|

市場調查報告書

商品編碼

1626345

北美危險區域馬達:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)North America Hazardous Location Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

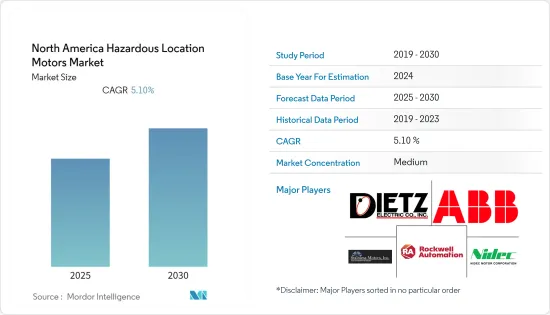

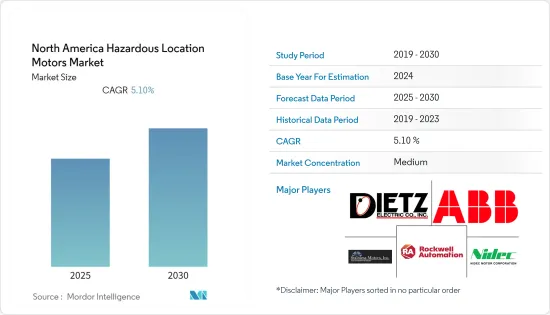

北美危險場所馬達市場預計在預測期內複合年成長率為 5.1%

主要亮點

- 使用專為在存在可燃性氣體、灰塵和纖維的危險環境中使用而設計的防爆馬達對於人員和設備的安全至關重要。馬達在標準操作條件下會產生熱量,如果馬達線圈故障,可能會產生火花。如果馬達外殼溫度過高或火花未充分遏制,則可能在存在某些危險材料的環境中引起爆炸或著火。

- 穀物和麵粉加工產業是最常見的粉塵爆炸設施之一。麵粉看似無害,但當它高濃度分佈在空氣中並與火源、密閉空間、擴散和氧氣結合時,就會引起爆炸。麵粉廠對於美國經濟和該地區的農業至關重要。北美地區麵粉產量的增加是所研究市場成長的催化劑。

- 例如,根據美國農業部國家農業統計局(NASS)的數據,2020年美國麵粉廠生產了425,338,000克麵粉,比2019年的422,277,000克增加了3,061,000克(0.7%)。

- 此外,可可粉廣泛用於該地區的糖果零食和麵包店。在北美,可可研磨過程受到嚴格的監管,這就是為什麼防爆馬達普及率很高的原因。檢驗全球事故資料,北美記錄的可燃粉塵火災和爆炸事故中,75%以上是由食品和木製品引起的。根據美國糖果零食協會(NCA)統計,2021年可可壓榨量從2020年的115,591噸增加到117,956噸,增加了2.05%。可可需求和產量的增加也推動了該地區的市場成長。

- 然而,完全吞噬內部爆炸而不破裂的馬達的設計和構造,或者以將熱氣體通過稱為火焰管道的長而窄的開口排放的方式排放機殼,面臨著兩個主要挑戰市場。此外,COVID-19 大流行也為所研究的市場帶來了一些挑戰,例如供應鏈中斷和原料價格上漲。

北美危險場所馬達市場趨勢

石油和天然氣需求的增加預計將推動市場成長

- 普通馬達在含有石油、天然氣蒸氣和液體等易燃材料的環境中運作時容易發生爆炸。後果可能包括輕微的生產停機、嚴重的傷害甚至死亡。

- 北美石油和天然氣產業為危險區域馬達帶來了一些最嚴峻的挑戰。從海上鑽井到加拿大油砂的寒冷環境,馬達是營運設施的重要生命線。該地區石油和天然氣的大規模生產和出口正在推動所研究市場的成長。

- 例如,根據美國能源資訊署(EIA)的數據,2020年德克薩斯州生產了17.82億桶原油,北達科他州生產了4.312億桶原油。

- 此外,根據英國石油公司(BP plc)的數據,2020年美國每天出口811萬桶,使其成為全球領先的原油和石油產品出口國。同時,加拿大的出口量為每天442萬桶。該地區也是石油和天然氣行業幾家重要公司的所在地。例如,根據湯森路透統計,截至2021年10月,總部位於美國德克薩斯的埃克森美孚市值為2,579.5億美元,其次是總部位於美國加州的雪佛龍,市值為2017.70美元。萬美元。

- 因此,該地區正在採用 I 級危險場所馬達,其設計目的是防止馬達外殼溫度在存在可燃性氣體、蒸氣或液體的環境中超過安全溫度。

煤炭生產中的防爆馬達可望佔據主要市場佔有率

- 在煤礦中,甲烷和煤塵是兩種最常見的爆炸危險。當累積的甲烷氣體與熱源接觸並且沒有足夠的空氣將氣體稀釋到爆炸點以下時,就會發生甲烷爆炸。

- 同樣,適當濃度的煤塵細顆粒在接觸熱源時也會爆炸。甲烷和煤塵混合也可能發生混合爆炸。

- 不符合危險場所標準的馬達在產生的熱量超過一定水平時可能會引起爆炸。在北美,危險區域分類由美國電氣規範 (NEC) 和加拿大電氣規範 (CEC) 決定。這些規範還規定了允許在危險環境中運行的馬達的設計和標籤要求。

- 北美地區煤炭產量的增加極大地推動了所研究市場的成長。例如,根據美國勞工部的數據,2020 年懷俄明州煤炭產量為 2.185 億噸,其次是西維吉尼亞,產量為 6,720 萬噸。此外,根據英國石油公司 (BP plc) 的數據,2020 年美國和加拿大的原油產量將分別佔全球原油產量的 18.6% 和 5.8%。

- II 級危險區域馬達以較低的額定電流運行,以減少產生的熱量,並配備了類似恆溫器的系統,可在達到臨界溫度之前關閉馬達電源,以限制馬達外殼溫度過高的情況。其他故障安全方法。

北美危險區域馬達產業概況

北美危險場所馬達市場競爭激烈,主要企業包括 Brook Crompton、Stainless Motors, Inc.、Dietz Electric Co, Inc.、Emerson Electric Co 和 WEG Industries。這些公司應注重技術創新和策略聯盟,以增加市場佔有率。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 影響評估

第5章市場動態

- 市場促進因素

- 增加安全措施

- 對節能馬達的需求不斷成長

- 市場限制因素

- 監理與合規

- 與非防爆馬達相比,材料和人事費用導致安裝成本較高

第6章 市場細分

- 按類型

- 防爆通用馬達

- 馬達

- 防爆泵馬達

- 防爆變頻負載馬達

- 防爆重載馬達

- 按班級

- Ⅰ類

- 二級

- 三級

- 按部門分類

- 1級

- 2區

- 按區域

- 0區

- 1區

- 21區

- 22區

- 按用途

- 噴漆和精加工區域

- 精製

- 乾洗設施

- 天然氣廠

- 穀物提昇機和穀物加工設施

- 麵粉廠

- 鋁材生產及倉儲區

- 火力發電廠和儲存設施

- 糖果廠

- 其他用途

- 按國家/地區

- 美國

- 加拿大

- 北美其他地區

第7章 競爭格局

- 公司簡介

- Brook Crompton

- Stainless Motors, Inc.

- Dietz Electric Co., Inc.

- Emerson Electric Co.

- WEG Industries

- Rockwell Automation, Inc.

- Nidec Motor Corporation

- Kollmorgen Corporation

- ABB Ltd

- Heatrex Inc.

第8章投資分析

第9章 市場的未來

簡介目錄

Product Code: 47996

The North America Hazardous Location Motors Market is expected to register a CAGR of 5.1% during the forecast period.

Key Highlights

- The use of explosion-proof motors, which are designed for use in hazardous environments where flammable gases, dust, or fibers are present, is essential for the safety of personnel and equipment. Electric motors generate heat under standard operating conditions and can generate a spark if a motor coil fails. Excessive motor case temperatures or an inadequately contained spark can cause an explosion or ignite a fire in environments where specific hazardous materials are present.

- The grain and milling industries are among the most common facilities for dust explosions. Flour might seem harmless, but when it is distributed in the air in high concentrations, combined with an ignition source, confined space, dispersion, and oxygen, it causes an explosion. Flour mills have been an essential part of the American economy and the region's agricultural industry. The increasing production of flour in the North American region acts as a catalyst for the growth of the studied market.

- For instance, wheat flour production by US flour mills in 2020 totaled 425.338 million cwts, up by 3.061 million cwts, or 0.7%, from 422.277 million cwts in 2019, according to the National Agricultural Statistics Service (NASS) of the US Department of Agriculture.

- Further, cocoa powder is widely used in the region's confectioneries and bakeries. The grinding process of cocoa falls under strict regulations in the North American region, due to which the penetration of the explosion-proof motor is high. In reviewing the global incident data, food and wood products made up over 75% of the combustible dust fires and explosions recorded in the North American Region. According to the National Confectioners Association (NCA), in 2021, cocoa grindings featured an increase of 2.05%, from 1,15,591 tonnes in 2020 to 1,17,956 tonnes in 2021. The rising demand and production of cocoa are also aiding the market growth in the region.

- However, designing and manufacturing motors that completely engulf an internal explosion without rupturing or passing out any hot gases from the enclosure so that they are forced to exit through a long, narrow opening known as flame paths are the two major challenges faced by hazardous location motors market. Further, the Covid-19 pandemic has also posed several challenges to the studied market, like disruption in the supply chain and increased raw materials prices.

North America Hazardous Location Motors Market Trends

The Increasing demand for Oil and Gas is Expected to Drive the Market Growth

- When operated in environments containing combustible materials like oil and gas vapors or liquids, regular electric motors are prone to explosions. The consequences may range from minor production downtime to severe injuries and even death.

- The North American oil and gas industry presents some of the harshest challenges for hazardous location motors. The motors are a critical lifeline to the operation of the facilities, from offshore drilling to the frigid conditions of the Canadian oil sands. The region's massive production and export of oil and gas is aiding the growth of the studied market.

- For instance, According to Energy Information Administration (EIA), in 2020, Texas produced 1,782 million barrels of crude oil, while North Dakota produced 431.2 million barrels of crude oil.

- Further, according to BP plc, in 2020, The United States was among the leading global crude oil and oil products exporters, exporting 8.11 million barrels per day. At the same time, the exports from Canada totaled 4.42 million barrels per day. The region is also home to some of the significant companies in the oil and gas industry. For instance, according to Thomson Reuters Corporation, as of October 2021, Exxon Mobil Corporation, headquartered in Texas, United States, had a market capitalization of USD 257.95 billion, followed by Chevron Corporation, headquartered in California, United States, with USD 201.77 billion market value.

- Resultantly, the class-I hazardous location motors, which are designed in such a way that their motor case temperatures do not exceed safe temperatures for environments where combustible gases, vapors, or liquids are present, are increasingly being adopted in the region.

Explosion Proof Motor in Coal Production is Expected to Hold a Major Market Share

- In coal mines, methane and coal dust are two of the most common explosive hazards. Methane explosions occur when a buildup of methane gas comes into contact with a heat source, and there is insufficient air to dilute the gas level below the point of explosion.

- Similarly, fine particles of coal dust in the right concentration that come into contact with a source of heat can be explosive. Hybrid explosions caused by a combination of methane and coal dust are also possible.

- The usage of electric motors, which do not comply with the hazardous location standards, can cause explosions when they generate heat beyond certain levels. In North America, hazardous classifications are established by the National Electric Code (NEC) and the Canadian Electric Code (CEC). The codes also stipulate the requirements for the design and labeling of the motors that are allowed to operate in hazardous environments.

- The increasing production of coal in the North American region is substantially driving the growth of the studied market. For instance, according to the United States Department of Labor, in 2020, Wyoming produced 218.5 million short tons of coal, followed by West Virginia with 67.2 million short tons of coal. Further, according to BP plc, in 2020, the United States and Canada produced 18.6% and 5.8% of the total global crude oil production, respectively.

- The class-II hazardous location motors, which reduce the heat produced by operating at a lower current rating, employ other failsafe methods like thermostats that disengage the motor power before it reaches critical temperatures to limit an excessive motor case temperature condition, are becoming increasingly popular in the region.

North America Hazardous Location Motors Industry Overview

The North America Hazardous Location Motors market is moderately competitive with significant players like Brook Crompton, Stainless Motors, Inc., Dietz Electric Co., Inc., Emerson Electric Co., WEG Industries, etc. The players in the market must focus on technological innovations and strategic collaborations to expand their market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Safety Measures

- 5.1.2 Increasing Demand for Energy Efficient Motors

- 5.2 Market Restraints

- 5.2.1 Regulations & Compliance

- 5.2.2 High Installation Cost for Material and Labor in Comparison to Non-Explosion Proof Motors

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Explosion-Proof General Purpose Motors

- 6.1.2 Drill Rig Duty Motors

- 6.1.3 Explosion-Proof Pump Motors

- 6.1.4 Explosion-Proof Inverter Duty Motors

- 6.1.5 Explosion-Proof Severe Duty Motors

- 6.2 By Class

- 6.2.1 Class I

- 6.2.2 Class II

- 6.2.3 Class III

- 6.3 By Division

- 6.3.1 Division 1

- 6.3.2 Division 2

- 6.4 By Zone

- 6.4.1 Zone 0

- 6.4.2 Zone 1

- 6.4.3 Zone 21

- 6.4.4 Zone 21

- 6.4.5 Zone 22

- 6.5 By Applications

- 6.5.1 Spray Painting and Finishing Areas

- 6.5.2 Petroleum Refining Plants

- 6.5.3 Dry Cleaning Facilities

- 6.5.4 Utility Gas Plants

- 6.5.5 Grain Elevators and Grain Handling Facilities

- 6.5.6 Flour Mills

- 6.5.7 Aluminum Manufacturing and Storage Areas

- 6.5.8 Fire Work Plants and Storage Areas

- 6.5.9 Confectionary Plants

- 6.5.10 Other Applications

- 6.6 By Country

- 6.6.1 United States

- 6.6.2 Canada

- 6.6.3 Rest of North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Brook Crompton

- 7.1.2 Stainless Motors, Inc.

- 7.1.3 Dietz Electric Co., Inc.

- 7.1.4 Emerson Electric Co.

- 7.1.5 WEG Industries

- 7.1.6 Rockwell Automation, Inc.

- 7.1.7 Nidec Motor Corporation

- 7.1.8 Kollmorgen Corporation

- 7.1.9 ABB Ltd

- 7.1.10 Heatrex Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219