|

市場調查報告書

商品編碼

1626904

災難復原即服務 (DRaaS):市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Disaster Recovery as a Service (DRaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

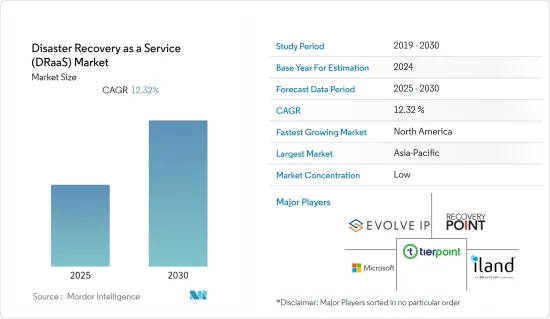

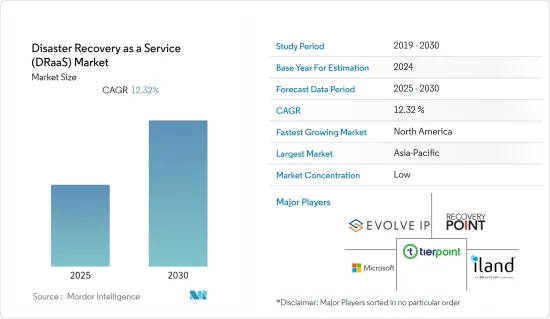

災難復原即服務 (DRaaS) 市場預計在預測期內複合年成長率為 12.32%

主要亮點

- 用於規劃測試、練習和聲明的按需恢復雲端。將伺服器映像和資料複製到雲端、生產和目標雲端環境之間的自動容錯移轉和故障復原以及復原時間的服務等級協定 (SLA)。

- 最初,DRaaS 解決方案通常由沒有輔助站點的中小型企業或正在退役資料中心以降低成本的公司部署。然而,DRaaS 也受到現代環境中大型組織的青睞,因為供應商報告大型複雜環境的增加以及每個客戶端伺服器數量的增加。市場促進因素包括資料外洩和勒索軟體攻擊數量不斷增加、對強大資料保護解決方案的需求以及與傳統解決方案相比 DRaaS 解決方案更低的營運成本。

- 市場上的公司正在尋求具有增強的入門選項、支援不同復原目標的附加功能、支援的平台(即除 VMware 和實體 x86 之外)以及內建附加元件(例如自動復原測試和變更管理保證)的附加元件解決方案。

- DRaaS 市場由多家能夠支援不同需求的公司組成。這些涉及工作負載類型、地理位置、規模、加入、持續支援等級、復原點目標 (RPO) 和復原時間目標 (RTO) 選項的數量以及復原位置目標。提供者可以提供完全託管、輔助恢復或自助服務。

- 另一方面,客戶可能需要了解其資料中心內的內容。客戶需要了解他們的各種 IT 資產以及它們的重要性如何反映在 DRaaS 提供者的服務層級。服務提供者的複製方法通常以其他價格分佈提供不同的恢復期。最昂貴的層級可以在幾秒鐘到幾分鐘內恢復工作負載。相較之下,中間層的企業工作負載恢復時間為 4-8 小時,最便宜的層恢復時間為 24-48 小時。

- 大流行導致全國範圍內的封鎖,並迫使員工遠距工作。多起資料外洩事件和網路攻擊的增加表明人們對資料安全的依賴日益增加。此外,勒索軟體攻擊在疫情期間大幅增加,凸顯了災難復原解決方案的必要性,以防止可能對組織造成嚴重損失的系統停機。

災難復原即服務 (DRaaS) 市場趨勢

BFSI 產業引領市場

- 隨著商業銀行和信用合作社等金融機構因提供一致、不間斷的客戶服務而享有盛譽,BFSI 部門準備大力採用 DRaaS 解決方案。系統停機可能會損害這種聲譽並導致客戶流失。利用 DRaaS 解決方案可以即時恢復資料、應用程式和系統。

- 銀行等關鍵產業預計將更多地採用基於雲端基礎的服務部署。這是因為 IT 部門不斷需要最佳化的基礎設施,而解決方案建構者現在可以從多個提供者取得應用程式和基礎設施元件,以建立雲端基礎的混合解決方案。

- 許多金融機構特定的雲端恢復供應商將檢查和升級您的雲端基礎設施,以滿足合規性、審核和金融部門標準。這些監管修正案將使規模較小的金融機構受益,因為它們需要更多資源來讓員工投入時間來滿足合規標準。

- 為了保護 IT 流程和系統、保護敏感的客戶資料並遵守政府法規,私人和公共組織擴大採用最新技術來防止網路攻擊。此外,客戶期望的提高、技術力的提高以及監管要求的收緊,迫使銀行機構採取積極主動的安全措施。

- 銀行業面臨的最常見的惡意軟體攻擊包括無簽名和無檔案惡意軟體,它們利用本機進程而不是像其他惡意程式一樣隱藏其活動。

北美地區預計成長最快

- 美國是全球最大的 DRaaS 解決方案市場之一。該國是數位轉型策略的早期採用者,這使得一些最終用戶更容易受到網路攻擊,並且對安全儲存和恢復網路的需求不斷增加。該國是市場上主要企業的所在地,包括 IBM、Recovery Point 和 Sungard Availability Services。

- 隨著該國資料外洩的數量不斷增加,公共和私營部門可能會在網路解決方案上投入更多資金來研究和防止此類攻擊。美國最新預算核准109 億美元用於網路安全相關措施。該地區的最終用戶正在重新關注組織彈性和最大限度地減少停機時間。各種規模的企業都在尋找外部部署方法來實施災難復原。

- 多起資料外洩事件主要發生在美國。根據身分盜竊資源中心的一項研究,去年上半年美國發生了 817 起資料外洩事件。同時,同期有超過5,300萬人受到資料外洩、資料外洩、資料外洩等資料外洩的影響。

- 該地區各國政府正在採取措施支持 DRaaS 的採用。例如,去年 10 月,FEMA核准了超過 3.57 億美元的聯邦救災援助,以幫助超過 191,508 名個人和家庭開始復原工作。

災難復原即服務業概述

DRaaS 市場競爭非常激烈,有幾家主要公司進入該市場。然而,iLand Internet Solutions、Microsoft Corporation、Recovery Point Systems Evolve IP LLC、TierPoint LLC 和 IBM Corporation 等領先公司正在資料儲存和安全系統方面引入創新。公司正在透過建立新的夥伴關係關係和開拓新興市場來擴大其市場佔有率。

2022 年 6 月,IBM Cloud Pak for Data 4.5 引進了新的功能和特性,協助組織連接資料並推動智慧業務成果。 IBM Cloud Pak for Data 4.5 包含無中斷備份和災難復原。

2022 年 5 月,Falconstore Software 是一家致力於實現混合雲端世界災難復原和備份作業現代化的值得檢驗的資料保護軟體服務供應商商,宣布與 IBM 公司建立新的策略夥伴關係。的雲端遷移和支援雲端的備份需求。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 市場影響評估

- 技術簡介

- 完全託管

- 輔助型

- 自助服務

第5章市場動態

- 市場促進因素

- 由於資料外洩和勒索軟體攻擊的數量不斷增加,對強大的資料保護解決方案的需求增加

- 與傳統解決方案相比,DRaaS 解決方案降低了營運成本

- 市場限制因素

- 實施和條件設定的複雜性

第6章 市場細分

- 按最終用戶產業

- BFSI

- IT

- 政府機構

- 衛生保健

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- iLand Internet Solutions Corporation

- Microsoft Corporation

- Recovery Point Systems Inc.

- Evolve IP LLC

- TierPoint LLC

- IBM Corporation

- Sungard Availability Services LP

- C and W Business Ltd

- Expedient Holdings USA LLC

- Cloudhpt

- Intervision Systems LLC

- Phoenixnap LLC

- Flexential Colorado Corp.

第8章投資分析

第9章市場的未來

The Disaster Recovery as a Service Market is expected to register a CAGR of 12.32% during the forecast period.

Key Highlights

- An on-demand recovery cloud for planned tests, exercises, and declarations. Server image and production data replication to the cloud, automated failover and failback between production and the target cloud environment, and recovery time service-level agreements (SLAs).

- Initially, DRaaS solutions were considerably implemented by small businesses that didn't have secondary sites or were eliminating data centers to reduce costs. However, DRaaS is also preferred by larger organizations in the modern landscape, as providers have reported an increase in large and complex environments and the volume of servers per client. The drivers in the studied market include increasing data breaches and ransomware attacks, creating a need for robust data protection solutions, and reducing the operational cost of DRaaS solutions compared to traditional solutions.

- The players in the market are expected to increase market capture and reduce customer friction by offering enhanced onboarding options and additional capabilities in support of various recovery targets, platforms supported (i.e., beyond VMware and physical x86), and international aid and bolster DRaaS solutions with built-in add-ons like automated recovery testing and change management assurance.

- The DRaaS market consists of multiple players with varying abilities to support requirements. These can relate to workload types, geographies, scale, onboarding, ongoing support levels, the number of recovery point objective (RPO) and recovery time objective (RTO) options, and target recovery locations. The provider may deliver fully managed, assisted recovery or self-service services.

- On the other hand, customers may need to be made aware of what they have in their data centers. They must be aware of their various IT assets and how their criticality translates into the service tiers of a DRaaS provider. The service provider's replication method generally gives different recovery periods at other price points. The most costly tier may offer workload recovery in seconds or minutes. In contrast, the mid-tier may offer a 4-to-8-hour enterprise workload recovery time, and the least expensive tier may offer a 24-to-48-hour recovery.

- A nationwide lockdown across the globe marked the pandemic, and company employees have begun to work remotely. The increased dependency on the security of data measures was brought to light by several data breaches and an increase in cyberattacks. Furthermore, ransomware attacks have increased significantly during the pandemic, which has underlined the need for disaster recovery solutions to prevent the downtime of systems that could result in severe losses for organizations.

Disaster Recovery as a Service Market Trends

The BFSI Sector is Driving the Market

- The BFSI sector is poised to significantly adopt DRaaS solutions because financial institutions such as commercial banks and credit unions build their reputations around providing consistent and uninterrupted customer service. Any system downtime could damage these reputations and potentially lead to lost customers. The usage of DRaaS solutions could provide instant recovery of data, applications, and systems.

- Critical sectors, like banking, are expected to adopt cloud-based deployment of services increasingly. This is due to the IT sector's continuing quest for optimized infrastructure and the ability of solution builders to source application and infrastructure components from multiple providers to construct a hybrid cloud-based solution, thereby augmenting the studied market growth.

- Most financial institution-specific cloud recovery vendors will inspect and upgrade their cloud infrastructure to meet compliance, auditing, and financial sector standards. These regulatory modifications benefit smaller institutions that need more resources to commit employee time to meet compliance criteria.

- To secure their IT processes and systems, secure customer critical data, and comply with government regulations, private and public organizations are increasingly focused on implementing the latest technologies to prevent cyber attacks. Also, with greater customer expectations, growing technological capabilities, and regulatory requirements, banking institutions are being pushed to adopt a proactive approach to security.

- Some of the most common malware attacks that the banking industry faces include signature-less and file-less malware, which does not behave like other malicious programs but can instead exploit native processes to hide their activities.

North America is Expected to Register the Fastest Growth

- The United States is one of the largest markets for DRaaS solutions globally. The country is an early adopter of digital transformation strategies that have led multiple end-users to become more vulnerable to cyber-attacks, creating a demand for a secure storage and recovery network. The country houses prominent players in the market, such as IBM, Recovery Point, Sungard Availability Services, etc.

- With such an increasing number of data breaches in the country, the public and private sectors are inclined to spend more on cyber solutions to study these attacks and take preventive measures. The recent US budget has endorsed USD 10.9 billion for cybersecurity-related initiatives. End-users in the region are refocusing on organizational resiliency and minimizing downtime; enterprises of all sizes are looking for off-premise ways to implement disaster recovery.

- Multiple data breaches are being centred around the United States. According to a survey by the Identity Theft Resource Center, the number of data compromises in the United States was recorded at 817 cases in the first half of the last year. Meanwhile, throughout the same time, over 53 million individuals were impacted by data compromises, which included data breaches, data exposure, and data leakage.

- The government in the region is taking initiatives to support the deployment of DRaaS. For instance, in October last year, FEMA approved more than USD 357 million in federal disaster assistance to more than 191,508 individuals and households to help begin their recoveries.

Disaster Recovery as a Service Industry Overview

The DRaaS market is highly competitive and consists of several major players. However, major companies like iLand Internet Solutions, Microsoft Corporation, Recovery Point Systems Evolve IP LLC, TierPoint LLC, and IBM Corporation have introduced data storage and security systems innovations. The companies have increased their market presence by securing new partnerships and tapping emerging markets.

In June 2022, IBM Cloud Pak for Data 4.5 introduced new capabilities and features to help organizations connect with their data and drive smart business outcomes. IBM Cloud Pak for Data 4.5 includes disruption-free backup and disaster recovery.

In May 2022, FalconStor Software, Inc., the trusted data protection software provider modernizing disaster recovery and backup operations for the hybrid cloud world, announced a new strategic partnership with IBM Corporation to provide jointly-validated solutions for IBM Power Systems, designed to assist enterprise customers and managed services providers (MSPs) with their cloud migration and cloud-enabled backup needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of Impact of COVID-19 on the Market

- 4.4 Technology Snapshot

- 4.4.1 Fully Managed

- 4.4.2 Assisted

- 4.4.3 Self Service

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Data Breach and Ransomware Attacks Creating a Need For Robust Data Protection Solutions

- 5.1.2 Reducing Operational Cost of DRaaS Solutions Compared to Traditional Solutions

- 5.2 Market Restraints

- 5.2.1 Complexity of Deployment and Setting Terms

6 MARKET SEGMENTATION

- 6.1 End-user Vertical

- 6.1.1 BFSI

- 6.1.2 IT

- 6.1.3 Government

- 6.1.4 Healthcare

- 6.1.5 Other End-user Verticals

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 iLand Internet Solutions Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Recovery Point Systems Inc.

- 7.1.4 Evolve IP LLC

- 7.1.5 TierPoint LLC

- 7.1.6 IBM Corporation

- 7.1.7 Sungard Availability Services LP

- 7.1.8 C and W Business Ltd

- 7.1.9 Expedient Holdings USA LLC

- 7.1.10 Cloudhpt

- 7.1.11 Intervision Systems LLC

- 7.1.12 Phoenixnap LLC

- 7.1.13 Flexential Colorado Corp.