|

市場調查報告書

商品編碼

1628707

稀有氣體 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Noble Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

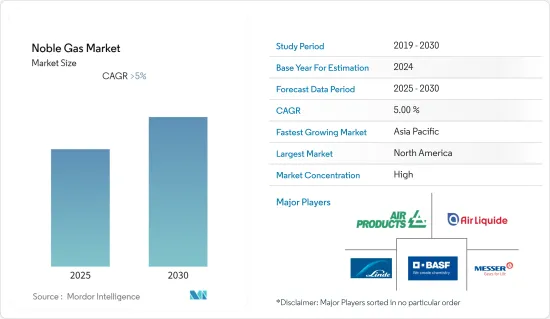

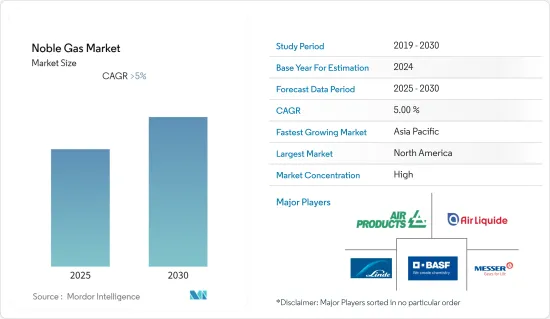

預計在預測期內,惰性氣體市場的複合年成長率將超過 5%。

COVID-19 對惰性氣體市場產生了正面影響。稀有氣體主要用於醫療領域,基本上不受 COVID-19 大流行的影響。疫情期間醫療對氦氣、氖氣和氬氣的需求增加,導致醫療產業稀有氣體的消耗增加。

主要亮點

- 醫療行業需求的增加以及鋼鐵和汽車行業的擴張預計將推動稀有氣體市場的成長。

- 醫療應用中使用量的增加可能會成為未來的機會。

- 然而,對高效能氣體提取方法的需求和稀有氣體的價格波動是阻礙所研究市場成長的主要因素。

- 預計美國將主導北美惰性氣體市場,在預測期內也可能呈現最高的複合年成長率。

稀有氣體市場趨勢

醫療產業需求不斷成長

- 稀有氣體有著廣泛的應用。氦氣在醫療領域的需求量最大,因為它用於冷卻磁振造影機 (MRI) 中的超導性磁體。

- 氦氣對多種呼吸系統疾病有效,包括上呼吸道阻塞、氣喘惡化和拔管後斜頸。顯微鏡為氦氣在技術先進的醫療領域的使用開闢了新的可能性。

- 其他惰性氣體如氬氣和氙氣也用於各種醫療目的。氬氣用作麻醉劑和神經保護劑,氙氣已被發現在神經保護和麻醉領域中有效。

- 此外,中國、美國和日本是醫療領域收益的主要貢獻國家。新興經濟體,特別是印度、日本和中國等亞太地區,日益關注的健康問題和對醫療領域的關注,見證了對此類氣體的巨大需求。

- 根據美國醫療保險和醫療補助服務中心預測,2021年美國國民醫療支出(NHE)將成長2.7%,達到4.3兆美元,佔國內生產總值(GDP)的18.3%。

- 根據中國國家統計局數據,2021年中國整體醫療支出約7.7兆元人民幣(1.19兆美元),與前一年同期比較增加6.4%。

- 醫療行業的這種積極成長可能會增加預測期內對稀有氣體的需求。

美國在北美地區佔主導地位

- 由於對消費品和投資品的需求不斷成長,北美(尤其是美國)在收益方面佔據了最高的市場佔有率。

- 由於航太、石油和天然氣、健康和雷射應用的需求不斷成長,美國稀有氣體市場預計將出現健康成長。

- 與建築、醫療、汽車和半導體相關的大型製造業的存在預計將成為支持該國稀有氣體市場成長的因素。

- 在石油和天然氣工業中,稀有氣體廣泛用於原油的探勘和生產。稀有氣體資料可以準確說明已發現石油和天然氣探勘和開採所涉及的複雜岩地工程過程。

- 根據醫療保險和醫療補助服務中心的數據,從 2021 年到 2030 年,美國國家醫療支出 (NHE) 預計每年成長 5.1%。這一趨勢顯示了惰性氣體在醫療領域的未來潛力。

- 根據EIA的數據,美國是全球最大的原油生產國,佔14.5%。此外,根據英國石油公司 (BP) 的數據,2021 年美國石油產量總計約為 16,585,000 桶/日。這一趨勢預計將支持石油和天然氣領域的研究市場。

- 由於上述因素,預計在預測期內各行業對稀有氣體的需求將會增加。

稀有氣體產業概述

惰性氣體市場已部分整合。該市場的主要企業(排名不分先後)包括BASF股份公司、空氣化學產品公司、液化空氣公司、林德公司和梅塞爾北美公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 醫療產業需求不斷成長

- 鋼鐵和汽車工業的擴張

- 抑制因素

- 稀有氣體價格波動

- 需要高效率的氣體萃取方法

- 產業價值鏈分析

- 波特五力

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(金額:百萬美元)

- 類型

- 氦

- 氪

- 氬氣

- 氖

- 氙

- 放射性氡

- 目的

- 影像投影

- 麻醉劑

- 焊接

- 絕緣

- 照明

- 電視管

- 廣告

- 冷媒

- 工作液

- 化學分析

- 最終用戶產業

- 石油和天然氣

- 礦業

- 醫療保健

- 航太

- 建造

- 能源/電力

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Air Liquide

- Air Products and Chemicals Inc.

- Airgas Inc.

- American Gas

- BASF SE

- Buzwair Industrial Gases Factories

- Gulf Cryo

- ITM Power

- Linde plc

- Messer North America, Inc.

- Praxair Technology, Inc.

- Ras Gas Company Limited

- Royal Dutch Shell PLC

- TAIYO NIPPON SANSO CORPORATION

第7章 市場機會及未來趨勢

- 增加在醫療應用的使用

The Noble Gas Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 had a positive impact on the noble gas market. Noble gases are primarily used in the healthcare sector and were largely unaffected by the COVID-19 pandemic. The demand for helium, neon, and argon increased during the pandemic for medical Purposes, which in turn increased the consumption of noble gases in the healthcare industry.

Key Highlights

- Increasing demand from the healthcare industry and the expansion of the steel and automotive industry are expected to drive the noble gas market's growth.

- Growing usage in medical applications is likely to act as an opportunity in the future.

- However, the need for a high-efficient gas-extracting method and fluctuating prices of noble gases are the major factors hindering the growth of the studied market.

- United States is expected to dominate the noble gas market in North America and is also likely to witness the highest CAGR during the forecast period.

Noble Gas Market Trends

Increasing Demand from the Healthcare Industry

- Noble gases find usage in a wide range of applications. They have the highest demand in the medical sector as they are involved in the cooling of superconducting magnets in magnetic resonance imaging (MRI) scanners.

- Helium has been effective in a variety of respiratory conditions, including upper airway obstruction, asthma exacerbation, post-extubation strido, etc. Microscopy has opened new possibilities for the use of helium gas in the technologically advanced fields of medicine.

- Other noble gases, such as argon and xenon, are also used for various medical purposes. Argon is used as an anesthetic and neuroprotective agent, and xenon is found to be effective in the field of neuroprotective and anesthesia.

- Moreover, countries such as China, the United States, Japan, etc., are the major countries contributing to the revenue of the healthcare sector. Rising health concerns and focus on the medical sector in developing economies, mainly in the Asia-Pacific region, including India, Japan, and China, have witnessed a great demand for such gases.

- According to the Centers for Medicare & Medicaid Services, national health expenditures (NHE) in the United States grew 2.7% to USD 4.3 trillion in 2021, accounting for 18.3% of the Gross Domestic Product (GDP).

- According to the National Bureau of Statistics of China, overall healthcare expenditure in China was around 7.7 trillion yuan (USD 1.19 trillion) in 2021, representing a 6.4% increase over the previous year.

- Such positive growth in the healthcare industry is likely to increase the demand for noble gas in the forecast period.

United States to Dominate the North America Region

- North America holds the highest market share in terms of revenue, due to the increasing demand for consumer and investment goods, especially in the United States.

- It is estimated that the noble gas market in the United States is likely to witness healthy growth on account of increased demand from aerospace, oil and gas, health, and laser applications.

- The presence of large manufacturing industries associated with construction, healthcare, automobiles, and semiconductors is expected to be a factor that will support the growth of the noble gases market in the country.

- In the oil and gas industry, noble gas is widely used in the exploration and production of crude oil. The noble gas data permit an accurate description of complex natural and technological processes involved in exploring and extracting oil and gas discoveries.

- According to the Centers for Medicare & Medicaid Services, national health expenditures (NHE) in the United States are projected to rise 5.1 percent annually from 2021 to 2030. This trend is indicating about the future opportunity for noble gases in the healthcare sector.

- According to the EIA, the United States is the largest producer of crude oil, with a share of 14.5% across the world. Furthermore, according to BP, the production of oil in the United States was about 16,585 thousand barrels per day in 2021. This trend is expected to support the studied market in the oil and gas sector.

- Owing to the aforementioned factors, the demand for noble gases is expected to increase in various industries during the forecast period.

Noble Gas Industry Overview

The noble gas market is partially consolidated in nature. Some of the major players (not in any particular order) in the market include BASF SE, Air Products and Chemicals, Inc, Air Liquide, Linde plc, and Messer North America, Inc, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand in the Healthcare Industry

- 4.1.2 Expansion of Steel and Automotive industry

- 4.2 Restraints

- 4.2.1 Fluctuating Prices of Noble gases

- 4.2.2 Need of high-efficient gas extracting method

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Value in USD Million)

- 5.1 Type

- 5.1.1 Helium

- 5.1.2 Krypton

- 5.1.3 Argon

- 5.1.4 Neon

- 5.1.5 Xenon

- 5.1.6 Radioactive Radon

- 5.2 Application

- 5.2.1 Picture Projection

- 5.2.2 Anesthetic

- 5.2.3 Welding

- 5.2.4 Insulation

- 5.2.5 Lighting

- 5.2.6 Television Tubes

- 5.2.7 Advertising

- 5.2.8 Refrigerant

- 5.2.9 Working Fluid

- 5.2.10 Chemical Analysis

- 5.3 End-user Industry

- 5.3.1 Oil and Gas

- 5.3.2 Mining

- 5.3.3 Healthcare

- 5.3.4 Aerospace

- 5.3.5 Construction

- 5.3.6 Energy and Power

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Air Products and Chemicals Inc.

- 6.4.3 Airgas Inc.

- 6.4.4 American Gas

- 6.4.5 BASF SE

- 6.4.6 Buzwair Industrial Gases Factories

- 6.4.7 Gulf Cryo

- 6.4.8 ITM Power

- 6.4.9 Linde plc

- 6.4.10 Messer North America, Inc.

- 6.4.11 Praxair Technology, Inc.

- 6.4.12 Ras Gas Company Limited

- 6.4.13 Royal Dutch Shell PLC

- 6.4.14 TAIYO NIPPON SANSO CORPORATION

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing usage in medical applications