|

市場調查報告書

商品編碼

1628746

合成橡膠塗料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Elastomeric Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

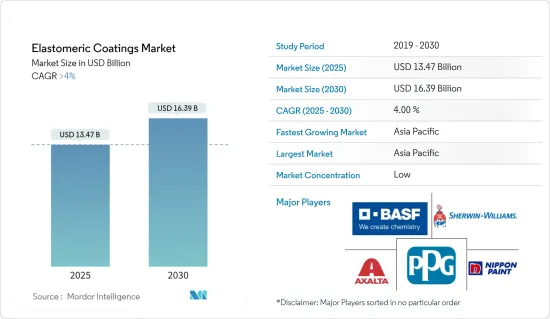

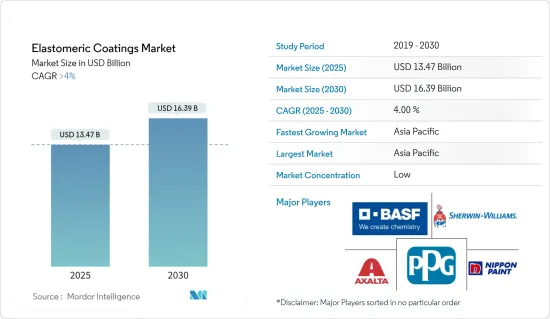

合成橡膠塗料市場規模預計到2025年為134.7億美元,預計到2030年將達到163.9億美元,在預測期內(2025-2030年)複合年成長率將超過4%。

COVID-19 大流行阻礙了合成橡膠塗料市場。由於多個國家採取全國封鎖措施,嚴格的社會疏散措施影響了住宅和基礎設施建設活動,進一步影響了合成橡膠塗料市場。然而,隨著限制的取消以及世界各地住宅和基礎設施建設活動的正常化,市場出現復甦。

主要亮點

- 建築基礎設施產業的使用量不斷增加以及汽車產業對合成橡膠塗料產品的需求不斷成長預計將推動合成橡膠塗料市場的發展。

- 另一方面,與傳統塗料相比,成本較高,原料價格波動預計將阻礙市場成長。

- 快速工業化和建築業投資的增加預計將在預測期內為市場創造機會。

- 預計亞太地區將主導市場。預計在預測期內仍將維持最高複合年成長率。這是由於住宅和基礎設施最終用戶行業對合成橡膠塗料的需求不斷增加。

合成橡膠塗料市場趨勢

牆面塗料領域主導市場需求

- 牆面塗料應用預計將主導合成橡膠塗料的需求。合成橡膠牆面塗料以其優異的防水和伸長性能而聞名。因此,它是建築領域牆壁和屋頂塗料的理想選擇。

- 根據牛津經濟研究院的數據,2022 年全球建築業價值將達到 9.7 兆美元。在中國、美國和印度超級建築市場的推動下,預計到 2037 年將達到 13.9 兆美元。此外,未來15年,全球前10大建築市場國家的建築工程預計將佔全球建築市場總量的70%。

- 根據國際建築公司預測,2022年中國、北美和歐洲將成為建築業最大的市場。儘管這些市場可能面臨挑戰,但印度預計將成為世界上成長最快的建築強國。同時,菲律賓、越南、馬來西亞和印尼預計將成為未來 15 年成長最快的建築市場。

- 在北美地區,政府在房地產市場住宅建設方面的支出增加以及豪華住宅需求的增加預計將對市場成長產生積極影響。此外,房地產成本的上漲,特別是該地區單戶住宅和多層公寓市場的發展,預計將推動牆面塗料市場的發展。

- 美國建築業是北美最大的。根據美國人口普查局的數據,2022年美國年度建築業價值為17,920億美元,而2021年為16,264億美元,成長率為10.2%。 2022 年美國住宅建築年產值為 9,080 億美元,而 2021 年為 8,020 億美元。因此,住宅建築市場的擴張預計將推動該國合成橡膠塗料市場的發展。

- 因此,建築業的這種有利趨勢預計將在預測期內推動合成橡膠塗料市場的發展。

亞太地區主導市場

- 亞太地區主導全球市場。由於印度、中國、菲律賓、越南和印尼等國家對住宅和商業建築的投資增加,預計未來幾年合成橡膠塗料市場將擴大。

- 由於人口成長、中等收入群體的壯大和都市化進程,亞太地區的建築業正在健康發展。中國和印度不斷擴大的住宅建築市場預計將成為亞太地區成長最快的地區。

- 根據中國國家統計局的數據,建築業產值將從2021年的29.3兆元(4.2兆美元)增加至2022年的31.2兆元(4.5兆美元)。預計到2030年,中國在建築方面的支出將達到約13兆美元,為目前的研究市場創造了光明的前景。

- 住宅需求的增加預計將推動該國公共和私營部門的住宅建設。高層建築和酒店建設的增加正在推動市場。住宅的增加將進一步推動對纖維混凝土的需求。中國政府已主動向全國40個主要城市贈送650萬套保障性租賃住宅。這將導致約 1300 萬人居住在該國。

- 同樣,印度政府正在積極推動住宅建設,為約13億人提供住宅。預計未來六到七年印度的住宅投資將達到約 1.3 兆美元。全國將新建6000萬住宅。

- 因此,亞太地區的這些投資和計劃計劃正在推動該地區的建設活動。在預測期內,該地區對合成橡膠塗料的需求可能會增加。

合成橡膠塗料市場-產業概覽

合成橡膠塗料市場是細分的。市場上的主要企業包括(排名不分先後)艾仕得塗料系統有限公司、BASFSE、立邦塗料控股公司、PPG工業公司和宣偉公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建築基礎設施產業的使用量增加

- 汽車產業對合成橡膠塗料產品的需求增加

- 其他司機

- 抑制因素

- 與傳統塗料相比成本高

- 原物料價格波動

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 種類

- 丁基

- 聚氨酯

- 矽膠

- 丙烯酸纖維

- 其他類型(聚硫、乙烯基等)

- 科技

- 水性的

- 溶劑型

- 目的

- 牆漆

- 屋頂塗料

- 地坪塗料

- 其他用途(汽車內裝漆等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Asian Paints

- Axalta Coating Systems, LLC

- BASF SE

- Dow

- Gaco

- Henry Company

- Jotun

- Kansai Nerolac Paints Limited

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- Progressive Painting, Inc.

- RODDA PAINT, CO

- Sika AG

- The Sherwin-Williams Company

第7章 市場機會及未來趨勢

- 工業化快速發展,建築業投資增加

- 其他機會

The Elastomeric Coatings Market size is estimated at USD 13.47 billion in 2025, and is expected to reach USD 16.39 billion by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the Elastomeric coatings market. Due to nationwide lockdowns in several countries, strict social distancing measures affected residential and infrastructural construction activities, further affecting the market for elastomeric coatings. However, the market recovered after the restrictions were lifted and residential and infrastructural activities across the globe normalized.

Key Highlights

- The increasing usage in the architectural and infrastructural industries and the rising demand for elastomeric coating products in the automotive industry are expected to drive the market for elastomeric coatings.

- On the flip side, the higher costs compared to conventional coatings and the fluctuations in the prices of raw materials are expected to hinder the growth of the market.

- The rapid industrialization and the increasing investments in the construction industry are expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period. It is due to the rising demand for elastomeric coatings in residential and infrastructural end-user industries.

Elastomeric Coatings Market Trends

Wall Coatings Segment to Dominate the Market Demand

- The wall coating application is expected to dominate the demand for elastomeric coatings. Elastomeric wall coatings are known for their superior waterproofing and elongation properties. It makes them ideal to use as wall and roof coatings in the construction sector.

- According to Oxford Economics, the global construction industry was valued at USD 9.7 trillion in 2022. It is estimated to reach USD 13.9 trillion by 2037, driven by superpower construction markets China, the United States, and India. Furthermore, all construction work done over the next 15 years by the world's top 10 construction markets is expected to account for 70% of the total global construction market.

- According to International Construction, China, North America, and Europe were the largest markets for the construction industry in 2022. While these markets will likely face challenges, India is forecasted to be the fastest-growing construction superpower in the world. In contrast, the Philippines, Vietnam, Malaysia, and Indonesia are forecasted to be the fastest-growing construction markets over the next 15 years.

- In the North American region, the increased government spending in the real estate market for residential construction and the growing demand for high-class residential homes are likely to benefit the market's growth. In addition, rising real estate costs, particularly the development of single-family homes and multistory apartments in the region, are expected to drive the market for wall coatings.

- The construction industry in the United States is the largest in North America. According to the US Census Bureau, the annual construction in the United States accounted for USD 1,792 billion in 2022, compared to USD 1,626.4 billion in 2021, at a growth rate of 10.2%. The annual value of residential construction output in the United States was valued at USD 908 billion in 2022, compared to USD 802 billion in 2021. Thus, increasing the residential construction market is expected to drive the market for elastomeric coatings in the country.

- Hence, such favorable trends in the construction industry are expected to boost the elastomeric coatings market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. Owing to the growing investments in residential and commercial construction in countries such as India, China, the Philippines, Vietnam, and Indonesia, the market for elastomeric coatings is expected to increase in the coming years.

- The construction sector in the Asia-Pacific region is increasing at a healthy rate, owing to the rising population, increase in middle-class income and urbanization. The highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India.

- According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.3 trillion (USD 4.2 trillion) in 2021. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for the current studied market.

- The growing demand for housing is likely to drive residential construction in the country, both in the public and private sectors. The increase in the construction of tall buildings and hotels is driving the market studied. This increasing residential construction further fuels the demand for fiber reinforced concrete. China's government took the initiative to gift 40 key cities in the country with 6.5 million government-subsidized rental homes. These are supposed to accommodate around 13 million people in the country.

- Similarly, the Indian government is actively boosting housing construction to provide homes to about 1.3 billion people. The country will likely witness around USD 1.3 trillion of investment in housing over the next six to seven years. It is likely to witness the construction of 60 million new homes in the country.

- Hence, such investments and planned projects in Asia-Pacific are boosting the construction activities in the region. It may increase the demand for elastomeric coatings in the region during the forecast period.

Elastomeric Coatings Market - Industry Overview

The Elastomeric coatings market is fragmented. Some of the major players (not in any particular order) in the market include Axalta Coating Systems, LLC, BASF SE, Nippon Paint Holdings Co., Ltd, PPG Industries Inc., and The Sherwin-Williams Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing usage in the Architectural and Infrastructural Industries

- 4.1.2 Rising Demand for Elastomeric Coating Products in the Automotive Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Higher Costs Compared to Conventional Coatings

- 4.2.2 Fluctuations in the Prices of Raw materials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Butyl

- 5.1.2 Polyurethane

- 5.1.3 Silicone

- 5.1.4 Acrylic

- 5.1.5 Other Types (Polysulfide, Vinyl, etc.)

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.3 Application

- 5.3.1 Wall Coatings

- 5.3.2 Roof Coatings

- 5.3.3 Floor Coatings

- 5.3.4 Other Applications (Automotive Interior Coatings, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Asian Paints

- 6.4.3 Axalta Coating Systems, LLC

- 6.4.4 BASF SE

- 6.4.5 Dow

- 6.4.6 Gaco

- 6.4.7 Henry Company

- 6.4.8 Jotun

- 6.4.9 Kansai Nerolac Paints Limited

- 6.4.10 Nippon Paint Holdings Co., Ltd.

- 6.4.11 PPG Industries Inc.

- 6.4.12 Progressive Painting, Inc.

- 6.4.13 RODDA PAINT, CO

- 6.4.14 Sika AG

- 6.4.15 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Industrialization and Increasing Investments in the Construction Industry

- 7.2 Other Opportunities