|

市場調查報告書

商品編碼

1627213

超磨粒:市場佔有率分析、產業趨勢、成長預測(2025-2030)Super Abrasives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

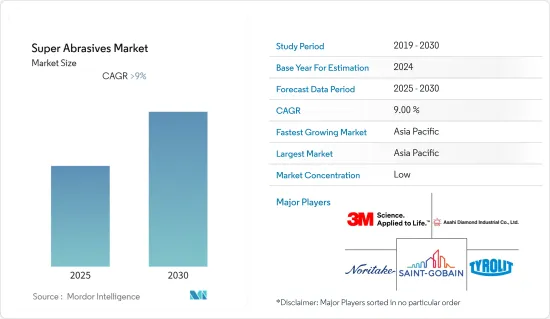

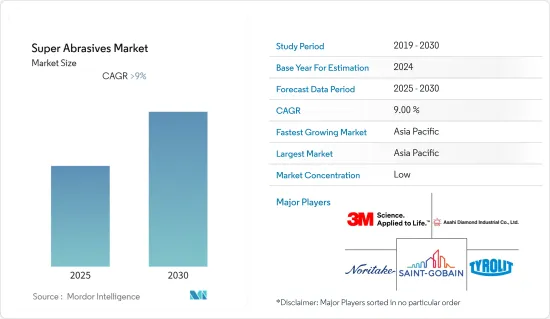

預計預測期內超磨粒市場複合年成長率將維持在9%以上。

COVID-19 對 2020 年市場產生了負面影響。不過,市場預計已達到疫情前水平,預計將穩定成長。

主要亮點

- 電子產業中超磨粒的使用不斷增加預計將在預測期內推動市場成長。

- 另一方面,磨料磨俱的高成本增加了初始投資,預計這將阻礙市場成長。

- 促進超磨粒生產和使用的新技術可能會在未來幾年提供市場機會。

- 由於印度、中國和日本等主要國家的市場開發不斷增加,預計亞太地區將在預測期內主導市場。

超磨粒市場趨勢

電子工業的擴張

- 超磨粒在電子工業中有多種應用。這些刀具用於加工半導體材料、陶瓷、硬質合金、銅及銅合金、鋁、樹脂、橡膠等,主要用於電子元件製造。

- 超磨粒研磨磨俱主要用於電子產業印刷電路基板(PCB)的開發。 PCB 對於許多電子設備至關重要,例如桌上型電腦和家庭劇院系統。

- 電子工業中的超磨粒具有穩定的切片性能、均勻的鑽石數、均勻的線徑、均勻的鑽石分佈、防止鑽石叢集。

- 磁碟紋理、晶圓製造、拋光、光學窗口、半導體和散熱器等電子應用也需要超磨粒。

- 此外,一些電子公司也在顯著成長。例如,2022年,蘋果以3,787億美元的銷售額位居《富比士》雜誌排行榜其他消費性電子公司第一,其次是三星電子。因此,隨著電子製造企業的成長,對超磨粒的需求也大幅增加。

- 隨著更多創新和高效能電子設備的使用,對超磨粒及其工具的需求預計也會增加。

亞太地區主導市場

- 亞太地區主導超磨粒市場。隨著中國、印度、日本等國家對電子設備的需求不斷成長,製造業對超磨粒的需求也不斷增加。

- 中國擁有全球最大的電子產品生產基地。電線、電纜、計算設備和其他個人設備等電子產品在電子行業中成長最快。該國滿足國內對電子產品的需求,並向其他國家出口電子產品。根據中國國家統計局的數據,2021 年家電及電器產品產業銷售額達 9.3464 億元(約 1.384 億美元)。

- 此外,根據國際汽車工業協會(OICA)的數據,中國是全球最大的汽車生產國,約佔全球產量的32.5%。 2021年全國產量為26,082,220輛,較2020年的25,225,242輛成長3%。

- 在印度,中產階級收入的增加、快速都市化和工人階級生活方式的改變導致家電等耐用消費品的生產和銷售大幅增加。政府措施支持了家用電器的擴張。

- 印度的電子工業是世界上成長最快的工業之一。由於100%外國直接投資(FDI)、無需工業許可證、以及從手工生產流程向自動化生產過程的技術轉變等有利的政府政策,國內電子製造業正在穩步擴張。

- 根據印度品牌股權基金會(IBEF)預測,到2025年,印度電子製造業的產值預計將達到5,200億美元。由於「印度製造」、「電子設備國家政策」、「電子設備淨零進口」和「印度製造」等政府舉措,印度的電氣和電子設備產量正在迅速成長。國內製造業,減少進口依賴,促進出口,並支持印度製造計劃等製造業舉措,該計劃旨在使該國實現自力更生。

- 根據IATA(國際航空運輸協會)的報告,預計到預測期結束時,印度將成為世界第三大航空市場。據國際航空運輸協會稱,印度預計到2030年將超過中國和美國,成為全球第三大航空客運市場。預計未來20年該國需要2,100架飛機,銷售額將超過2,900億美元。

- 所有上述因素預計將推動預測期內的市場研究。

超磨粒產業概況

超磨粒市場是分散的。市場主要企業包括(排名不分先後)Asahi Diamond Industrial、Saint-Gobain、3M、NORITAKE CO., LIMITED 和 TYROLIT。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進要素

- 電子工業的擴張

- 用超磨粒磨料取代傳統磨料

- 抑制因素

- 研磨顆粒成本高,初期投資高

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 依材料類型

- 鑽石

- 立方氮化硼(CBN)

- 按用途

- 動力傳動系統

- 軸承

- 齒輪

- 工具研磨

- 渦輪

- 其他用途

- 按最終用戶產業

- 航太

- 車

- 醫療保健

- 電子產品

- 石油和天然氣

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 北歐國家

- 其他歐洲國家

- 世界其他地區

- 南美洲

- 中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Asahi Diamond Industrial Co.,Ltd.

- CUMI

- Dr.Kaiser

- Gunter Effgen GmbH

- Heger GmbH Excellent Diamond Tools

- Husqvarna Group

- Hyperion Materials & Technologies

- KURE GRINDING WHEEL

- NORITAKE CO., LIMITED

- Saint-Gobain

- Tyrolit

- Zhengzhou Hongtuo Superabrasive Products Co. Ltd

第7章 市場機會及未來趨勢

- 新技術促進超磨粒的生產和使用

簡介目錄

Product Code: 51124

The Super Abrasives Market is expected to register a CAGR of greater than 9% during the forecast period.

COVID-19 negatively impacted the market in 2020. However, the market is estimated to have reached pre-pandemic levels and is expected to grow steadily.

Key Highlights

- Increasing usage of super abrasives in the Electronics industry is likely to fuel the market growth during the forecast period.

- On the other hand, high initial investment due to the high cost of abrasives is expected to hinder market growth.

- Emerging technologies easing production and using super abrasives will likely create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market during the forecast period owing to its growing development in major countries such as India, China, and Japan.

Super Abrasives Market Trends

Expanding Electronics Industry

- Super abrasives find various applications in the electronics industry. These tools can be used to process semiconductor materials, ceramics, carbide alloys, copper and copper alloys, aluminum, resin, and rubber, which are majorly used in electronic component manufacturing.

- Super abrasive grinding tools are primarily used to develop Printed Circuit Boards (PCBs) PCBs in the electronics industry. PCBs are critical for many electronic devices, like desktop computers and home theater systems.

- Super abrasives in the electronics industry provide consistent slicing performance, uniform diamond counts, uniform wire diameter, even diamond distribution, and no diamond clustering.

- Super abrasives are also required in the electronics sector for disc texturing, wafer manufacturing, polishing, optic windows, semiconductors, and heat sinks.

- Furthermore, several electronic companies are also growing substantially. For instance, in 2022, Apple, with 378.7 billion US dollars in sales, ranked number one among other consumer electronics companies on the Forbes list, followed by Samsung Electronics. Thus, with the growth of electronic manufacturing companies, the demand for super abrasives also increases substantially.

- The increasing usage of more innovative and efficient electronic devices is expected to lead to increased demand for super abrasives and their tools.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the super abrasives market. Owing to the demand for electronics in countries such as China, India, and Japan, the demand for super abrasives in manufacturing is also increasing in the region.

- China includes the world's most extensive electronics production base. Electronic products, such as wires, cables, computing devices, and other personal devices, recorded the highest growth in the electronics segment. The country serves the domestic demand for electronics and exports electronic output to other countries. According to the National Bureau of Statistics of China, the revenue in the consumer electronics and household appliances segment reached CNY 934.64 million (~USD 138.40 million) in 2021.

- Furthermore, according to the International Organization of Motor Vehicle Manufacturers (OICA), China is the largest producer of automobiles, accounting for about 32.5% of the global volume. The country produced 26,082,220 units in 2021, registering an increase of 3% compared to 25,225,242 units in 2020.

- In India, the consumer durables, like electronic appliances, have witnessed a tremendous increase in production and sales, owing to the growing middle-class income, rapid urbanization, and change in lifestyle of the working class. Government initiatives have supported the expansion of consumer electronics products.

- The Indian electronics industry is one of the fastest-growing industries globally. The domestic electronics manufacturing sector is expanding at a steady rate, owing to favorable government policies, such as 100% foreign direct investment (FDI), no requirement for industrial licenses, and the technological transformation from manual to automatic production processes.

- According to the India Brand Equity Foundation (IBEF), the Indian electronics manufacturing industry is expected to reach USD 520 billion by 2025. Electrical and electronics production in India is expected to increase rapidly due to government initiatives with policies, such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect, which offer a commitment to growth in domestic manufacturing, lowering import dependence, energizing exports, and manufacturing, like the "Make in India" program to make the country self-reliant.

- According to IATA (International Air Transport Association) report, India is poised to become the third-largest aviation market in the world by the end of the forecast period. According to the IATA, India is expected to overtake China and the United States as the world's third-largest air passenger market by 2030. The country is projected to demand 2,100 aircraft over the next two decades, amounting to over USD 290 billion in sales.

- All the factors above are expected to boost the market studied during the forecast period.

Super Abrasives Industry Overview

The super abrasives market is fragmented in nature. Some of the major players in the market include Asahi Diamond Industrial Co., Ltd., Saint-Gobain, 3M, NORITAKE CO., LIMITED, and TYROLIT, among others. (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expanding Electronics Industry

- 4.1.2 Conventional Abrasives Substituted by Super Abrasives

- 4.2 Restraints

- 4.2.1 High Initial Investment due to High Cost of Abrasives

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Diamond

- 5.1.2 Cubic Boron Nitride (CBN)

- 5.2 Application

- 5.2.1 Powertrain

- 5.2.2 Bearing

- 5.2.3 Gear

- 5.2.4 Tool Grinding

- 5.2.5 Turbine

- 5.2.6 Other Applications

- 5.3 End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Automotive

- 5.3.3 Medical

- 5.3.4 Electronics

- 5.3.5 Oil and Gas

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Nordic Countries

- 5.4.3.6 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Asahi Diamond Industrial Co.,Ltd.

- 6.4.3 CUMI

- 6.4.4 Dr.Kaiser

- 6.4.5 Gunter Effgen GmbH

- 6.4.6 Heger GmbH Excellent Diamond Tools

- 6.4.7 Husqvarna Group

- 6.4.8 Hyperion Materials & Technologies

- 6.4.9 KURE GRINDING WHEEL

- 6.4.10 NORITAKE CO., LIMITED

- 6.4.11 Saint-Gobain

- 6.4.12 Tyrolit

- 6.4.13 Zhengzhou Hongtuo Superabrasive Products Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Technologies Easing Production and Use of Super Abrasives

02-2729-4219

+886-2-2729-4219