|

市場調查報告書

商品編碼

1626887

託管資料中心服務:市場佔有率分析、產業趨勢、成長預測(2025-2030)Managed Data Center Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

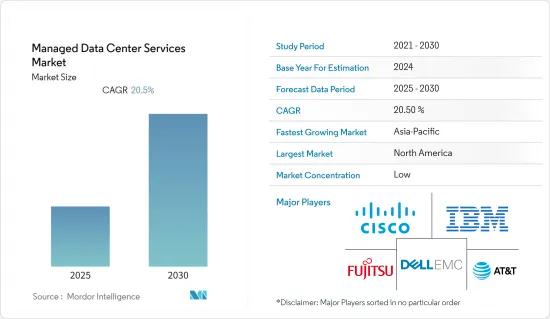

託管資料中心服務市場預計在預測期內複合年成長率為 20.5%

主要亮點

- 託管資料中心服務使企業能夠擺脫實體基礎設施並降低管理成本。擁有資料中心的成本很高,而且市場上有許多連接的設備。此外,元宇宙概念作為產業擴張的關鍵驅動力才剛開始受到關注。此外,資料中心服務預計未來將變得更加流行,因為它們允許公司以低成本擴展其 IT業務,而無需添加硬體。

- 由於網路威脅的增加和資料外洩的可能性,該市場正在擴大。最受歡迎的資料保護託管服務之一是複製。最受歡迎的資料保護託管服務之一是複製。網路強化減少了攻擊面並防止惡意軟體均勻傳播。資料中心安全團隊透過強化軟體二進位來消除所有類型的威脅。

- 業務永續營運和可用性是資料中心服務面臨的兩大挑戰。由於提供者或 WAN 中斷,資料中心使用的應用程式可能無法存取。即使服務等級協定涵蓋了資料中心服務可用性,計劃外停機也可能會產生嚴重後果。此外,資料中心服務是雲端運算的一部分,因此容易受到各種線上危險的影響。資料安全性和可用性預計將阻礙產業擴張。

- COVID-19 的爆發導致許多行業的許多業務關閉以及多個資料中心的建設。這對 DCaaS 產業影響不大,因為傳統觀點傾向於保持社交距離和企業在家工作文化。由於資料量不斷增加,疫情迫使許多公司將整個IT基礎設施遷移到雲端。許多公司選擇資料中心作為服務,因為它們提供比本地資料中心更高的容量和資料處理能力。

- Rackspace Technology 和Google Cloud 去年對1,400 多名IT 高層進行的一項民意調查發現,51% 的人目前將基礎設施部署在雲端中,49% 的人正在將工作負載從本地基礎設施轉移到雲端,他們表示有計劃這樣做。此外,疫情鼓勵了社群媒體和其他數位工具的使用,增加了世界上的資料量。由於擴大轉向雲端運算,資料中心即服務的普及預計將進一步加速。 COVID-19 的爆發對市場來說是一個福音。市場在大流行期間成長,預計這種情況將在預測期內持續成長。

託管資料中心服務市場的趨勢

零售業主導市場

- 在現代社會中,資料中心已成為零售企業的重要組成部分,因為它們提供數位服務和線上客戶體驗。消費者在與品牌互動時(無論是在網路上還是在店內)越來越期望獲得高度客製化和相關的體驗。根據特定客戶需求客製化宣傳活動和體驗需要大量資料和資訊。

- 電子商務和線上零售本質上是傳統實體購物的延伸。以 eBay 和亞馬遜為首的許多公司僅以線上和數位方式營運。隨著消費者越來越依賴智慧型手機進行商店比較購物,大型實體零售商開始關注線上體驗並推出更多行動購物應用程式。

- 個人化購物體驗意味著記錄顧客的交易歷史並允許零售商提供產品推薦。消費者數量的不斷成長使得強大的資料中心成為必須。

- 零售業出現了引進新技術的一個主要重點領域。 Amazon Go是一家概念店,您無需結帳即可提貨並走出商店,標誌著亞馬遜從線上零售商轉向實體店的轉變。產品上的感測器和消費者的行動應用程式用於追蹤交易。除了零售業中常規使用的資料中心之外,還有更現代、更先進的解決方案,許多公司剛開始嘗試這些解決方案。創新的數位電子看板,例如基於魔鏡 AR 技術的數位標牌,就是一個很好的例子。

亞太地區將經歷最高成長

- 這可能是由於資料中心的擴展以處理大量資料。此外,該地區數位服務的使用不斷增加,廣泛的通訊網路預計將支持市場擴張。此外,新興企業和小型企業數量的不斷成長預計將加速資料中心服務的使用。亞太地區正在經歷由數位產品和服務驅動的資料的增加。這是由於該地區人口不斷成長和電子商務不斷成長。

- 亞太地區有兩個重要的資料中心市場。有些是響應本地需求,例如香港和新加坡,而有些則響應國內需求,例如東京、上海和澳洲。印尼和印度是令人感興趣的層級市場,因為它們的人口成長迅速,需要更多的資料中心空間。

- 悉尼的資料中心市場也仍在成長。儘管澳洲地處偏遠,但由於其高度數位化的國家身份,需求強勁。澳洲是全球最大的雲端用戶。澳洲是許多國際公司的所在地。

- 印度是世界上人口第二多的國家,也是最年輕的國家之一。他們必須應對巨大的資料爆炸。許多人擁有多部行動電話。印度只有252兆瓦的資料中心,但這個數字將會急劇增加。印度,尤其是孟買,擁有許多大型資料中心建築。

- 雲端技術在亞太地區逐漸發展動能。因此,速度和敏捷性正在推動對託管服務的需求。雲端基礎的部署預計將獲得動力。

- 監管機構在促進或抑制託管資料中心服務的成長方面發揮關鍵作用。儘管亞太地區的一些監管機構已經明確了外包規則和指南,以幫助企業實現合規性,但雲端採用的監管限制和阻礙因素仍然存在。

託管資料中心服務產業概述

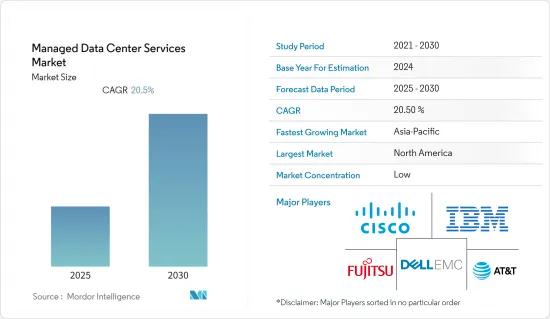

託管資料中心服務市場較為分散,大多數主要公司都提供資料中心管理和企業網路服務等服務,以實現業務永續營運。該市場的主要參與者包括富士通、Cisco、戴爾易安信和IBM公司。由於進入障礙相當低,參與企業數量正在增加。

2022 年 11 月,富士通有限公司宣布計劃在特拉維夫開設一個新的研發中心,並聘請頂尖人才,以推動資料和安全創新,以應對連網型和不可預測性的增加。

2022 年 10 月,美國的全球技術服務和電訊設備供應商思科宣布將在印度投資建置 WebEx 專用資料中心,這是一套用於遠端會議、文件共用和客服中心業務的服務。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 市場定義和範圍

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 網路攻擊和資料外洩風險增加推動市場擴張

- 管理大量資料的需求擴大了市場

- 零售業資料中心服務使用量的增加提振了市場

- 市場限制因素

- 缺乏熟練、敬業的人才阻礙了市場成長

- COVID-19 對資料中心服務市場的影響

第6章 重大技術投入

- 雲端技術

- 人工智慧

- 網路安全

- 數位服務

第7章 市場區隔

- 按類型

- 託管儲存

- 託管

- 託管託管

- 依部署類型

- 雲

- 本地

- 按最終用戶產業

- BFSI

- 能源

- 零售

- 衛生保健

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第8章 競爭格局

- 公司簡介

- Fujitsu Ltd

- Cisco Systems Inc.

- Dell EMC

- IBM Corporation

- AT&T Inc.

- HP Development Company LP

- Microsoft Corporation

- Verizon Communications Inc.

- Dell Inc.

- Rackspace Inc.

- TCS Limited

- Deutsche Telekom AG

第9章投資分析

第10章市場機會與未來趨勢

The Managed Data Center Services Market is expected to register a CAGR of 20.5% during the forecast period.

Key Highlights

- Enterprises could move away from physical infrastructure owing to managed data center services, enabling overhead cost savings. The cost of owning a data center is considerable, there are many linked devices on the market, and the metaverse concept is just starting to take off as a major element driving industry expansion. It is also expected that data center services will become more popular because they offer businesses a cheap way to expand their IT operations without having to invest in more hardware.

- The market is expanding due to rising cyber threats and the possibility of data leakage. One of the most popular managed services for data protection is replication. One of the most popular managed services for data protection is replication. Cyber hardening reduces attack surfaces and prevents malware from spreading uniformly. Data center security teams eliminate a whole class of threats by hardening software binaries.

- Business continuity and availability are two of the main data center services issues. Applications used by data centers may become inaccessible if there is a provider or WAN outage. Unexpected downtimes are anticipated to have significant consequences, even though a service-level agreement covers the availability of data center services. Additionally, as data center services are a part of cloud computing, they are susceptible to various online dangers. It is expected that data security and availability would hinder industry expansion.

- The COVID-19 outbreak caused the halting of numerous operations in numerous industries and the construction of multiple data centers. Due to social conventions favoring social distance and corporate work-from-home cultures, this had little to no effect on the DCaaS industry. Due to increasing data volumes, numerous businesses were forced to move their entire IT infrastructure to the cloud due to the pandemic outbreak. Many businesses are likely to choose data centers as a service because they have far greater volume and data handling capacity than on-premises data centers.

- A poll of more than 1,400 IT executives in the previous year by Rackspace Technology and Google Cloud found that 51% of them said their infrastructure is currently in the cloud, and 49% said they have plans to move workloads from on-premises infrastructure to the cloud. Additionally, the epidemic raised worldwide data volumes by encouraging more people to use social media and other digital tools. The popularity of data centers as a service is projected to be fueled by the growing shift toward cloud computing. So, the COVID-19 outbreak was good for the market. During the pandemic, the market grew, and this is expected to continue for the rest of the forecasted period.

Managed Data Center Services Market Trends

Retail Industry to Dominate the Market

- In the modern world, data centers are essential elements of retail operations since they provide digital services and online customer experiences. When interacting with brands, whether online or in a physical store, consumers now demand a highly tailored and pertinent experience. A lot of data and information are needed to customize a campaign or experience to meet the needs of specific customers.

- E-commerce and online retail are essentially an extension of traditional and physical shopping. Numerous businesses only operate online and digitally, with eBay and Amazon being the two most prominent players. Now that consumers are utilizing smartphones more frequently for in-store comparison shopping, large brick-and-mortar retailers are placing a lot of emphasis on their online experiences and rolling out more mobile shopping apps.

- Personalizing the shopping experience means customers' transaction history is recorded so that the retailer can provide recommendations. Due to the increasing number of shoppers, robust data centers have become mandatory.

- A major area of concentration for implementing new technologies has emerged in retail. With its Amazon Go concept store, which lets customers take items and walk out without a cashier, Amazon has transitioned from an online retailer to a physical store. Sensors on the merchandise and the shopper's mobile app are used to track transactions. The more contemporary or cutting-edge solutions are in addition to some of the usual data center uses in retail that many companies are just beginning to experiment with. Innovative digital signage, like that based on Magic Mirror AR technology, is a prime example.

Asia-Pacific to Witness the Highest Growth

- The expansion of data centers to handle enormous data volumes can be attributed to it. Additionally, the region's growing use of digital services and wide telecom network are anticipated to support market expansion. In addition, the region's expanding startup and SME population is expected to accelerate the use of data center services. Asia-Pacific is seeing a rise in the amount of data made by digital products and services. This is because the region's population is growing and e-commerce is on the rise.

- There are two significant data center marketplaces in the Asia Pacific region: those that cater to local demand, like those in Hong Kong and Singapore, and those that cater to domestic demand, like those in Tokyo, Shanghai, and Australia. Indonesia and India are interesting Tier II markets because their populations are growing quickly and they need more data center space.

- The market for data centers in Sydney is also still expanding. Despite its remote location, Australia has a strong demand due to its highly digitalized populace. The world's highest cloud use is found in Australia. In Australia, there are numerous international corporations.

- India is home to the second-largest and one of the youngest populations in the world. They must deal with a massive data surge. Many people own multiple cell phones. India only has 252 MW of data center power, but this number will rise dramatically. In India, particularly in Mumbai, there are a lot of buildings for large data centers.

- Cloud technology is slowly gaining momentum in Asia-Pacific. Thus, the demand for managed services is increasing due to speed and agility. It will give a boost to cloud-based deployments.

- Regulators play a crucial role in enabling-or impeding-the growth of managed data center services. While some APAC regulators are clarifying outsourcing rules and guidelines to help firms achieve compliance, regulatory restrictions and cloud adoption blockers still exist.

Managed Data Center Services Industry Overview

The market for managed data center services is fragmented, with the majority of the giants providing services like data center management and enterprise network services, resulting in business continuity. Some major players in the market are Fujitsu Ltd., Cisco Systems Inc., Dell EMC, and IBM Corporation. New companies are also entering the market as the entry barrier is quite low.

In November 2022, in an era of growing connectedness and unpredictability, Fujitsu Limited announced plans to establish a new center for research and development in Tel Aviv, expediting the hiring of top personnel to drive innovation in data and security.

In October 2022, Cisco, a US-based global provider of technology services and telecom equipment, said it would invest in a dedicated data center in India for WebEx, its suite of services for remote conferencing, file sharing, and call center operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Cyber Attacks and Risk of Data Leaks is Causing the Market to Grow

- 5.1.2 Need for Management of Large Volume of Data Generated is Expanding the Market

- 5.1.3 Rising use of Data center service in Retail Industry to boost the market.

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled and Dedicated Personnel is Hindering the Market Growth

- 5.3 Impact of Covid-19 on Data Center Services Market

6 KEY TECHNOLOGY INVESTMENTS

- 6.1 Cloud Technology

- 6.2 Artificial Intelligence

- 6.3 Cyber Security

- 6.4 Digital Services

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Managed Storage

- 7.1.2 Managed Hosting

- 7.1.3 Managed Collocation

- 7.2 By Deployment Type

- 7.2.1 Cloud

- 7.2.2 On-premise

- 7.3 By End-user Industry

- 7.3.1 BFSI

- 7.3.2 Energy

- 7.3.3 Retail

- 7.3.4 Healthcare

- 7.3.5 Manufacturing

- 7.3.6 Other End-user Industries

- 7.4 Geography

- 7.4.1 North America

- 7.4.1.1 United States

- 7.4.1.2 Canada

- 7.4.1.3 Rest of North America

- 7.4.2 Europe

- 7.4.2.1 Germany

- 7.4.2.2 United Kingdom

- 7.4.2.3 France

- 7.4.2.4 Spain

- 7.4.2.5 Rest of Europe

- 7.4.3 Asia-Pacific

- 7.4.3.1 China

- 7.4.3.2 Japan

- 7.4.3.3 India

- 7.4.3.4 Rest of Asia-Pacific

- 7.4.4 Latin America

- 7.4.4.1 Brazil

- 7.4.4.2 Argentina

- 7.4.4.3 Rest of Latin America

- 7.4.5 Middle East and Africa

- 7.4.5.1 UAE

- 7.4.5.2 Saudi Arabia

- 7.4.5.3 South Africa

- 7.4.5.4 Rest of Middle East and Africa

- 7.4.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Fujitsu Ltd

- 8.1.2 Cisco Systems Inc.

- 8.1.3 Dell EMC

- 8.1.4 IBM Corporation

- 8.1.5 AT&T Inc.

- 8.1.6 HP Development Company LP

- 8.1.7 Microsoft Corporation

- 8.1.8 Verizon Communications Inc.

- 8.1.9 Dell Inc.

- 8.1.10 Rackspace Inc.

- 8.1.11 TCS Limited

- 8.1.12 Deutsche Telekom AG