|

市場調查報告書

商品編碼

1627188

BFSI Security -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)BFSI Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

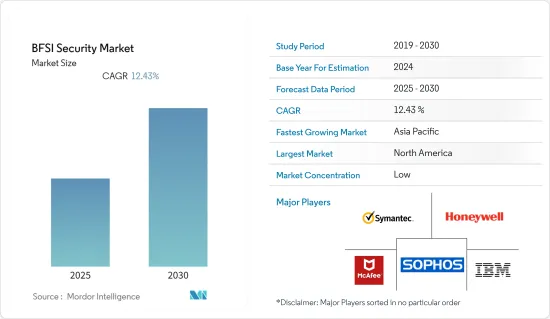

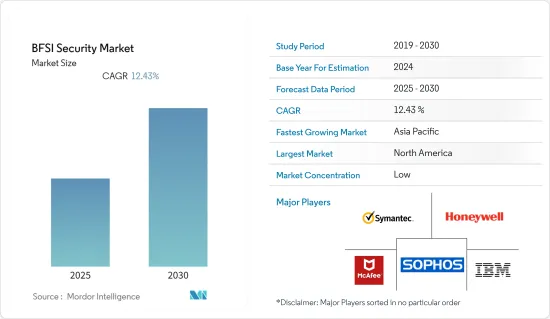

BFSI 證券市場預計在預測期內複合年成長率為 12.43%。

主要亮點

- BFSI 安全解決方案有助於改善銀行和保險公司等金融機構的投資監控。組織開始採用這些解決方案來保護儲存在其系統和數位儲存設備上的敏感資訊。

- 隨著監管標準的繼續實施、雲端基礎的安全解決方案的採用增加以及線上付款形式的增加,預計先進的安全解決方案將會出現。雲端基礎的技術的採用也使得資料更容易受到安全攻擊,因此駭客依靠 SWIFT 網路使用 Odinaff、Danabot、Camubot 和 Backswap 等惡意軟體發送轉帳訊息,他們開始將目標瞄準這樣做的銀行。對雲端基礎的安全解決方案不斷成長的需求預計將進一步推動市場成長,這些解決方案使 BFSI 部門能夠有效地利用資料。

- 預計多種因素將增加市場上網銀行的機會,例如透過物聯網 (IoT) 出現的客製化解決方案、生物識別和網路安全解決方案。然而,高昂的實施成本和缺乏有效的安全解決方案正在阻礙市場成長。

- BFSI 旗下的許多安全公司都是第三方服務供應商,同時為各種客戶和產業提供安全解決方案。此外,管理來自多個公司的資料可能會為公司帶來管理挑戰。安全解決方案和服務的可靠性問題以及第三方參與導致機密資訊外洩的可能性正在限制市場的成長。

- 隨著全球線上數位化金融服務的使用和消費不斷增加,COVID-19 大流行對 BFSI 安全市場產生了重大影響。 BFSI 安全供應商在疫情危機期間加快了步伐,並逐漸在其安全平台下提供 SaaS(軟體即服務)。因此,在全球健康危機中,這已成為 BFSI 安全產業的關鍵成長要素之一。疫情過後,數位付款在全球興起,市場蓬勃發展。

BFSI安全市場趨勢

網路資料外洩的增加推動市場成長

- BFSI 產業是關鍵基礎設施產業之一,由於其龐大的基本客群和財務資訊面臨風險,因此一次又一次遭受資料外洩和網路攻擊。金融服務機構受到網路攻擊的可能性是其他行業的四倍,因此對安全解決方案的需求預計會增加。

- 機器學習、人工智慧和區塊鏈正在 BFSI 的多個領域迅速採用,對資料安全構成嚴重威脅。由於網路攻擊和竊盜的盛行,該行業數位化的提高也需要資料保護,從而增加了對 BFSI 安全性的需求。此外,隨著銀行、其他金融機構和企業轉向數位化業務營運,安全解決方案的採用和使用正在顯著增加。網路安全是BFSI安全產業提供的服務,預計將成為市場擴張的驅動力。

- 2019年,美國第一美國金融公司發現了2008年至去年全球最大的金融業資料外洩事件。這次資料外洩揭露了 8.85 億則財務和個人資訊。銀行業是最容易遭受網路攻擊並導致資料外洩的行業之一。

- 凱馬特母公司西爾斯控股透露,凱馬特商店付款系統感染了惡意軟體。摩根大通是歷史上最大的銀行資料外洩事件之一的受害者,駭客取得了約 3,500 名客戶的財務資訊。針對此類案例,企業傾向於加強網路安全,從而推動 BFSI 安全市場。

- 銀行、金融機構和其他金融機構擴大轉向數位化業務營運,採用和實施安全解決方案和服務的需求正在推動市場成長。

- 隨著經濟的成長,BFSI 安全有許多機會擴大和擴大其提供的服務範圍。此外,BFSI 領域增加網際網路選擇以及透過網際網路使用數位化系統預計將帶來成長潛力。新興市場的網路普及率不斷提高,刺激了連網設備的採用,這些設備可實現便利、安全的金融交易,從而導致 BFSI 安全市場引入威脅管理系統來保護付款閘道。

北美可望創最大市場規模

- 北美,尤其是美國,由於嚴重依賴數位付款,成為 BFSI 安全最大的市場之一。由於政府採取多項措施尋求更好的安全解決方案,預計該地區也將實現健康成長。

- 隨著該國嚴重依賴線上付款和銀行基礎設施的恢復,銀行面臨實施強大的威脅管理系統以防止財務資料受到損害的壓力。保護資訊免受駭客攻擊的需求日益成長,推動了 BFSI 安全解決方案在該地區的採用。

- 此外,行動銀行詐欺也呈現上升趨勢。隨著客戶擴大使用行動銀行應用程式和付款系統,預計它們將比傳統的卡片詐騙和銷售點攻擊更加普遍。北美監管機構正在密切關注向行動付款的轉變,特別是第三方和金融科技平台的付款。

- 數位化正在促使金融機構實施威脅管理系統來保護數位資產和客戶資料。敏感客戶資訊包括信用卡和簽帳金融卡詳細資料、銀行帳戶詳細資料、付款資訊等。在美國,我們看到 BFSI 公司大量採用網路安全平台。許多美國領先的金融機構,包括花旗銀行、摩根大通和美國銀行,都實施了先進的網路安全系統,全天候(24/7)保護他們免受網路犯罪分子的侵害。

- 美國主要金融機構之一的Flagstar銀行去年遭遇重大資料外洩事件,約150萬客戶的社保資訊外洩。這次洩漏是這家總部位於密西根州的線上銀行巨頭遭受的第二次攻擊。該地區的此類事件正在推動 BFSI 安全市場的成長。

BFSI 安全產業概覽

BFSI 安全市場高度分散,主要參與者包括 Symantec Corporation、Sophos Group Plc.、McAfee Inc.、IBM Corporation 和 Honeywell International Inc.。市場參與企業正在採取聯盟、併購、創新、投資和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2022 年 11 月,全球線上安全領域的領導者麥克菲宣布與萬事達卡建立合作夥伴關係,為持卡人提供線上安全軟體。此次合作將允許萬事達卡持卡會員從麥克菲購買網路安全軟體。

2022 年 10 月,義大利最大的銀行集團之一 BPER Banca Group 宣布與 IBM 公司建立為期四年的合作夥伴關係,以協助該銀行加速發展成為一家全數位化公司。這項為期四年的協議將透過將IBM Cloud for Financial Services 的安全性、可擴展性和可靠性與IBM z16 和Red Hat OpenShift(領先的Kubernetes 平台)的彈性相結合,實現銀行的技術基礎架構和應用程式的現代化,從而擴展您的混合雲端策略和規模。

2022 年 2 月,思科和樂天簽署策略協議,以加速開放 RAN 和電信雲端市場。此次收購所描述的解決方案將使行動行動電話業者能夠在雲端時代更有效地競爭。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 網路銀行業的成長

- 網路資料外洩增加

- 市場限制因素

- 安全和隱私問題

第6章 市場細分

- 按類型

- 資訊安全

- 實體安全

- 按服務

- 系統整合

- 維護

- 支援

- 按行業分類

- 銀行

- 保險

- 其他金融機構

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 西班牙

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 東南亞

- 其他亞太地區

- 其他

- 北美洲

第7章 競爭格局

- 公司簡介

- Symantec Corporation

- Sophos Group Plc.

- McAfee Inc.

- IBM Corporation

- Honeywell International Inc.

- EMC Corporation

- Computer Sciences Corporation

- Trend Micro Incorporated

- Booz Allen Hamilton Inc.

- Cisco Systems Inc.

第8章投資分析

第9章 市場未來展望

The BFSI Security Market is expected to register a CAGR of 12.43% during the forecast period.

Key Highlights

- BFSI security solutions help improve investment monitoring in financial institutions, including banks and insurance companies. Various organizations have started adopting such solutions to protect vital information stored on their systems and digital memory devices.

- The increasing implementation of regulatory standards, coupled with the rise in the adoption of cloud-based security solutions and increasing modes of online payments, is expected to give rise to advanced security solutions. Also, because the adoption of cloud-based technologies has made data more vulnerable to security attacks, hackers have begun using malware, such as Odinaff, Danabot, Camubot, and Backswap, to target banks that rely on the SWIFT network to send money-moving messages. Market growth is anticipated to be further driven by rising demand for cloud-based security solutions that allow the BFSI sector to use their data effectively.

- Multiple factors, such as the emergence of customized solutions, biometrics, and cybersecurity solutions based on the internet of things (IoT), are expected to increase online banking opportunities in the market. However, high implementation costs and a lack of efficient security solutions hinder the market growth.

- Most BFSI security companies are third-party service providers, providing security solutions simultaneously to various clients and business verticals. Additionally, managing the data of several companies might cause management challenges for companies. Trust difficulties concerning security solutions and services, as well as the potential for third parties to become involved and cause the leakage of sensitive information, restrain the market growth.

- Due to the global increase in the use and consumption of online and digitalized financial services, the COVID-19 pandemic substantially impacted the BFSI security market. BFSI security providers gained pace during the pandemic crisis and are progressively offering software-as-a-services under security platforms. Consequently, amid the global health crisis, this has emerged as one of the key growth factors for the BFSI security industry. After the pandemic, the market is growing rapidly with increasing digital payments across the globe.

BFSI Security Market Trends

Rise in Cyber Data Breaches Drives the Market Growth

- The BFSI sector is one of the critical infrastructure segments that suffers several data breaches and cyber-attacks, owing to the large customer base that the industry serves and the financial information that is at stake. Financial service institutions are four times more susceptible to cyberattacks than other industries, which is expected to drive the demand for security solutions.

- Machine learning, artificial intelligence, and blockchain have all seen rapid adoption in several BFSI sectors, posing serious threats to data security. Due to the prevalence of cyber-attacks and theft, the development in digitalization in this industry also necessitates data protection, which raises the demand for BFSI security. Additionally, as banks, other financial institutions, and enterprises switch to digitalized business operations, the adoption and use of security solutions have grown significantly. Cybersecurity is a service provided by the BFSI security industry and is anticipated to drive market expansion.

- The most significant major global data breach in the financial industry between 2008 and last year was discovered in 2019 in the United States at First American Financial Corporation. This data breach exposed 885 million financial and personal details. The banking industry is one of the most vulnerable to cyber assaults that result in data leaks.

- Sears Holdings, the parent company of Kmart, revealed that Kmart's store payment systems were infected with malware. JPMorgan was a victim of one of the biggest bank breaches in history, where hackers accessed the financial information of around 3,500 customers. With such instances, the companies are bound to increase cybersecurity, which drives the BFSI security market.

- The increasing number of banks, financial institutions, and other financing firms switching toward digitalized business operations and the need to adopt and implement security solutions and services have driven market growth.

- Growing economies provide considerable opportunities for BFSI safety to expand and broaden its offerings. Additionally, the rise in the internet option in the BFSI sector and the use of digitalized systems through the internet is anticipated to offer growth possibilities. The rising penetration of the internet in developing regions, which is stimulating the adoption of connected devices that enable convenient and secure financial transactions, is encouraging the BFSI security market to implement threat management systems for securing payment gateways.

North America is Expected to Register the Largest Market

- North America, particularly the United States, is one of the largest markets for BFSI security owing to the region's majorly dependence on digital payments. The region is also expected to witness healthy growth due to multiple government initiatives in the country demanding better security solutions.

- The country's high dependence on online payments and recovering banking infrastructure urged banks to implement a strong threat management system to prevent financial data breaches. Increasing the need to protect information from hackers has propelled the adoption of BFSI security solutions in the region.

- Further, mobile banking fraud is on the rise. With customers increasingly using mobile banking applications and payment systems, it is expected to become more prevalent than traditional credit card fraud and POS attacks. Regulators in North America are closely monitoring the shift toward mobile payments, especially those enabled by third-party or FinTech platforms.

- Digitalization has encouraged financial institutions to implement threat management systems to protect their digital assets and customer data. Sensitive customer information includes credit or debit card details, bank account details, and payment information. USA has observed a significant adoption of cybersecurity platforms across BFSI companies. Many leading financial institutions in the country, such as Citi Bank, JP Morgan Chase, and the Bank of America, have implemented advanced cybersecurity systems to offer 24/7 protection against cybercriminals.

- Flagstar Bank, one of the major financial organizations in the United States, had a significant data breach in the previous year, exposing the Social Security information of about 1.5 million clients. The breach is the second attack on the Michigan-based online banking giant. Such incidents in this region propel the growth of the BFSI security market.

BFSI Security Industry Overview

The BFSI Security Market is highly fragmented, with the presence of major players like Symantec Corporation, Sophos Group Plc., McAfee Inc., IBM Corporation, and Honeywell International Inc., among others. Players in the market are adopting strategies such as partnerships, mergers, innovations, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In November 2022, McAfee, a global leader in online security, announced a partnership with Mastercard to provide online security software to cardholders. The collaboration will allow Mastercard Cardholders to purchase McAfee internet security software.

In October 2022, BPER Banca Group, one of Italy's largest banking groups, announced a four-year partnership with IBM Corporation to assist in accelerating the bank's development into a completely digital corporation. The four-year agreement will expand the bank's hybrid cloud strategy to modernize its technology infrastructure and applications by combining the security, scalability, and reliability of IBM Cloud for Financial Services with the resiliency of IBM z16 and Red Hat OpenShift, a leading Kubernetes platform, to help meet the compliance requirements of the heavily regulated industry.

In February 2022, Cisco and Rakuten signed a strategic agreement to accelerate the open RAN and Telco Cloud Market. The acquisition offers solutions that will allow mobile operators to compete more effectively in the cloud era.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of the Online Banking Industry

- 5.1.2 Rise in Cyber Data Breaches

- 5.2 Market Restraints

- 5.2.1 Security and Privacy Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Information Security

- 6.1.2 Physical Security

- 6.2 By Services

- 6.2.1 System Integration

- 6.2.2 Maintenance

- 6.2.3 Support

- 6.3 By Vertical

- 6.3.1 Banking

- 6.3.2 Insurance

- 6.3.3 Other Financial Institutions

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 Spain

- 6.4.2.4 France

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 South Korea

- 6.4.3.4 India

- 6.4.3.5 South East Asia

- 6.4.3.6 Rest of Asia Pacific

- 6.4.4 Rest of the World

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Symantec Corporation

- 7.1.2 Sophos Group Plc.

- 7.1.3 McAfee Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Honeywell International Inc.

- 7.1.6 EMC Corporation

- 7.1.7 Computer Sciences Corporation

- 7.1.8 Trend Micro Incorporated

- 7.1.9 Booz Allen Hamilton Inc.

- 7.1.10 Cisco Systems Inc.