|

市場調查報告書

商品編碼

1628728

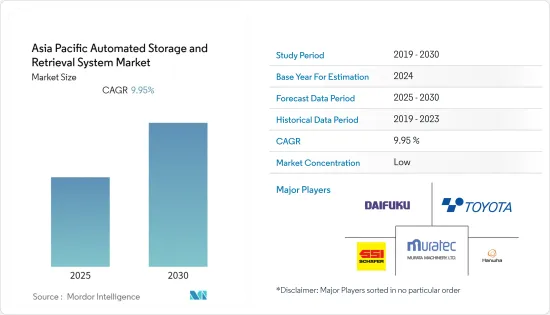

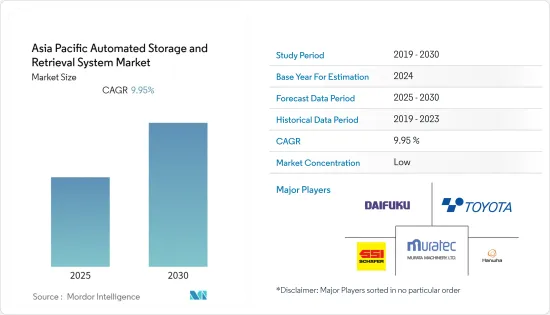

亞太地區自動儲存和搜尋系統:市場佔有率分析、產業趨勢和成長預測(2025-2030)Asia Pacific Automated Storage and Retrieval System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

亞太地區自動儲存和搜尋系統 (ASRS) 市場預計在預測期內複合年成長率為 9.95%

主要亮點

- 在亞太地區,倉庫公司對自動化的日益關注預計將推動自動化儲存和搜尋系統市場的發展。根據斑馬技術進行的倉庫2020亞太願景研究,該地區73%的倉儲公司計劃在2020年增加倉庫數量,其中52%計劃在2020年擴大現有倉庫的空間。

- 此外,許多食品和飲料公司已經認知到 ASRS 系統提供的優勢,並更加重視市場實施。

- 例如,澳洲糖果零食製造商吉百利史威士已成功升級其位於墨爾本的全國配送中心。此次升級使倉庫的自動化儲存和搜尋系統的生產率提高了 20%,同時保持了完整的交付能力。升級包括維修和升級四台 ASRS 起重機,並對配送中心的輸送機和分類系統進行現代化改造。

- 自1990年代以來,韓國一直是世界頂級汽車製造國之一,也是最大的汽車出口國之一。環保汽車,包括電動車、混合動力電動車和燃料電池電動車,預計將成為預測期內韓國成長最快的汽車最終用戶細分市場。這代表著該國汽車產業自動化的巨大機會。

- 此外,日本也將精益製造、準時化概念引入物流。嚴密的結構使得日本在各個層面都採用了AS/RS系統,經濟高效。當前,世界正在期待第四次工業革命,而日本正在發揮重要作用。

- 此外,印尼被列為積極採用自動化的國家。該國在工業工作中使用機器人的情況增加。由於日本既是供應國又是消費國,印尼預計將從與日本的貿易中受益。這增加了該地區對自動化的需求。

亞太地區ASRS系統市場趨勢

零售業預計將佔據主要市場佔有率

- 與其他行業相比,零售業對 ASRS 的需求在該地區排名第二,僅次於郵件和小包裹。與不同類型的設備相比,ASRS 在該地區零售業的採用率很高,其中中國和印度對此做出了重大貢獻。

- 此外,自2011年以來,中國零售收益穩定成長,有力推動了中國零售業的自動化發展。零售貿易的增加需要對需要 ASRS 的產品進行有效的儲存和倉儲。中國商務部表示,由於零售企業的創新和轉型,中國的零售額預計將在未來幾年超越美國。

- 此外,工業自動化系統的採用補充了印度市場的成長,不同的公司提供不同的解決方案,其特點是最新的趨勢。例如,台達電子提供廣泛的自動化產品和解決方案,包括倉庫機器人解決方案。

- 技能印度和數位印度等旗艦項目的整合是實現這一目標的關鍵,從而促進該國的市場成長。 2020年12月,技能部與塔塔共同揭牌了第一批印度技能實驗室。印度正在推出此類計劃,以培養工廠自動化和搜尋系統的技能,並提高公眾和商業組織的認知。

- 此外,在印度尼西亞,工業 4.0 的出現正在推動專注於食品和飲料行業、紡織和服飾、汽車、化學和電子製造中工廠自動化系統實施的研究市場。印尼和德國之間的一項政府間計劃正在加強該國的Start-Ups生態系統。此外,2020年6月,日本工業機械和施工機械公司Maruka Corp.宣佈在印尼設立全資子公司,專門從事工廠自動化和倉儲系統。隨著東南亞國家對工廠自動化系統的需求增加,我們將設計、生產、銷售和維修機器人系統、生產線和清洗設備。

中國佔最大市場佔有率

- 中國是亞太地區 ASRS 市場成長的主要貢獻者。製造、零售、汽車和電子商務等行業對 ASRS 產品的需求不斷增加,推動了市場的成長。

- 此外,政府雄心勃勃的「中國製造2025」舉措部分受到德國的啟發,面向工業4.0,旨在加強中國在製造業的競爭。

- 中國電子商務巨頭京東公司最近建立了一個高效的 ASRS,用於有效的倉庫管理,以滿足不斷成長的零售銷售的需求。此外,三星控股是中國家具行業最早引入ASRS的公司之一,允許自動、機械地存儲、追蹤和搜尋所有生產的產品,使每批貨物都獨一無二,從而節省了組裝所需的大量準備時間。 。

- 此外,中國零售商正在開發無人商店。例如,中國網路購物平台蘇寧推出了五家無人店,並將臉部辨識技術應用於付款服務,為消費者提供基於購物習慣的智慧購物體驗。這對該地區研究市場的成長做出了重大貢獻。

- 2020年10月,騰訊支持的外送服務公司美團點評在北京首鋼園區推出了第一家智慧AI零售店MAI Shop。該店結合了人工智慧和機器人技術,遵循中國超級市場和便利商店常見的「新零售」業態。這種組合技術帶來了無人駕駛配送零售體驗,美團整合了全自動倉庫和配送,以最大限度地提高外帶配送能力。

亞太地區ASRS系統產業概況

亞太地區自動化儲存和搜尋系統市場細分且競爭激烈。產品發布、高額研發支出、夥伴關係和收購是該地區公司保持競爭力的關鍵成長策略。近期市場發展趨勢如下。

- 2020 年 8 月 - 凱傲集團與一家中國製造商簽署了一份銷售協議和合作備忘錄,以製定聯合開發計劃,以擴展其自動化解決方案。與Quicktron的合作預計將進一步加強Quicktron在自動化倉庫和卡車市場的地位。

- 2020 年 6 月 - Cohesio Group(現稱為 Korber Supply Chain)在澳洲和紐西蘭推出了新的分類機器人解決方案。 Colvar 的解決方案使物流業者能夠透過靈活、經濟且可擴展的自動化來最大限度地提高營運能力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 日益重視職業安全

- 人們對人事費用的擔憂日益加劇

- 市場限制因素

- 對熟練勞動力的需求以及對人工替代的擔憂

- COVID-19 對市場的影響

第6章 市場細分

- 依產品類型

- 固定通道法

- 輪播(水平輪播+垂直輪播)

- 垂直升降模組

- 按最終用戶產業

- 飛機場

- 車

- 飲食

- 一般製造業

- 小包裹

- 零售業

- 其他

- 按國家/地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- DAIFUKU Co. Ltd.

- Murata Machinery Ltd.

- Schaefer Systems International Pvt Ltd

- Toyota Industries Corporation

- Hanwha Group

- GEEK+INC.

- Kardex Group

- Siasun Robot & Automation Co. Ltd.

- System Logistics SpA

- Noblelift Intelligent Equipment Co. Ltd.

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 52365

The Asia Pacific Automated Storage and Retrieval System Market is expected to register a CAGR of 9.95% during the forecast period.

Key Highlights

- The Asia-Pacific region is witnessing an increasing focus towards automation by the warehousing companies, which is anticipated to drive the market for Automated Storage and Retrieval Systems. According to Warehouse 2020 APAC Vision Study conducted by Zebra, 73% of the warehousing companies in the region plan to increase the number of warehouses by 2020, and 52% of them also plan to reduce space expansion in existing warehouses in 2020.

- Further, many of the food and beverage industry companies have recognized the advantages provided by the ASRS systems and have increased their focus towards market adoption.

- For instance, Australia's confectionery manufacturer, Cadbury Schweppes, successfully upgraded its national distribution center in Melbourne. The upgrade resulted in a 20% productivity improvement to its warehouse's automated storage and retrieval system while maintaining full distribution capability. It involved refurbishing and upgrading four ASRS cranes and modernizing the distribution center's conveyor and sortation system.

- South Korea has always been one of the world's top automotive manufacturing countries and one of the largest automotive exporters since the 1990s. Eco-friendly vehicles, including electric vehicles, hybrid electric vehicles, and fuel-cell electric vehicles, are expected to be the fastest-growing automotive end-user segment in South Korea during the forecast period. This provides a massive opportunity for automation in the automotive industry in the country.

- Moreover, Japan introduced lean manufacturing, a Just-In-Time concept in intralogistics. The close-knitted structure allowed the nation to adopt AS/RS systems at every level, economic and efficient. Currently, with the world looking forward to the fourth industrial revolution, Japan plays a significant part.

- Further, Indonesia is categorized as an aggressive automation-adopting nation. The country has recorded increased robotic usage for industrial work. Since Japan is both its supplier and consumer, Indonesia is expected to benefit from the trade with Japan. Thus increasing the demand for automation in the region.

Asia-Pacific ASRS Systems Market Trends

Retail Industry is Expected to Hold Significant Market Share

- The retail sector generated the second-highest demand for ASRS in the region, after post and parcel, compared to other industries. ASRS, when compared to different equipment types, has witnessed a higher adoption in the region's retail sector, and China and India have significantly contributed to this.

- Additionally, the Chinese retail revenue has been on a constant increase since 2011, significantly driving up the automation in the country's retail sector. A rise in retail requires effective storage and warehouse management of products suitably requiring ASRS. According to China's Ministry of Commerce (MOFCOM), China's retail sales are expected to surpass sales in the United States in upcoming years due to the innovation and transformation of retail enterprises.

- Moreover, the growth of the market in India is complemented by the adoption of industrial automation systems with various companies offering different solutions and is characterized by recent developments. For instance, Delta Electronics provides a wide range of automation products and solutions, including robot solutions for warehouses.

- The convergence of flagship programs, such as Skill India and Digital India, is the key to achieving this goal, thereby driving the country's market growth. In December 2020, Skill Ministry and Tata launched the first batch of the Indian Institute of Skills. Such programs are rolled out in India to develop Factory Automation and Retrieval System skills and create greater awareness amongst the general public and business organizations.

- Further, In Indonesia, the onset of Industry 4.0 is driving the studied market, focusing on implementing factory automation systems in the manufacturing of the food and beverage industry, textiles and clothing, automotive, chemical, and electronics. Cross government initiatives between Indonesia and Germany are strengthening the start-up ecosystem in the country. In addition to this, in June 2020, Maruka Corp., a Japanese industrial and construction machinery trader, announced to set up a wholly-owned subsidiary in Indonesia for a dedicated factory automation and storage system unit. It offers to design, produce, market, and repair robot systems, production lines, and washing equipment as demand for factory automated systems in the Southeast Asian country increases.

China Accounts For the Largest Market Share

- China has been a prominent contributor to the growth of the ASRS market in the Asia-Pacific region. The increasing demand for ASRS products across industries, such as manufacturing, retail, automotive, and e-commerce, boosts the market's growth.

- Further, the government's ambitious 'Made in China 2025' initiative, partially inspired by Germany, for Industry 4.0 aims to boost the country's competitiveness in the manufacturing sector.

- An e-commerce giant in China, JD.com Inc., recently built an efficient ASRS for effective warehouse management to cater to the demand for increasing retail sales. Additionally, Samson Holding was one of the first companies to implement ASRS in the Chinese furniture industry, enabling automatically and mechanically storing, tracking, and retrieving every product produced, thus saving ample preparation time required to assemble different products for each shipment.

- Furthermore, Chinese retailers are developing unmanned shops. For instance, Suning, the Chinese online shopping platform, launched five unmanned shops in China, which apply facial recognition technology to payment services and offer shoppers an intelligent shopping experience based on their consumption habits. This has significantly contributed to the growth of the market studied in the region.

- In October 2020, Tencent-backed food delivery service, Meituan-Dianping, introduced its first-ever smart AI retail store, MAI Shop, within Beijing's Shougang Park. The store is equipped with a combination of AI and robotics, which are regularly seen in "New Retail" formats across supermarkets, convenience stores, and more in China. The combined technology brings an unmanned delivery retail experience as Meituan integrates a fully automated warehouse and distribution to maximize its takeout delivery capacity.

Asia-Pacific ASRS Systems Industry Overview

The Asia-Pacific automated storage and retrieval system market is fragmented and highly competitive. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the region to sustain the intense competition. Some of the recent developments in the market are -

- August 2020 - KION Group has signed a distribution agreement and a memorandum of understanding on plans for joint development with the Chinese manufacturer to expand automation solutions. The collaboration with Quicktron is anticipated to strengthen further the former's position in the automated storage and trucks market.

- June 2020 - Cohesio Group, now known as Korber Supply Chain, introduced a new sorting robot solution in Australia and New Zealand. The Korber solution will allow logistics operators to maximize operational capabilities through flexible, affordable, and scalable automation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emphasis on Workplace Safety

- 5.1.2 Increasing Concerns about Labor Costs

- 5.2 Market Restraints

- 5.2.1 Need for Skilled Workforce and Concerns over Replacement of Manual Labor

- 5.3 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Fixed Aisle System

- 6.1.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 6.1.3 Vertical Lift Module

- 6.2 By End-User Industries

- 6.2.1 Airports

- 6.2.2 Automotive

- 6.2.3 Food and Beverage

- 6.2.4 General Manufacturing

- 6.2.5 Post and Parcel

- 6.2.6 Retail

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South Korea

- 6.3.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DAIFUKU Co. Ltd.

- 7.1.2 Murata Machinery Ltd.

- 7.1.3 Schaefer Systems International Pvt Ltd

- 7.1.4 Toyota Industries Corporation

- 7.1.5 Hanwha Group

- 7.1.6 GEEK+ INC.

- 7.1.7 Kardex Group

- 7.1.8 Siasun Robot & Automation Co. Ltd.

- 7.1.9 System Logistics S.p.A.

- 7.1.10 Noblelift Intelligent Equipment Co. Ltd.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219