|

市場調查報告書

商品編碼

1627203

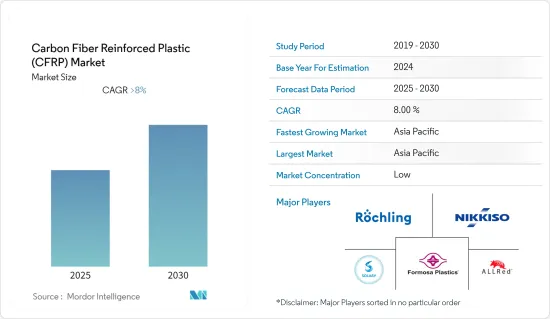

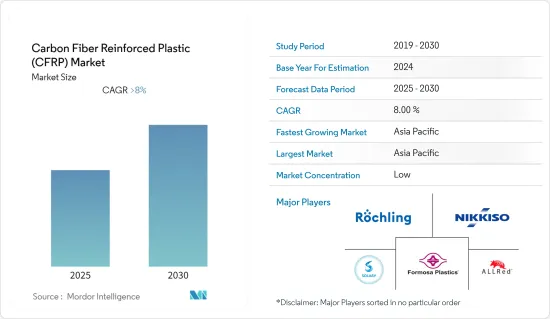

碳纖維增強塑膠(CFRP):市場佔有率分析、產業趨勢、成長預測(2025-2030)Carbon Fiber Reinforced Plastic (CFRP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計碳纖維增強塑膠 (CFRP) 市場在預測期內的複合年成長率將超過 8%。

由於所有消耗 CFRP 的主要行業都關閉,市場受到了 COVID-19 的負面影響。由於 COVID-19 爆發造成的破壞,包括建築、汽車和航太的所有行業都關閉了生產工廠,減少了對 CFRP 的需求。然而,隨著企業復甦,未來幾年投資預計將增加並推動對 CFRP 的需求。

主要亮點

- 從長遠來看,航太業不斷成長的需求以及對節能和輕型車輛日益成長的偏好預計將推動市場成長。

- 然而,CFRP的高成本和產能不足預計將阻礙市場成長。

- 將重點轉向低成本產品和技術的開發似乎是未來的機會。

- 亞太地區主導全球市場,其中中國和印度的消費量最高。

碳纖維增強塑膠(CFRP)市場趨勢

航太業的需求增加

- CFRP是一種複合材料,由基體和增強體兩部分組成。基體是聚合物樹脂,增強體是碳纖維。

- 隨著航太工業對性能提高的重視,CFRP 材料由於其高強度重量比和剛度而被用作金屬和合金的替代品。

- 最初,CFRP用於波音787和空中巴士A350,主要是為了減輕CFRP零件的重量。最新的民航機型號,例如波音夢幻飛機和空中巴士 A350,含有高達 52% 的 CFRP。

- 2022 年 6 月,全球機隊總數為 28,674 架飛機,其中現役飛機 23,513 架,地面飛機 5,161 架。這一數量意味著現役飛機數量與 2021 年 6 月相比增加了 11%,與 2020 年 6 月相比增加了 91%。

- 根據波音商業市場展望,到2041年,全球飛機持有預計將成長80%,新飛機交付市場價值將達到7.2兆美元。波音公司預計,到 2041 年,全球將總合交付41,170 架民航機。

- 由於上述因素,預計市場在預測期內將出現復甦後的成長。

亞太地區主導市場

- 由於印度、日本和中國等國家的工業、航空和汽車領域廣泛採用碳纖維複合材料,亞太地區在全球碳纖維複合材料市場中佔據最大佔有率。

- 近年來,中國對全球航空運輸量的成長做出了巨大貢獻。每年平均旅客成長率超過10%。這一成長主要是由於消費能力的提高和航空連通性的改善而導致的客運量增加所推動的。因此,客運量的增加預計將推動飛機需求。

- 中國的汽車製造業是全世界最大的。然而,近年來該產業增速放緩,產銷量下降。中國工業協會數據顯示,2022年12月中國汽車銷量256萬輛,年減8.4%,但2022年全年成長至2,686萬輛。

- CFRP有助於提高受損建築構件的彎曲和剪切強度,因此這種材料廣泛應用於建設產業。 2021年,建設產業新簽約金額186.6億美元,較去年成長2.5%,成長速度較去年同期回落7.1個百分點。

- 2022年1月,中國宣布了「十四五」(2021-2025)期間建築業的發展計劃,為國家經濟走上更綠色、更聰明、更安全的道路奠定了基礎。 2022年8月,中國政府宣布將投資1兆美元用於各種建設計劃,其中包括建設一條從西南省四川省到西藏首都拉薩、全長1,629公里的高鐵。

- 碳纖維有助於吸收大量衝擊能量,使汽車更安全。 CFRP在汽車製造上有廣泛的應用。因此,對該材料的需求預計很快就會增加。

- 根據印度品牌資產基金會預測,到2027年,印度汽車市場規模預計將達到548.4億美元,複合年成長率超過9%。印度汽車工業的目標是到2026年將汽車出口量增加五倍。 2022年印度汽車出口總量為5,617,246輛。

- 許多汽車製造商正在該行業的各個領域進行大量投資。例如,2022年11月,馬魯蒂鈴木印度公司宣布將投資8.6512億美元用於設立新設施、推出新車型等多個計劃。

- 因此,預計上述因素將在未來幾年對市場產生重大影響。

碳纖維增強塑膠(CFRP)產業概況

碳纖維增強塑膠(CFRP)市場部分分散,主要企業之間競爭激烈。這些主要企業包括 Solvay、Formosa M、Nikkiso、ALLRed & Associates Inc. 和 Rochling Group。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 航太業不斷成長的需求

- 對節能和輕型車輛的需求不斷增加

- 抑制因素

- CRFP高成本

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 依樹脂類型

- 熱固性CFRP

- 熱塑性碳纖維增強塑膠

- 按最終用戶產業

- 航太

- 車

- 運動/休閒

- 建築/施工

- 風電產業

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Solvay

- Hexcel Corporation

- Formosa M Co. Ltd

- Mitsubishi Chemical Corporation

- Nippon Graphite Fiber Co. Ltd

- SABIC

- TEIJIN LIMITED

- TORAY INDUSTRIES INC.

- ALLRed & Associates Inc.

- Rochling

- Nikkiso Co. Ltd

第7章 市場機會及未來趨勢

- 轉向低成本產品和技術開發

The Carbon Fiber Reinforced Plastic Market is expected to register a CAGR of greater than 8% during the forecast period.

The market was negatively impacted due to COVID-19, as all the major industries that consume CFRP were put on a halt. All the industries, such as construction, automotive, aerospace, and others, shut their production plant due to the disruption caused by the COVID-19 pandemic, which reduced the demand for CFRP. However, with firms recovering, the investments are expected to grow and drive the demand for CFRP in the coming years.

Key Highlights

- Over the long term, the growing demand from the aerospace industry and a rising preference for fuel-efficient and lightweight vehicles are expected to drive market growth.

- However, the high cost of the CFRP and inadequate production capacity are expected to hinder the market's growth.

- Shifting focus on developing low-cost products and technologies will likely act as an opportunity in the future.

- Asia-Pacific dominated the market across the world, with the largest consumption from China and India.

Carbon Fiber Reinforced Plastics (CFRP) Market Trends

Increasing Demand from the Aerospace Industry

- CFRP is a composite material consisting of two parts: matrix and reinforcement. The matrix is a polymer resin, and the reinforcement is a carbon fiber, which provides high strength to the material.

- With the focus on performance improvement in the aerospace industry, CFRP material is being used as a replacement for metals and alloys, as it possesses a high strength-to-weight ratio and rigidity.

- Initially, CFRP was used in Boeing 787 and the Airbus A350, primarily driven by the weight savings of CFRP parts. The latest models in civil aviation, such as the Boeing Dreamliner and Airbus A350, are made of up to 52% CFRP.

- In June 2022, the total worldwide fleet size was 28,674, with 23,513 active and 5,161 grounded aircraft. The volume represents an expansion of 11% in operational aircraft fleet size compared to June 2021 and 91% compared to June 2020.

- According to the Boeing Commercial Market Outlook, the global fleet will increase by 80% and is expected to reach a market value of USD 7.2 trillion by 2041 for new airplane deliveries. According to Boeing forecasts, a total of 41,170 commercial airplanes will be delivered by the year 2041 globally.

- Owing to all the abovementioned factors, the market is expected to grow post-recovery during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounted for the largest share of the global CFRP market, owing to widespread adoption in the industrial, aviation, and automotive sectors in countries like India, Japan, and China.

- China is a key contributor to global air traffic growth for the past few years. The average passenger growth rate is over 10% per year. This growth is primarily driven by rising passenger traffic due to higher spending power and better air connectivity. Thus, increasing passenger traffic is expected to boost the demand for aircraft.

- The Chinese automotive manufacturing industry is the largest in the world. However, the industry witnessed a slowdown in recent years, wherein production and sales declined. According to the China Association of Automobile Manufacturers (CAAM), automotive sales in China fell by 8.4% y-o-y to 2.56 million units in December 2022, whereas for the full year 2022, the sales grew to 26.86 million units.

- CFRP helps improve the bending and shear strength of damaged construction elements, so the material is extensively used in the construction industry. In 2021, the value of newly signed contracts in the construction industry was USD 18.66 billion, an increase of 2.5% year-on-year, and the growth rate narrowed by 7.1% points compared with the same period last year.

- In January 2022, China unveiled plans to develop its construction industry during the 14th Five-Year Plan (2021-2025), paving a pillar of the country's economy on a greener, smarter, and safer path. In August 2022, the Chinese government announced the investment of USD 1 trillion into different construction projects, including the construction of 1,629 km of high-speed rail from Sichuan province in the Southwest to the Tibetan capital Lhasa.

- The carbon fiber helps absorb large amounts of impact energy, increasing vehicle safety. CFRP includes huge applications in the manufacturing of automobiles. As a result, the demand for this material is expected to increase shortly.

- According to India Brand Equity Foundation, the Indian car market is expected to reach USD 54.84 billion by 2027 while registering a CAGR of over 9%. Indian automotive industry is targeting to increase the export of vehicles by five times by the year 2026. In 2022, total automobile exports from India stood at 5,617,246.

- Many Automakers are investing heavily in various segments of the industry. For instance, in November 2022, Maruti Suzuki India announced an investment of USD 865.12 million on various projects, including new facilities set-up and the introduction of new models.

- In turn, the abovementioned factors are projected to significantly impact the market in the coming years.

Carbon Fiber Reinforced Plastics (CFRP) Industry Overview

The carbon fiber reinforced plastic (CFRP) market is partly fragmented and is highly competitive among the major players. These major players include Solvay, Formosa M Co. Ltd, Nikkiso Co. Ltd, ALLRed & Associates Inc., and Rochling Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Aerospace Industry

- 4.1.2 Rising Demand for Fuel-efficient and Light-weight Vehicles

- 4.2 Restraints

- 4.2.1 High Cost of CRFP

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Resin Type

- 5.1.1 Thermosetting CFRP

- 5.1.2 Thermoplastic CFRP

- 5.2 End-user Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Sports and Leisure

- 5.2.4 Building and Construction

- 5.2.5 Wind Power Industry

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Solvay

- 6.4.2 Hexcel Corporation

- 6.4.3 Formosa M Co. Ltd

- 6.4.4 Mitsubishi Chemical Corporation

- 6.4.5 Nippon Graphite Fiber Co. Ltd

- 6.4.6 SABIC

- 6.4.7 TEIJIN LIMITED

- 6.4.8 TORAY INDUSTRIES INC.

- 6.4.9 ALLRed & Associates Inc.

- 6.4.10 Rochling

- 6.4.11 Nikkiso Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Toward the Development of Low Cost Products and Technologies