|

市場調查報告書

商品編碼

1626886

亞太半導體(矽)智慧財產權 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Asia-Pacific Semiconductor (Silicon) Intellectual Property - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

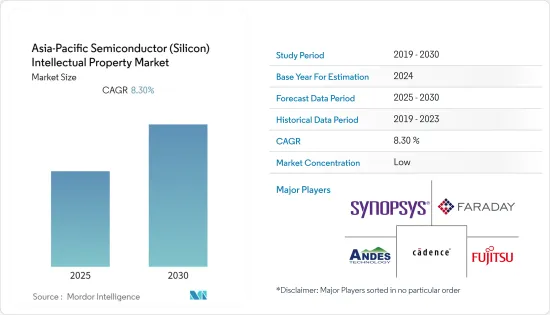

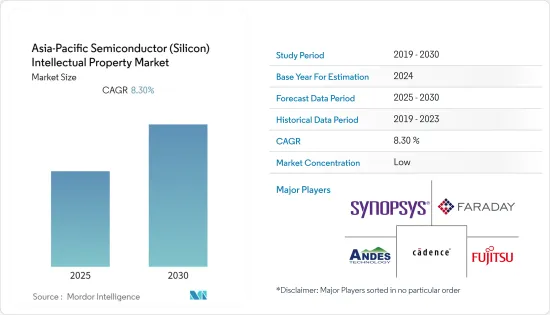

亞太半導體智慧財產權市場預計在預測期內複合年成長率為8.3%

主要亮點

- 政府在塑造中國市場方面也扮演著重要角色。自2020年8月以來,中國政府宣布了多項新的相關措施,以促進半導體產業的發展。一是2020年8月,國務院印發《關於促進積體電路產業及軟體產業發展多項措施的通知》。

- 此外,2021 年 3 月,政府宣布了多項實施措施,包括企業必須滿足的標準才能獲得政府獎勵措施、稅收和海關法規。此外,中國的新措施將鼓勵美國和外國半導體公司將某些技術、智慧財產權、研發轉移到中國境內營運,從而促進國內市場的成長。此外,這些措施也為願意在中國建立生產設施等能力的企業提供了未來10年的優惠條件,包括智慧財產權保護、稅收和融資。

- 台灣是世界領先的半導體生產國之一。台灣擁有台積電、聯華等主要企業,在台灣半導體產業中領先。該國半導體市場的成長在一定程度上要歸功於政府的支持。最近,國家發展基金宣布,台灣企業計劃在 2021 年至 2025 年間投資 1,070 億美元來發展半導體產業。政府也透過資金和人才招聘計劃支持新半導體技術的開發。因此,半導體市場的成長也會帶來智慧財產權的成長。

- 然而,系統單晶片 (SoC) 設計的複雜性已經超出了系統工程能力。設計複雜性的增加導致資料量的增加,使半導體開發比以前更加困難,並限制了所研究市場的成長。此外,儘管受到 COVID-19 大流行的影響,與 2019 年相比,2020 年整體半導體市場仍顯示出強勁成長,並且由於終端用戶的巨大需求,預計未來幾年將進一步成長。這也支持了市場供應商的成長。

- 例如,2020 年 10 月,Cadence Inc. 報告收益2019 年同期報告的營收為 5.8 億美元。此外,由於下半年中國硬體和IP銷售活動的增加以及我們的系統設計和分析業務的持續進展,我們上調了2020年的收益和業績預測。 2020年第四季度,我們預期企業收益在7.2億美元至7.4億美元之間。

亞太半導體(矽)知識產權市場趨勢

消費性電子產品佔據主要市場佔有率

- 消費性電子產業正在呈指數級發展,來自消費者的壓力迫使供應商提供差異化產品並保持市場領先地位。現今的智慧產品由複雜的電子系統組成,需要無錯誤操作。更快的資料速度、更小的設備尺寸、對多種無線技術的支援以及更長的電池壽命都需要嚴格的分析。此外,將各種功能整合到單一設備中的願望導致了複雜的電路基板設計。

- 半導體體內置於行動電話等通訊設備以及遊戲機、電視和家用電子電器產品等消費家用電子電器。積體電路 (IC) 的發明一直是消費性電子產業(包括寬頻和日益成長的行動應用)發展的主要推動力之一。

- 受平板設備銷售成長推動的資料處理市場和智慧型手機銷售成長所推動的通訊市場的推動,市場依然強勁。此外,消費性電子產品也受惠於銷售量的成長,尤其是數位機上盒。

- 供應商正在為消費性電子市場開發和整合新技術。例如,2021 年 5 月,Synopsys Inc. 宣佈為基於 Arm Mali G710 GPU、Armv9 和 Arm DynamIQ 的下一代 Arm Cortex-X2、Cortex-A510 和 Cortex-A710 CPU 的早期採用者推出多個 SoC。這些下一代 SoC 專為高階消費性設備而開發,並利用 Arm 的全新架構創新來提供更高的效能和能源效率。此外,兩家公司還共同開發了針對 5nm、4nm 和 3nm 先進製程技術的流程和方法。

- 此外,Imagination Technologies 也為智慧型手機、數位電視、平板電腦和機上盒提供半導體 IP 解決方案。該公司將把半導體設計能力與PowerVR多媒體和人工智慧核心結合,打造先進的SoC,推動智慧型手機的進一步革命。

汽車領域預計將保持高成長

- 汽車產業技術創新的快節奏直接影響了汽車電子在汽車設計和製造總成本的成本。因此,人們的注意力集中在完成汽車領域技術整合所需的智慧財產權價值上。自動駕駛汽車已成為半導體晶片的最大消費者之一。 ADAS(高級駕駛輔助系統)、自動駕駛系統和車載資訊娛樂系統正在推動對 LiDAR 和 RADAR 等感測器、互連攝影機、顯示器和車載處理器的需求。

- 預計每輛自動駕駛汽車每小時能夠創建和消耗高達 4 Terabyte的資料。高速有線連接對於將這些資料從感測器移動到處理節點並以低延遲連接車輛組件至關重要。此外,嚴格的安全要求意味著車載連接必須高度可靠,並且能夠在惡劣環境下抵抗干擾和噪音。 2020 年,以行動為導向的全球商業聯盟 MIPI 宣布了首個汽車長距離 SerDes 介面規範,可實現高達每秒 16Gigabit的資料傳輸,並計劃實現每秒 48Gigabit及以上的資料傳輸。

- 許多公司透過提供車載半導體 IP 來利用自動駕駛汽車的趨勢。例如,Achronix Semiconductor Corporation 的 Speedcore eFPGA IP 允許汽車半導體供應商在其設備中包含客自訂數量的可程式邏輯,從而比典型的 CPU 或 GPU 實現更多客製化。

- 此外,在汽車領域,機器擴大與機器學習 (ML) 和人工智慧 (AI) 整合,主要是為了實現自動駕駛功能。此外,5G網路的結合預計將增加V2X(車輛到一切)技術在大都會圈的可行性。通用汽車在中國推出了搭載V2X技術的商用車別克GL8。是國內首個搭載此技術的品牌。通用汽車還宣布,將從 2022 年開始為新款凱迪拉克汽車以及大多數雪佛蘭和別克汽車配備 5G 技術。

- 將此類先進技術融入汽車領域將增加對半導體的需求,從而產生對特定應用半導體IP的需求。因此,公司正在進行投資以滿足市場需求。

亞太半導體(矽)智慧財產權產業概況

亞太半導體(矽)智慧財產權市場是一個競爭激烈的市場,由智原科技公司(Faraday Technology Corporation)、Cadence Design Systems Inc.、富士通有限公司(Fujitsu Ltd)和 eMemory Technology Inc. 等重要參與企業組成。從市場佔有率來看,目前該市場由幾家大型企業主導。這些公司正在利用策略合作措施來擴大市場佔有率並提高盈利。

- 2021 年 6 月 - 智原科技公司宣布,高達 4.2Gbps 的 LPDDR4 和 LPDDR4X 組合 PHY IP 現已在三星 14 奈米 LPC 製程上推出。高度緊湊的設計透過兩種硬化配置提供了額外的靈活性,支援內聯矩形和角落邊緣放置。

- 2021 年 6 月 - Synopsys Inc. 與 Samsung Foundry 合作提供 Synopsys Fusion 設計平台,讓 Samsung Foundry 成功交付多系統晶片(SoC) 首輪晶片。該平台增強了下一代 3nm 環柵 (GAA) 製程技術的功耗、效能和麵積擴展優勢。

- 2021 年 4 月 - eMemory Technology Inc. 與 Achronix Semiconductor Corporation 合作,Achronix Semiconductor Corporation 是一家基於 FPGA 的資料加速器設備的著名供應商,可提高半導體晶片等級的安全性。 eMemory 在 Achronix 產品組合中列出了其 NeoFuse 和 NeoPUF IP。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第4章市場動態

- 市場促進因素

- 對連網型設備的需求不斷成長

- 對現代 SoC 設計的需求不斷成長

- 市場限制因素

- IP經營模式與規模經濟

第5章市場區隔

- 按收益類型

- 執照

- 版稅

- 服務

- 按IP類型

- 處理器IP

- 有線/無線介面IP

- 其他

- 按行業分類

- 消費性電子產品

- 電腦、網路、通訊

- 車

- 工業的

- 其他行業

- 按國家/地區

- 中國

- 台灣

- 日本

- 韓國

- 印度

- 其他亞太地區

第6章 競爭狀況

- 公司簡介

- Faraday Technology Corporation

- Fujitsu Ltd

- ARM Limited

- Synopsys Inc.

- Cadence Design Systems Inc.

- CEVA Inc.

- Andes Technology Corporation

- MediaTek Inc.

- Digital Media Professionals Inc.

- VeriSilicon Holdings Co. Ltd

- Rambus Incoporated

- eMemory Technology Inc.

第7章 投資分析

第8章市場的未來

The Asia-Pacific Semiconductor Intellectual Property Market is expected to register a CAGR of 8.3% during the forecast period.

Key Highlights

- The government has also played a significant role in molding the market in China. Since August 2020, the government of China has issued several new related policy measures to boost the development of its semiconductor industry. To begin with, in August 2020, China's State Council issued a Notice on different policies to promote the development of the IC industry and software industry.

- Also, in March 2021, the government issued several implementing measures that include criteria companies must meet to qualify for government preferences, tax, and tariff provisions. In addition, China's new policies encourage the United States and foreign semiconductor companies to transfer specific technology, intellectual property, research, and development to operations in China, driving growth in the domestic market. Furthermore, such policies offer preferential terms over the next ten years, including IP protection, tax, and financing for companies willing to establish capabilities, including production facilities in China.

- Taiwan is one of the largest producers of semiconductors in the world. The country is home to Taiwan Semiconductor Manufacturing Limited (TSMC), United Microelectronics Corporation, and other prominent players, driving the country's semiconductor industry. The semiconductor market in the country is also growing due to support from the government. Recently, the National development fund announced that between 2021 and 2025, the Taiwan companies have planned USD 107 billion investment for the semiconductor industry's growth. The government is also helping develop new semiconductor technologies with funding support and talent recruitment programs. Therefore, the increase in the semiconductor market leads to a rise in intellectual properties as well.

- However, The complexity of system on chip (SoC) designs is outpacing systems engineering capabilities. Increasing design complexity has given rise to increasing data size and thus, making semiconductor development more challenging than before, and is restraining the growth of the studied market. Further, the overall semiconductor market witnessed significant growth in 2020 compared to 2019, despite the COVID-19 pandemic, and it is further expected to grow in the coming years, owing to massive end-user demand. This has also supported the growth of the market vendors.

- For instance, in October 2020, Cadence reported a revenue of USD 667 million in the third quarter of 2020, compared to the revenue of USD 580 million reported for the same period in 2019. The company also raised its 2020 revenue and earnings forecast due to higher second-half hardware and IP sales activity in China and continuing progress in the system design and analysis business. For the fourth quarter of 2020, the company expected the total revenue in the range of USD 720 million-USD 740 million.

APAC Semiconductor (Silicon) Intellectual Property Market Trends

Consumer Electronics to Hold a Major Market Share

- The consumer electronics industry is evolving exponentially, and the pressure of demands from the consumer side has been compelling suppliers to provide differentiated products and be the first movers in the market. Currently, smart products are comprised of complex electronic systems that require an error-less operation. Faster data rates, device miniaturization, support for multiple wireless technologies, and longer battery life demand rigorous analysis. Furthermore, demand for various feature integrations onto a single device has led to intricate circuit board designs.

- Semiconductors are integrated into communication devices such as mobile phones and consumer electronics like gaming consoles, TV sets, and household appliances. The invention of integrated circuits (ICs) was one of the major drivers behind the development of the consumer electronics industry, including broadband and increasingly mobile applications.

- The market is continued in a strong position due to the data processing application market, driven by increased tablet sales and the communications market by smartphone sales. Moreover, consumer electronics also benefitted from a growth in units sold, particularly in digital set-top boxes.

- Vendors in the market are developing and integrating new technologies for applications in the consumer electronics market. For instance, in May 2021, Synopsys Inc. announced multiple SoC tape-outs at early adopters of the next-generation Arm Cortex-X2, Cortex-A510, and Cortex-A710 CPUs based on Arm Mali G710 GPUs, Armv9, and Arm DynamIQ. These next-generation SoCs were developed for high-end consumer devices to deliver improved performance and power efficiency through Arm's new architectural innovations. Furthermore, the company jointly developed flows and methodologies aiming at 5nm, 4nm, and 3nm advanced-process technologies.

- Moreover, Imagination Technologies provides Semiconductor IP solutions targeting smartphones, digital television, tablet, and set-top box. The company integrates semiconductor design capability with PowerVR multimedia and AI cores to create advanced SoCs for further smartphone revolution.

The Automobile Segment is Anticipated to Register High Growth Rate

- The fast pace of innovation in the automobile industry has directly impacted the cost of automobile electronics in the total cost of vehicle design and build. As a result, this has led to an increased focus on the value of the IP needed to complete technology integration in the automotive space. Autonomous vehicles have become one of the largest consumers of semiconductor chips. Advanced driver assistance systems, autonomous driving systems, and in-vehicle infotainment drive the need for sensors such as LiDARs and RADARs, interconnected cameras, displays, and onboard processors.

- It is anticipated that each autonomous car will be able to create and consume up to 4 terabytes of data per hour. High-speed wired connectivity is crucial to moving this data from sensors to processing nodes and connecting the automotive components with low latency. Moreover, due to stringent safety requirements, automotive connectivity has to be resilient and reliable to interference and noise under harsh environments. In 2020, MIPI, a mobility-oriented global business alliance, released the first automotive long-reach SerDes interface specification, allowing data rates as high as 16 gigabits per second with a plan to 48 gigabits per second and beyond.

- Many companies are utilizing the autonomous vehicles trend by providing automotive semiconductor IPs. For instance, Achronix Semiconductor Corporation's Speedcore eFPGA IP enables automotive semiconductor suppliers to include a custom amount of programmable logic in their devices which permits more customization than a typical CPU or GPU.

- Further, the automobile sector is witnessing the integration of Machine Learning (ML) and Artificial Intelligence (AI) in vehicles, primarily for enabling autonomous driving functionalities. Additionally, combining 5G networks is expected to make vehicle-to-everything (V2X) technology more viable in major metropolitan areas. General Motors has launched a production vehicle equipped with V2X technology, the Buick GL8, in China. It is the first such brand with this technology in China. General Motors also announced that 5G technology would be available on new Cadillac and most Chevrolet and Buick vehicles starting in 2022.

- Incorporating such advanced technologies in the automobile sector drives the need for semiconductors, resulting in driving application-specific semiconductor IPs. As a result, companies are investing to fulfill the market demands.

APAC Semiconductor (Silicon) Intellectual Property Industry Overview

The Asia Pacific Semiconductor (Silicon) Intellectual Property Market is a highly competitive market and consists of several significant players like Faraday Technology Corporation, Cadence Design Systems Inc., Fujitsu Ltd, eMemory Technology Inc., etc. In terms of market share, few of the major players currently dominate the market. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability.

- June 2021 - Faraday Technology Corporation announced its LPDDR4 and LPDDR4X combo PHY IP up to 4.2Gbps, which is currently available in Samsung's 14nm LPC process. The highly compact design provides additional flexibility with two hardened configurations supporting both in-line rectangular and corner-edge placement.

- June 2021 - Synopsys Inc. partnered with Samsung Foundry to provide Synopsys Fusion Design Platform to enable Samsung Foundry to achieve first-pass silicon success for multi-subsystem system-on-chip (SoC). It augments the extended power, performance, and area benefits of its next-generation, 3nm gate-all-around (GAA) process technology.

- April 2021 - eMemory Technology Inc. partnered with Achronix Semiconductor Corporation, a prominent provider of FPGA-based data accelerator devices for improving security at the semiconductor chip level. eMemory will contribute its NeoFuse and NeoPUF IP to the Achronix portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 MARKET INSIGHTS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Bargaining Power of Suppliers

- 3.2.2 Bargaining Power of Buyers

- 3.2.3 Threat of New Entrants

- 3.2.4 Threat of Substitutes

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Industry Value Chain Analysis

- 3.4 Assessment of Impact of COVID-19 on the Market

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand for Connected Devices

- 4.1.2 Growing Demand for Modern SoC Designs

- 4.2 Market Restraints

- 4.2.1 IP Business Model and Economies of Scale

5 MARKET SEGMENTATION

- 5.1 By Revenue Type

- 5.1.1 License

- 5.1.2 Royalty

- 5.1.3 Services

- 5.2 By IP Type

- 5.2.1 Processor IP

- 5.2.2 Wired and Wireless Interface IP

- 5.2.3 Other IP Types

- 5.3 By End-user Vertical

- 5.3.1 Consumer Electronics

- 5.3.2 Computers, Networking and Communication

- 5.3.3 Automobile

- 5.3.4 Industrial

- 5.3.5 Other End-user Verticals

- 5.4 By Country

- 5.4.1 China

- 5.4.2 Taiwan

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 India

- 5.4.6 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Faraday Technology Corporation

- 6.1.2 Fujitsu Ltd

- 6.1.3 ARM Limited

- 6.1.4 Synopsys Inc.

- 6.1.5 Cadence Design Systems Inc.

- 6.1.6 CEVA Inc.

- 6.1.7 Andes Technology Corporation

- 6.1.8 MediaTek Inc.

- 6.1.9 Digital Media Professionals Inc.

- 6.1.10 VeriSilicon Holdings Co. Ltd

- 6.1.11 Rambus Incoporated

- 6.1.12 eMemory Technology Inc.