|

市場調查報告書

商品編碼

1626304

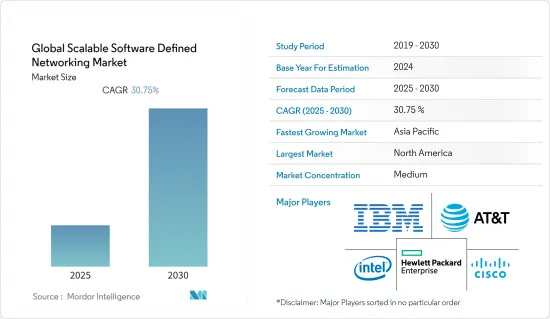

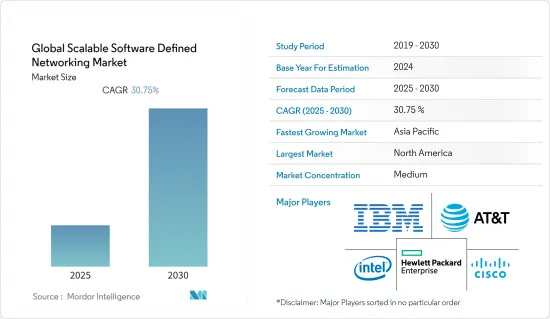

全球可擴展軟體定義網路市場:市場佔有率分析、產業趨勢、統計與成長預測(2025-2030)Global Scalable Software Defined Networking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

可擴展軟體定義網路 (SDN) 的全球市場預計在預測期內年複合成長率為 30.75%。

主要亮點

- 軟體定義網路創建和維護虛擬網路,並透過軟體控制傳統硬體。各種規模和行業的企業都在採用 SDN 作為提高網路效率和智慧性同時降低複雜性的一種方式。

- 雲端運算技術的出現、行動裝置的激增、伺服器視覺性和其他人工智慧技術正在迫使企業重新評估傳統的網路架構。透過 SDN 網路,可以從一個中央集線器控制這些應用程式流。因此,網路工程師可以使用SDN控制器來管理網路,而無需存取單獨的網路設備。

- 通訊業對用戶和業務流量的需求不斷成長,需要更安全、更集中的系統來實現平穩運作。 SDN 是一項幫助電信業者管理能源需求和碳排放的技術。基於預期流量和能夠滿足該需求的最節能設備,SDN控制平面可以確定所需的最大設備數量。然後其餘部分切換到待機模式。

- 隨著公司採用遠距工作策略,COVID-19 的爆發增加了對雲端基礎的解決方案的需求。網路基礎設施正在重新安排,以允許員工遠端工作。隨著 VPN(虛擬私人網路)使用的增加,可擴展的軟體定義網路技術在高效運作這些IT基礎設施方面發揮了關鍵作用。

- 安全問題和網路攻擊正在限制 SDN 市場的成長。攻擊者需要存取一個節點(SDN控制器)來控制整個網路的安全。

可擴展的軟體定義網路市場趨勢

BFSI 產業受益於市場研究。

- 金融業正快速邁向數位化,鼓勵客戶採用 DIY 模式來進行關鍵活動。透過使用SDN技術,基礎設施管理將實現自動化,這不僅有助於降低風險,也為未來的技術和商業創新鋪平道路。 SDN 減少了人員接觸點的數量,並在某些情況下將人員從流程中移除,從而降低了營運風險。

- 為了提高市場競爭力,32% 的銀行目前正在使用語音辨識和預測分析等人工智慧技術。

- 2022 年 3 月 - UCB 孟加拉(聯合商業銀行有限公司)與 UiPath 合作實施機器人流程自動化 (RPA),將其銀行業務轉變為數位平台。這使得無法提交 KYC 文件、發送自動通知、安排電話提交所需文件等的客戶可以輕鬆關閉帳戶。

- 2022 年 9 月 - Banking Lab 是一家由人工智慧驅動的金融情報公司,已與雲端原生平台供應商 Anaplan 建立夥伴關係。透過此次合作,兩家公司將透過複雜的場景建模功能、資料主導的見解和智慧解決方案,幫助金融機構改善產業計畫,從而更好地執行銷售、業務和財務。

北美佔主要佔有率

- 根據 World 資料 的一項研究,2022 年第二季度,北美地區繼續主導私人銀行業人工智慧 (AI) 專家的招募。 2022年第二季人工智慧就業比為48.2%,而2021年同期為42.8%。美國貢獻了人工智慧在私人銀行業的41.9%的作用。

- 2022 年 6 月 - Kindril 和思科合作開發新的私有雲端服務、網路、邊緣運算解決方案、軟體定義網路 (SDN) 解決方案和多網路廣域網路 (WAN) 選項。這些公司還計劃與多家公司合作,以支持和實現全球範圍內的數位轉型工作。

- 2022 年 9 月 - 瞻博網路和 IBM 合作提供可立即使用的整合且檢驗的元件組合。這種整合匯集了兩家公司的服務。瞻博網路基於意圖的管理、雲端原生軟體定義網路 (SDN) 解決方案和雲端原生路由與 IBM Cloud Pak 結合,為生命週期管理和編配提供網路自動化解決方案。該夥伴關係關係旨在透過向客戶提供即用型服務來支援數位轉型和人工智慧的採用。透過選擇此整合包,客戶可以降低營運複雜性、加快實現價值並降低總擁有成本。

可擴展的軟體定義網路產業概述

可擴展的軟體定義網路的市場集中度適中。大公司,尤其是電信業的大公司,正在收購致力於 SDN 技術的新興企業。這些公司正在投入大量精力將多個開放原始碼SDN系統與其雲端運算平台整合,以最佳化和自訂其網路基礎設施。主要公司包括思科系統公司、HPE、英特爾公司、Big Switch Network、AT&T Inc.、Pluribus Network、Plexxi Inc.、華為技術公司、NEC Corporation、Arista Network 和 IBM Corporation。

- 2022 年 2 月 - 開放網路基金會 (ONF) 與 Microsoft、Google 和 Intel夥伴關係,在資料中心雲端開放網路軟體 (SONiC) 中推出了 SDN 解決方案。新的 P4 整合網路堆疊 (PINS) 可獨立運行,允許使用者調整其 SDN 解決方案,而無需 SDN 控制器。

- 2022 年 10 月 - 諾基亞和美國鐵塔開發 SDN虛擬,以實現光纖寬頻部署的現代化。諾基亞是阿根廷 FTTH 網路的唯一供應商。諾基亞的 Altiplano 開放接取 SDN 解決方案提供更靈活的服務設計,以滿足大型和小型營運商租戶的需求。它提供了各種網路共用選項來幫助基礎設施建設者,虛擬網路營運商獲得專門的工具來支援他們的營運並改善用戶體驗。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 雲端採用率增加

- BYOD設備趨勢

- 市場限制因素

- 安全問題

- 產業價值鏈分析

- COVID-19 對可擴展 SDN 市場的影響

- 使用案例

- 行動核心、EPC、IMS虛擬

- 營運支撐系統和業務支撐系統(OSS/BSS)

- 無線接取網路

- 有線固定接取網路

- 用戶端設備 (CPE)

- 行動回程傳輸

- 按解決方案

- SDN交換

- SDN控制器

- 雲端配置

- 編配

- 安全技術

- 其他解決方案

第6章 市場細分

- 按最終用戶

- 雲端服務供應商

- 公司

- 通訊服務供應商

- 按行業分類

- 學術/研究

- BFSI

- 消費品/零售

- 政府/國防

- 製造業

- 通訊/IT

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Cisco Systems Inc.

- HPE

- Intel Corporation

- Big Switch Network

- AT&T Inc.

- Pluribus Network

- Plexxi Inc.

- Huawei Technologies Co. Ltd.

- NEC Corporation

- Arista Network

- IBM Corporation

第8章投資分析

第9章 市場機會及未來趨勢

The Global Scalable Software Defined Networking Market is expected to register a CAGR of 30.75% during the forecast period.

Key Highlights

- A software-defined Network creates and maintains a virtual network or uses software to command conventional hardware. Businesses of all sizes and industries are embracing SDN as a means to boost the efficiency and intelligence of their networks while decreasing complexity.

- Enterprises are being compelled to re-evaluate their traditional network architectures by the emergence of cloud computing technologies, the proliferation of mobile devices, server visualization, and other AI-enabled technologies. Using SDN networking allows control of these app flows from one centralized hub. Network engineers can therefore manage the network using the SDN controller without the need to access individual networking devices.

- The growing demand for user and business traffic in the telecom industry is urging for a more secure and centralized system for smooth functioning. SDN is the technology that will help telcos manage energy demands and their carbon footprint. Based on anticipated traffic and the most power-efficient devices that can fulfill the need, the SDN control plane might determine the maximum number of devices necessary. The remaining are subsequently switched to standby mode.

- The COVID-19 pandemic has increased demand for cloud-based solutions as companies adopted remote working strategies. For the employees to work remotely, networking infrastructure has been relocated. Scalable Software Defined Networking Technology played an important role in efficiently working these IT infrastructures, as there was a higher use of VPNs (virtual private networks).

- Security Concerns and cyber attacks are restraining the growth of the SDN market. Attackers need to get access to one node, i.e, the SDN controller to take over control of the security of the entire network.

Scalable Software Defined Networking Market Trends

BFSI Sector is Benefitting from the Studied Market

- The financial sector is moving towards rapid digital advancements and urging customers to adopt the DIY model for significant activities. Using SDN technologies, infrastructure management will be automated, and it will not only assist in decreasing risk but will also pave the way for future technological and commercial innovation. SDN reduces the number of human touchpoints and, in some situations, eliminates people from the process, thereby reducing operational risk.

- To gain a competitive edge in the market, 32% of banks now use AI technologies, including speech recognition, predictive analytics, and others.

- March 2022 - UCB Bangladesh (United Commercial Bank Limited), in partnership with UiPath, implemented Robotic Process Automation (RPA) to switch to a digital platform for its banking operations. With this adaptation, it will become easy for the bank to detect and close customers' accounts failing to provide KYC documents, send automated notifications, and schedule calls for the required document submissions.

- September 2022 - AI-powered financial intelligence company Banking Labs signed a partnership with Anaplan, the provider of a cloud-native platform. Through this partnership, the duo will assist Financial Institutions in improving business planning for better execution in sales, operations, and finance through sophisticated scenario modeling capabilities, data-driven insights, and intelligence-enabled solutions

North America to Account for a Major Share

- As per a study by Global Data, in Q2 2022, North America continued to dominate the hiring of artificial intelligence (AI) specialists in the private banking sector. There were 48.2% total AI jobs in Q2 2022 compared to 42.8% in the same period in 2021. United States contributed 41.9% towards AI roles in the private banking industry.

- June 2022 - Kyndryl and Cisco teamed up to develop new private cloud services, network, and edge computing solutions, software-defined networking (SDN) solutions, and multi-network wide area network (WAN) options that will provide organizations with high-level security capabilities. The duo further plans to collaborate with various companies to support and deliver digital transformation initiatives on a global scale.

- September 2022 - Juniper and IBM partnered to combine and present pre-integrated, validated components for ready usage. This integration will result in the combination of services from both companies. Juniper's intent-based management, cloud-native software-defined networking (SDN) solution and cloud-native routing will be combined with IBM's Cloud Pak for a network automation solution for lifecycle management and orchestration. The partnership aims to support digital transformation and AI adoption by providing clients with ready-to-use services. Clients can decrease the complexity of operations, quicken time to value, and cut total ownership costs, by choosing this integrated package.

Scalable Software Defined Networking Industry Overview

Market concentration for scalable software-defined networking is moderate. Big firms, especially in the telecom sector, buy up startups working on SDN technology. These companies invest a lot of effort into integrating multiple open-source SDN systems with their cloud computing platforms for network infrastructure optimization and customization. Some key players include Cisco Systems Inc., HPE, Intel Corporation, Big Switch Network, AT&T Inc., Pluribus Network, Plexxi Inc., Huawei Technologies Co. Ltd., NEC Corporation, Arista Network, and IBM Corporation, among others.

- February 2022 - The Open Networking Foundation (ONF), in partnership with Microsoft, Google, and Intel, introduced an SDN solution to its software for open networking in the cloud (SONiC) for data centers. The new P4 Integrated Network Stack (PINS) will work independently, allowing users to adapt to an SDN solution without needing an SDN controller.

- October 2022 - To reinvent the fiber broadband deployment, Nokia and American Tower developed SDN virtualization. Nokia is the sole supplier of the FTTH network in Argentina. The Altiplano Open Access SDN solution from Nokia provides a more flexible service design adapted to the requirements of both large and small operator tenants. It would give various network-sharing options to assist infrastructure builders, and the virtual network operators get specialized tools to support their operations and enhance the subscriber experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions &and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Cloud

- 5.1.2 Trend of BYOD devices

- 5.2 Market Restraints

- 5.2.1 Concerns related to security

- 5.3 Industry Value Chain Analysis

- 5.4 Impact of COVID-19 on the Scalable SDN Market

- 5.5 By Use Case

- 5.5.1 Mobile Core, EPC, IMS Virtualization

- 5.5.2 Operation Support System and Business Support System (OSS/BSS)

- 5.5.3 Radio Access Networks

- 5.5.4 Wireline Fixed Access Networks

- 5.5.5 Customer Premises Equipment (CPE)

- 5.5.6 Mobile Backhaul

- 5.6 By Solution

- 5.6.1 SDN Switching

- 5.6.2 SDN Controllers

- 5.6.3 Cloud Provisioning

- 5.6.4 Orchestration

- 5.6.5 Security Technologies

- 5.6.6 Other Solutions

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Cloud Service Providers

- 6.1.2 Enterprises

- 6.1.3 Telecommunications Service Providers

- 6.2 By Industry Vertical

- 6.2.1 Academia and Research

- 6.2.2 BFSI

- 6.2.3 Consumer Goods and Retail

- 6.2.4 Government and Defense

- 6.2.5 Manufacturing

- 6.2.6 Telecom and IT

- 6.2.7 Other Industry Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 HPE

- 7.1.3 Intel Corporation

- 7.1.4 Big Switch Network

- 7.1.5 AT&T Inc.

- 7.1.6 Pluribus Network

- 7.1.7 Plexxi Inc.

- 7.1.8 Huawei Technologies Co. Ltd.

- 7.1.9 NEC Corporation

- 7.1.10 Arista Network

- 7.1.11 IBM Corporation