|

市場調查報告書

商品編碼

1628743

歐洲自動化倉庫和搜尋系統:市場佔有率分析、產業趨勢和成長預測(2025-2030)Europe Automated Storage and Retrieval System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

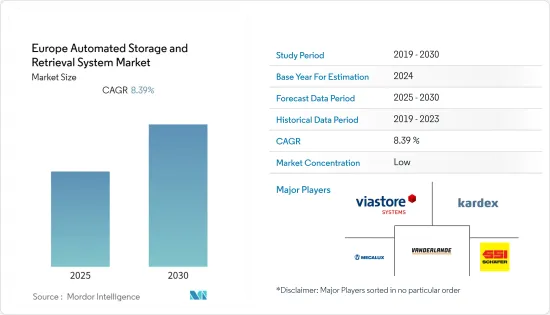

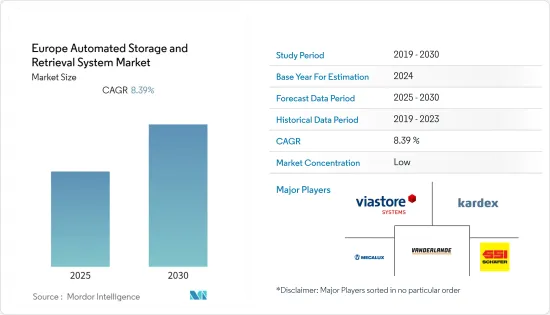

歐洲自動儲存和搜尋系統 (AS/RS) 市場預計在預測期內複合年成長率為 8.39%

主要亮點

- 由於對工業4.0革命的投資增加,歐洲已成為最早採用工業自動化的國家之一。據CBI外交部稱,歐洲佔全球工業4.0投資的三分之一以上。西歐和北歐是其主要市場,尤其是該術語最初創造的德國,是領導者。

- 北歐傳統上是倉庫自動化最發達的市場。除了高昂的人事費用之外,工廠的工作條件也推動了複雜和高水準自動化的採用。在斯堪的斯堪地那維亞,System Logistics 為食品和飲料行業的重要客戶提供支持,幫助其有效管理其揀選、倉儲和物料輸送操作。

- 此外,投資管理公司仲量聯行表示,在歐洲各地的倉庫中,人員和機器通常會更加緊密地合作,而缺乏高效且熟練的勞動力將進一步加速自動化進程。

- 此外,在德國,由於各種工業公司的成長以及儲存和加工自動化的不斷引入,工業機器人的引進正在增加,這主要是由於安全措施和人事費用的增加。例如,根據IFR的數據,德國仍然是歐洲的主要用戶,其運作英國約為221,500台,大約是義大利(74,400台)的三倍,是法國(42,000台)的五倍,約為10倍。的數量(21,700 輛)。根據國際機器人聯合會 (IFR) 的數據,到 2020 年,德國的機器人密度將位居世界第三,僅次於新加坡和韓國(每 1 萬名工人擁有 346 台機器人)。這將增加對PLC、MES、HMI、SCADA和DCS等工業控制系統的需求。

- 此外,跨境電子商務的擴張、小包裹數量的增加以及自動化程度較低的州的意識提高也有助於加速成長。然而,從數量上看,其他國家對 AS/RS 的需求低於該地區德國、法國和英國等頂級國家。

歐洲自動化倉庫/搜尋系統市場趨勢

汽車預計將佔據較大市場佔有率

- 智慧工廠(包括自動化倉儲和搜尋系統)為汽車產業提供了快速回應市場需求、減少製造停機時間、提高供應鏈效率和擴大該地區生產的機會。

- 在歐洲,法國、德國等主要國家正大力投資機械設備。由於汽車行業工業機器人的大量訂單,汽車零件供應商的需求增加。隨著生產系統的現代化和數位化,創新機械和設備的採用範圍越來越大。

- 由於歐盟(EU)的舉措,歐洲的中小企業也正在引進自動化並生產價格實惠且易於安裝的模組化機器人。協作機器人也幫助越來越多的中小企業完成製造流程,同時減少生產時間和人事費用。

- 此外,汽車製造商和供應商正在轉向使用協作機器人(稱為協作機器人)進行 AS/RS。此類設備通常體積小、靈活,並且可以與人類操作員一起安全部署。例如,寶馬依靠協作機器人來改善工廠工人的安全並提高所生產的商品和零件的品質。其他公司包括日產汽車公司和福特公司(尤其是德國科隆工廠)。

- 此外,隨著汽車組裝透過自動化顯著增加,該行業的智慧工廠採用可能會大幅成長,這表明該地區生產的汽車數量呈成長模式,同時也證實了成本的降低。

英國佔最大市場佔有率

- 在英國,政治、經濟和技術的發展對製造業的成長有相應的影響。英國脫歐公投震驚了所有產業,但製造業依然樂觀。

- 此外,隨著勞動力短缺的預測以及企業尋求勞動力密集程度較低的業務,物流自動化的案例得到加強。高需求和進一步的市場成長機會引起了自動化物流供應商的樂觀情緒。

- 此外,在主要的自動化物料輸送產品中,由於製造、物流和分銷行業的需求,自動化倉儲和搜尋系統(AS/RS)在英國廣泛應用。

- 此外,2020年9月,英國政府在第二輪「智造製造」中投資1.47億英鎊。這將使英國製造公司能夠開發出具有成本效益的創新解決方案,並在製造業中部署。

- 此外,英國AS/RS解決方案供應商Industore擁有全面的產品線,適用於倉庫、小型倉儲和大型倉儲區域。 ExMac Automation 也是 AS/RS 解決方案的市場領導者,為該國多個工業部門提供自動化倉庫和搜尋起重機系統(從大容量小型負載起重機和貨架到高架倉庫起重機)。

歐洲自動化倉庫與搜尋系統產業概況

歐洲自動化倉儲和搜尋系統市場分散且競爭激烈。產品研究、研發、聯盟和收購是該地區公司為保持競爭力而採取的關鍵成長策略。近期市場發展趨勢如下。

- 2021 年 3 月 - 全球烈酒公司 Amber Beverage Group (ABG) 與倉儲設備製造商永恆力簽署協議,購買價值 1550 萬歐元的設備,用於建造 ABG 的自動化高架倉庫。

- 2020 年 8 月 - 卡迪斯投資 Rocket Solution GmbH,這是新興企業。該公司開發了創新、標準化、最新一代的自動化儲存和搜尋系統。其創新技術具有開放的物聯網和網路介面,可輕鬆整合到完整的系統中。憑藉 Rocket 的創新技術,卡迪斯在標準化子系統方面又邁出了一步,並擴大了其在具有重要戰略意義的輕型貨運領域的產品組合。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 日益重視職業安全

- 人們對人事費用的擔憂日益加劇

- 市場限制因素

- 對熟練勞動力的需求以及對人工替代的擔憂

- COVID-19 對市場的影響

第6章 市場細分

- 依產品類型

- 固定通道法

- 輪播(水平輪播+垂直輪播)

- 垂直升降模組

- 按最終用戶產業

- 飛機場

- 車

- 飲食

- 一般製造業

- 小包裹

- 零售業

- 其他最終用戶產業

- 按國家/地區

- 英國

- 德國

- 義大利

- 法國

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Viastore Systems GmbH

- Vanderlande Industries BV

- Kardex AG

- Schaefer Holding International Gmbh

- Mecalux SA

- Witron Logistik

- KUKA AG

- TGW Logistics Group GmbH

- System Logistics Spa

- Knapp AG

第8章投資分析

第9章 市場的未來

簡介目錄

Product Code: 52745

The Europe Automated Storage and Retrieval System Market is expected to register a CAGR of 8.39% during the forecast period.

Key Highlights

- Europe has been the earliest adopter of industrial automation, owing to increasing investments in the Industry 4.0 revolution. According to the CBI Ministry of Foreign Affairs, Europe accounts for more than one-third of the global Industry 4.0 investments. Western and Northern Europe are its main markets, especially Germany, where the term was initially coined and a frontrunner.

- Northern Europe is traditionally the most developed market in terms of the use of automation in warehouses. Besides the high labor costs, the working conditions at the factory have also prompted the adoption of sophisticated and advanced automation. In Scandinavia, System Logistics has supported essential clients in the food and beverage sector in effectively managing picking, warehousing, and material handling operations.

- Moreover, in warehouses across Europe, man and machine are frequently working more closely together, and a lack of an efficient and skilled workforce could accelerate automation further, according to JLL, an investment management company.

- Additionally, Germany is also increasing the adoption of Industrial Robots due to the growth of various industrial enterprises and increased automation adoption in storage and processing, primarily due to the increasing safety measures and labor costs. For instance, according to IFR, Germany remained the primary user in Europe with an operational stock of about 221,500 units which is about three times the stock of Italy (74,400 units), five times the supply of France (42,000 units), and about ten times the stock of the UK (21,700 units). Also, as per the International Federation of Robotics (IFR), in 2020, Germany has the third-highest robot density globally (346 units per 10,000 workers), after Singapore and South Korea. This increases the need for PLC, MES, HMI, SCADA, DCS, among other industrial control systems.

- Further, expanding cross-border e-commerce, increasing the volume of parcels being handled, and growing awareness among states with lesser automation contribute to faster growth. But, the demand for ASRS is volumetrically lower in other countries than the top nations, like Germany, France, and the United Kingdom in this region.

Europe Automated Storage and Retrieval System Market Trends

Automotive is Expected to Hold Significant Market Share

- Smart factory, which includes Automated Storage and Retrieval System that offers the automotive industry opportunities to react faster to the market requirements, reduce manufacturing downtimes, enhance the efficiency of supply chains, and expand production in the region.

- In Europe, leading countries like France and Germany invest heavily in machinery and equipment. The demand from automotive part suppliers increased due to a significant order for industrial robots from the motor vehicle sector. With the modernization and digitalization of production systems, the scope for employing innovative machinery and equipment is increasing.

- Due to the initiatives taken by the European Union, small- and medium-sized enterprises in Europe are also adopting automation to produce affordable, easy-to-install, and modular robots. Collaborative robots are also helpful to the increasing number of SMEs in their manufacturing process while also reducing their production times and labor costs.

- Moreover, Automakers and suppliers are moving toward using collaborative robots, known as cobots, for ASRS. Such devices often are smaller, have more agility, and can be safely deployed alongside human operators. For instance, BMW relies on cobots to improve the safety of workers within its plat and for the quality of goods and components produced. Other companies following the same include Nissan, Ford - specifically in their Cologne, Germany, plant.

- Further, as it has been identified that the auto assembly increased significantly using automation, showing a growth pattern in the number of cars being produced in the region while simultaneously cutting costs, the smart factory implementation in this sector has grown considerably.

United Kingdom Accounts For the Largest Market Share

- In the United Kingdom, the political, economic, and technological developments are impacting the growth of the manufacturing industry proportionally. Although the BREXIT vote sent shockwaves across all sectors, the manufacturing industry remained positive.

- In addition, the predicted labor shortage is strengthening the case for logistics automation as firms seek to make their operations less labor-intensive. High demand and opportunities for further market growth have invoked optimism among automated logistics suppliers.

- Furthermore, out of all the major automated material handling products, the automated storage, and retrieval system (AS/RS) is widely used in the United Kingdom due to the demand from the manufacturing, logistics, and distribution sectors.

- Moreover, in September 2020, the British government has invested GPB 147 million into the second round of "Manufacturing Made Smarter." This should enable UK Manufacturing companies to develop cost-effective, innovative solutions for deployment in the manufacturing sector.

- Further, Industore, an AS/RS solution provider in the United Kingdom, has a comprehensive product line used in warehouses, small storage units, and spacious storage units. ExMac Automation, another market leader in AS/RS solutions, supplies automated storage and retrieval crane systems (from high-capacity mini-load cranes and racking to high-bay warehouse cranes) for several industries sectors in the country.

Europe Automated Storage and Retrieval System Industry Overview

The Europe Automated Storage and Retrieval System market are fragmented and highly competitive. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the region to sustain the intense competition. Some of the recent developments in the market are -

- March 2021 - Global spirits company Amber Beverage Group (ABG) has signed an agreement with Jungheinrich, the manufacturer of warehousing equipment, to purchase EUR 15.5 million worth of equipment needed to build ABG's automated high-bay warehouse.

- August 2020 - Kardex has invested in the start-up company Rocket Solution GmbH, based in Unterhaching near Munich. The company develops innovative, standardized automatic storage and retrieval systems of the latest generation. Its innovative technology features open IoT and Web interfaces and can therefore be easily integrated into complete systems. Through Rocket's innovative technology, Kardex takes another step towards standardized sub-systems and expands its strategically essential light goods area portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emphasis on Workplace Safety

- 5.1.2 Increasing Concerns about Labor Costs

- 5.2 Market Restraints

- 5.2.1 Need for Skilled Workforce and Concerns over Replacement of Manual Labor

- 5.3 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Fixed Aisle System

- 6.1.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 6.1.3 Vertical Lift Module

- 6.2 By End-User Industries

- 6.2.1 Airports

- 6.2.2 Automotive

- 6.2.3 Food and Beverage

- 6.2.4 General Manufacturing

- 6.2.5 Post and Parcel

- 6.2.6 Retail

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 Italy

- 6.3.4 France

- 6.3.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Viastore Systems GmbH

- 7.1.2 Vanderlande Industries BV

- 7.1.3 Kardex AG

- 7.1.4 Schaefer Holding International Gmbh

- 7.1.5 Mecalux SA

- 7.1.6 Witron Logistik

- 7.1.7 KUKA AG

- 7.1.8 TGW Logistics Group GmbH

- 7.1.9 System Logistics Spa

- 7.1.10 Knapp AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219