|

市場調查報告書

商品編碼

1626880

亞太地區分子篩-市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Asia-Pacific Molecular Sieve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

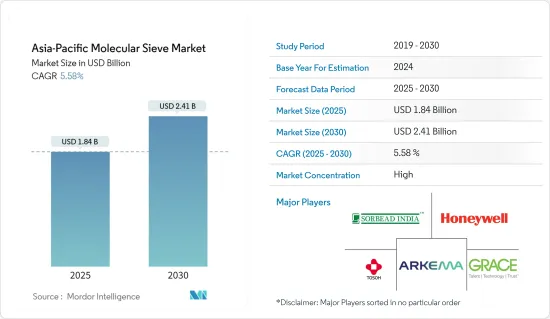

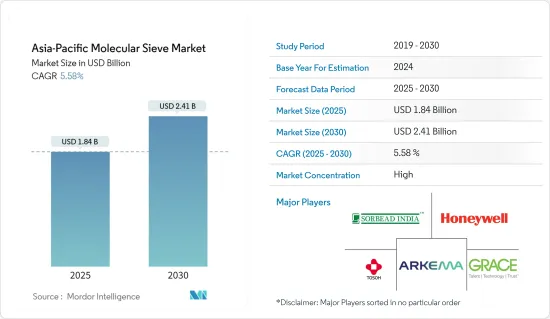

亞太地區分子篩市場規模預估至2025年為18.4億美元,預估至2030年將達24.1億美元,預測期間(2025-2030年)複合年成長率為5.58%。

由於全國範圍內的封鎖、嚴格的社會隔離措施和供應鏈中斷,COVID-19 大流行對分子篩市場產生了負面影響。 COVID-19 疫情導致中國和印度的石油和天然氣探勘活動以及精製中心關閉。從而影響了分子篩的市場需求。然而,新冠疫情大流行後,限制解除後市場恢復良好。由於石油和天然氣、製藥、汽車、化妝品和清潔劑等終端用戶行業對分子篩的需求增加,市場已顯著復甦。

主要亮點

- 分子篩作為石油和石化催化劑的廣泛應用以及污水處理行業中有害有機物處理意識的不斷提高預計將推動分子篩市場的發展。

- 化學合成物、酵素和其他替代品的威脅預計將阻礙市場成長。

- FDA 批准抗菌沸石分子篩用於消耗品和市場開發預計將在預測期內為市場創造機會。

- 由於石油和天然氣、汽車和製藥業對分子篩的需求不斷增加,中國在市場上佔據主導地位,預計在預測期內複合年成長率最高。

亞太分子篩市場趨勢

石油和天然氣終端用戶產業佔市場主導地位

- 分子篩用於石油和天然氣產業的精製應用。分子篩用於石化應用,例如乙烯、丙烯和丁二烯等原料的脫水和精製,裂解氣體和液體的脫水,石腦油進料的脫水以及乙炔轉換器的氫氣乾燥。

- 沸石用作將原油精製成最終石油產品的催化劑。由於其優異的選擇性,沸石催化劑通常是將煉油廠物流轉化為高辛烷值汽油混合原料的最有效和最具成本效益的技術。

- 在亞太地區,石油生產活動不斷增加,精製活動進一步增加。中國是該地區最大的石油生產市場之一。根據BP世界能源統計年鑑,2022年該國石油產能將為411.1萬桶/日,而2021年為399.4萬桶/日。

- 同樣,在印度,隨著石油產量的增加,精製活動也增加。根據英國石油公司統計,2022年該國石油產能為73.7萬桶/日。此外,預計未來幾年石油產量將增加,從而推動精製應用中對分子篩的需求。

- 此外,據 IBEF 稱,由於 Reliance Industries Limited 和石油天然氣公司 (ONGC) 營運的計劃的實施,預計印度石油和天然氣行業將在 2023 年至 2032 年實現強勁成長。因此,未來幾年石油和氣體純化計劃的實施預計將為該行業開闢新的途徑。

- 由於所有這些因素,石油和天然氣最終用戶產業預計將在預測期內主導分子篩市場。

中國主導市場

- 預計中國將在預測期內主導分子篩市場。石油和天然氣行業的擴張,工業、汽車、化妝品和製藥行業的顯著成長預計將推動該國分子篩市場的成長。

- 中國是該地區最大的汽車製造商。根據國際汽車協會預測,2022年中國汽車產量將達2,702萬輛,較去年同期成長3%。

- 此外,該國汽車產業的趨勢正在轉變,消費者對電池驅動的汽車越來越感興趣。此外,中國政府預計2025年電動車生產的滲透率將達到20%。這反映在該國的電動車銷售趨勢上,2022年電動車銷量創下歷史新高。根據中國乘用車協會的數據,中國政府在 2022 年銷售了 567 萬輛電動車和插電式混合動力車,幾乎是 2021 年銷量的兩倍。

- 近年來,各油田的天然氣產量增加。例如,根據中石油資料,中國最大的超深水陸上油田塔里木油田2022年產量為3,310萬噸,較2021年增加1.28噸。同樣,據中石化稱,涪陵油田的產能為2540億立方英尺(Bcf)。與 2021 年相比,增加了約 1 Bcf。根據國家發展和改革委員會統計,中國目前持有石油和天然氣管道11.2萬公里。計劃在未來五年內將目前的數字增加到25萬公里。

- 此外,中國的製藥業是世界上最大的製藥業之一。我們生產學名藥、治療藥物、原料藥、中草藥等。在日本註冊的藥品90%以上都是學名藥。未來幾年,中國醫藥產業預計將達到 3 兆元(4,500 億美元)。

- 分子篩在各種化妝品中用作化妝品添加劑。在中國,化妝品和個人護理行業是成長最快的領域之一。到2025年,該國個人保健產品市場預計將達到800億美元,推動預測期內對分子篩的需求。

- 由於上述因素,研究期間預計中國分子篩市場將顯著成長。

亞太分子篩產業概況

亞太分子篩市場本質上是部分一體化的。該市場的主要企業包括(排名不分先後)阿科瑪集團、霍尼韋爾國際公司、Sorbead India、東曹公司和 WR Grace & Co.-Conn。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 廣泛用作石油和石化行業的催化劑

- 提高對污水中有害有機物處理的認知

- 其他司機

- 抑制因素

- 合成化學品、酵素和其他替代品的威脅

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(以金額為準))

- 形式

- 顆粒

- 串珠的

- 粉末

- 尺寸

- 微孔的

- 介孔的

- 大孔的

- 產品

- 碳

- 黏土

- 多孔玻璃

- 矽膠

- 沸石

- 最終用戶產業

- 車

- 化妝品/清潔劑

- 石油和天然氣

- 製藥

- 廢棄物和水處理

- 其他最終用戶(農業、塑膠等)

- 地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Arkema Group

- Axens

- BASF SE

- Bete Ceramics Co. Ltd.

- Calgon Carbon Corporation

- CarboTech

- Clariant

- Dalian Daxi Absorbent Co., Ltd.

- Desicca Chemicals Pvt.Ltd.

- Graver Technologies

- Hengye Inc.

- Honeywell International Inc

- JIUZHOU CHEMICALS

- KNT Group

- Merck KGaA

- MolsivCN

- Solvay

- Sorbead India

- Tosoh Corporation

- WR Grace & Co.-Conn.

- Zeochem

- Zeolyst International

第7章 市場機會及未來趨勢

- FDA核准用於消耗品

- 抗菌沸石分子篩的研製

The Asia-Pacific Molecular Sieve Market size is estimated at USD 1.84 billion in 2025, and is expected to reach USD 2.41 billion by 2030, at a CAGR of 5.58% during the forecast period (2025-2030).

The COVID-19 pandemic had negatively impacted the market due to nationwide lockdowns, strict social distancing measures, and disruption in supply chains, which negatively affected the market for molecular sieves. The COVID-19 pandemic resulted in the closure of the oil and gas exploration activities and petroleum refining centers in China and India. It, thereby, affected the market demand for molecular sieves. However, post-COVID pandemic, the market recovered well after the restrictions were lifted. The market recovered significantly, owing to the rise in demand for molecular sieves in oil and gas, pharmaceutical, automotive, cosmetics, and detergent end-user industries.

Key Highlights

- The extensive application of molecular sieves as a catalyst in petroleum and petrochemical products and the rising awareness regarding the treatment of hazardous organic materials in the wastewater treatment industry is expected to drive the market for molecular sieves.

- The threat from chemical composites, enzymes, and other substitutes is expected to hinder market growth.

- FDA approval for usage in consumable items and the development of anti-microbial zeolite molecular sieves are expected to create opportunities for the market during the forecast period.

- China is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period due to rising demand for molecular sieves in the oil and gas, automotive, and pharmaceutical industries.

Asia-Pacific Molecular Sieve Market Trends

Oil and Gas End-User Industry Segment to Dominate The Market

- Molecular sieves are used in petroleum refining applications in the oil and gas industry. The molecular sieves are utilized in petrochemical applications such as ethylene, propylene, butadiene, and other feedstock dehydration and purification, cracked gas and liquid dehydration, naphtha feed dehydration, and drying hydrogen gas for acetylene converters.

- Zeolites are used as catalysts in refining crude oil into finished petroleum products. Zeolite catalysts are often the most efficient and cost-effective technique for converting refinery streams into high-octane gasoline blending stock due to their excellent selectivity.

- In the Asia-Pacific region, the oil production activities are increasing, further increasing the petroleum refining activities in the region. China is one of the largest markets for oil production in the region. According to the BP Statistical Review of World Energy, the country's oil production capacity is registered at 4,111 thousand barrels per day in 2022, as compared to 3994 thousand barrels per day in the year 2021.

- Similarly, in India, petroleum refining activities are increasing with the increasing oil production in the country. According to the BP Statistical Review, the country's oil production capacity is registered at 737 thousand barrels per day in the year 2022. Furthermore, the oil production volume is expected to increase in the coming years, thereby driving the demand for Molecular Sieves used in oil refining applications.

- Furthermore, according to the IBEF, India's oil and gas industry is expected to register a significant growth rate between 2023 and 2032, with the implementation of projects operated by Reliance Industries Limited and Oil and Natural Gas Corporation (ONGC). Thus, the implementation of oil and gas refinery projects in the coming years is expected to open new avenues for the industry.

- Owing to all these factors, the oil and gas end-user industry segment is expected to dominate the market for molecular sieves during the forecast period.

China to Dominate the Market

- China is expected to dominate the market for molecular sieves during the forecast period. The expansion of the oil and gas industry, along with significant growth in the industrial, automotive, cosmetics, and pharmaceutical industries, are likely to help propel the growth of the molecular sieve market in the country.

- China is the largest automotive vehicle manufacturer in the region. According to OICA (The Organisation Internationale des Constructeurs d'Automobiles), automotive vehicle production in China reached a total of 27.02 million units in 2022, an increase of 3% over the actual year for the same period.

- Moreover, the automobile industry in the country is witnessing switching trends as the consumer inclination toward battery-operated vehicles is on the higher side. Furthermore, the Chinese government estimated a 20% penetration rate of electric vehicle production by 2025. It is reflected in the electric vehicle sales trend in the country, which went to a record-breaking high in 2022. As per the China Passenger Car Association, the government sold 5.67 million EVs and plug-ins in 2022, touching almost double the sales figures achieved in 2021.

- In gas production, the country is witnessing increased production from different oilfields over the past few years. For instance, according to CNPC data, Tarim Oilfield, China's largest ultra-deep onshore oilfield, recorded production of 33.1 million tons (Mt) in 2022, which is up by 1.28 Mt from 2021. Similarly, as per Sinopec, the Fuling field produced 254 billion cubic feet (Bcf). That's up by roughly 1 Bcf as compared to 2021. According to the National Development and Reform Commission, currently, China holds 112,000 km of oil and gas pipelines. The plans are set to expand the current figure to 250,000 km in the next five years.

- Moreover, the pharmaceutical industry in China is also one of the largest in the world. The country produces generics, therapeutic medicines, active pharmaceutical ingredients, and traditional Chinese medicine. More than 90% of the drugs registered in the country are generic. The pharmaceutical industry in China is expected to reach CNY 3 trillion (USD 450 billion) in the coming years.

- Molecular Sieve is used as a cosmetic additive in various cosmetic products. In China, the cosmetics and personal care industry is one of the fastest-growing sectors. The country's personal care products market is projected to reach USD 80 billion by 2025, thereby driving the demand for molecular Sieve during the forecast period.

- Owing to the factors mentioned above, the market for molecular Sieves in China is projected to grow significantly during the study period.

Asia-Pacific Molecular Sieve Industry Overview

Asia-Pacific molecular sieve market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) Arkema Group, Honeywell International Inc., Sorbead India, Tosoh Corporation, and W. R. Grace & Co.-Conn., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Extensive Application as a Catalyst in Petroleum and Petrochemical Products

- 4.1.2 Rising Awareness Regarding the Treatment of Hazardous Organic Materials in Wastewater

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Threat from Chemical Composites, Enzymes, and Other Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Shape

- 5.1.1 Pelleted

- 5.1.2 Beaded

- 5.1.3 Powdered

- 5.2 Size

- 5.2.1 Microporous

- 5.2.2 Mesoporous

- 5.2.3 Macroporous

- 5.3 Product

- 5.3.1 Carbon

- 5.3.2 Clay

- 5.3.3 Porous Glass

- 5.3.4 Silica Gel

- 5.3.5 Zeolite

- 5.4 End-User Industry

- 5.4.1 Automotive

- 5.4.2 Cosmetics and Detergent

- 5.4.3 Oil and Gas

- 5.4.4 Pharmaceutical

- 5.4.5 Waste and Water Treatment

- 5.4.6 Other End-users (Agriculture, Plastics, etc.)

- 5.5 Geography

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 South Korea

- 5.5.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema Group

- 6.4.2 Axens

- 6.4.3 BASF SE

- 6.4.4 Bete Ceramics Co. Ltd.

- 6.4.5 Calgon Carbon Corporation

- 6.4.6 CarboTech

- 6.4.7 Clariant

- 6.4.8 Dalian Daxi Absorbent Co., Ltd.

- 6.4.9 Desicca Chemicals Pvt.Ltd.

- 6.4.10 Graver Technologies

- 6.4.11 Hengye Inc.

- 6.4.12 Honeywell International Inc

- 6.4.13 JIUZHOU CHEMICALS

- 6.4.14 KNT Group

- 6.4.15 Merck KGaA

- 6.4.16 MolsivCN

- 6.4.17 Solvay

- 6.4.18 Sorbead India

- 6.4.19 Tosoh Corporation

- 6.4.20 W. R. Grace & Co.-Conn.

- 6.4.21 Zeochem

- 6.4.22 Zeolyst International

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 FDA Approval for Usage in Consumable Items

- 7.2 Development of Anti-microbial Zeolite Molecular Sieves