|

市場調查報告書

商品編碼

1626311

中東和非洲的化妝品包裝:市場佔有率分析、行業趨勢、統計和成長預測(2025-2030)Middle East And Africa Cosmetic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

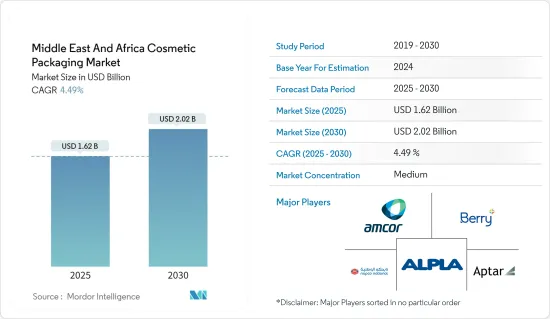

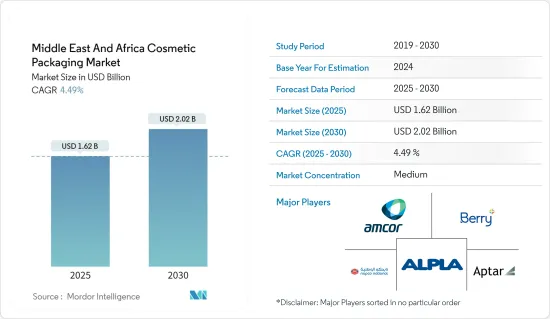

中東和非洲化妝品包裝市場規模預計到2025年為16.2億美元,預計到2030年將達到20.2億美元,預測期內(2025-2030年)年複合成長率為4.49%。

主要亮點

- 化妝品包裝市場主要受到沙烏地阿拉伯和阿拉伯聯合大公國等地區消費能力增強導致化妝品需求激增的推動。此外,某些因素預計將在市場成長中發揮關鍵作用,例如每個國家的年輕人口、產品可用性的增加以及消費者意識的提高。

- 化妝品包裝包括各種產品,例如玻璃填充用罐、塑膠瓶和罐以及軟性塑膠袋。這些包裝解決方案可保護化妝品、維持品質並增強貨架吸引力。包裝材料的選擇通常取決於化妝品的類型、保存期限和品牌的永續性目標。

- 沙烏地阿拉伯是中東和非洲地區化妝品消費率最高的國家,其中護膚護髮產品消費量佔壓倒性優勢。沙烏地阿拉伯消費者往往在外表上花很多錢,這預計將補充化妝品行業並推動該地區對化妝品包裝的需求。

- 由於該地區可支配收入的增加,化妝品的採用率不斷上升,預計將進一步刺激產品的美學價值。此外,社群媒體和電子商務網站的滲透率在該國有所增加,從而增加了對化妝品的需求,從而導致化妝品包裝產品的採用。歐萊雅年報顯示,2023年上半年,該公司在海灣國家的宗教節日中經歷了令人印象深刻的成長。撒哈拉以南非洲地區也實現了兩位數的成長。

- 此外,中東最大的環境監管機構阿布達比環境局 (EAD) 宣布,其目標是透過培育回收和再利用文化,消除可避免的一次性塑膠與非塑膠材料的使用。政府的這些措施預計將對市場產生重大影響。最近由多家公司主導的舉措,加上政府的政治承諾和根據沙烏地阿拉伯 2030 年願景等舉措增加的投資,預計將推動市場發展。

- 包裝是塑膠廢棄物的一級資訊來源。該地區的塑膠廢棄物問題是與塑膠污染和安全處置相關的重大環境問題。儘管人們努力使用替代材料,並且最近出現了生物分解性塑膠的發展趨勢,但情況仍需要改善。

中東和非洲化妝品包裝市場趨勢

護膚產業推動了對包裝產品的需求

- 消費者對永續性的興趣日益濃厚,迫使產品和包裝製造商提供環保產品。化妝品包裝製造商透過開發和提供創新的包裝解決方案來回應具有環保意識的消費者。包裝製造商也致力於建立回收設施以減少碳足跡。

- 中東和非洲的美容品牌推出不斷增加。 2024 年 3 月,印度領先的美容零售商 Nykaa 在杜拜開設了第一家美容零售店 Nysaa。這項重要舉措是透過與波灣合作理事會(GCC) 零售巨頭領先服裝集團的策略合作夥伴關係實現的。 Nykaa 制定了雄心勃勃的計劃,目標是在未來五年內在海灣合作理事會開設 70 家商店,並獲得海灣合作理事會主要美容市場 7% 的佔有率。

- 美容產品推出的快速增加也增加了對化妝品包裝的需求,包括塑膠瓶和容器、玻璃罐以及其他初級和次級包裝解決方案。這一趨勢凸顯了創新和永續包裝在滿足消費者偏好和監管標準方面的重要性。

- 公司越來越注重環保材料和設計,以吸引環保意識的消費者。此外,包裝技術的進步延長了產品的保存期限和安全性,進一步促進了市場成長。因此,包裝產業將在中東和非洲不斷變化的美麗景觀中發揮重要作用。

- 正如 Signifyd 2024 年 1 月的報導所述,從 2023 年 6 月到 11 月,EMEA(歐洲、中東和非洲)的美容和化妝品線上銷售經歷了不同程度的環比成長。 6 月銷售額年增 5%,9 月達到驚人的 52% 高峰。隨著品牌尋求改善消費者體驗並滿足環保標準,線上銷售的激增也推動了對創新和永續化妝品包裝的需求。

沙烏地阿拉伯市場將錄得顯著成長

- 沙烏地阿拉伯是中東和非洲最大的化妝品市場。沙烏地阿拉伯女性在化妝品和護膚品上花費大量金錢,以增強她們的魅力、吸引力和自信。

- 在沙烏地阿拉伯,對天然和道德產品的需求不斷增加,各個類別的「清潔美容」趨勢明顯。 ROEN 和 Glow Recipe 等品牌正在響應這一需求,優先考慮永續成分和環保包裝,並提供純素和零殘忍產品。傳統上,國內分銷主要由雜貨零售商以及美容和健康專家主導,但該地區逐漸轉向全通路零售。

- 2024 年 7 月,領先的工業和消費品公司漢高在利雅德開設了一家最先進的美容護理生產工廠。該工廠將生產各種 Pert 品牌產品,包括洗髮精、護髮素和其他特色產品,以滿足中東地區對優質個人保健產品不斷成長的需求。

- 此外,此舉是漢高消費品牌部門向前邁出的重要一步,該部門致力於加強其在沙烏地阿拉伯和更廣泛地區的業務,並強調其對本地生產和永續商業實踐的關注。

- ITC貿易地圖報告顯示,2023年,沙烏地阿拉伯向吉布地、義大利、德國、約旦、巴林等國家出口美容產品價值274.5萬美元。此外,沙烏地阿拉伯也從德國、荷蘭、義大利、法國、美國、英國等國進口了價值5.1101億美元的美容產品。這些重要的貿易活動影響了該地區的化妝品銷售,並推動了對多樣化和高品質產品的需求。

- 因此,化妝品包裝市場也在不斷成長,製造商尋求創新且有吸引力的包裝解決方案來滿足消費者的偏好。進口的增加引入了新的品牌和產品,進一步刺激了競爭和包裝創新。總體而言,充滿活力的貿易環境正在促進沙烏地阿拉伯的化妝品和包裝產業。

中東和非洲化妝品包裝產業概況

中東和非洲的化妝品包裝市場正在變得半固體。 Amcor Group、Aptar Group, Inc. 和 Berry Global Inc. 等多家全球和地區公司認為該地區是推出產品和擴大市場佔有率的有利機會。相較之下,傳統品牌正在重塑其包裝,以實現產品現代化並提高其價值。

此外,由於可支配收入增加,該地區化妝品支出不斷增加,奢侈品牌開始專注於產品包裝,這是推動奢侈品銷售的關鍵因素。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 越來越重視客製化奢侈品包裝

- 對永續美容產品的關注推動了對永續化妝品包裝的需求

- 市場挑戰

- 各類化妝品包裝材料使用的主要規定

第5章 當前地緣政治情勢對市場的影響

第6章 市場細分

- 依材料類型

- 塑膠

- 玻璃

- 金屬

- 紙

- 依產品類型

- 塑膠瓶和容器

- 玻璃瓶/容器

- 金屬容器

- 折疊式紙盒

- 瓦楞紙箱

- 管和棒

- 蓋子和塞子

- 泵浦和分配器

- 滴管

- 安瓿

- 軟塑膠包裝

- 依化妝品類型

- 頭髮護理

- 彩妝品

- 護膚

- 男士美容

- 香水和除臭劑

- 其他化妝品(除毛、嬰幼兒照顧、防曬)

- 國家名稱

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第7章 競爭格局

- 公司簡介

- Berry Global Inc.

- Amcor Group

- DS Smith PLC

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Napco National

- Nioro Plastics(Pty)Ltd.

- AtLendon Packaging(Pty)Ltd

- Mpact Plastics

第8章投資分析

第9章 市場機會及未來趨勢

The Middle East And Africa Cosmetic Packaging Market size is estimated at USD 1.62 billion in 2025, and is expected to reach USD 2.02 billion by 2030, at a CAGR of 4.49% during the forecast period (2025-2030).

Key Highlights

- The cosmetic packaging market is driven by the proliferation in demand for cosmetic products, primarily due to increasing spending powers in the region, including Saudi Arabia and the United Arab Emirates. Additionally, certain factors, such as the young population, increasing product availability, and increasing consumer awareness in the countries, are expected to play a significant role in the market's growth.

- Cosmetic packaging encompasses a range of products, including glass refillable jars, plastic bottles and jars, and flexible plastic pouches. These packaging solutions protect cosmetic products, maintain their quality, and enhance their shelf appeal. The choice of packaging material often depends on the type of cosmetic product, its shelf life, and the brand's sustainability goals.

- Saudi Arabia has one of the highest rates of cosmetics consumption in the Middle East and Africa, dominating the consumption of skin and hair care products. Saudi Arabian consumers are inclined to spend large sums on appearance, which is expected to supplement the cosmetic industry, increasing the demand for cosmetic packaging in the region.

- The rising adoption of cosmetics due to the increase in disposable income in the region is further expected to stimulate the products' aesthetic value. Also, the penetration of social media and e-commerce websites is increasing in the country proliferating the demand for cosmetic products, hence, resulting in the adoption of cosmetic packaging products. As per the annual report by L'Oreal, the company experienced excellent growth over the religious holidays in the Gulf States in the first half of 2023. Also, the company saw double-digit growth in Sub-Saharan Africa.

- Moreover, the Environment Agency of Abu Dhabi (EAD), the largest environmental regulator in the Middle East, announced that it aims to eliminate avoidable single-use plastic usage of non-plastic materials by fostering a culture of recycling and re-use. These initiatives by the government are expected to affect the market significantly. The recent initiatives led by multiple companies coupled with the increasing government political commitments and investments aligning with the initiative such as Saudi Vision 2030 are expected to drive the market.

- Packaging is one of the primary sources of plastic waste. The plastic waste problem in the region is a major environmental issue related to plastic pollution and safe disposal. Despite efforts to use alternative materials and recent developments in biodegradable plastics, the situation still needs improvement.

Middle East And Africa Cosmetic Packaging Market Trends

Skincare Segment Drives Demand for Packaging Products

- The growing concern among consumers about sustainability forces product and packaging manufacturers to offer environmentally friendly products. Cosmetic packaging manufacturers are trying to cater to the environmentally conscious consumer by developing and offering innovative packaging solutions. Also, packaging manufacturers are focusing on establishing recycling facilities to reduce their carbon footprints.

- Beauty brand launches are rising across Africa and the Middle East. In March 2024, Nykaa, a prominent Indian beauty retailer, debuted its first beauty retail outlet, Nysaa, in Dubai. This significant move was made possible through a strategic partnership with the renowned Apparel Group, a leading Gulf Cooperation Council (GCC) retail giant. Nykaa has ambitious plans, eyeing 70 stores in the GCC over the next five years, with a target of securing a 7% share in the GCC's prestigious beauty market.

- The surge in beauty product launches has also driven demand for cosmetics packaging, including plastic bottles and containers, glass jars, and other primary and secondary packaging solutions. This trend underscores the importance of innovative and sustainable packaging in meeting consumer preferences and regulatory standards.

- Companies are increasingly focusing on eco-friendly materials and designs to appeal to environmentally conscious consumers. Additionally, advancements in packaging technology are enhancing product shelf life and safety, further boosting market growth. The packaging sector is thus poised to play a crucial role in the evolving beauty landscape of the Middle East and Africa.

- As reported in a January 2024 article by Signifyd, online beauty and cosmetics sales in the EMEA (Europe, Middle East, and Africa) experienced fluctuating Month-on-Month growth from June to November 2023. Starting at 5% in June, the YoY sales growth peaked at an impressive 52% in September. This surge in online sales has also driven demand for innovative and sustainable cosmetics packaging, as brands seek to enhance the consumer experience and meet environmental standards.

Saudi Arabia to Register Significant Market Growth

- Saudi Arabia is the largest market for cosmetic products in the Middle East and Africa, owing to the increasing spending power and ability of women in the region. Saudi Arabian women spend heavily on makeup and skin care products to boost their attractiveness, desirability, and self-confidence.

- The demand for natural and ethical products is rising in Saudi Arabia, with a notable trend towards "clean beauty" across various categories. Brands like ROEN and Glow Recipe are meeting this demand, providing vegan and cruelty-free offerings that prioritize sustainable ingredients and eco-friendly packaging. While grocery retailers and health and beauty specialists have traditionally dominated domestic distribution, the region is witnessing a gradual shift towards omnichannel retail.

- In July 2024, Henkel, a prominent player in industrial and consumer products, inaugurated a state-of-the-art beauty care production facility in Riyadh. This facility manufactures a diverse array of products under the Pert brand, such as shampoos, conditioners, and other specialized items, catering to the rising demand for premium personal care products in the Middle East.

- Futhermore, This move marks a significant advancement for Henkel's Consumer Brands division with focus on bolstering its presence in Saudi Arabia and the wider region, highlighting the company's focus on local production and sustainable business practices.

- In 2023, Saudi Arabia exported beauty products worth USD 2.745 million to various countries, including Djibouti, Italy, Germany, Jordan, and Bahrain, as reported by ITC Trade Map. Additionally, Saudi Arabia imported beauty products valued at USD 511.01 million from nations such as Germany, the Netherlands, Italy, France, the United States, and the United Kingdom. This significant trade activity impacts cosmetics sales in the region, driving demand for diverse and high-quality products.

- Consequently, the cosmetics packaging market also experiences growth, as manufacturers seek innovative and attractive packaging solutions to cater to consumer preferences. The increase in imports introduces new brands and products, further stimulating competition and packaging advancements. Overall, the dynamic trade environment fosters both the cosmetics and packaging industries in Saudi Arabia.

Middle East And Africa Cosmetic Packaging Industry Overview

The Middle East and Africa cosmetic packaging market is semi-consolidated. Several global and regional players, such as Amcor Group, Aptar Group, Inc., Berry Global Inc., and others, view the region as a lucrative opportunity to launch their products and expand their market presence. In contrast, legacy brands are engaged in reinventing their packaging methods to renew their products and increase their value.

Further, with growing disposable income enabling higher spending on cosmetic products in the region, luxury brands are focusing on product packaging, which is the primary factor driving sales of luxury products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increasing Focus on Customized and Luxury Packaging

- 4.4.2 Focus towards Sustainable Beauty Products Driving the Demand for Sustainable Cosmetic Packaging

- 4.5 Market Challenge

- 4.5.1 Key Regulation over the Usage of Packaging Material for Different Cosmetic Products

5 IMPACT OF CURRENT GEOPOLITICAL SCENARIO ON THE MARKET

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 Product Type

- 6.2.1 Plastic Bottles and Containers

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tubes and Sticks

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Droppers

- 6.2.10 Ampoules

- 6.2.11 Flexible Plastic Packaging

- 6.3 Cosmetic Type

- 6.3.1 Hair Care

- 6.3.2 Color Cosmetics

- 6.3.3 Skin Care

- 6.3.4 Mens Grooming

- 6.3.5 Fragrances & Deodorants

- 6.3.6 Other Cosmetic Types (Depilatories, Baby and Child Care, and Sun Care)

- 6.4 Country

- 6.4.1 United Arab Emirates

- 6.4.2 Saudi Arabia

- 6.4.3 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berry Global Inc.

- 7.1.2 Amcor Group

- 7.1.3 DS Smith PLC

- 7.1.4 ALPLA Werke Alwin Lehner GmbH & Co KG

- 7.1.5 Napco National

- 7.1.6 Nioro Plastics (Pty) Ltd.

- 7.1.7 AtLendon Packaging (Pty) Ltd

- 7.1.8 Mpact Plastics