|

市場調查報告書

商品編碼

1626902

染料和顏料:市場佔有率分析、產業趨勢、成長預測(2025-2030)Dyes and Pigments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

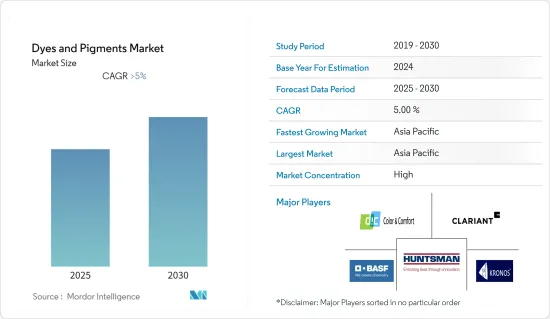

預計染料和顏料市場在預測期內的複合年成長率將超過 5%。

COVID-19 的爆發導致世界各地的國家封鎖,擾亂了製造活動和供應鏈、生產停頓和勞動力供應,對染料和顏料市場產生了負面影響。然而,隨著 2021 年情況開始改善,市場成長軌跡可能會在預測期內恢復。

主要亮點

- 從中期來看,亞太地區油漆和塗料行業需求的增加以及紡織業需求的增加是市場成長的主要驅動力。

- 另一方面,有關染料和顏料使用的環境問題預計將在預測期內抑制目標行業的成長。

- 然而,對 3D 列印材料等可靠商業產品的需求不斷成長,可能會在不久的將來為市場創造利潤豐厚的成長機會。

- 亞太地區已成為最大的染料和顏料市場。預計在預測期內複合年成長率將達到最高。亞太地區的主導地位是由於中國、印度和其他亞洲國家對染料和顏料的高需求。

染料和顏料市場趨勢

油漆和塗料的需求增加

- 油漆和塗料佔據了最大的市場佔有率,預計是最重要和成長最快的最終用戶產業。

- 建築和裝飾塗料在其生產過程中消耗了大量的顏料。因此,全球不斷成長的建築和基礎設施活動是染料和顏料市場的主要促進因素。

- 根據美國人口普查局的數據,2021 年美國私人建築支出增至 12,454 億美元,2020 年增至 11,079 億美元。

- 各種油漆和塗料行業的擴張可能會在未來幾年擴大顏料市場。作為參考,2022年10月,亞洲塗料公司宣布計劃投資2.58億美元在該國建設新工廠,生產油漆和塗料樹脂、醋酸乙烯-乙烯乳液(VAE)和醋酸乙烯單體(VAM)。

- 此外,在汽車領域,油漆和被覆劑用於汽車的內部和外部部件,以賦予它們保護和吸引力。它也用於汽車金屬部件和塑膠車輛部件。

- 根據OICA(國際汽車構造組織)的數據,2021年全球汽車產量約8,015萬輛,較2020年的7,771萬輛成長3%。

- 上述因素預計將在預測期內推動全球市場。

亞太地區主導市場

- 由於廉價勞動力的存在,中國和印度的紡織業成長迅速,增加了對染料和顏料的需求。在全球紡織品市場中,中國佔最大佔有率,約40%,其次是印度,佔有率超過5%。

- 根據工業與資訊化部數據顯示,2021年1-9月中國紡織業平穩成長,毛利達到1,711億元人民幣(約268億美元),年增31.7%。

- 根據IBEF預計,2022年,印度包括手工藝品在內的紡織品服飾產品出口總額為444億美元(與前一年同期比較成長41%),包括棉質配件在內的成衣出口額為6.19美元億。

- 2021年9月,艾仕得宣布其最先進的塗料工廠已在中國北部吉林省吉林市動工。平方公尺的新工廠將生產流動性塗料,以滿足中國不斷成長的客戶需求,包括輕型商用車和汽車塑膠零件。

- 此外,根據中國國家統計局的數據,2021年12月塑膠製品產量約795萬噸,而2021年11月為732萬噸。

- 根據塑膠出口促進委員會(PLEXCONCIL)統計,2021年4月至6月印度塑膠出口總額為34.17億美元(累計金額),較2020年4月至6月的22.11億美元增加了55%,市場不斷擴大。

- 因此,由於油漆和塗料、紡織和塑膠行業等各種最終用戶行業的需求不斷增加,預計在預測期內對染料和顏料的需求將迅速增加。

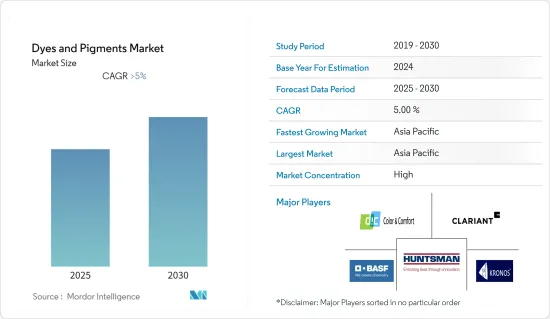

染料顏料產業概況

染料和顏料市場已部分整合。該市場的主要企業(排名不分先後)包括BASF SE、Huntsman International LLC、KRONOS Worldwide Inc.、Clariant 和 DIC Corporation。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 亞太地區油漆和塗料行業的需求不斷成長

- 紡織業需求增加

- 抑制因素

- 關於使用染料和顏料的環境問題

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 按類型

- 染料

- 活性染料

- 分散染料

- 硫化染料

- 奧克染色

- 偶氮染料

- 酸性染料

- 依顏料分類

- 有機顏料

- 無機顏料

- 染料

- 按最終用戶產業

- 油漆和塗料

- 紡織品

- 印刷油墨

- 塑膠

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ALTANA AG

- Archroma

- BASF SE

- Bodal Chemicals Ltd

- Carl Schlenk AG

- CATHAY INDUSTRIES

- Clariant

- DIC CORPORATION

- DuPont

- Flint Group

- Huntsman International LLC

- ISHIHARA SANGYO KAISHA LTD

- Kiri Industries Ltd

- KRONOS Worldwide Inc.

- LANXESS

- Meghmani Group

- Merck KGaA

- Sudarshan Chemical Industries Limited

- Tronox Holdings PLC

第7章 市場機會及未來趨勢

- 對 3D 列印材料等可靠商業產品的需求不斷成長

- 其他機會

The Dyes and Pigments Market is expected to register a CAGR of greater than 5% during the forecast period.

Due to the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, production halts, and labor unavailability have negatively impacted the dyes and pigment market. However, the conditions started recovering in 2021, which will likely restore the market's growth trajectory during the forecast period.

Key Highlights

- Over the medium term, growing demand from Asia-Pacific's paints and coatings industry and increasing demand from the textile industry are the major driving factors augmenting the growth of the market studied.

- On the flip side, environmental concerns regarding using dyes and pigments are anticipated to restrain the target industry growth over the forecast period.

- Nevertheless, the growing demand for reliable commercial products, like 3D printing material, will likely create lucrative growth opportunities for the market soon.

- The Asia-Pacific emerged as the largest market for dyes and pigments. It is expected to witness the highest CAGR during the forecast period. The dominance of the Asia-Pacific is attributed to the high demand for dyes and pigments in China, India, and other Asian countries.

Dyes and Pigments Market Trends

Increasing Demand from the Paints and Coatings

- Paints and coatings account for the largest share of the market and are estimated to be the most significant and fastest-growing end-user industry.

- Architectural and decorative coatings account for the enormous consumption of pigments in their production. Thus, rising construction and infrastructure activities across the globe are the primary driver for the dye and pigment market.

- According to the US Census Bureau, United States spending on private construction grew in 2021, which was USD 1,245.40 billion, and in 2020 it was USD 1,107.90 billion.

- Various paints and coatings industry expansions will augment the pigment markets in the coming years. For reference, in October 2022, Asian Paints announced plans to invest USD 258 million to set up a new plant to produce paints and coatings resins, vinyl acetate-ethylene emulsion (VAE), and vinyl acetate monomer (VAM) in the country.

- Furthermore, in the automotive sector, paints and coatings are used in the interior and exterior parts of the vehicle, as they impart protection and appeal to vehicles. They are used in metallic parts and plastic vehicle components of automobiles.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2021, around 80.15 million vehicles were produced worldwide, witnessing a growth rate of 3% compared to ~77.71 million vehicles in 2020, hence driving the market studied in the forecast period.

- All the factors above are expected to drive the global market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The growth of the textile industry in China and India is rapidly increasing with the availability of a cheap labor force, thus augmenting the dyes and pigments demand. In the global textile market, China holds the largest share of about 40%, followed by India with over 5% share.

- The textile industry of China grew steadily during the first nine months of 2021, with collective profits worth CNY 171.1 billion (approximately USD 26.80 billion), a 31.7% increase year-on-year (YoY), according to the Ministry of Industry and Information Technology (MIIT).

- According to the IBEF, in India, textiles and apparel exports, including handicrafts, totaled USD 44.4 billion in 2022, a 41% increase YoY, and the exports of readymade garments, including cotton accessories, stood at USD 6.19 billion in the same year.

- In September 2021, Axalta announced that it broke ground to construct a state-of-the-art coatings facility in Jilin City, Jilin Province, North China which is scheduled to open in 2023. This 46,000 sq m new plant will produce mobility coatings to support growing customer demand in China for light vehicles, commercial vehicles, and automotive plastic components.

- Furthermore, according to the National Bureau of Statistics of China, about 7.95 million metric tons of plastic products were produced in December 2021, compared with 7.32 million metric tons in November 2021.

- According to the Plastics Export Promotion Council (PLEXCONCIL), India's plastics export increased by 55% to USD 3,417 million (cumulative value) from April to June 2021 as compared to USD 2,211 million in April-June 2020, thus augmenting the market.

- Hence, with the increasing demand from various end-user industries, like the paints and coatings, textiles, and plastics industries, the demand for dyes and pigments is expected to increase rapidly over the forecast period.

Dyes and Pigments Industry Overview

The dyes and pigments market is partially consolidated. Some major players in the market (in no particular order) include BASF SE, Huntsman International LLC, KRONOS Worldwide Inc., Clariant, and DIC Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Paints and Coating Industry in Asia-Pacific

- 4.1.2 Increasing Demand from the Textile Industry

- 4.2 Restraints

- 4.2.1 Environmental Concerns Regarding the Use of Dyes and Pigments

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Dye

- 5.1.1.1 Reactive Dye

- 5.1.1.2 Disperse Dye

- 5.1.1.3 Sulfur Dye

- 5.1.1.4 Vat Dye

- 5.1.1.5 Azo Dye

- 5.1.1.6 Acid Dye

- 5.1.2 Pigment

- 5.1.2.1 Organic Pigment

- 5.1.2.2 Inorganic Pigment

- 5.1.1 Dye

- 5.2 End-user Industry

- 5.2.1 Paints and Coatings

- 5.2.2 Textile

- 5.2.3 Printing Inks

- 5.2.4 Plastics

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALTANA AG

- 6.4.2 Archroma

- 6.4.3 BASF SE

- 6.4.4 Bodal Chemicals Ltd

- 6.4.5 Carl Schlenk AG

- 6.4.6 CATHAY INDUSTRIES

- 6.4.7 Clariant

- 6.4.8 DIC CORPORATION

- 6.4.9 DuPont

- 6.4.10 Flint Group

- 6.4.11 Huntsman International LLC

- 6.4.12 ISHIHARA SANGYO KAISHA LTD

- 6.4.13 Kiri Industries Ltd

- 6.4.14 KRONOS Worldwide Inc.

- 6.4.15 LANXESS

- 6.4.16 Meghmani Group

- 6.4.17 Merck KGaA

- 6.4.18 Sudarshan Chemical Industries Limited

- 6.4.19 Tronox Holdings PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Reliable Commercial Products, like 3D Printing Materials

- 7.2 Other Opportunities