|

市場調查報告書

商品編碼

1626900

可見光通訊:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Visible Light Communication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

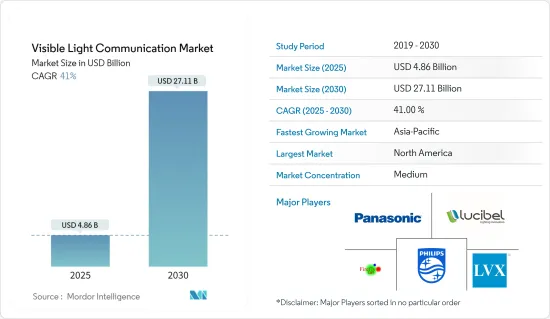

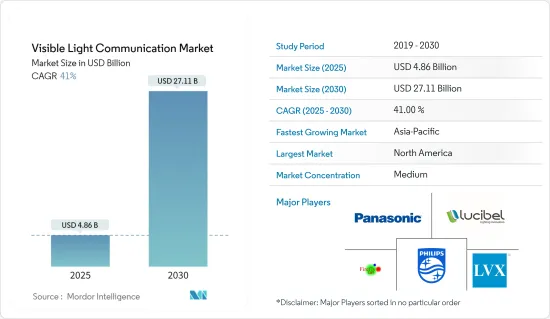

2025年可見光通訊市場規模預估為48.6億美元,預估至2030年將達271.1億美元,預測期間(2025-2030年)複合年成長率為41%。

對高速資料傳輸、資料安全的需求、即將到來的射頻頻譜限制以及相對於 Wi-Fi 技術的各種技術優勢是可見光通訊市場的主要推動力。 Li-Fi不僅具有成本效益,而且比目前Wi-Fi技術具有多種優勢,包括大約快100倍的資料傳輸速度、更高的資料安全性、無電磁干擾以及更低的功耗。

主要亮點

- 然而,由於通訊範圍有限,Li-Fi的應用受到限制。這是因為 Li-Fi 在封閉、受控的環境中效果最佳,而在存在其他光源的情況下其性能會下降。儘管如此,該領域的大量研究預計將推動光照上網技術(Li-Fi) 市場的未來需求。

- VLC 對於物聯網 (IoT) 裝置特別有用,因為即使在 Wi-Fi、藍牙和 Zigbee 等其他無線技術可能受到干擾的環境中,它也能實現可靠、安全的通訊。此外,VLC 可以防止竊聽和未授權存取,因為光線不會穿過牆壁,從而增加了額外的安全層。 VLC 在物聯網應用中的使用範例包括為物聯網設備啟用無電池雙工通訊、初始化和引導無線設備之間的安全通訊以及使用可見光和紅外線技術的室內物聯網,其中包括加強通訊。

- 此外,思科的年度網際網路報告預測,到 2023 年,連網裝置和連線的數量可能會達到近 300 億,高於 2018 年的 184 億。到 2023 年,物聯網設備將佔所有連網裝置的 50%(147 億),高於 2018 年的 33%(61 億)。物聯網設備的如此顯著增加預計將推動所研究的市場。

- 市場參與企業正在合作以滿足消費者不斷變化和複雜的需求。例如,2022年6月,Situm與ZERO1合作開發了採用可見光通訊技術的室內導航系統。 Situm 專門提供精確的室內定位和導航,無需專用基礎設施(透過 Wi-Fi),並且在某些情況下只需最少的 BLE 信標。法國ZERO1公司專門從事的OCC和VLC技術利用LED設備和行動電話(許多建築物中已經配備了這些設備)來精確定位室內位置。這兩項技術的結合有望在購物中心、機場、醫院、工廠和其他大型室內空間提供超高的可靠性和前所未有的使用者體驗。

- 另一方面,可見光通訊(VLC)在普及之前有幾個問題需要解決。與射頻 (RF) 相比,VLC 的通訊範圍有限,這可能會限制其可用性,具體取決於應用。 VLC 需要發送器和接收器之間的視距連接,這可能會限制其在某些應用中的可用性。 VLC 可能會受到其他環境光源(例如陽光和螢光)的干擾。這些因素可能會阻礙所研究的市場。

- VLC 市場的關鍵宏觀經濟成長要素是世界日益數位化。例如,隨著印度政府專注於推動數位化經濟,資訊科技、業務流程管理、數位通訊服務和電子製造等核心數位產業將在2025年對GDP成長做出貢獻,預計將加倍,達到3550億美元4350億美元,惠及市場。目前,越來越多的智慧型手機和筆記型電腦等設備配備了VLC接收器,使企業和消費者更容易採用VLC解決方案。

可見光通訊(VLC) 市場趨勢

消費性電子領域預測市場成長率顯著

- 可見光通訊技術可用於使用智慧型手機上可用的螢幕和智慧型手機的相機在裝置之間傳輸資料。 VLC 可在智慧型手機、筆記型電腦和平板電腦等行動裝置之間建立無線連線。這些連接可讓您傳輸照片、音樂和影片等資料。接收器從發送者的智慧型手機螢幕捕獲資料,並使用加速魯棒特徵 (SURF) 演算法等演算法來檢測和提取資訊。此外,支援 VLC 的智慧型手機可用於視覺障礙者的室內導航系統,並可透過 BlinkComm 初始化物聯網 (IoT) 設備,BlinkComm 使用智慧型手機螢幕作為 VLC 的調變光源。

- 愛立信預計,2022年全球智慧型手機和行動網路用戶數量預計將超過66億,2028年將達到78億人。智慧型手機行動網路訂閱數量最多的國家是中國、印度和美國。智慧型手機的普及可能為研究市場創造利潤豐厚的機會。

- 各種應用(包括串流視訊和遊戲)對高速資料傳輸的需求正在增加。 VLC 可以在不使用電線或電纜的情況下提供高速資料傳輸,使其成為傳統有線和無線通訊技術的有前途的替代品。例如,歐盟(EU)正在投資5G,預計2025年將擁有5G網路。歐盟委員會已撥出70億歐元用於5G研發,這將加速新的5G應用程式的成長。

- 此外,根據2022年11月發布的愛立信行動報告,預計到2028年終, 5G行動用戶數將達到約50億。此外,到2028年,5G人口覆蓋率預計將達到85%,5G網路可能承載約70%的行動流量。此外,此類事件可能會推動家用電子電器產品的需求並促進所研究市場的成長。

- 2022年9月,中國南京郵電大學的研發團隊展示了一種新型可見光通訊系統,該系統利用單一光路在空中開發多通道通訊鏈路。這種方法可以用作備份通訊鏈路或用於連接物聯網設備。多量子阱 III - 它基於一種稱為氮化物二極體的設備,可以同時發射和檢測光。這種通訊模式最終可用於開發光子 CPU。這些創新預計將增加 VLC 在家用電子電器領域的採用。

- 此外,隨著消費者尋求讓家居更加舒適、方便和安全的方法,智慧家庭設備變得越來越受歡迎。 VLC 控制智慧家庭設備的能力使其成為該市場的重要技術。

北美佔最大市場佔有率

- 可見光通訊已成為一種有前景的車對車 (V2V)通訊技術,並正在考慮用於自動駕駛汽車。車載 VLC (V-VLC) 利用車輛的前燈和尾燈作為無線發送器,隨著 LED 技術在車輛和基礎設施中變得越來越普遍,V-VLC 的機會正在增加。 V-VLC 已證明前燈的通訊範圍可達 100 米,尾燈的通訊範圍可達 30 米,適合近距離通訊需求。

- 美國公路交通安全管理局 (NHTSA) 將「自主」或「自動駕駛」車輛定義為無需駕駛員直接輸入即可控制加速、轉向和煞車的車輛。道路。根據美國安全保險協會的數據,到 2025 年,美國道路上將有 350 萬輛自動駕駛汽車,到 2030 年將有 450 萬輛。如此巨大的自動駕駛汽車預計將推動被調查的市場。

- 交通號誌採用 LED 照明,為全市交通管理系統創造了新的機會,例如使用 VLC 的行人和交通號誌。例如,與行人配備 VLC 的智慧型手機通訊的路燈可以調節車輛交通,以允許行人過馬路。交通系統中的 VLC 技術可協助駕駛者連接到交通照明系統並使用智慧型裝置或汽車頭燈產生資訊。該資訊還可以透過尾燈傳輸到其他汽車。諸如交通更新、預計到達特定位置的最早時間(考慮到交通堵塞)或網際網路訪問等資訊都可以透過該技術進行傳達。

- LED 在美國的採用推動了市場成長。根據美國能源局預測,LED照明預計將於2020年至2035年在美國廣泛普及,特別是戶外應用。到 2025 年,93% 的戶外照明將安裝 LED 照明,使其成為所有行業最受歡迎的光源。

- 北美酒店和零售店照明燈具中整合的室內定位服務的增加預計也將成為推動該地區收益成長的因素之一。包括 GELightings 和 ByteLight Inc. 在內的幾家公司正在超級市場部署 VLC,幫助零售商透過追蹤顧客的位置來將其與他們的購物歷史聯繫起來。

- 此外,VLC 在智慧家庭的應用包括智慧照明系統、家庭自動化和控制、能源監控,甚至用於行動和物聯網設備的無電池雙工通訊。根據消費者科技協會的數據,2,200 萬個家庭,尤其是美國家庭,已經採用物聯網和智慧技術來讓他們的生活更輕鬆。到2023年,智慧家庭市場預計將產生235億美元的收益。該地區智慧家庭的日益普及預計將顯著促進所研究市場的成長。

可見光通訊(VLC) 產業概述

可見光通訊市場是一個競爭適度的市場,擁有皇家飛利浦、LVX System、松下公司和 Oledcomm 等主要企業。這是一個擁有更新管道技術的新興市場,為可見光通訊技術創造了潛力。

2022 年 7 月,蘇格蘭國家投資銀行向總部位於愛丁堡的 pureLiFi 授予了 1,000 百萬歐元的撥款,以支持其可見光通訊在全球的推廣。網路方法。 pureLiFi 宣布將利用這筆額外資金進一步開發新的 LiFi 技術,同時進一步探索行動電話、平板電腦、穿戴式裝置和其他連網裝置等更多面向消費者的細分市場的市場。

2022 年 1 月,謝菲爾德研發中心的研究人員開發出一種創建微顯示器的新方法,使下一代VR頭戴裝置、智慧型手機和智慧型手錶具有更高的解析度、速度和效率。我們使用微型雷射二極體 (microLED) 開發終極微型顯示器和可見光通訊設備。謝菲爾德研究人員表示,VLC 技術有潛力提供比 WiFi 或 5G 高得多的頻寬和效率,並且可以在射頻發射受到控制的任何地方使用,例如飛機、醫院、水下和危險環境。起作用的地方。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈分析

- 評估宏觀經濟趨勢對產業的影響

第5章市場動態

- 市場促進因素

- 與其他無線通訊技術的競爭加劇

- 智慧城市基礎建設需求不斷成長

- 市場問題

- 由於政府措施和缺乏認知而造成的威脅

第6章 市場細分

- 按成分

- 發光二極體

- 光電探測器

- 微控制器

- 軟體和服務

- 按傳輸類型

- 單向

- 雙向

- 按用途

- 消費性電子產品

- 國防安全

- 運輸

- 公共基礎設施

- 生命科學

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 歐洲其他地區

- 亞太地區

- 中國

- 韓國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Koninklijke Philips NV

- LVX System

- Bytelight Inc.(A Acuity Brand's Company)

- Panasonic Corporation

- Purelifi Ltd.

- Oledcomm

- Lucibel SA

- Outstanding Technology Co. Ltd.

- Axrtek Company

- Firefly Wireless Networks LLC

第8章投資分析

第9章 市場機會及未來趨勢

The Visible Light Communication Market size is estimated at USD 4.86 billion in 2025, and is expected to reach USD 27.11 billion by 2030, at a CAGR of 41% during the forecast period (2025-2030).

The need for high-speed data transfer, data security, an imminent RF spectrum constraint, and various technological advantages over Wi-Fi technology primarily drives the market for visible light communication. Besides being more cost-effective, Li-Fi has various advantages over current Wi-Fi technology, including roughly 100 times quicker data transfer speed, greater data security, no electromagnetic interference, and lower power usage.

Key Highlights

- However, the limited range of communication limits Li-Fi's application because it works best in a closed control environment, and the presence of other light sources slows its performance. Nonetheless, substantial research in this field is expected to drive future demand in the light fidelity (Li-Fi) market.

- VLC can be particularly useful for Internet of Things (IoT) devices as it enables reliable and secure communication in environments where other wireless technologies, such as Wi-Fi, Bluetooth, or Zigbee, can be subject to interference. Moreover, VLC provides an added layer of security as light cannot penetrate walls, preventing eavesdropping and unauthorized access. Some examples of how VLC can be used in IoT applications include enabling battery-free duplex communication for IoT devices, initialization and bootstrapping of secure communication between wireless devices, and enhancing indoor IoT communication with visible light and infrared technology.

- Moreover, by 2023, there will likely be close to 30 billion network-connected devices and connections, an increase from 18.4 billion in 2018, according to Cisco's Annual Internet Report predictions. By 2023, IoT devices would make up 50% (14.7 billion) of all networked devices, up from 33% (6.1 billion) in 2018. Such a huge rise in IOT devices would drive the studied market.

- The players in the market are collaborating to cater to consumers' evolving and complex requirements. For instance, in June 2022, Situm collaborated with ZERO1 to create indoor navigation systems based on visible light communication technologies. Situm has specialized in providing exact indoor location and navigation without needing dedicated infrastructure (through Wi-Fi) or, in some situations, with the fewest BLE beacons. OCC and VLC technologies, in which French company ZERO1 specializes, employ LED installations - which are already present in many buildings - and cellphones to locate indoors precisely. The combination of these two technologies is expected to provide ultra-high dependability and an unprecedented user experience for shopping malls, airports, hospitals, factories, and other large indoor spaces, as well as the new potential for businesses to present their points of interest throughout these huge indoor spaces.

- On the flip side, visible Light Communication (VLC) has several challenges that must be addressed for widespread adoption. VLC has a limited range compared to radio frequency (RF), which can limit its usability in some applications. VLC requires a line-of-sight connection between the transmitter and receiver, which can limit its usability in some applications. VLC can experience interference from other environmental light sources, such as sunlight or fluorescent lights. Factors like these can hinder the studied market.

- A key macroeconomic growth driver of the VLC market is the increasing digitization worldwide. For instance, the increased focus of the Indian government on creating a digitally empowered economy is expected to benefit the market, with core digital sectors such as information technology and business process management, digital communication services, and electronics manufacturing expected to double their GDPs to USD 355-435 billion by 2025. A growing number of smartphones, laptops, and other devices are now equipped with VLC receivers, making it easier for businesses and consumers to adopt VLC solutions.

Visible Light Communication (VLC) Market Trends

The Consumer Electronics Segment is Anticipated to Witness a Significant Market Growth Rate

- Visible light communication technology can be used on smartphones for data transmission between devices using available screens and smartphone cameras. VLC can establish wireless connections between mobile devices like smartphones, laptops, and tablets. These connections can transfer data, including photos, music, and video. The receiver captures data from the screen of a transmitting smartphone and utilizes algorithms like the Speeded Up Robust Features (SURF) algorithm to detect and extract information. Additionally, VLC-enabled smartphones can be used for indoor navigation systems for visually impaired people and for initializing Internet of Things (IoT) devices through BlinkComm, which uses the smartphone screen as a modulated light source for VLC.

- According to Ericsson, the global number of smartphone mobile network subscriptions reached over 6.6 billion in 2022 and is expected to hit 7.8 billion by 2028. The countries with the most smartphone mobile network subscriptions are China, India, and the United States. Such a huge smartphone rise would create lucrative opportunities for the studied market.

- The demand for high-speed data transmission is increasing in various applications, including streaming video, gaming, etc. VLC can provide high-speed data transmission without wires or cables, making it a promising alternative to traditional wired and wireless communication technologies. For instance, the European Union is investing in 5G, and the bloc is expected to have 5G networks by 2025. The European Commission has set aside Euro 7 billion for 5G research and development, which will help to accelerate the growth of new 5G applications.

- Further, according to the Ericsson Mobility Report released in November 2022, 5G mobile subscriptions were anticipated to reach approximately 5 billion by the end of 2028. Additionally, 5G population coverage is anticipated to reach 85%, while 5G networks will likely carry around 70% of mobile traffic by 2028. Such events are also likely to drive the demand for consumer electronics, thereby boosting the growth of the studied market.

- In September 2022, researchers at the Nanjing University of Posts and Telecommunications in China demonstrated a new visible light communication system that utilizes a single optical path to develop a multi-channel communication link over the air. This approach could be employed as a backup communication link or for connecting IoT devices. It is based on devices called multiple quantum well III-nitride diodes that can emit and detect light at the same time. The communication mode could eventually be used to develop a photonic CPU. Such innovations are anticipated to boost the adoption of VLC in the consumer electronics segment.

- Additionally, the popularity of smart home devices is increasing as consumers look for ways to make their homes more comfortable, convenient, and secure. VLC can control smart home devices, making it a key technology for the market.

North America to Account for the Largest Market Share

- Visible light communication has emerged as a promising vehicle-to-vehicle (V2V) communication technology and is being explored for autonomous vehicles. Vehicular VLC (V-VLC) utilizes vehicle headlights and taillights as wireless transmitters, and as LED technology has become more prevalent in vehicles and infrastructure, opportunities for V-VLC have increased. V-VLC has demonstrated a range of up to 100 meters for headlights and 30 meters for taillights, making it suitable for short-range communication needs.

- The National Highway Traffic Safety Administration (NHTSA) defines "autonomous" or "self-driving" vehicles as those that operate without direct driver input to control acceleration, steering, and braking and are developed so that the driver is not anticipated to monitor the roadway while using in self-driving mode constantly. According to the Insurance Institute for Highway Safety, 3.5 million self-driving vehicles will be on American roads by 2025 and approximately 4.5 million by 2030. Such huge Autonomous vehicles would drive the studied market.

- As traffic lights employ LED lighting, it is an emerging opportunity in citywide traffic management systems, like pedestrian signals and traffic signals using VLC. For instance, streetlights communicating with a pedestrian's VLC-equipped smartphone can regulate vehicle traffic, allowing pedestrians to cross a street. VLC technology in traffic systems facilitates drivers to use smart devices or car headlights to connect and generate information from traffic lighting systems. This information can also be transmitted to other cars using taillights. Information, such as traffic updates, the shortest estimated arrival time to a specific location (considering traffic congestion), or even internet access, can be communicated through this technology.

- The adoption of LED in the United States boosted the market growth. According to the U.S. Department of Energy, LED lights are expected to gain popularity in the United States between 2020 and 2035, particularly in outdoor applications. LED lights should be implemented in 93 percent of outdoor lighting by 2025, making them the most prevalent light source across all industries.

- Increasing indoor location-based services embedded with light fixtures in hotels and retail shops in the North American region is also projected to be one of the factors driving revenue growth in the region. Several companies, such as G.E. Lightings and ByteLight Inc., are deploying VLC installations in supermarkets, which, in turn, is aiding retailers in tying customers' shopping history by tracking their location details.

- Further, the applications of VLC in smart homes include smart lighting systems, home automation & control, energy monitoring, and even battery-free duplex communication for mobile & IoT devices. According to Consumer Technology Association, particularly in the USA, 22 million homes already employ IoT or smart technology to make life easier. By 2023, the smart home market is estimated to produce USD 23.5 billion in revenue. The increasing adoption of smart homes in the region is anticipated to significantly boost the growth of the studied market.

Visible Light Communication (VLC) Industry Overview

The Visible Light Communication Market is a moderately competitive market with prominent players like Koninklijke Philips, LVX System, Panasonic Corporation, Oledcomm, etc. It is an emerging market with newer pipeline technologies, creating potential visible light communication technology.

In July 2022, The Scottish National Investment Bank awarded EUR 10 million to aid Edinburgh-based pureLiFi, which spent years designing a new Visible Light Communication based networking method called LiFi, to support a global rollout of their technology. PureLiFi announced that it would utilize the extra funding to develop new LiFi technologies further while opening up additional markets in more consumer-friendly areas, like mobile phones, tablets, wearables, and other connected devices.

In January 2022, Sheffield researchers developed a new way of creating micro-displays to bring the next generation of VR headsets, smartphones, and smartwatches with higher resolution, speed, and efficiency. It used microlaser diodes - micro LEDs, to develop ultimate micro-display and visible light communication devices. As per Sheffield researchers, VLC technology had the potential to offer much greater bandwidth & efficiency than WiFi or 5G and could be utilized where radio frequency emissions were controlled or did not work, like in aircraft, hospitals, underwater and hazardous environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of Macro Economic Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Competition from other Wireless Communication Technologies

- 5.1.2 High Demand for Building Smart City Infrastructure

- 5.2 Market Challenges

- 5.2.1 Threat from Government Policies and Lack of Awareness

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Light Emitting Diodes

- 6.1.2 Photodetectors

- 6.1.3 Microcontrollers

- 6.1.4 Software and Services

- 6.2 By Transmission Type

- 6.2.1 Uni-directional

- 6.2.2 Bi-directional

- 6.3 By Application

- 6.3.1 Consumer Electronics

- 6.3.2 Defense and Security

- 6.3.3 Transportation

- 6.3.4 Public Infrastructure

- 6.3.5 Life Sciences

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 South Korea

- 6.4.3.3 India

- 6.4.3.4 Japan

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Koninklijke Philips NV

- 7.1.2 LVX System

- 7.1.3 Bytelight Inc. (A Acuity Brand's Company)

- 7.1.4 Panasonic Corporation

- 7.1.5 Purelifi Ltd.

- 7.1.6 Oledcomm

- 7.1.7 Lucibel SA

- 7.1.8 Outstanding Technology Co. Ltd.

- 7.1.9 Axrtek Company

- 7.1.10 Firefly Wireless Networks LLC