, environmentally safe, recyclable, and shatterproof. Owing to its chemical inertness and physical properties, especially glass-like transparency, lightweight, and rigidity, PET is widely used as a food packaging material.

- Common applications of PET in the food and beverage industry are bottled water, milk, juices, and carbonated drinks bottles, ketchup, jars for peanut butter, mayonnaise, pickles, jam, and others, sandwich boxes, tubs, and food containers, can laminations, etc.

- In Saudi Arabia, bottled water spending accounted for the largest proportion of soft drink sales, standing at around 55.3% of soft drink spending in 2021. Carbonated drinks accounted for the second largest proportion of soft drinks spending in 2021, accounting for over 26% of soft drinks spending.

- Besides packaging, PET is also used in the food industry for clamshells, deli containers, as well as microwave food trays. Growing population, increase in consumers' disposable income and purchasing power, and increasing demand for easily transportable and flexible food packaging, etc. are further expected to increase the demand for PET during the forecast period.

- Saudi Arabia's food and beverage sector increased by 6.3 percent in the first half of 2022. Additionally, according to the Saudi Arabian General Authority for Investment (SAGIA), the spending on food service will grow by 6% per annum over the next five years. As the population in The Kingdom reached about 36 million in 2022, Saudi now holds the largest domestic food & beverage market in the GCC.

Saudi Arabia to Dominate the Market

- Being an oil-producing economy, the country's interest in other industries was less from the initial phase itself. However, after the emergence and dominance of the non-OPEC countries globally and the high volatility of crude oil prices, Saudi Arabia decided to diversify its portfolio to help the economy grow uniformly.

- The market's openness and investment opportunities in Saudi Arabia are less when compared to other emerging economies. However, in its 10th development plan, the government is reforming economic policies with investments in diversified sectors and is trying to attract private investments in the country to make it a diversified economy that is not dependent on oil.

- The packaging industry has been witnessing substantial growth in Saudi Arabia, majorly driven by the increasing food manufacturing and processing and growing online food delivery services. The food delivery and apps market in Saudi Arabia is also expanding rapidly; it was valued at USD 511 million in 2021 and is predicted to increase by 10% a year through 2026.

- The Saudi Arabian food manufacturing and processing sector rapidly grew in the past 10 years. The processed food industry in Saudi Arabia is expected to grow significantly, due to the increasing market for frozen foods, chilled processed foods, snacks, and chocolate confectionery.

- The healthcare industry in Saudi Arabia accounts for the largest expenditure in the GCC region, and there is a rising demand for increasing hospital bed capacity and long-term care centers. In 2021, the number of beds in the healthcare sectors was 77,224, an increase from 72,981 in 2019.

- In Gulf Cooperation Council (GCC) countries, Saudi Arabia accounts for 60% of healthcare expenditure, and the sector remains a top priority for the Saudi Arabian Government. In 2022, it spent USD 36.8 billion on healthcare and social development, 14.4 percent of its 2022 budget.

- The increasing healthcare expenditure in the country, along with the privatization of several public hospitals, is expected to drive the demand for healthcare equipment in the country, which, in turn, is expected to drive the PET market in the coming years.

MEA Polyethylene Terephthalate (PET) Resin Industry Overview

The Middle East and Africa polyethylene terephthalate (PET) resin market is consolidated. Key players in the market include SABIC, Indorama Ventures Public Company Limited, Equate Petrochemical Company, and BASF SE, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Food and Beverage Industry

- 4.1.2 Increasing Emphasis on Recycling

- 4.2 Restraints

- 4.2.1 Increasing Usage of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Bottles

- 5.1.2 Films and Sheets

- 5.1.3 Other Product Types

- 5.2 End-user Industry

- 5.2.1 Food and Beverage

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics

- 5.2.4 Healthcare

- 5.2.5 Consumer Goods

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 South Africa

- 5.3.3 United Arab Emirates

- 5.3.4 Qatar

- 5.3.5 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alpek S.A.B. de C.V.

- 6.4.2 Bamberger Polymers

- 6.4.3 BariQ

- 6.4.4 BASF SE

- 6.4.5 Dow

- 6.4.6 Eastman Chemical Company

- 6.4.7 Equate Petrochemical Company

- 6.4.8 GAP Polymers

- 6.4.9 Indorama Ventures Public Company Limited

- 6.4.10 Invista

- 6.4.11 KAP Industrial

- 6.4.12 SABIC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Bio-based PET Products