|

市場調查報告書

商品編碼

1627207

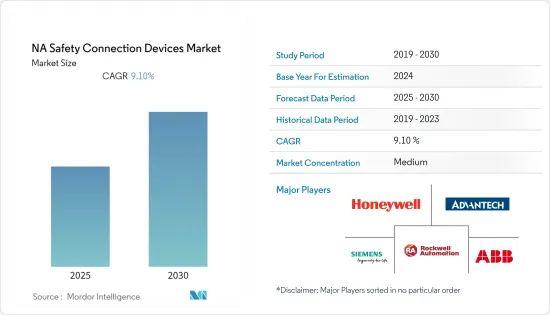

北美安全連接設備:市場佔有率分析、產業趨勢、成長預測(2025-2030)NA Safety Connection Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

北美安全連接設備市場預計在預測期內複合年成長率為 9.1%

主要亮點

- 自動化生產設備正在自動化許多類別的專業工作,從生產工人到工程師。這種廣泛且不斷提高的自動化增加了各個最終用戶產業對安全連接設備的需求。

- 隨著工業 4.0 的出現,工廠自動化確保了工人的安全工作環境。因此,隨著工業自動化需求的增加,安全連接設備的數量也會增加。

- 另一方面,安全連接設備的高成本以及行業對其新興市場發展缺乏認知正在限制市場的成長。

北美安全連接設備市場趨勢

汽車工業呈現顯著成長

- 汽車產業是安全連接設備成長最快的消費者之一。隨著世界各地對電動車的需求增加,該公司正在推廣自動化系統,以提高現有工廠的生產力。

- 許多汽車製造商正在世界各地建造新的製造基礎設施,或將汽車製造過程從體力勞動轉移到機器人機器。例如,2021 年 10 月,汽車巨頭日產和大眾汽車宣布了創建更好、更智慧工廠的新計畫。

- 日產汽車推出智慧工廠舉措來應對新的需求和趨勢,帶動汽車產業的快速成長和發展。該舉措將使日產能夠使用手工機器人製造下一代汽車。

- 因此,汽車產業擴大引入安全連接設備,允許控制器和其他設備相互通訊。

美國佔最高市場佔有率

- 據估計,美國是該地區安全連接設備市場成長最快的市場。工業自動化程度不斷提高,機器也變得越來越複雜。因此,需要更安全、更可靠的連接裝置。

- 該地區擁有大量國內外智慧製造公司,智慧家庭的快速普及和物聯網業務的擴展預計將推動該地區的安全互聯設備市場。

- 智慧家庭技術正在將家庭安全提升到一個新的水平。除了警報之外,您還可以使用現代相機、動作感測器,甚至智慧門鎖將您的家變成真正的堡壘,讓您可以在發生情況時立即向智慧型手機發送訊息。所有這些功能推動了對可靠和安全連接設備的需求,進一步推動了成長。

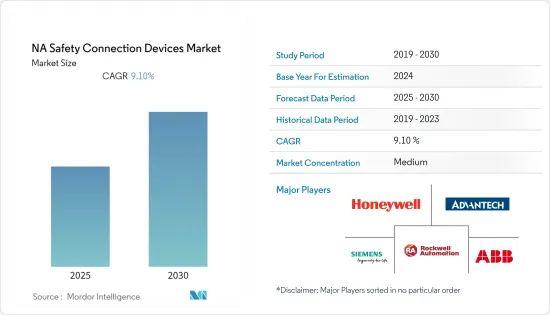

北美安全連接設備產業概況

北美安全連接設備市場適度分散,由多家公司組成。從市場佔有率來看,目前該市場由少數大公司主導。然而,憑藉創新和永續的包裝,許多公司正在透過贏得新合約和開發新市場來擴大其市場佔有率。

- 2021 年10 月- 隨著電動車充電站安全問題的增加,福祿克將推出新型FEV100 電動車充電站測試適配器,測試使用1 型連接器的1 級或2 級電動汽車交流充電站(EVSE) 的安全性和性能。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 工業 4.0 和高速工廠自動化的發展

- 汽車產業對安全設備的需求增加

- 市場限制因素

- 設備成本上升

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 電纜線

- 連接器

- 閘道

- 適配器

- 繼電器

- T型連接器

- 配電箱

- 按最終用戶

- 車

- 製造業

- 衛生保健

- 能源/電力

- 其他

- 按國家/地區

- 美國

- 加拿大

第6章 競爭狀況

- 公司簡介

- Rockwell Automation Inc.

- ABB Ltd

- Advantech Co. Ltd

- Bihl+Wiedemann GmbH

- Honeywell International Inc.

- Schneider Electric SE

- Lumberg Automation Components GmbH

- Murrelektronik Inc.

- Weidmuller Interface GmbH & Co. KG

- TE Connectivity Ltd

- Ifm electronic gmbh

- Banner Engineering Corp.

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 51022

The NA Safety Connection Devices Market is expected to register a CAGR of 9.1% during the forecast period.

Key Highlights

- Different categories of professional work are being automated with automated production equipment, ranging from production workers to engineers. This wide range and increasing automation is increasing the demand for safety connection devices from various end-user industries.

- With the advent of Industry 4.0, factory automation ensures a safe working environment for workers. Hence, as the demand for automation in industries is increasing, safety connection devices will also witness an increase.

- On the other hand, the high cost of safety connection devices and lack of awareness about its developments in the industry is restraining the market growth.

North America Safety Connection Devices Market Trends

Automotive Industry to Show Significant Growth

- The automotive industry is one of the fastest-growing consumers of safety connection devices. With the growing demand for Electric Vehicles across the world, companies are pushing toward automated systems to increase the productivity of the existing plants.

- Many automotive manufacturers are either establishing new manufacturing infrastructures across the world or moving the processes of automotive manufacturing from manual labor to robotic machinery. For instance, in October 2021, automotive giants Nissan and Volkswagen announced new plans to create better, smarter factories.

- Nissan's introduction of the Intelligent Factory Initiative to respond to emerging needs and trends brought about the rapid growth and advancement of the automotive industry. The Initiative enables Nissan to use robots that have inherited the skills of Takumi (master technicians) to manufacture next-generation vehicles.

- The automotive industry is thus deploying safety connection devices so as to make controllers and other devices communicate with each other.

United States to Hold the Highest Market Share

- The United States is estimated to be the fastest-growing market in the region for safety connection devices. The industries are adopting automation, thus making the machines more complex. This ultimately demands more secure and reliable connection devices for the applications.

- The presence of a large number of domestic and international smart manufacturing companies in the region, rapid implementation of smart homes, and expansion of IoT in businesses are projected to drive the safety connection device market in this region.

- Smart home technology has taken the safety of the home to the next level. Not only alarms, modern cameras, motion sensors, and even smart door locks enable you to turn home into a real fortress and immediately send a message to your smartphone if something happens. All these functionalities urge for reliable safety connection devices, which further fuels the growth.

North America Safety Connection Devices Industry Overview

The North America Safety Connection Device market is moderately fragmented and consists of several players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many of the companies are increasing their market presence by securing new contracts and tapping new markets.

- October 2021 - With growing safety concerns over electric vehicle charging stations, Fluke introduced a new FEV100 Electric Vehicle Charging Station Test Adapter that tests the safety and performance of level 1 or level 2 electric vehicle AC charging stations (EVSEs) with type 1 connectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth in Industry 4.0 and Rapid Factory Automation

- 4.3.2 Increasing demand of Safety devices in Automotive Industry

- 4.4 Market Restraints

- 4.4.1 Higher Cost of Devices

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Cable and Cords

- 5.1.2 Connectors

- 5.1.3 Gateways

- 5.1.4 Adaptors

- 5.1.5 Relays

- 5.1.6 T-Couplers

- 5.1.7 Distribution Box

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Manufacturing

- 5.2.3 Healthcare

- 5.2.4 Energy and Power

- 5.2.5 Other End-user Applications

- 5.3 By Country

- 5.3.1 United States

- 5.3.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Rockwell Automation Inc.

- 6.1.2 ABB Ltd

- 6.1.3 Advantech Co. Ltd

- 6.1.4 Bihl + Wiedemann GmbH

- 6.1.5 Honeywell International Inc.

- 6.1.6 Schneider Electric SE

- 6.1.7 Lumberg Automation Components GmbH

- 6.1.8 Murrelektronik Inc.

- 6.1.9 Weidmuller Interface GmbH & Co. KG

- 6.1.10 TE Connectivity Ltd

- 6.1.11 Ifm electronic gmbh

- 6.1.12 Banner Engineering Corp.

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219