|

市場調查報告書

商品編碼

1626322

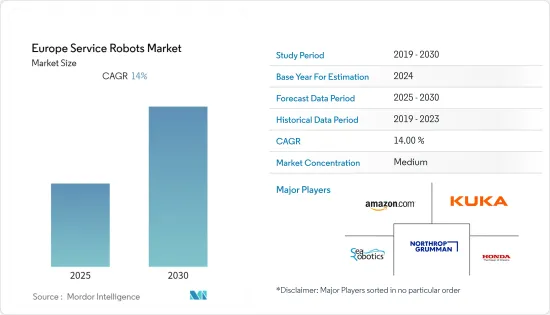

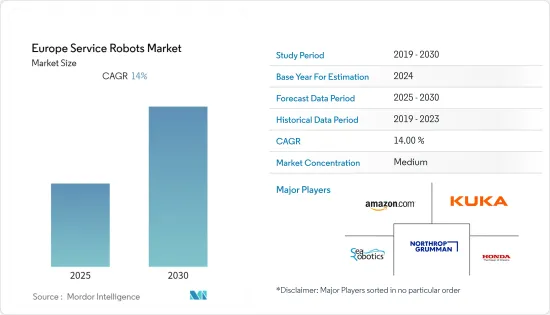

歐洲服務機器人:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Europe Service Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

歐洲服務機器人市場預計在預測期內複合年成長率為 14%

主要亮點

- 歐洲引領服務機器人市場,包括現場機器人、物流和建築機器人。機器人在這個市場的應用多種多樣,也用於專業清潔。

- 服務機器人的軍事應用高於專業應用。國防使用有人和無人機器人。無人機在無人駕駛車輛中非常常用。多年來,無人機在戰場上的使用不斷增加。無人機用於情報、監視和偵察任務,幫助地面或遠處的士兵規劃下一步。

- 德國市場是最大的機器人市場之一,預計未來將進一步成長。西班牙、義大利和英國等其他市場也有可能在未來幾年成長為服務機器人市場的主要企業。

- IFR 的數據顯示,歐洲服務機器人製造商在全球市場中發揮重要作用,在 700 家註冊供應服務機器人的公司中,約有 290 家是歐洲公司。

- 此外,歐洲的勞動力短缺成為 COVID-19 大流行期間使用服務機器人的驅動力之一。例如,丹麥紫外線消毒機器人製造商UVD Robotics已向中國和歐洲的醫院運送了數百台機器人。

歐洲服務機器人市場趨勢

歐洲勞動力短缺導致服務機器人需求增加

- 歐洲經濟成長引人注目,各行業人手不足日益嚴重。

- 醫院、超級市場等引進地面清潔機器人、微生物清除消毒機器人。隨著對衛生和社交距離的新重視,一些公司發現機器人業務具有行銷優勢。

- 在英國,脫歐使情況明顯惡化。至少有20萬名曾經在農業、運輸和物流等部門工作的歐盟國民(主要來自東歐)已經離開該國,並且可能永遠不會返回。

- 在該地區,服務機器人在軍事和國防部門的使用也在增加。服務機器人可以被派往危險的情況並在安全距離內保護士兵。軍用機器人可以透過掃描化學物質的存在來評估化學、生物和放射性威脅。

德國該地區服務機器人密度較高

- 事實證明,德國比歐洲任何其他國家都更親和性工業機器人、服務機器人、整合組裝解決方案和機器視覺系統。

- 據IFR稱,德國是歐洲最大的機器人市場,歐洲38%的工業機器人在德國工廠運作。德國汽車工業的機器人密度位居世界前列。

- COVID-19 大流行促進了德國零售、酒店和工業部門的自動化。德國的幾家療養院正在使用由 Robshare 位於萊茵蘭-普法爾茨州的 Robshare 設計的名為「James」的機器人來促進虛擬探訪。詹姆斯透過視訊會議將家庭與療養院的親人聯繫起來。

- 此外,該國RaaS(機器人即服務)市場的成長可能會進一步增加對服務機器人的需求。

歐洲服務機器人產業概況

歐洲服務機器人市場隨著需求增加而穩定發展,市場集中度適中。

- 英國政府希望在 2021 年讓全自動駕駛汽車上路,並且已經在倫敦 26 公里的公共道路上開始測試。

- 2021年,Sesto將成為第一家總部位於新加坡的機器人公司,為歐洲智慧製造提供自主移動機器人解決方案。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場趨勢

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業政策

- 市場促進因素

- 國防領域對機器人的需求不斷增加

- 透過專注於研究和開發,機器人正在開發具有更多方便用戶使用功能的機器人。

- 市場限制因素

- 一些用戶發現與機器人互動是一種障礙。

- 與開發相關的初始成本較高

- 評估 COVID-19 對市場的影響

第5章市場區隔

- 按類型

- 個人機器人

- 家庭機器人

- 調查

- 娛樂

- 其他

- 商務用機器人

- 田間機器人(農林業/其他)

- 國防/安全(消防)

- 醫療(輔助機器人、診斷/檢修系統)

- 無人機無人機

- 其他

- 個人機器人

- 按領域

- 航空

- 土地

- 水下

- 按成分

- 感應器

- 致動器

- 控制系統

- 軟體

- 其他

- 按最終用戶產業

- 軍事/國防

- 農業、建築、採礦

- 運輸/物流

- 衛生保健

- 政府機構

- 其他

- 按國家/地區

- 英國

- 德國

- 法國

- 其他

第6章 競爭狀況

- 公司簡介

- Amazon Inc.

- KUKA AG

- Northrop Grumman Corporation

- Robobuilder Co. Ltd.

- SeaRobotics Corporation

- Honda Motors Co. Ltd.

- iRobot Corporation

- Hanool Robotics Corporation

- Iberobtoics SL

- Gecko Systems Corporation

- RedZone Robotics

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 47462

The Europe Service Robots Market is expected to register a CAGR of 14% during the forecast period.

Key Highlights

- Europe is a leader in the service robotics market for field robotics, logistics, and construction. The usage of robotics in this market is varied and is also used in professional cleaning.

- The military application of service robotics is high in the professional use of service robotics. In defense, both manned and unmanned types of robots are used. In unmanned use, drones are very common. The use of drones has increased in the battlegrounds for a few years. They are being used for intelligence, surveillance, and reconnaissance missions and have helped the soldiers on the ground and sitting far away to plan their next move.

- The German market is one of the big markets for robotics and is estimated to grow more in the period to come. Other markets like Spain, Italy, and the UK will also grow to become major players in the service robotics market in the years to come.

- European service robot manufacturers play an important role in the global market as about 290 out of the 700 registered companies supplying service robots come from Europe, according to IFR.

- Moreover, the labor shortage in Europe was one of the driving factors for the use of service robots during the COVID-19 pandemic. For instance, UVD Robots, Danish manufacture of ultraviolet-light-disinfection robots, shipped hundreds of machines to hospitals in China and Europe.

Europe Service Robots Market Trends

Increasing demand of service robots due to labor shortage in Europe

- Fast-growing economies in Europe have led to severe labor shortages in all industries.

- Floor-cleaning and microbe-zapping disinfecting robots were introduced in hospitals, supermarkets, and other environments. Some enterprises found that robotic operations offered a marketing advantage, given the new emphasis on hygiene and social distancing.

- In the UK, Brexit has greatly exacerbated the situation. At least 200,000 EU nationals, primarily from eastern Europe, who once filled roles in areas such as agriculture, transportation, and logistics, have left the country and may never return.

- The use of service robots in the region is on the rise, even in the military and defense. Service robots can be sent into dangerous situations to keep soldiers at a safe distance. Military service robots are able to assess chemical, biological, and radiological threats by scanning for chemical agents present.

Germany experiences high service robot density in the region

- Germany has proven to have a greater affinity for industrial and service robots, integrated assembly solutions, and machine vision systems than any other country in Europe.

- According to IFR, Germany is the largest robot market in Europe, with 38% of Europe's industrial robots operating in factories here. Robot density in the German automotive industry is among the highest in the world.

- The COVID-19 pandemic gave a push to automation in Germany's retail, service, and industrial sectors. A few German nursing homes have employed a robot called "James" designed by Robshare in Rhineland-Palatinate to facilitate virtual visits. James connects family members with their loved ones in the nursing homes through video conferencing, as visitors stay away from the facilities due to quarantine restrictions.

- Moreover, the growth of the Robots as a Service RaaS market in the country shall further develop the need for service robots.

Europe Service Robots Industry Overview

The European Service Robot market has medium market concentration as the market is in developing steadily with rising demand.

- The UK government expects to develop and have fully autonomous vehicles on the road by 2021, and a test band of 26 km of public road in London has already been launched.

- In 2021, Sesto is believed to be the first Singapore-based robotics company to provide autonomous mobile robot solutions for smart manufacturing in Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Trends

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Policies

- 4.5 Market Drivers

- 4.5.1 Increasing demand for these robots in defense sector

- 4.5.2 Focus towards research and development is leading to robots with more user-friendly features

- 4.6 Market Restraints

- 4.6.1 Interaction with robot is hindrance for some users

- 4.6.2 Initial high costs associated with development

- 4.7 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Personal Robots

- 5.1.1.1 Domestic Robots

- 5.1.1.2 Research

- 5.1.1.3 Entertainment

- 5.1.1.4 Others

- 5.1.2 Professional Robots

- 5.1.2.1 Field Robots (Agriculture, Forestry and Others)

- 5.1.2.2 Defense and Security (Fire Fighting)

- 5.1.2.3 Medical (Assistive robots, diagnostic and overhauling systems)

- 5.1.2.4 UAV Drones

- 5.1.2.5 Others

- 5.1.1 Personal Robots

- 5.2 By Areas

- 5.2.1 Aerial

- 5.2.2 Land

- 5.2.3 Underwater

- 5.3 By Components

- 5.3.1 Sensors

- 5.3.2 Actuators

- 5.3.3 Control Systems

- 5.3.4 Software

- 5.3.5 Others

- 5.4 By End-User industries

- 5.4.1 Military and Defense

- 5.4.2 Agriculture, Construction and Mining

- 5.4.3 Transportation & Logistics

- 5.4.4 Healthcare

- 5.4.5 Government

- 5.4.6 Others

- 5.5 By Countries

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amazon Inc.

- 6.1.2 KUKA AG

- 6.1.3 Northrop Grumman Corporation

- 6.1.4 Robobuilder Co. Ltd.

- 6.1.5 SeaRobotics Corporation

- 6.1.6 Honda Motors Co. Ltd.

- 6.1.7 iRobot Corporation

- 6.1.8 Hanool Robotics Corporation

- 6.1.9 Iberobtoics S.L

- 6.1.10 Gecko Systems Corporation

- 6.1.11 RedZone Robotics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219