|

市場調查報告書

商品編碼

1628717

資料中心刀鋒伺服器:市場佔有率分析、產業趨勢、成長預測(2025-2030)Data Center Blade Server - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

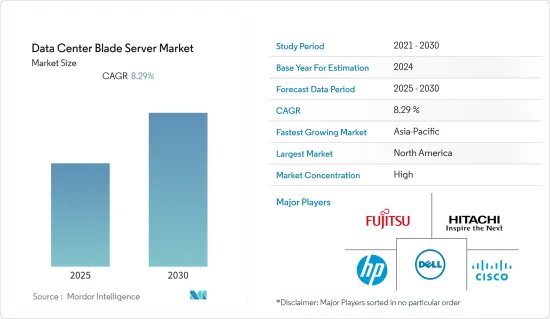

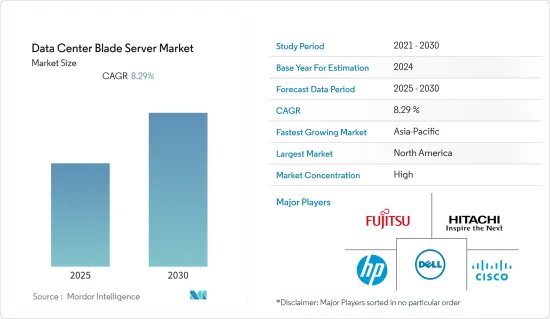

資料中心刀鋒伺服器市場預計在預測期內複合年成長率為 8.29%

主要亮點

- 可以插入或移除單個或多個伺服器刀片,而不會影響其他運作中的系統。此外,由於每個刀鋒伺服器不包含單獨的基礎設施或底盤,因此與其他解決方案相比相對便宜。

- 雲端運算是對資料中心託管產業產生重大影響的行業之一。

- 在資料中心基礎設施方面,提供雲端服務的全球公司和第三方供應商已確認將透過超大規模資料中心和刀鋒伺服器來支援其服務,以降低營運成本。將刀鋒伺服器和雲端結合起來可以降低營運成本並提高效率。雲端供應商公司需要具有高水準頻寬和容錯能力的專用網路,以及來自強大資料中心供應商的支援。

- 但與機架伺服器相比,採用刀鋒伺服器的初始成本較高,在一定程度上限制了市場的成長。

- 隨著 COVID-19 大流行的爆發,許多行業的各種供應鏈都受到了影響,包括資料中心基礎設施。資料中心的所有主要組件都是在異地建造、交付和安裝的,這為市場供應鏈造成了脆弱的斷裂點。然而,各行業向雲端遷移的增加增加了後疫情時代對資料中心的需求。

資料中心刀鋒伺服器市場趨勢

醫療保健領域預計將顯著成長

- 透過電子健康記錄(EMR) 實現消費者健康記錄的數位化有助於資料累積。醫療設備的最新創新和遺留作業系統的現代化(例如人力資源管理和病患照護系統的改進)正在產生大量資料,進一步增加了對資料中心的需求。這些資料中心需求正在推動資料中心冷卻的需求。

- 展望未來,醫療保健的發展可能會集中在圍繞數位健康重新構想臨床護理和營運,以及廣泛、即時地使用資料和高級分析來實現這些目標。實現這樣的結果需要儲存大量資料,這可能會增加預測期內對資料中心刀鋒伺服器的需求。

- 遠端醫療擴大被用於各種好處,包括允許任何地點的消費者聯繫他們需要的醫生。這是改變正常安排的醫療就診的有效方法,可以節省金錢和時間,從而產生大量資料並凸顯對資料中心的需求。

此外,各個地區的政府正在採取舉措支持醫療保健資料中心的發展。例如,2022年11月,印度政府宣布推出國家生命科學資料儲存庫。印度生物資料中心(IBDC)位於法裡達巴德地區生物技術中心。 IBDC 擁有 4 Petabyte的資料儲存容量和 Brahm 高效能運算設施。我們還經營一個線上儀表板,提供客製化存取、資料提交、資料分析服務和即時 SARS-CoV-2 變異監測。

北美地區佔比最大

- 根據英特爾安全公司的研究,僅採用混合雲端服務的公司數量就比前幾年增加了兩倍。雲端供應商正在提高安全性並為組織提供更好、更強大的系統,這是非常有益的。

- 該地區的公司也在人工智慧基礎設施上投入巨資,需要快速處理即時收集的大量資料。

- 根據 CBRE 的數據,北維吉尼亞仍是全球最大的資料中心市場,2021 年下半年新增供應量為 185.1MW。我們正在建造 239 兆瓦的批發託管空間,其中 100 兆瓦已經出租。

- 此外,2023 年 1 月,亞馬遜宣布計劃在未來 20 年內投資 350 億美元,擴大在維吉尼亞的資料中心業務。如果獲得維吉尼亞州議會核准,該公司將獲得高達1.4億美元的州經濟激勵措施以及15年的設備和軟體額外稅收減免。

- 2023 年 1 月,Zoho Corporation 的企業 IT 管理部門 ManageEngine 宣佈在多倫多和蒙特婁推出兩個新的加拿大資料中心。為了應對更嚴格的隱私保護條例和更高的效能要求,加拿大的大型企業,包括政府機構、銀行和金融服務部門,越來越注重資料儲存和處理的本地化。

在預測期內,該地區的公司和政府預計將繼續致力於此類計劃並對其進行大量投資。因此,該地區對資料中心刀鋒伺服器的需求預計將增加。

資料中心刀鋒伺服器產業概況

資料中心刀鋒伺服器市場適度整合,市場上有幾個主要參與者。此外,這些公司繼續投資於策略性收購和聯盟,以增加市場佔有率。此外,由於公司進入市場需要高昂的初始資本成本,因此新進入的障礙很高。以下列出了這些公司最近的一些措施。

- 2023 年 1 月 - 思科與英特爾合作,宣布推出搭載先進英特爾至強處理器的新型伺服器。英特爾發布了第四代英特爾至強可擴展處理器,思科發布了基於英特爾創新的新型靈活、更強大且永續的伺服器。 UCS X 系列由 Intersight 提供支援和管理,可支援刀鋒伺服器架構上的工作負載,而這些負載先前僅適用於基於機架的伺服器。

- 2023 年 1 月 - 思科宣布推出採用第四代英特爾至強可擴充處理器的第七代 UCS C 系列和 X 系列伺服器。憑藉對最新英特爾處理器的支持,思科發布了 X 系列的兩款新刀片:Cisco UCS X210c M7 計算節點和 Cisco UCS X410c M7 計算節點。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場概況

- 市場促進與市場約束因素介紹

- 市場促進因素

- 每個機架的伺服器密度高

- 營運成本低、功耗低

- 擴大雲端和物聯網服務的採用

- 市場限制因素

- 初始投資高

第6章 市場細分

- 按類型

- 1層級

- 2層級

- 3層級

- 4層級

- 按最終用戶產業

- BFSI

- 製造業

- 能源與公共事業

- 衛生保健

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Cisco Systems, Inc.

- Dell, Inc.

- Fujitsu Limited

- Hewlett-Packard Company

- Hitachi, Limited

- Huawei Technologies Co., Ltd.

- Lenovo Group Limited

- NEC Corporation

- Oracle Corporation

第8章投資分析

第9章 市場的未來

The Data Center Blade Server Market is expected to register a CAGR of 8.29% during the forecast period.

Key Highlights

- Single or multiple server blades can be inserted or removed without distressing another running system. It reduces hardware costs, which is likely to entice industry players to adopt the technology, thereby fueling market growth.Additionally, each server blade does not consist of a distinct infrastructure and chassis, owing to which the product is relatively cheaper as compared to other solutions.

- Cloud computing is one of the industries that has had a significant impact on the data center colocation industry.The adoption of cloud computing has been proliferating over the past few years.

- Regarding the data center infrastructure, global corporations offering cloud services and third-party vendors have been identified to support their services with hyper-scale data centers and blade servers to reduce operational costs. Combining blade servers with the cloud can help reduce operational costs and increase efficiency. Cloud provider companies require private networks with high levels of bandwidth and resiliency, as well as support from a robust data center provider.

- However, when compared to rack servers, the adoption of blade servers has a higher initial cost, which limits market growth to some extent.

- With the onset of the COVID-19 pandemic, different supply chains across many industries were affected, including data center infrastructure. All major components of a data center were built off-site, delivered, and then installed, which indicates vulnerable breakage points for the market's supply chain. However, the increased cloud migrations of various industries boosted the demand for data centers in the post-Covid scenario.

Data Center Blade Server Market Trends

Healthcare Segment is Expected to Witness a Significant Growth

- Digitization of consumer health records in the form of electronic medical records (EMR) contributes to data accumulation. The latest innovations in medical equipment and modernization of legacy operating systems, such as personnel management, patient response systems improvement, etc., generate a multitude of data, further necessitating the need for data centers. This need for data centers, in turn, drives the demand for data center cooling.

- In the coming future, the evolution of healthcare will focus on the reengineering of clinical care and operations around digital health and the pervasive, real-time use of data and advanced analytics to achieve these goals. Such achievements would require a large amount of data to be stored, which would drive the need for data center blade servers over the forecast period.

- Telemedicine is increasing in usage owing to various advantages, such as consumers from any region being able to gain access to the required doctor. It is an efficient method, as both money and time are saved, owing to the change in the typically scheduled visits, thereby generating a lot of data and emphasizing the need for data centers.

Moreover, the government across various regions is taking initiatives to support the growth of data centers in healthcare. For instance, in November 2022, the Indian government announced the launch of a national repository for life science data. The Indian Biological Data Center (IBDC) is situated at the Regional Centre for Biotechnology in Faridabad. The IBDC has a four-petabyte data storage capacity and houses the Brahm high-performance computing facility. It also runs an online dashboard that provides customized access, data submission, data analysis services, and real-time SARS-CoV-2 variant monitoring.

North America to Hold a Largest Share

- The region is seeing a shift away from individual device and system storage and toward the core cloud and network edge.According to a survey by Intel Security, the number of companies adopting hybrid cloud services alone has risen by three times the previous level. Cloud providers have been increasing security and enabling better and more robust systems in organizations, which can be highly beneficial.

- Also, companies in the area are putting a lot of money into AI infrastructure, which means that the huge amounts of data being collected in real time need to be processed right away.

- According to CBRE, Northern Virginia remained the world's largest data center market and added 185.1 MW of new supply in the second half of 2021. It is building 239 MW of wholesale colocation space, of which 100 MW has already been leased.

- Moreover, in January 2023, Amazon announced its plan to invest USD 35 billion over the next two decades to expand its data center business across Virginia. If approved by Virginia lawmakers, the company would receive up to USD 140 million in economic incentives from the state and as many as 15 years of additional tax breaks for equipment and software.

- In January 2023, ManageEngine, the enterprise IT management division of Zoho Corporation, announced the launch of two new Canadian data centers in Toronto and Montreal, offering enhanced data security and privacy to regional customers. Owing to the increased privacy regulations and performance requirements, large enterprises in Canada, including those in the government, banking, and financial services sectors, are placing an increased emphasis on localized data storage and processing.

During the forecast period, companies and governments in the region are expected to keep working on these kinds of projects and make large investments. This is expected to increase the demand for data center blade servers in the region.

Data Center Blade Server Industry Overview

The market for data center blade servers is moderately consolidated, with the presence of some significant players in the market. Additionally, these companies are continuously investing in strategic acquisitions and partnerships to gain more market share. Moreover, as the companies need higher initial capital costs to enter the market, the barrier to entry for new players is high. Some of the recent developments by these companies are mentioned below.

- January 2023 - Cisco, in partnership with Intel, announced the launch of new servers powered by the advanced Intel Xeon processors. Intel unveiled the 4th Gen Intel Xeon Scalable processors, while Cisco introduced the new flexible, more powerful, and sustainable servers based on Intel innovation. Powered and managed by Intersight, the UCS X-Series can support workloads on a blade-server architecture that has historically been only practical on rack-based servers.

- January 2023 - Cisco announced the launch of the 7th generation of UCS C-Series and X-Series servers, powered by 4th generation Intel Xeon Scalable processors. With support for the latest Intel processors, Cisco has launched two new blades for the X-Series: the Cisco UCS X210c M7 Compute Node and the Cisco UCS X410c M7 Compute Node.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Introduction to Market Drivers and Restraints

- 5.3 Market Drivers

- 5.3.1 High Density Servers Per Rack

- 5.3.2 Low Operational Cost and Power Consumption

- 5.3.3 Increasing Adoption of Cloud and IoT Services

- 5.4 Market Restraints

- 5.4.1 High Initial Investments

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Tier 1

- 6.1.2 Tier 2

- 6.1.3 Tier 3

- 6.1.4 Tier 4

- 6.2 End-user Verticals

- 6.2.1 BFSI

- 6.2.2 Manufacturing

- 6.2.3 Energy & Utility

- 6.2.4 Healthcare

- 6.2.5 Other End-user Verticals

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle-East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle-East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems, Inc.

- 7.1.2 Dell, Inc.

- 7.1.3 Fujitsu Limited

- 7.1.4 Hewlett-Packard Company

- 7.1.5 Hitachi, Limited

- 7.1.6 Huawei Technologies Co., Ltd.

- 7.1.7 Lenovo Group Limited

- 7.1.8 NEC Corporation

- 7.1.9 Oracle Corporation