|

市場調查報告書

商品編碼

1627119

泡沫浮選化學品:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Froth Flotation Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

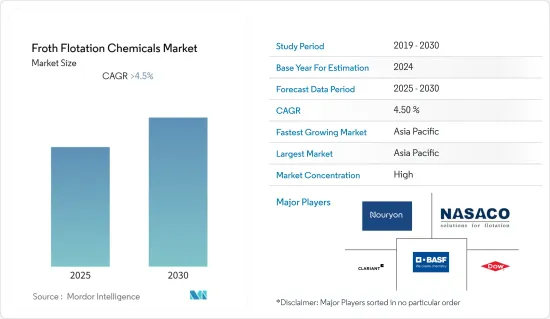

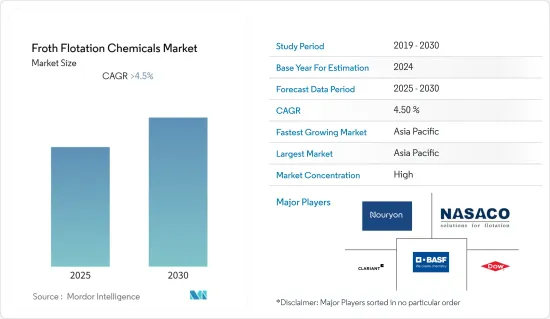

預計預測期內,牙線浮選化學品市場的複合年成長率將超過 4.5%。

COVID-19 的爆發導致全球範圍內的國家封鎖、製造活動和供應鏈中斷以及生產停頓,對 2020 年的市場產生了負面影響。然而,到了2021年,情況開始好轉,市場恢復了成長軌跡。

主要亮點

- 主要因素包括亞太地區對泡沫浮選化學品的需求增加以及加拿大和墨西哥採礦活動的活性化。

- 北美和歐洲嚴格的政策和不斷變化的監管環境預計將嚴重阻礙市場成長。

- 鐵礦石浮選中的混合捕收劑系統可能是未來的機會。

- 預計亞太地區將在預測期內主導全球市場。

牙線浮選化學品市場趨勢

採礦業需求增加

- 採礦業是泡沫浮選化學品的最大最終用戶。採礦活動中使用的化學物質取決於該地區所探勘礦山的性質。

- 泡沫浮選化學品主要用於透過使礦物黏附在氣泡上來提取礦物。透過利用組分疏水性的差異來實現礦物質從漿料中的特定分離。

- 長石、石英、方解石、鉀肥、重晶石、磷酸鹽和螢石等各種礦物的浮選是使用化學物質進行的。根據沉積礦物的方法,有直接浮選法和反浮選法兩種。

- 泡沫浮選化學品在礦石開採和加工中發揮重要作用。隨著基底金屬(鐵、鋼、鋁等)和貴金屬(銀、金、鉑等)消費量的不斷增加,這些金屬的開採活動在全球蓬勃發展。

- 根據美國人口普查局的數據,2022 年採礦和採石業收益達到 143.9 億美元,而前一年為 136.8 億美元。預計 2023 年該產業收益將達到 152.5 億美元。

- 根據美國地質探勘局的數據,2022 年美國礦場生產了約 982 億美元的非燃料礦產商品。

- 採礦和冶金是該國的主要工業。加拿大向世界各國供應 60 多種金屬和礦物。採礦業正在投資創新和新技術,迅速重塑這個產業。採礦業也出現了整合,引發了對該行業未來幾年成長前景的猜測。

- 由於上述原因,預計採礦業研究市場的需求在預測期內將會增加。

亞太地區主導需求

- 由於中國和印度的需求不斷成長,預計亞太地區將主導市場。

- 由於大規模的採礦作業,中國是泡沫漂浮化學品的最大消費國。該國是最大的礦產品生產國和消費國之一。

- 採礦業正在推動印度泡沫浮選化學品市場的發展。由於其大量的金屬和礦產蘊藏量,採礦業是該國的主要經濟活動。礦產分佈因地區而異,但全國境內普遍含有煤、鐵礦石、錳、礬土以及其他黑色金屬和有色金屬礦產。

- 基礎設施發展、汽車發展以及電力和水泥產業的崛起正在推動金屬和採礦業的成長。該國煤炭部40年來首次允許私人公司進行採礦活動,允許對採礦業進行100%的直接投資。

- 中國的採礦業是世界上最大的採礦業之一。它是 20 多種金屬的主要生產國,包括金、石墨、鐵、鋁、水泥、煤、鉛、鎂和稀土。預計2023年中國採礦業收入將達9,500億美元,年增率為4.09%。全國礦業公司總數超過10,392家。

- 透過第一個國家污水綜合規劃(2007-2015年),韓國透過不斷擴建污水處理設施,實現了92%以上的污水覆蓋率。大多數污水處理廠都設有厭氧消化池,因此有機物含量相對較低,濃度介於40%~70%之間。處理後的污水主要作為污水處理廠的製程水再利用(53%),其餘用於河道流量維護(34%)、工業(3%)、農業(3%)和其他用途(7%)。用於.製程用水的主要用途是清洗水(41%)、冷卻水(10%)、清洗水(6%)、稀釋水(3%)和其他(40%)。

- 採礦業是印度經濟的八個核心產業之一。它為許多重要行業提供基本原料。根據MOSPI(國家統計局)的數據,2022年印度礦業產量年增率為18.2%。

- 上述因素,加上政府的大力支持,導致近期亞太地區對牙線浮選化學品的需求增加。

礦用浮選化學品產業概述

牙線浮選化學品市場因其性質而整合。受調查的主要企業包括BASF公司、科萊恩、陶氏化學、諾力昂和 NASACO。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 亞太地區對牙線浮選化學品的需求增加

- 加拿大和墨西哥採礦活動增加

- 其他司機

- 抑制因素

- 北美和歐洲的嚴格政策和不斷變化的監管環境

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 按試劑類型

- 集電極

- 陽離子

- 陰離子的

- 非離子型

- 氣泡劑

- 酸性的

- 基本的

- 中性的

- 改質劑

- 酸抑制劑

- pH調節劑

- 活化劑

- 惰性劑

- 其他試劑類型

- 集電極

- 按最終用戶產業

- 礦業

- 紙漿/造紙製造

- 工業廢棄物及污水處理

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)分析**/市場排名分析

- 主要企業策略

- 公司簡介

- Air Products and Chemicals Inc.

- Arkema

- BASF SE

- Chevron Phillips Chemical Company LLC

- CLARIANT

- Solvay

- Dow

- Kemira

- NASACO

- Nouryon

第7章 市場機會及未來趨勢

- 鐵礦石浮選混合捕收劑系統

- 其他機會

The Froth Flotation Chemicals Market is expected to register a CAGR of greater than 4.5% during the forecast period.

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- The studied market's major factors include rising demand for froth flotation chemicals in Asia-Pacific and increasing mining activities in Canada and Mexico.

- Stringent policies and changing regulatory landscape in North America and Europe are expected to significantly hinder the studied market's growth.

- Mixed collector systems in iron ore flotation are likely to act as an opportunity in the future.

- Asia-Pacific is expected to dominate the global market during the forecast period.

Froth Flotation Chemical Market Trends

Rising Demand from the Mining Industry

- The mining industry is the largest end-user of froth flotation chemicals. The chemicals are used in mining activities, according to the nature of the mine explored in the area.

- Froth flotation chemicals are primarily employed to extract minerals by allowing them to attach to air bubbles. The specific separation of minerals from the slurry is done using the difference in hydrophobic properties of the components.

- Flotation of various minerals, such as feldspar, quartz, calcite, potash, barite, phosphate, fluorspar, etc., is carried out using the chemicals. Direct and reverse flotation are the two methods, depending on the attachment manner of the mineral.

- Froth flotation chemicals play a major role in the mining and processing of mineral ores. With increased consumption of base metals (such as iron, steel, aluminum, etc.) and precious metals (such as silver, gold, and platinum), mining activities for the above metals surged globally.

- As per the US Census Bureau, revenue in mining and quarrying amounted to USD 14.39 billion in 2022, compared to USD 13.68 billion in the previous year. The revenue from this sector is projected to amount to USD 15.25 billion in 2023.

- According to USGS, the United States mines produced approximately USD 98.2 billion in nonfuel mineral commodities in 2022.

- Mining and metallurgy are key industries in the country. Canada supplies over 60 metals and minerals to different countries worldwide. The mining industry invests in innovation and new technologies, rapidly reshaping the sector. The mining industry also witnessed consolidations, which led to speculations regarding the growth prospects for the industry in the coming years.

- All the reasons above are expected to boost the demand for the market studied, in the mining industry, over the forecast period.

Asia-Pacific to Dominate the Demand

- Asia-Pacific is expected to dominate the market, owing to the rising demand from China and India.

- Due to the country's large mining operations, China is the largest consumer of froth flotation chemicals. The country is one of the largest producers and consumers of mining products.

- The mining industry drives the froth floatation chemicals market in India. Due to large metal and mineral reserves, mining is a major economic activity in the country. The distribution of minerals varies from region to region, but the country roughly contains coal, iron ore, manganese, bauxite, and other ferrous and non-ferrous minerals.

- Rise in infrastructure development, automotive development, and power and cement industries are driving the growth for the metal and mining sector. The country's coal ministry allowed private companies to engage in mining activities for the first time in four decades, and 100% FDI was allowed in the mining sector.

- The mining industry in China is one of the largest in the world. It is the leading producer of over 20 metals, including gold, graphite, iron, aluminum, cement, coal, lead, magnesium, rare earth, etc. Revenue from mining and quarrying in China is projected to reach USD 0.95 trillion in 2023, with an annual growth rate of 4.09%. The country's total number of mining enterprises amounted to more than 10,392.

- South Korea achieved more than a 92% penetration rate of sewage through the first National Sewage Comprehensive Plan (2007 - 2015) through the continuous expansion of sewage treatment facilities. Most sewage treatment plants contain anaerobic digesters, so the organic matter content is relatively low, and the concentration range is about 40-70%. The treated sewage is reused mainly in the STPs as process water (53%), and the rest is used for river flow maintenance (34%), industries (3%), agriculture (3%), and other purposes (7%). The main uses of the process water were washing water (41%), cooling water (10%), cleaning water (6%), dilution water (3%), and others (40%).

- The mining industry in India is one of the eight core industries of the economy. It provides basic raw materials to many important industries. According to MOSPI (National Statistical Office), the annual growth rate of mining production in India was 18.2% in 2022.

- The factors above, coupled with huge government support, are contributing to the recent increasing demand for froth flotation chemicals in the Asia-Pacific region.

Froth Flotation Chemical Industry Overview

The froth flotation chemicals market is consolidated in nature. Some of the major players in the market studied include BASF SE, Clariant, Dow, Nouryon, and NASACO, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Froth Flotation Chemicals in Asia-Pacific

- 4.1.2 Increasing Mining Activities in Canada and Mexico

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Policies and Changing Regulatory Landscape Exist in North America and Europe

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Reagent Type

- 5.1.1 Collectors

- 5.1.1.1 Cationic

- 5.1.1.2 Anionic

- 5.1.1.3 Non-ionic

- 5.1.2 Frothers

- 5.1.2.1 Acidic

- 5.1.2.2 Basic

- 5.1.2.3 Neutral

- 5.1.3 Modifiers

- 5.1.3.1 Acidic Depressants

- 5.1.3.2 pH modifiers

- 5.1.3.3 Activators

- 5.1.3.4 Deactivators

- 5.1.4 Other Reagent Types

- 5.1.1 Collectors

- 5.2 End-user Industry

- 5.2.1 Mining

- 5.2.2 Pulp and Paper

- 5.2.3 Industrial Waste and Sewage Treatment

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Products and Chemicals Inc.

- 6.4.2 Arkema

- 6.4.3 BASF SE

- 6.4.4 Chevron Phillips Chemical Company LLC

- 6.4.5 CLARIANT

- 6.4.6 Solvay

- 6.4.7 Dow

- 6.4.8 Kemira

- 6.4.9 NASACO

- 6.4.10 Nouryon

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Mixed Collector Systems in Iron Ore Flotation

- 7.2 Other Opportunities