|

市場調查報告書

商品編碼

1626348

零售業物聯網 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Internet of Things in Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

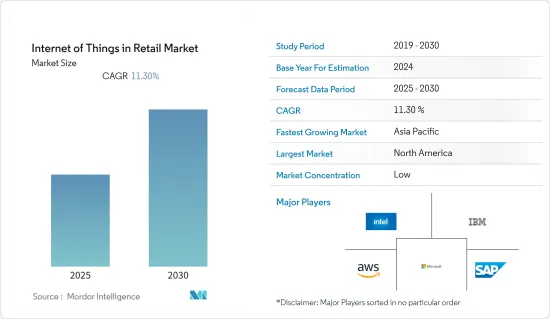

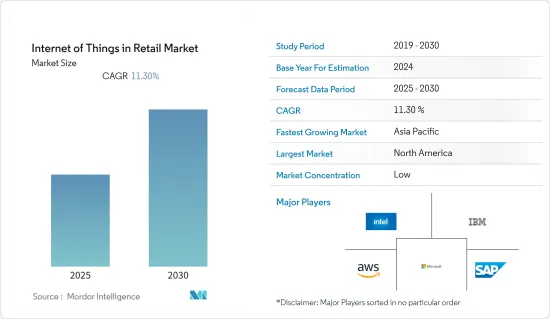

零售業物聯網市場預計在預測期內複合年成長率為 11.3%

主要亮點

- 物聯網使零售商能夠與企業和人員建立聯繫。物聯網使零售商能夠深入了解產品性能以及與客戶參與的新方法。克羅格、Zara、沃爾瑪和樂購等多家公司正在推出智慧設備來改善客戶體驗。

- 此外,由於購物的便利性和智慧型手機的廣泛採用,電子商務平台的使用量正在迅速增加,預計這將推動市場的發展。對資料分析和分析整合的需求不斷成長預計將在預測期內推動物聯網市場的利用。例如,亞馬遜位於美國西雅圖的第一家商店就內建了自助結帳服務以及可在Android和iOS系統上使用的行動付款方式。該商店配備了攝影機、感測器和RFID讀取器,利用電腦視覺、深度學習演算法和「感測器融合」來識別消費者和產品。

- 此外,零售商店人工智慧 (AI) 和擴增實境(AR) 的進步極大地改變了零售環境。零售商正在使用人工智慧來識別目標市場,了解消費者過去的購買習慣,並向客戶提供個人化的產品廣告。例如,今年1月,Google雲端宣布了四項針對零售商的新人工智慧技術。這些新技術主要旨在幫助零售商轉變商店貨架檢查流程,擴大電子商務業務,並提供更流暢、更自然的網路購物體驗。它還包括一個主要基於 Vertex AI 構建的新的“自我檢查人工智慧”,它利用谷歌廣泛的資料庫來幫助零售商識別“數十億種產品”並確保商店貨架上有足夠的庫存。

- 然而,隨著各種安全相關問題和互通性問題的增加,整個預測期內的整體市場成長率可能會受到抑制。

- 這場大流行對全球物聯網支出產生了重大影響,特別是在零售領域。在經濟危機期間,零售商推遲了一些新舉措,因為維持生計是首要任務。因此,物聯網零售市場在疫情期間收益下降。然而,在 COVID-19 之後,物聯網在零售業的使用預計將逐漸增加。零售商已經在整合人工智慧技術、雲端服務、行動付款系統、自主清潔機器人等,以消除人類的參與並阻止冠狀病毒的傳播。

零售物聯網市場趨勢

軟體組件預計將佔據很大佔有率

- 網路購物的顯著成長歸因於交易額和訂單頻率的增加。物聯網可以最佳化供應鏈管理、減少庫存錯誤並降低人事費用。物聯網可以顯著改善客戶體驗並削減不必要的開支,從而幫助傳統實體店在當今線上優先的購物世界中競爭。

- 各種軟體解決方案供應商正在提供物聯網以改善零售業。其中包括 Qliktag、Evrythng、ThinFilm NC 解決方案、Gimble、Kaa Projects、Wise Shelf、Swirl、Memomi、Authentic or Not、Queuehop 等。

- 此外,支援 NFC 的技術為零售商告知和說服消費者創造了巨大的成長機會。例如,全國連鎖超級市場克羅格公司試行了智慧貨架標籤來顯示產品資訊。此外,NFC 還解決了無電源物件無法存取網路的難題,提供了最簡單、最直覺的方式來展示用戶採取行動的興趣,並透過輕鬆直覺地連接設備來實現物聯網的重要功能。因此,NFC 解決方案的使用越來越多,已經滲透到零售市場,並正在顯著推動市場發展。

- Paytm 等公司去年宣布計劃進行 22 億美元的 IPO,成為頭條新聞。這家總部位於諾伊達的金融科技公司最初被稱為 One97 Communications,最初是一家重要的數位電話付款提供商。儘管如此,它已經發展到涵蓋保險銷售、機票預訂和其他數位金融服務。在印度的網路購物中,PhonePe 和 Paytm 比信用卡和簽帳金融卡更常用。

- 據該網站(Boku)稱,到 2025年終, Google Pay、PhonePe 和 Paytm 預計將在印度擁有數億用戶。因此,隨著行動錢包用戶數量的增加,零售業物聯網市場預計在整個預測期內將出現顯著的成長機會。

北美佔最大佔有率

- 電子商務技術的出現和最佳店內體驗的結合一直是美國零售業模式轉移的關鍵驅動力。零售商正在優先考慮全通路零售支出,從純粹的網路商店商店轉向實體店,反之亦然。

- 此外,美國越來越多的消費者正在採用智慧家庭環境,而物聯網正在整個全部區域擴展。因此,零售公司正在尋求圍繞家庭助理開發解決方案。 Alexa 和 Google Home 的成功清楚地表明了這一趨勢。此外,部署 IoT 使用感測器和 RFID 標籤追蹤庫存可以實現即時管理和簡化整個流程。美國的亞馬遜倉庫配備了智慧貨架,可以幫助零售商監控和追蹤庫存,減少重新訂購產品時的人為錯誤,並消除倉庫中積壓的產品。

- 網上購物的顯著成長是由於交易價值的增加以及由於便利性而增加的訂單頻率。美國零售業分為實體零售商,這些零售商在線上策略取得了成功,並在亞馬遜的競爭中倖存下來。此外,零售商廣泛使用物聯網為客戶提供個人化體驗。例如,沃爾瑪在美國倉庫中使用物聯網來深入了解社群媒體上流行的產品。

- 此外,沃爾瑪、塔吉特和百思買等公司已成功地找到了正確的產品和服務組合(例如雜貨銷售),以留住消費者。雖然亞馬遜仍然是電子商務領域的領導者,但這些公司正在利用實體店來履行線上訂單,同時增加數位促銷活動。

- 去年 12 月,亞馬遜計劃為其應用程式帶來類似 TikTok 的購物體驗。該公司宣布推出 Inspire,這是一種新的短影片和照片來源,可讓消費者從品牌、影響者和其他客戶創建的內容中發現創意、產品和購物。該功能的主要目的是吸引消費者遠離 TikTok 等應用程式,品牌可以在這些應用程式中直接向消費者進行行銷,從而顯著提高亞馬遜網站上的銷售額。

零售業物聯網產業概述

零售業的物聯網市場需要變得更具凝聚力。越來越多的消費者接受智慧家庭環境、倉庫溫度感測器的引入以及電子商務技術的出現,為零售業的物聯網市場提供了利潤豐厚的機會。整體而言,現有競爭對手之間的競爭非常激烈。產品創新及拓展有效滲透產業成長。

- 2023 年 1 月 - 安永宣布開始採用由 Microsoft Cloud 支援的零售解決方案,以協助為消費者提供無縫的購物體驗。安永宣布推出新的安永零售智慧解決方案,該解決方案主要使用微軟雲端和零售雲端為消費者提供直接、無縫的購物體驗。

- 2022 年 12 月 - 全球物聯網 (IoT) 解決方案和全球物聯網 CaaS(物聯網連接即服務)領域的領導者 KORE 與 Google Cloud 和 Go 合作,為全球企業提供物聯網功能 - 宣布成立。 。這項多年合作夥伴關係將使該公司能夠利用 Google Cloud 的基礎架構和功能以及 KORE 的物聯網解決方案來建立強大的物聯網解決方案。此外,這種合作夥伴關係還將透過為車隊/物流、工業IoT、連線健診和零售/通訊服務供應商等產業拓展新的市場途徑來改變物聯網產業。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 技術簡介

第5章市場動態

- 市場促進因素

- 物聯網在零售業的應用不斷增加,包括預測性設備維護、聯網消費者和智慧商店

- 越來越需要有競爭力的經營模式來維持競爭

- 競賽

- 市場問題

- 安全性問題和互通性問題

第6章 市場細分

- 按成分

- 硬體

- 軟體

- 服務

- 管理的

- 專業的

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Amazon Web Services Inc.

- AT&T Inc.

- Ayla Networks Inc.

- Bosch Software Innovations GmbH

- Cisco Systems Inc.

- Fujitsu Ltd

- General Electric

- Google Inc.

- Hewlett Packard Enterprise

- Hitachi Ltd

- Huawei Technologies Co. Ltd

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Siemens AG

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 48120

The Internet of Things in Retail Market is expected to register a CAGR of 11.3% during the forecast period.

Key Highlights

- IoT enables retailers to connect with both businesses and people. It allows retailers to gain insights into product performance and new ways of customer engagement with both new and existing customers. Several companies, like Kroger, Zara, Walmart, Tesco, etc., have launched smart devices to improve customer experience.

- Additionally, the e-commerce platform's use is rapidly increasing owing to the ease of shopping and smartphone penetration, which will likely boost the market. The increasing need for data analysis and analytics integration is expected to propel the utilization of the Internet of Things market over the forecast period. For instance, Amazon's first store in Seattle, the United States, is incorporated with a self-checkout service and mobile payment methods available on Android and iOS systems. The store is equipped with cameras, sensors, and RFID readers to identify shoppers and products and uses computer vision, deep learning algorithms, and the 'sensor fusion.'

- Also, with the advancement of artificial intelligence (AI) and augmented reality (AR) in retail establishments, the retail environment underwent a seismic shift. Retailers employ AI to identify the target market, comprehend the purchasing habits of past consumers, and provide customers with personalized product advertisements. For instance, in January this year, Google Cloud said it would launch four new artificial intelligence technologies aimed at retailers. The new technologies are mainly designed to aid retailers in transforming in-store shelf-checking processes and augment e-commerce operations, delivering more fluid and natural online shopping experiences. They also include a new "self-checking AI solution" that is primarily built on Vertex AI and leverages Google's extensive databases to provide retailers recognize "billions of products" and ensure that in-store shelves are well-stocked.

- However, with the rise in various security-related concerns and interoperability issues, the market's overall growth rate might get restrained throughout the forecast period.

- The pandemic significantly impacted IoT spending globally, especially in the retail sector. The merchants have postponed several new initiatives as their main priority during the economic crisis was maintaining corporate operations. As a result, IoT's retail market saw a revenue fall during the pandemic. However, it is anticipated that IoT use in retail will progressively rise after COVID-19. To eliminate human involvement and stop the coronavirus from spreading, retailers are already integrating AI technologies, cloud services, mobile payment systems, autonomous cleaning robots, and many others.

IoT in Retail Market Trends

Software Component Expected to Hold Significant Share

- The significant growth of internet shopping can be attributed to higher transaction values and increased order frequency. IoT can optimize supply chain management, reduce inventory error, and decrease labor costs. Ultimately, IoT can help the traditional brick-and-mortar shop compete with today's online-first shopping world by exponentially improving customer experience and reducing unnecessary expenses.

- Different software solutions providers provide IoT for the retail sector's betterment. Some of them are Qliktag, Evrythng, ThinFilm NC solutions, Gimble, Kaa Projects, Wise Shelf, Swirl, Memomi, Authentic or Not, Queuehop, and many others.

- Moreover, NFC-enabled technology creates immense growth opportunities for retailers to inform and persuade shoppers. For instance, national supermarket chain Kroger Co. piloted smart shelf tags to display product information. Moreover, the NFC provides significant functionalities to IoT by solving the challenges of unpowered objects lacking network access, providing the simplest, most intuitive way to indicate a user's interest in taking action, and connecting devices easily and intuitively. Hence, an increase in NFC solutions usage is penetrating the retail market, driving the market significantly.

- Companies like Paytm made headlines last year as it declared its plans for a USD 2.2 billion IPO. The country's highest-valued startup at USD 16 billion, the Noida-based fintech first known as One97 Communications originally started as a significant provider of digital phone payments. Still, it grew to cover insurance sales, ticket booking, and other digital financial services. PhonePe and Paytm were more commonly used than credit or debit cards for online shopping in India.

- According to the website (Boku), Google Pay, PhonePe, and Paytm are expected to grow by hundreds of millions of users in India by the end of 2025. Hence, with the rise in the number of users of mobile wallets, the market for IoT in the retail sector is expected to witness significant growth opportunities throughout the forecast period.

North America to Hold Largest Share

- The advent of e-commerce technologies and the incorporation of the best in-store experience have been the major factors responsible for the paradigm shift in US retailing. Retailers are prioritizing their spending toward omnichannel retailing by moving from purely online stores to brick-and-mortar stores and vice-versa.

- In addition, with an increasing number of consumers embracing the smart home environment in the United States, the expansion of IoT is on the rise across the region. As a result, retailers are aiming to develop their solutions around home assistants. The success of Alexa and Google Home are clear indicators of the trend. Also, deploying IoT to track inventory using sensors and RFID tags enables real-time management and streamlining of the entire flow. Amazon's warehouses in the United States have smart shelves, which help the retailer monitor and track inventory items, reducing human errors while reordering items and eliminating overstocking products in warehouses.

- The significant growth of internet shopping can be attributed to higher transaction values and increased order frequency owing to convenience. The retail Industry in America is divided into brick-and-mortar retailers boasting of successful online strategies and surviving the competition with Amazon. Moreover, the Internet of Things is also being widely used by retailers to provide a personalized experience to their customers. For example, Walmart uses IoT in its United States warehouses to gain insights about popular products on social media.

- Companies like Walmart, Target, and Best Buy have also found the right mix of products and services, like selling groceries, to keep shoppers coming into their stores. While Amazon remains the leader in e-commerce, these players are using their physical stores to fulfill online orders, simultaneously increasing their digital promotions.

- In December last year, Amazon planned to bring a TikTok-like shopping experience to its app. The company declared the launch of Inspire, a new short-form video and photo feed that enables consumers to explore ideas and products and shop from content created by brands, influencers, and other customers. The feature is primarily designed to draw consumers' attention away from apps like TikTok, where brands can directly market to consumers, significantly driving sales on Amazon.com instead.

IoT in Retail Industry Overview

The internet of things in the retail market needs to be more cohesive. An increasing number of consumers embracing the smart home environment, temperature sensors deployment in warehouses, and the advent of e-commerce technologies provide lucrative opportunities in the internet of things in the retail market. Overall, the competitive rivalry among existing competitors is high. Product innovation and expansion are penetrating the industry growth effectively.

- January 2023 - EY declared the introduction launch of a retail solution that builds on the Microsoft Cloud to help achieve seamless consumer shopping experiences. The EY organization introduced a new EY Retail Intelligence solution that primarily uses the Microsoft Cloud and Cloud for Retail to offer consumers a direct and seamless shopping experience.

- December 2022 - KORE, a global leader in the Internet of Things (IoT) Solutions and worldwide IoT Connectivity-as-a-Service (IoT CaaS), declared that it had established a go-to-market alliance with Google Cloud to bring IoT capabilities to global businesses. This multi-year alliance would help enterprises create robust IoT solutions that leverage Google Cloud infrastructure and abilities, as well as KORE's IoT Solutions. In addition, the coalition would transform the IoT industry by expanding new paths to market for industries such as Fleet/Logistics, Industrial IoT, Connected Health, retail/communications service providers, and many more.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions? and Market Definition?

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis?

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing IoT Applications Among Retailers Such As Predictive Equipment Maintenance , Connected Consumer and Smart Store

- 5.1.2 Rising Need for a Competitive Business Model to Sustain Competition

- 5.1.2.1 Competition

- 5.2 Market Challenges

- 5.2.1 Security Concerns and Interoperability Issues

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Service

- 6.1.3.1 Managed

- 6.1.3.2 Professional

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Korea

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc.

- 7.1.2 AT&T Inc.

- 7.1.3 Ayla Networks Inc.

- 7.1.4 Bosch Software Innovations GmbH

- 7.1.5 Cisco Systems Inc.

- 7.1.6 Fujitsu Ltd

- 7.1.7 General Electric

- 7.1.8 Google Inc.

- 7.1.9 Hewlett Packard Enterprise

- 7.1.10 Hitachi Ltd

- 7.1.11 Huawei Technologies Co. Ltd

- 7.1.12 IBM Corporation

- 7.1.13 Intel Corporation

- 7.1.14 Microsoft Corporation

- 7.1.15 Oracle Corporation

- 7.1.16 SAP SE

- 7.1.17 Siemens AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219