|

市場調查報告書

商品編碼

1628759

北美燃料電池技術:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)North America Fuel Cell Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

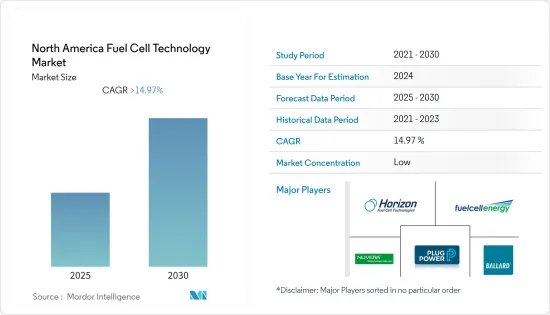

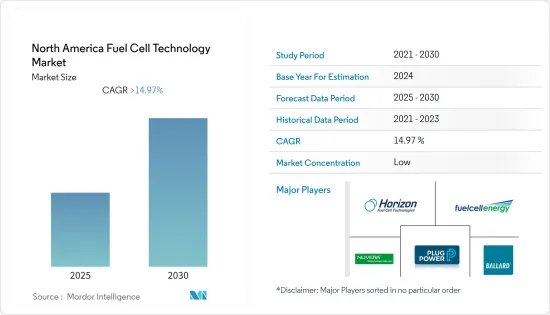

預計北美燃料電池技術市場在預測期內的複合年成長率將超過14.97%。

2020 年市場受到 COVID-19 的負面影響。目前市場處於大流行前的水平。

主要亮點

- 從長遠來看,燃料電池相對於鋰離子電池等替代品的優勢、政府措施和私人投資支持預計將推動研究的市場。

- 另一方面,經過驗證且具有成本效益的替代能源儲存系統的可用性以及氫供應基礎設施的缺乏預計將成為預測期內的市場限制因素。

- 純電池汽車無法滿足所有路線、負載容量和加油要求。因此,燃料電池是卡車保持原地行駛的實用解決方案。因此,這有望在不久的將來為燃料電池技術市場提供巨大的機會。

北美燃料電池技術市場趨勢

聚合物電解質膜燃料電池(PEM)主導市場

- 用於發電的質子交換膜燃料電池繼續在固定應用中佔據主導地位,家庭熱電聯產仍在發展中。 2018年,卡車和其他重型車輛開始越來越重要地應用PEM燃料電池。

- 在各類支撐材料中,炭黑(Vulcan XC-72)因其高導電率和比表面積而被廣泛應用於質子交換膜燃料電池。但燃料電池運作條件下有電解氧化問題,長期運轉後觸媒活性喪失。

- 北美地區(主要是美國)是最早進行商業規模部署基於固體聚合物電解質膜(PEM)的燃料電池的國家之一。這得到了政府資助的支持,並導致汽車行業等最終用戶的採用增加。

- 加州能源委員會 2013 年政府主導的替代和可再生燃料及車輛技術計劃制定了一項長期計劃,到 2021-22 年開發 100 個零售加氫站。這鼓勵了私營部門對燃料電池市場的投資。

- 截至 2021 年,大約有 11,956 輛配備燃料電池(包括 PEM 燃料電池)的輕型車輛在加州行駛。截至 2021 年,加州正在開發 115 個零售加氫站。

- 因此,發展和政府支持預計將推動該地區質子交換膜燃料電池技術市場的發展。

美國引領市場的前景

- 美國在燃料電池電動車(FCEV)的全球部署方面處於領先地位,截至2021年,超過535.6兆瓦的燃料電池固定發電服務於美國40多個州。

- 加州的零排放汽車計畫極大地補充了 FCEV 的銷量,預計未來幾年將繼續如此。

- 在該國,DMFC 和 SOFC 車輛系統的開發正在進行中,但 PEM 仍然是交通運輸領域的主流。豐田和現代等主要汽車製造商正在採用 PEM 堆疊電池技術,以降低 FCEV 的生產成本。

- 此外,預計美國安裝的燃料電池系統將有80%以上用於交通運輸領域。截至10月,美國燃料電池電動車累積數量已從2012年的4輛增加到2022年的14,435輛。

- 2022 年 5 月,現代汽車在 2022 年先進清潔交通 (ACT) 博覽會上強調了其計劃透過 XCIENT 燃料電池卡車加強其進入美國商用車市場的計劃。

- 政府和工業參與企業之間的這種合作預計將顯著降低質子交換膜燃料電池和燃料電池電動車的成本,從而增加該國對燃料電池的需求。

北美燃料電池技術產業概況

北美燃料電池技術市場是細分的。主要參與企業包括(排名不分先後)Ballard Power Systems Inc.、Horizon Fuel Cell Technologies Pte Ltd、FuelCell Energy Inc.、Plug Power Inc. 和 Nuvera Fuel Cells LLC。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 目的

- 可攜式的

- 固定式

- 用於運輸

- 燃料電池技術

- 固體電解質燃料電池(PEMFC)

- 固體氧化物燃料電池(SOFC)

- 其他燃料電池技術

- 地區

- 美國

- 加拿大

- 其他北美地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Ballard Power Systems Inc.

- Horizon Fuel Cell Technologies Pte. Ltd

- FuelCell Energy Inc.

- Hydrogenics Corporation

- FuelCell Energy Inc.

- Plug Power Inc.

- Nuvera Fuel Cells LLC

第7章市場機會與未來趨勢

The North America Fuel Cell Technology Market is expected to register a CAGR of greater than 14.97% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently. The market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the advantages of fuel cells over their alternatives, such as lithium-ion batteries, government initiatives, and private investment support, are expected to drive the market studied.

- On the other hand, the availability of proven and cost-effective alternate energy storage systems and the lack of hydrogen supply infrastructure are expected to restrain the market during the forecast period.

- Nevertheless, pure battery vehicles cannot cover all the route, load, and refueling requirements; therefore, fuel cells are a practical solution for trucks to maintain a place. Thus, this is expected to provide an excellent opportunity for the fuel cell technology market in the near future.

North America Fuel Cell Technology Market Trends

Polymer Electrolyte Membrane Fuel Cell (PEM) to Dominate the Market

- PEM fuel cell used for electrical power generation continues to dominate the stationary application, while household heat and power are nascent. During 2018, trucks and other heavy vehicles have increasingly started the significant application of PEM fuel cells.

- Among the various types of support materials, carbon black (Vulcan XC -72) has been widely used in PEM fuel cells due to its high electrical conductivity and specific area. However, it suffers from electro-oxidation under fuel cell operating conditions, resulting in the loss of catalytic activity after long-term operation.

- The North American region (primarily the United States) is one of the early adopters of the commercial-scale deployment of polymer electrolyte membrane (PEM)-based fuel cells. It was supported by government funding and had an increased uptake by end-users like the automobile industry.

- California Energy Commission's Alternative and Renewable Fuel and Vehicle Technology Program, a government initiative in 2013, established long-term plans to develop 100 retail hydrogen stations by 2021-22. This has encouraged the private sector to invest in the fuel cell market.

- As of 2021, around 11,956 fuel cells, including PEM fuel cells, powered light-duty vehicles were on the road in California. California has 115 retail hydrogen stations in development as of 2021.

- Therefore, development and government support are expected to drive the PEM fuel cell technology market in the region.

United States is Expected to Drive the Market

- The United States leads the global fuel cell electric vehicle (FCEV) deployed worldwide, and as of 2021, there were more than 535.6 MW of fuel cell stationary power, serving more than 40 states in the United States.

- California leads the deployment, where the Zero Emission Vehicle Program has significantly supplemented FCEV sales and is expected to remain the same in the coming years.

- PEM remains the dominant chemistry for the transportation sector in the country, though both DMFC and SOFC variants of vehicle systems are under development. Automotive giants, such as Toyota and Hyundai, have ventured into PEM stack cell technology to reduce the overall production costs of FCEVs.

- Besides, more than 80% of the fuel cell systems deployed in the United States are expected to be for the transportation sector. The cumulative number of fuel-cell electric vehicles in the United States grew from 4 in 2012 to 14,435 in 2022 till October.

- In May 2022, Hyundai Motor Company emphasized its plan to ramp up the United States commercial vehicle market entry with XCIENT Fuel Cell trucks at the 2022 Advanced Clean Transportation (ACT) Expo.

- Such collaborative efforts by the government and industry players are expected to significantly reduce PEMFC and FCEVs' costs and, in turn, increase the demand for fuel cells in the country.

North America Fuel Cell Technology Industry Overview

The North American fuel cell technology market is fragmented. Some of the key players are (in no particular order) Ballard Power Systems Inc., Horizon Fuel Cell Technologies Pte Ltd, FuelCell Energy Inc., Plug Power Inc., and Nuvera Fuel Cells LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Portable

- 5.1.2 Stationary

- 5.1.3 Transportation

- 5.2 Fuel Cell Technology

- 5.2.1 Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2 Solid Oxide Fuel Cell (SOFC)

- 5.2.3 Other Fuel Cell Technologies

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ballard Power Systems Inc.

- 6.3.2 Horizon Fuel Cell Technologies Pte. Ltd

- 6.3.3 FuelCell Energy Inc.

- 6.3.4 Hydrogenics Corporation

- 6.3.5 FuelCell Energy Inc.

- 6.3.6 Plug Power Inc.

- 6.3.7 Nuvera Fuel Cells LLC