|

市場調查報告書

商品編碼

1628705

北美智慧家庭:市場佔有率分析、產業趨勢與成長預測(2025-2030)NA Smart Homes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

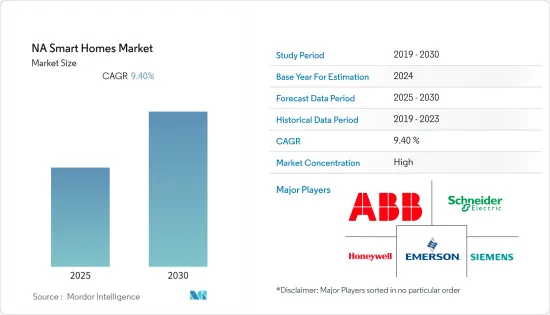

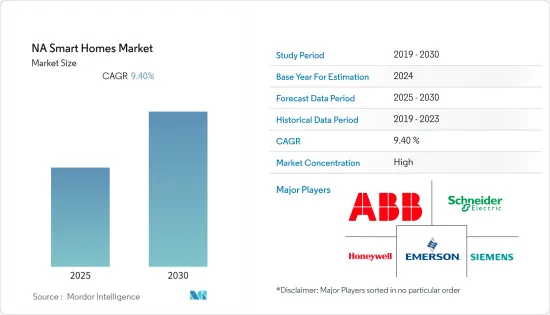

北美智慧家庭市場預計在預測期內複合年成長率為 9.4%

主要亮點

- 5G 在美國的大規模採用以及 Wi-Fi 6 等 Wi-Fi 技術的改進將使智慧家庭設備與更快、更強大的網路連接起來,從而使它們能夠更好地存取雲端的處理和資料資源。 5G 技術也正在徹底改變物聯網服務的交付,包括智慧家庭技術。 5G技術使設備擺脫了電線和電纜的束縛,並最大限度地降低了功耗。

- AT&T、Verizon、T-Mobile 和 Sprint 於 2020年終推出了 5G 無線網路。因此,目前5G已經在美國部分城市推出。然而,預計需要數年時間才能在美國實現全面、成熟、全速的 5G 覆蓋範圍(例如 4G LTE)。 T-Mobile也宣布將於2024年推出基於5G的家庭網路。目標是將覆蓋範圍擴大到美國以前服務不足的農村地區。 T-Mobile 目前正在其 4G LTE 網路上向特定 T-Mobile 客戶提供該服務的試用版。

- 在該地區,對節能解決方案不斷成長的需求是導致採用智慧家庭解決方案的主要趨勢。根據美國能源資訊署的數據,2020 年美國家庭平均消耗了 20.75 兆 BTU 的能源,其中一些能源被浪費了。據美國能源局稱,平均家庭使用的能源估計排放17,320 磅二氧化碳。從這個數字來看,一般家庭以年度為基礎的二氧化碳排放量比一般乘用車多 70%。此類案例正在推動對智慧家庭解決方案的需求。

- ValuePenguin 對 1,000 多人進行的一項調查發現,具有環保意識的人們擴大購買智慧家庭設備。 65% 的美國人至少擁有一台智慧家庭設備,許多人購買智慧科技是因為它對環境有益。受訪者中最受歡迎的智慧家庭設備是揚聲器(31%)、恆溫器(24%)和燈(20%)。

- 更重要的是,智慧揚聲器至關重要,因為它們代表了家庭中新的互動式數位端點,現在超過三分之一的美國成年人都可以使用它們。從亞馬遜和谷歌等市場先驅到第三方語音應用程式開發商,每個人都可以使用這個數位端點。視訊聊天的興起推動了帶有顯示器的智慧音箱的成長。

- 疫情和對恢復正常生活的擔憂導致消費者越來越傾向於採用安全解決方案。在 COVID-19 後的「新常態」中,「智慧家庭」方面變得更加實用。目前,這不是關於效率或智慧使用,例如打開燈或空調的智慧選項,而是打開每一個電器,這肯定會減少你觸摸它的次數,即使你不關閉它。

北美智慧家庭市場趨勢

智慧家電的需求與成長推動市場

- 冰箱、洗衣機、洗碗機等大型連網電器,以及咖啡機、微波爐、吸塵器、割草機器人等小型連網裝置是該地區主要的智慧家電。

- 許多知名的大公司都位於美國。這家美國供應商在創新產品方面享有盛譽。然而,這些公司大多將其製造活動外包,其工程重點放在設計和技術升級上。

- 在最近進行的 2020 年 HomeAdvisor 全國調查中,德克薩斯州住宅對一項有關智慧冰箱、智慧烤箱和智慧咖啡機使用增加的民意調查做出了回應。大多數智慧廚房電器業主都關注環保家電。

- 從方便的通知和節能電器到支援 Wi-Fi 的功能,智慧家庭廚房電器正在升級附加功能。例如,智慧微波爐現在可以掃描食物條碼並下載烹飪說明,並與人工智慧語音助理無縫整合,實現完全免持體驗。

- 在CES 2020上,智慧家庭領域推出了小家電(咖啡機、吸塵器、割草機等)產品,並突出了具體功能。相關智慧廚房電器具有可幫助消費者的功能,例如提高烹飪的速度和準確性、為膳食準備做出明智的選擇、改善健康和簡化清潔。

對自動化和安全系統的需求不斷成長推動市場

- 據泰雷茲集團稱,2020年是連網家庭警報系統將取代傳統警報服務的一年,預計到2024年將有6,300萬美國家庭擁有家庭安全系統,超過一半的消費者(56%)將改變他們的家庭安全提供者是否可以使用智慧型手機監控自己的家。

- 傳統的安全面板系統正在不斷發展,供應商推出了從門鎖監控到溫度控制再到防火系統的新服務。一些大公司正在進入家庭自動化和安全領域,包括亞馬遜、蘋果和谷歌。兩者都有強大的力量來吸引很大一部分市場。同時,該技術變得越來越便宜,越來越多的新興企業正在進入已經擁擠的蜂窩家庭安全產品市場。

- 智慧家庭產品被發現被用作殭屍網路的一部分,用於發送垃圾郵件並執行分散式阻斷服務 (DDoS) 攻擊。這些家用電器帶有個人帳戶的個人憑證,從 Google 日曆到 Wi-Fi 密碼。隨著消費性電子產品製造商添加智慧功能,確保其產品安全已成為一項關鍵挑戰。

- 對於擁有家庭 Wi-Fi 網路的家庭來說,被駭客入侵的路由器會帶來許多漏洞,使網路犯罪分子能夠存取電腦、設備、個人資訊以及嬰兒監視器和CCTV等保全攝影機。當智慧家庭路由器遭到駭客攻擊時,網路犯罪分子就可以完全存取系統,從而使連接的系統和設備面臨風險。

- 由於智慧家庭技術和產品的日益普及,該地區成為全球重要的市場。根據國家家庭安全委員會 (Alarms.org) 的研究,超過五分之三的美國人聲稱安全是擁有智慧家庭的最大好處。

北美智慧家庭產業概況

北美智慧家庭市場集中度高,競爭激烈。由於 ABB 有限公司、Schneider Electric和Honeywell國際公司等市場領導的存在,該市場得到了整合。

- 2021 年 2 月 - ADT Inc. 和 DISH Network Corporation 宣佈建立夥伴關係,DISH 將開始為 ADT 智慧家庭安全產品提供行銷、銷售和安裝服務。

- 2020 年 8 月 - Google 和 ADT 建立長期夥伴關係關係,共同開發下一代智慧家庭安全產品。此次合作將 Google 的硬體和服務與 ADT 的 DIY 和專業安裝的智慧家庭安全解決方案結合,徹底改變住宅安全產業。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- COVID-19 市場影響評估

- 技術簡介

- 技術概覽

- 智慧家庭系統中使用的通訊協定

第5章市場動態

- 市場促進因素

- 對節能解決方案的需求不斷成長

- 安全系統自動化的需求不斷增加

- 市場限制因素

- 安裝更換成本高、隱私問題

- 市場機會

- 當前市場趨勢

第6章 按技術

- Bluetooth

- Wi-Fi

- GSM/GPRS

- ZigBee

- RFID

- EnOcean

- Z-wave

第7章 按產品類型

- 安全/監控系統

- 照明系統

- 暖通空調控制

- 能源管理

- 娛樂控制

第 8 章 按國家/地區

- 美國

- 加拿大

第9章 競爭格局

- 公司簡介

- ABB Limited

- Emerson Electric Co.

- Honeywell International Inc.

- Schneider Electric SE

- Siemens AG

- LG Electronics Inc.

- Cisco Systems Inc.

- Google Inc.(Alphabet Inc)

- Microsoft Corporation

- GE Appliances(Haier Group)

- IBM Corporation

- Legrand SA

- Lutron Electronics Co. Inc.

- United Technologies Corporation

- Smart Home Inc.

- Control4 Corporation

第10章投資分析

第11章市場的未來

簡介目錄

Product Code: 51614

The NA Smart Homes Market is expected to register a CAGR of 9.4% during the forecast period.

Key Highlights

- With the significant rollout of 5G in the United States and improved Wi-Fi technology, such as Wi-Fi 6, smart home devices may be linked by faster, more powerful networks, meaning better access to processing and data resources in the cloud. 5G technology is also revolutionizing IoT services' delivery, including smart home technology, as it allows devices to work free of wires and cables while consuming a minimal amount of power.

- AT&T, Verizon, T-Mobile, and Sprint launched their 5G wireless networks toward the end of 2020. Hence, 5G is currently available to customers in select cities across the United States. However, it is expected to take a few years before full-fledged, top-speed 5G coverage is available across the country, like 4G LTE. T-Mobile also announced that it would be launching a 5G - based home network by 2024. The aim is to extend coverage to previously underserved rural areas across the United States. It is currently offering a trial version of the service on its 4G LTE network to a select number of T-Mobile customers.

- In the region, the increasing demand for energy-efficient solutions is a major trend that is leading towards the adoption of the smart home solution. According to the US Energy Information Administration, the average household in the United States consumed 20.75 quadrillion BTUs of energy in 2020, where a sign of that energy is being wasted. According to US DoE, the average household used energy that released an estimated 17,320 lbs. of CO2. To put this number in another perspective, on an annual basis, the average household is responsible for releasing 70% more CO2 emissions in comparison to the average passenger vehicle. Such instances are addressing the demand for smart home solutions.

- ValuePenguin surveyed more than 1,000 individuals and found that those concerned with the environment are purchasing smart home devices at a faster rate. 65% of Americans have at least one smart home device, and many purchased the smart technology because it's better for the environment. The most popular smart home devices among the respondents included speakers (31%), thermostats (24%), and lighting (20%).

- Further, smart speakers are essential because they represent a new interactive digital endpoint in the home that now provides access to over one-third of US adults. This digital endpoint is available to market pioneers such as Amazon and Google to third-party voice app developers. The rise in video chatting has spurred growth in smart speakers with a display.

- The consumer's propensity to adopt security solutions is on the rise due to the pandemic and the uncertainty of returning to normal life. The aspect of a 'smart home' is looking more practical in the 'new normal,' post-COVID-19. Currently, it is not about efficiencies or smart usages, like smart options of switching on of a luminaire or an HVAC, but the practical reality of ensuring fewer instances of touching, if not doing away altogether, off switches to switch on any appliance.

North America Smart Homes Market Trends

Demand and Growth of Smart Appliances to drive the market

- Connected large appliances, such as fridges, washing machines, and dishwashers, and connected small appliances, such as coffee machines, microwaves, and vacuum and mowing robots, are the major Smart Appliances in the region.

- Many of the major and renowned companies are based in the United States. The US-based market vendors have a good reputation for innovative products. However, most of these companies outsourced their manufacturing activities and focused their engineering on design and technology upgradation.

- In the recent 2020 national HomeAdvisor survey, Texas homeowners responded to polling about the growing use of Smart Refrigerator, Smart Oven, and Smart Coffee Maker in the states. Most of the smart kitchen appliance owners are high, focusing on eco-friendly appliances.

- From useful notifications, energy-efficient appliances to Wi-Fi-enabled features, smart home kitchen-based appliances are being upgraded with added functionality. For example, smart microwaves can now scan barcodes on food items and download cooking instructions with seamless integration, with AI voice assistants, for a completely hands-free experience.

- At CES 2020, the smart home segment featured small appliance (coffee-makers, vacuum and mowing products, etc.) products highlighting specific characteristics. The allied smart kitchen appliances featured capabilities that assisted consumers in improving cooking speed and accuracy, making informed choices for meal preparation, enhancing wellness, and simplifying cleaning chores, among others.

Growing Need for Automation and Security Systems to drive the market

- According to Thales Group, 2020 was the year that connected home alarm systems would overtake traditional alarm services, 63 million US households are poised to have a home security system by 2024, and more than half (56%) of consumers preferred to switch home security provider if it meant they could monitor their home with a smartphone.

- Conventional security panel systems are evolving, and vendors are introducing new services, everything from door lock monitoring to temperature control and fire prevention systems. Significant players are entering the home automation and security sector, including Amazon, Apple, and Google. All of whom have considerable power to attract vast swathes of the market. Simultaneously, technology is getting more affordable, and many start-up companies are entering an already crowded marketplace with cellular home security offerings.

- Smart home products have been witnessed to be used as part of a botnet to send out spam emails and run distributed denial of service (DDoS) attacks. These appliances have personal credentials of private accounts, that is, ranging from Google Calendar to Wi-Fi password. As appliance manufacturer companies add more smart features, making offerings secure has been a significant challenge.

- For homes with a home Wi-Fi network, a hacked router opens a lot of vulnerabilities where cybercriminals can access the computers, devices, personal information, and security cameras such as baby monitors and CCTV. If a smart home's router is hacked, cybercriminals will have complete access to the system in which connected systems and appliances are compromised.

- The region is a prominent market globally, owing to the growing adoption of smart home technology and products. According to the National Council For Home Safety and Security (Alarms.org) study, more than 3 in five Americans claim security is the top benefit for owning a smart home.

North America Smart Homes Industry Overview

The North America Smart Homes Market is Highly concentrated and has high competition for the market share. The presence of market leaders such as ABB ltd., Schneider Electric, Honeywell International makes the market consolidated.

- February 2021 - ADT Inc. and DISH Network Corporation announced a partnership whereby DISH will begin marketing, sales, and installation services for ADT smart home security products.

- August 2020 - Google and ADT have formed a long-term partnership to create the next generation of smart home security products. The partnership will combine Google's hardware and services and ADT's DIY and professionally installed smart home security solutions to innovate the residential security industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Market

- 4.3 Technology Snapshot

- 4.3.1 Technology Overview

- 4.3.2 Protocols Used in Smart Home Systems

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy Efficient Solutions

- 5.1.2 Growing Need for Automation of Security Systems

- 5.2 Market Restraints

- 5.2.1 High Installation and Replacement Costs Along With Privacy Concerns

- 5.3 Market Opportunities

- 5.4 Current Market Trends

6 BY TECHNOLOGY

- 6.1 Bluetooth

- 6.2 Wi-Fi

- 6.3 GSM/GPRS

- 6.4 ZigBee

- 6.5 RFID

- 6.6 EnOcean

- 6.7 Z-wave

7 BY PRODUCT TYPE

- 7.1 Security and Surveillance Systems

- 7.2 Lighting Systems

- 7.3 HVAC Controls

- 7.4 Energy Management

- 7.5 Entertainment Controls

8 BY COUNTRY

- 8.1 United States

- 8.2 Canada

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 ABB Limited

- 9.1.2 Emerson Electric Co.

- 9.1.3 Honeywell International Inc.

- 9.1.4 Schneider Electric SE

- 9.1.5 Siemens AG

- 9.1.6 LG Electronics Inc.

- 9.1.7 Cisco Systems Inc.

- 9.1.8 Google Inc. (Alphabet Inc)

- 9.1.9 Microsoft Corporation

- 9.1.10 GE Appliances (Haier Group)

- 9.1.11 IBM Corporation

- 9.1.12 Legrand SA

- 9.1.13 Lutron Electronics Co. Inc.

- 9.1.14 United Technologies Corporation

- 9.1.15 Smart Home Inc.

- 9.1.16 Control4 Corporation

10 INVESTMENT ANALYSIS

11 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219