|

市場調查報告書

商品編碼

1628750

己二酸 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Adipic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

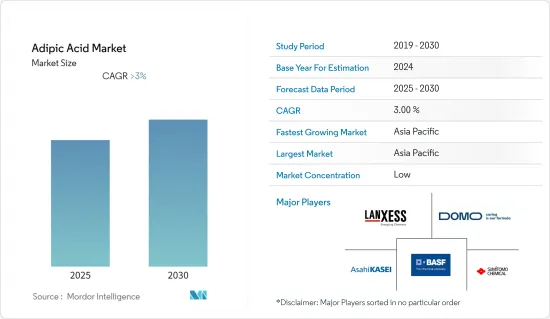

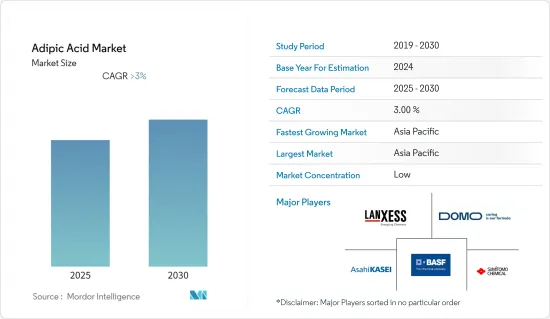

預計己二酸市場在預測期間內複合年成長率將超過3%

主要亮點

- 電子市場的成長和個人保健產品使用量的增加正在推動市場成長。

- 有關生產的嚴格環境法規預計將阻礙市場成長。

- 由於印度、中國和日本等主要國家的市場發展不斷成長,預計亞太地區將在預測期內主導市場。

己二酸市場趨勢

汽車產業需求增加

- 己二酸主要用作生產聚醯胺 6.6 顆粒和其他聚醯胺、工程塑膠聚合物以及軟質半硬質泡沫的聚氨酯的單體。

- 尼龍 66 由己二酸生產,由於其優異的機械性能、耐熱性和重量輕,主要用於汽車行業。聚醯胺也用於生產玻璃增強塑膠結構件、進氣歧管、引擎蓋、搖臂閥蓋、安全氣囊容器以及各種其他汽車內外飾件。

- 對輕質工程塑膠的需求不斷成長預計將推動己二酸市場的成長。當前的環境和經濟問題促使汽車製造商採用更先進的塑膠材料來減輕重量並提高車輛的燃油效率。

- 塑膠的高吸收特性也使汽車能夠滿足更嚴格的安全標準。另一方面,尼龍 6 和尼龍 6,6 等聚醯胺可以減少汽車中使用的零件的質量,因為它們比金屬提供更多的設計自由度。

- 輕型車和電動車的增加預計將對工程塑膠的消費產生直接影響,從而在預測期內長期推動己二酸的需求。根據中國汽車工業協會統計,2022年12月全國新能源汽車產量與前一年同期比較%。

- 預計上述因素將在預測期內促進汽車領域己二酸市場的成長。

亞太地區主導市場

- 預計亞太地區將主導己二酸市場。印度、中國等主要國家汽車、紡織、電子工業的崛起,推動了市場的龐大需求。

- 中國擁有全球最大的電子產品生產基地。電線、電纜、電腦設備和其他個人設備等電子產品在電子領域成長最快。該國為己二酸提供了龐大的市場,不僅滿足了國內電子產品的需求,也向其他國家出口電子產品。

- 此外,印度的電子工業是全球成長最快的工業之一。由於100%外國直接投資(FDI)、無需工業許可證以及從手動生產流程向自動化生產流程的技術轉換等政府優惠措施,國內電子製造業正在穩步擴張。

- 電子系統設計與製造 (ESDM) 是成長最快的產業,正在不斷改變世界各地的企業和經濟。例如,到2025年,印度數位經濟預計將達到1兆美元。

- 由於人事費用相對較低且商業障礙較少,中國也是對服飾製造最具吸引力的國家之一。根據中國國家統計局統計,截至2022年10月,中國服飾纖維產量為31.8億公尺。月產量始終超過30億米,這對市場成長有正面影響。

- 此外,根據中國汽車工業協會的數據,2022年12月中國乘用車產量年增11.2%。

- 此外,2022年11月,中國英威達尼龍化學品有限公司在上海化學工業園區投資10億美元的新己二腈工廠落成。新己二腈工廠年產能40萬噸。

- 因此,隨著國內電氣、電子、汽車和紡織業的成長,預計未來幾年對己二酸的需求將會增加。

己二酸產業概況

己二酸市場較為分散。該市場的主要參與企業包括(排名不分先後)旭化成公司、BASF、朗盛公司、道默化學公司和住友化學公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 尼龍 66 在汽車產業的使用增加

- 擴大在個人護理和電子行業中使用

- 抑制因素

- 有關製造過程的嚴格環境法規

- 其他限制因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(數量))

- 按原料分

- 環己醇

- 環己酮

- 按最終產品

- 尼龍66纖維

- 尼龍66工程樹脂

- 聚氨酯

- 己二酸酯

- 其他最終產品

- 按用途

- 塑化劑

- 不飽和聚酯樹脂

- 濕紙用樹脂

- 被覆劑

- 合成潤滑油

- 食品添加物

- 其他

- 按最終用戶產業

- 車

- 電力/電子

- 纖維

- 飲食

- 個人護理

- 藥品

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Asahi Kasei Corporation

- Ascend Performance Materials

- BASF SE

- Domo Chemicals

- HUAFENG GROUP

- INVISTA

- LANXESS

- Liaoyang Tianhua Chemical Co. Ltd

- Radici Partecipazioni SpA

- Shenma Industrial Co., Ltd

- Sumitomo Chemical Co. Ltd

- Shandong Hualu-Hengsheng Chemical Co., Ltd.

- Tangshan Zhonghao Chemical Co. Ltd

第7章 市場機會及未來趨勢

- 人們對生物基己二酸的認知不斷增強

簡介目錄

Product Code: 53107

The Adipic Acid Market is expected to register a CAGR of greater than 3% during the forecast period.

Key Highlights

- The growing electronics market and increased use of personal care products are fueling the market growth.

- Stringent environmental regulations regarding production are expected to hinder the market's growth.

- The Asia-Pacific region is expected to dominate the market during the forecast period owing to its growing development in major countries such as India, China, and Japan.

Adipic Acid Market Trends

Increasing Demand from the Automotive Industry

- Adipic acid is mainly used as a monomer in producing polyamide 6.6 pellets and other polyamides or polymers in engineering plastics and as polyurethane for flexible and semi-rigid foams.

- Nylon 66, manufactured from adipic acid, is used primarily for its superior mechanical, temperature-resistant, and lightweight properties in the automotive industry. Also, polyamide is used in producing glass-reinforced plastics-based structural parts, air intake manifolds, engine covers, rocker valve covers, airbag containers, and various other interior and exterior automotive parts.

- The increased demand for lightweight engineering plastic is expected to drive the adipic acid market's growth. Due to current environmental and economic concerns, automobile manufacturers are incorporating more advanced plastic materials to reduce weight and make vehicles more fuel-efficient.

- The high absorption properties of plastics also allow the vehicle to meet stricter safety standards. In contrast, using polyamides such as nylon 6 and nylon 6,6 provides for the depreciation of the mass of parts used in vehicles as they offer more design freedom than metals.

- The increasing number of light and electric vehicles directly impacts engineering plastic consumption, which, in turn, is anticipated to drive the demand for adipic acid over the long term during the forecast period. According to the China Association of Automobile Manufacturing, the production of New Energy Vehicles in the country witnessed a year-on-year increase of 96.9% in December 2022.

- The factors mentioned above are expected to contribute to the growth of the adipic acid market in the automotive segment during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to dominate the adipic acid market. The rising automotive, textiles, and electronics industries in major countries such as India, China, etc., contribute to the market's huge demand.

- China includes the world's most extensive electronics production base. Electronic products, such as wires, cables, computing devices, and other personal devices, recorded the highest growth in the electronics segment. The country serves the domestic demand for electronics and exports electronic output to other countries, thus, providing a massive market for adipic acid.

- Furthermore, the Indian electronics industry is one of the fastest-growing industries globally. The domestic electronics manufacturing sector is expanding steadily, owing to favorable government policies, such as 100% foreign direct investment (FDI), no requirement for industrial licenses, and the technological transformation from manual to automatic production processes.

- Electronics System Design and Manufacturing (ESDM) is the fastest-growing industry, continuously transforming businesses and economies worldwide. For instance, by 2025, India's digital economy will be worth USD 1 trillion.

- China is also one of the most attractive countries for clothing manufacturing due to relatively low labor costs and fewer commercial obstacles. According to the National Bureau of Statistics of China, the country manufactured 3.18 billion meters of textile for garments as of October 2022. The materials produced each month were consistently greater than three billion m. Hence positively impacting the market growth.

- Additionally, according to the China Association of Automobile Manufacturing, the production of passenger cars in the country witnessed a year-on-year increase of 11.2% in December 2022.

- Furthermore, in November 2022, INVISTA Nylon Chemicals Co. of China inaugurated its new adiponitrile plant with an investment of USD 1 billion at the Shanghai Chemical Industry Park. The new adiponitrile plant includes a capacity of 400,000 tons/year.

- Hence, with growth in the country's electrical, electronics, automotive, and textile sectors, the demand for adipic acid is expected to increase in the upcoming years.

Adipic Acid Industry Overview

The adipic acid market is fragmented in nature. Some of the major players in the market include Asahi Kasei Corporation, BASF SE, LANXESS, Domo Chemicals, and Sumitomo Chemical Co. Ltd., among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use of Nylon 66 in the Automotive Industry

- 4.1.2 Rising Use in the Personal Care and Electronics Industry

- 4.2 Restraints

- 4.2.1 Stringent Environment Regulations Regarding Production Process

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Raw Material

- 5.1.1 Cyclohexanol

- 5.1.2 Cyclohexanone

- 5.2 By End Product

- 5.2.1 Nylon 66 Fibers

- 5.2.2 Nylon 66 Engineering Resins

- 5.2.3 Polyurethanes

- 5.2.4 Adipate Esters

- 5.2.5 Other End Products

- 5.3 By Application

- 5.3.1 Plasticizers

- 5.3.2 Unsaturated Polyester Resins

- 5.3.3 Wet Paper Resins

- 5.3.4 Coatings

- 5.3.5 Synthetic Lubricants

- 5.3.6 Food Additives

- 5.3.7 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Electrical and Electronics

- 5.4.3 Textiles

- 5.4.4 Food and Beverage

- 5.4.5 Personal Care

- 5.4.6 Pharmaceuticals

- 5.4.7 Other End-user Industries

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East & Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East & Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Asahi Kasei Corporation

- 6.4.2 Ascend Performance Materials

- 6.4.3 BASF SE

- 6.4.4 Domo Chemicals

- 6.4.5 HUAFENG GROUP

- 6.4.6 INVISTA

- 6.4.7 LANXESS

- 6.4.8 Liaoyang Tianhua Chemical Co. Ltd

- 6.4.9 Radici Partecipazioni SpA

- 6.4.10 Shenma Industrial Co., Ltd

- 6.4.11 Sumitomo Chemical Co. Ltd

- 6.4.12 Shandong Hualu-Hengsheng Chemical Co., Ltd.

- 6.4.13 Tangshan Zhonghao Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Awareness of Bio-based Adipic Acid

02-2729-4219

+886-2-2729-4219