|

市場調查報告書

商品編碼

1628772

供應鏈巨量資料分析:市場佔有率分析、產業趨勢、成長預測(2025-2030)Supply Chain Big Data Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

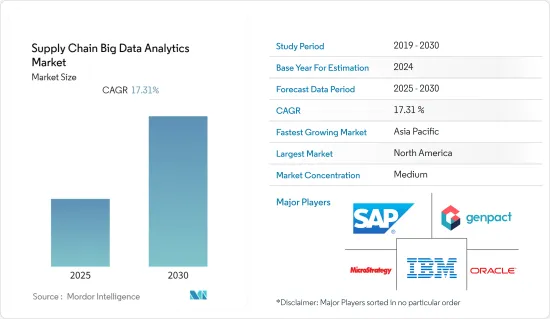

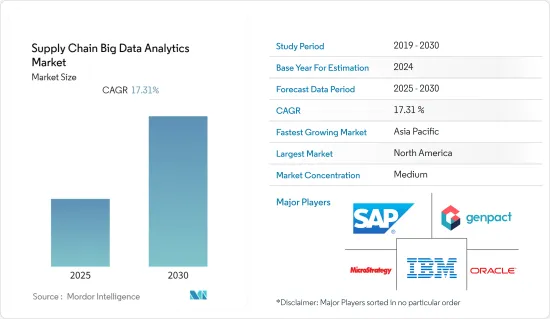

供應鏈巨量資料分析市場預計在預測期間內複合年成長率為17.31%

主要亮點

- 隨著數位技術的普及,巨量資料分析(BDA)已成為關鍵的業務能力,它為公司提供了更好的機會,從越來越多的資料中提取價值並獲得壓倒性的競爭優勢。

- 巨量資料分析有助於改善製造業的供應鏈。例如,可以利用電價的變化來安排能源密集型製造流程。儲存和檢查有關生產特徵的資料(例如組裝力和零件之間的尺寸變化)可以幫助識別錯誤的根本原因,即使錯誤發生在幾年後。農業種子加工商和生產商使用各種類型的攝影機來即時監控產品品質並獲得單一種子的品質評級。

- 貨運公司已經使用分析來最佳化業務。例如,我們採用燃油使用分析來提高車輛經濟性,並採用 GPS 技術透過即時分配儲存空間來減少等待時間。宅配公司開始根據卡車地理位置和擁塞資料安排向消費者即時送貨。例如,UPS 投資 10 年打造公路式綜合最佳化導航系統(Orion),改善其網路上的 55,000 條路線。執行長 David Abney 表示,新方法每年將節省 3 億美元至 4 億美元的成本。巨量資料分析還可以透過挖掘資料來預測小包裹何時交付,從而幫助物流營運商以更少的交付工作量交付貨物。

- 巨量資料分析還可以幫助企業探索相關產品分組的銷售效益。谷歌收購了 Skybox,一家提供高解析度衛星圖像的公司。 Skybox 可用於觀察停車場的汽車並預測商店的需求。一些公司也正在探索使用配備攝影機的無人機來追蹤商店的庫存水準。

- COVID-19 大流行對全球供應系統造成了破壞和風險。巨量資料分析 (BDA) 最近已成為一種可行的解決方案,可為企業提供預測性和先發製人的資訊,以規劃和減輕此類危害的影響。這場災難凸顯了供應鏈解決方案的必要性,以確保長期的經濟永續性。在這些困難時期,供應鏈分析透過識別需要立即調整的流程以及預計很快就會耗盡的產品和物品,幫助企業更好地管理供需之間的差距。此外,我們的供應商正在積極開發和提供解決方案,以減輕疫情對全球供應鏈的不利影響。

供應鏈巨量資料分析市場趨勢

零售業預計將大幅成長

- 零售業目前在供應鏈巨量資料分析市場中佔據很大一部分,透過在整個供應鏈中採用物聯網解決方案、信標和 RFID 技術產生的資料來源的增加預計將帶來許多成長機會。此外,零售額的擴張預計將推動市場成長。例如,去年美國零售總額約4.86兆美元,較前一年增加530億美元。

- 零售商可以利用新的資料來源來改善其規劃程序和需求感知能力。例如,Blue Yonder 創建了一種資料密集型預測演算法,已在零售業中使用,每天從 130,000 個 SKU 和 200 個影響變數中產生 150,000,000 個機率分佈。這顯著提高了預測準確性,並更好地了解公司的物流能力需求,減少了過時、存量基準和庫存積壓。 Blue Yonder 等第三方雲端基礎平台最近的擴張使得其他零售商更容易進行類似的活動。

- 隨著世界各國政府建議個人留在家中並制定社交距離規定,網上購物進一步增加。疫情期間,零售業對分析解決方案的需求急劇增加。例如,2021年,沃爾瑪開發了Walmart Luminate,這是一個從沃爾瑪消費者中心收集資訊的平台,並提供對沃爾瑪眾多品牌的認知度、受眾行為和管道成功的洞察。去年10月,該公司宣布很快將為供應商推出免費的基本套餐,使大大小小的供應商能夠更輕鬆地與商家合作並發展業務。沃爾瑪 Luminate Basics 將於今年稍後上市。

- 此外,商家正在使用物聯網解決方案和設備來分析消費者資料、管理存量基準並改善客戶互動。這些技術進步改善了對整個供應鏈中物品的監控,並提供了更清晰的客戶行為圖景。

- 例如,透過在銷售樓層的天花板空間安裝RFID讀取器,我們能夠掃描展示的所有產品,從而實現更準確的庫存視覺化。 American Apparel 使用 RFID 標籤和資料分析技術來增強庫存管理,而 Walmart 使用巨量資料分析來改善店內管理和供應鏈管理。

預計北美將佔據主要佔有率

- 美國企業和政府不斷致力於透過提高本國製造業的生產力並重點加強整個供應鏈的運作來振興該國的製造業。隨著美國電子商務業務的擴張,對有效供應鏈管理的需求也不斷成長。美國商務部數據顯示,去年第三季美國電子商務業務成長10.8%。線上訂單佔零售金額的 20.6% 以上。

- 美國是世界上最大的零售市場之一,COVID-19 對其造成了沉重打擊。但要讓數字走上正軌並促進成長以保持勢頭,需要複雜的技術來評估這種規模的資料。根據美國零售聯合會 (NRF) 的數據,零售業是美國最大的私營行業,年 GDP 達 3.9 兆美元,僱用了四分之一的美國人(5,200 萬人)。

- 根據美國人口普查局的數據,去年 3 月零售額經季節已調整的較 2 月成長 0.5%,較去年同月成長 6.9%。 2月份銷售額較上季成長0.8%,較去年同期成長18.2%。

- 此外,在北美零售業,電子零售商正在尋求透過當日送達來改善消費者體驗,這可以透過良好的供應鏈管理來有效實現。

- 此外,區域新興企業正在籌集資金,以利用巨量資料分析和其他新技術來提高業務效率。例如,去年 9 月,Kharon 是一家為全球安全和業務交叉點的企業提供情報的分析和資料公司,推出了一個用於分銷鏈映射和零售追蹤的國際業務連接和雲端基礎的平台。號合作。客戶可以使用 Transparency-One 執行產品級分銷鏈映射和文件監控,並根據 Kharon 的強迫勞動資料庫自動篩檢拒絕品和高風險個人。

供應鏈巨量資料分析產業概況

供應鏈巨量資料分析市場競爭激烈,由多家大型企業組成。就市場佔有率而言,目前由幾家大型企業主導市場,包括 SAP SE、IBM 公司、Oracle 公司、MicroStrategy Incorporated 和 Genpact Limited。這些公司利用策略合作舉措來提高市場佔有率和盈利。

2022 年 10 月, Oracle宣佈在其資料和分析解決方案組合中開發眾多新產品。 Oracle Fusion Analytics 針對 ERP、CX、SCM 和 HCM 分析的附加功能為決策者提供了 2,000 多個主動儀表板、KPI 和最佳實踐報告,以根據策略目標評估績效。 2022 年 11 月,AWS 宣布推出 AWS 供應鏈。這個新平台將使公司能夠提高供應鏈的可見性,並做出更快、更明智的選擇,從而降低風險、降低成本並改善客戶體驗。 AWS Supply Chain 無縫聚合和分析來自眾多供應鏈系統的資料。這使得企業能夠即時監控營運狀況,更快地識別模式,並提供更準確的需求預測,以確保有足夠的庫存來滿足消費者的期望。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 市場促進因素

- 對業務資料提高效率的需求不斷成長

- 市場限制因素

- 操作複雜、維護成本高

- 價值鏈/供應鏈分析

- 行業景點-波特五力

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場區隔

- 按類型

- 解決方案

- 供應鏈採購與規劃工具

- 銷售和業務規劃

- 製造分析

- 運輸/物流分析

- 其他解決方案(庫存計劃和最佳化分析、調度和彙報工具)

- 服務

- 專業服務

- 支援和維護服務

- 解決方案

- 按最終用戶

- 零售

- 運輸/物流

- 製造業

- 衛生保健

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 公司簡介

- SAP SE(SAP)

- IBM Corporation

- Oracle Corporation

- MicroStrategy Incorporated

- Genpact Limited

- SAS Institute Inc.

- Sage Clarity Systems

- Salesforce.com Inc(Tableau Software Inc.)

- Birst Inc.

- Capgemini Group

- Kinaxis Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The Supply Chain Big Data Analytics Market is expected to register a CAGR of 17.31% during the forecast period.

Key Highlights

- The widespread use of digital technologies has led to the emergence of Big Data Analytics (BDA) as a critical business capability to provide companies with better opportunities to obtain value from an increasingly huge amount of data and gain a commanding competitive advantage.

- Big data analytics aid in the improvement of the supply chain in the manufacturing business. For example, energy-intensive manufacturing runs can be scheduled to take advantage of changing electricity rates. Data on production characteristics, such as assembly forces or size variances between components, can be saved and examined to aid in the root-cause investigation of errors, even if they arise years later. Agricultural seed processors and producers monitor the quality of their products in real-time using various types of cameras to obtain quality assessments for every individual seed.

- Analytics are already being used by trucking businesses to optimize their operations. For example, they employ fuel usage analytics to increase vehicle economy and GPS technology to cut waiting times by distributing storage spaces in real time. Courier companies have begun real-time scheduling of deliveries to consumers based on geo-location and congestion data from their trucks. UPS, for example, has invested ten years in creating its On-Road Integrated Optimization and Navigation system (Orion) to improve the network's 55,000 paths. According to the company's CEO, David Abney, the new method would save $300 million to $400 million yearly. Big data analytics will also assist logistics operators in delivering goods with fewer delivery efforts by mining their data to estimate when a parcel will be delivered.

- Big data analytics can help businesses investigate the sales benefits of grouping related goods together. Google has bought Skybox, a source of high-resolution satellite images that can be used to watch automobiles in a parking lot to predict in-store demand. Others have investigated the use of camera-equipped drones to track on-shelf stock levels.

- The pandemic of COVID-19 has caused disruptions and hazards in global supply systems. Big data analytics (BDA) has recently arisen as a viable solution for providing firms with predicted and pre-emptive information to assist them in planning and reducing the effects of such hazards. The outbreak highlighted the need for solutions for supply chains to ensure long-term economic sustainability. During these difficult times, supply chain analytics helped firms to detect processes that needed immediate adjustment or products/items that were expected to run out soon, helping them to manage the demand-supply gap better. Furthermore, the suppliers are actively developing and delivering solutions to mitigate the detrimental effects of the outbreak on global supply chains.

Supply Chain Big Data Analytics Market Trends

Retail is Expected to Register a Significant Growth

- The retail industry currently accounts for a significant portion of the supply chain big data analytics market, and it is expected to present numerous growth opportunities as a result of the increasing number of data sources generated by the adoption of IoT solutions, beacons, and RFID technologies throughout the supply chain. Additionally, growing retail sales are expected to drive market growth. For instance, last year, total retail sales in the United States were roughly USD 4.86 trillion, up USD 53 billion from the previous year.

- Retailers may enhance their planning procedures and demand-sensing capacities by utilizing new data sources. Blue Yonder, for instance, has created data-intensive forecasting algorithms already being used in retail, wherein 130,000 SKUs and 200 impacting variables yield 150,000,000 probability distributions each day. This has significantly improved forecast accuracy, provided a better understanding of the firm's logistical capacity requirements, and decreased obsolescence, stock levels, and excess inventory. The recent expansion of third-party cloud-based platforms such as Blue Yonder makes similar activities more available to other retailers.

- Governments worldwide have advised individuals to stay at home and are enacting social distancing regulations, increasing internet purchasing even more. During the pandemic, the demand for analytics solutions in retail has increased dramatically. Walmart, for example, developed Walmart Luminate in 2021, a platform that collects information from Walmart's consumer center and provides insights on perception, audience behavior, and channel success for the numerous brands at Walmart. In October last year, the company announced the forthcoming introduction of a Basic package at no cost to suppliers, making it even more straightforward for suppliers of any scale to engage with merchants to expand their companies. Walmart Luminate Basic is scheduled to go on the market in the current year.

- Furthermore, merchants use IoT solutions and devices to analyze consumer data, manage stock levels, and improve customer interactions. These technological advancements allow for improved monitoring of items across the supply chain and aid in acquiring a clear insight into client behavior.

- For instance, merchants have also installed a system of RFID readers into the ceiling space of the sales floors, enabling them to scan all of the items on show and offering more precise inventory visibility. American Apparel uses RFID tags and data analytics technologies to enhance inventory control, while Walmart uses Big Data analytics to improve in-store and supply-chain management.

North America is Expected to Hold Major Share

- Companies and governments in the United States are constantly working to boost their manufacturing business by increasing productivity and focusing on strengthening operations across the supply chain in the country's manufacturing industry. As the e-commerce business in the United States expands, so does the demand for effective supply chain management. According to the US Commerce Department, the country's e-commerce business grew by 10.8% in the third quarter of the last year. Online orders accounted for over 20.6% of all retail dollars spent.

- The United States is one of the world's largest retail marketplaces, and covid-19 influenced it considerably. However, getting back on track with rising numbers and augmenting growth to keep the momentum going requires advanced tech to evaluate data at that scale. According to the National Retail Federation (NRF), retail is the country's biggest private industry, accounting for USD 3.9 trillion yearly GDP and employing one in every four Americans (52 million).

- According to the US Census Bureau, retail sales in March last year were up 0.5% seasonally adjusted from February and 6.9% Y-O-Y. In February, there were rises of 0.8% month over month and 18.2% Y-O-Y.

- Additionally, E-retailers in the North American retail sector are trying to improve the consumer experience by including same-day delivery, which may be accomplished efficiently with excellent supply chain management.

- Further, regional startups are gathering funds to improve operational efficiency using Big Data analytics and other new technologies. For example, Kharon, an analytics and data company providing companies with intelligence at the intersection of world security and business, announced a partnership with Transparency-One, an international business connectivity and cloud-based platform for distribution network mapping and sub-tier tracking, in September last year. Clients may use Transparency-One to perform product-level distribution network mapping and document monitoring while also automating refused and high-risk party screenings against Kharon's sector Forced Labor database.

Supply Chain Big Data Analytics Industry Overview

The supply chain big data analytics market is highly competitive and consists of several major players. In terms of market share, a few major players currently dominate the market, including SAP SE, IBM Corporation, Oracle Corporation, MicroStrategy Incorporated, and Genpact Limited, among others. These companies leverage strategic collaborative initiatives to increase their market shares and profitability.

In October 2022, Oracle unveiled a slew of new product developments across its complete data and analytics solutions portfolio. With the additional features in Oracle Fusion Analytics for ERP, CX, SCM, and HCM analytics, decision-makers have a prebuilt collection of over 2,000 best-practice dashboards, KPIs, and reports to evaluate performance against strategic objectives. In November 2022, AWS introduced AWS Supply Chain. This new platform enables organizations to supply chain visibility better to make quicker, more informed choices that reduce risks, save money, and enhance customer experiences. AWS Supply Chain seamlessly aggregates and analyzes data from numerous supply chain systems. This allows businesses to monitor their operations in real-time, identify patterns faster, and provide more accurate demand projections to guarantee enough inventory to fulfill consumer expectations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need of Business Data to Improve Efficiency

- 4.3 Market Restraints

- 4.3.1 Operational Complexity Coupled with High Maintenance Costs

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Solution

- 5.1.1.1 Supply Chain Procurement and Planning Tool

- 5.1.1.2 Sales and Operations Planning

- 5.1.1.3 Manufacturing Analytics

- 5.1.1.4 Transportation and Logistics Analytics

- 5.1.1.5 Other Solutions (Inventory Planning and Optimization Analytics and Scheduling and Reporting Tools)

- 5.1.2 Service

- 5.1.2.1 Professional Service

- 5.1.2.2 Support and Maintenance Service

- 5.1.1 Solution

- 5.2 End User

- 5.2.1 Retail

- 5.2.2 Transportation and Logistics

- 5.2.3 Manufacturing

- 5.2.4 Healthcare

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 South Korea

- 5.3.3.4 India

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Mexico

- 5.3.4.2 Brazil

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of Latin America

- 5.3.5 Middle-East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE (SAP)

- 6.1.2 IBM Corporation

- 6.1.3 Oracle Corporation

- 6.1.4 MicroStrategy Incorporated

- 6.1.5 Genpact Limited

- 6.1.6 SAS Institute Inc.

- 6.1.7 Sage Clarity Systems

- 6.1.8 Salesforce.com Inc (Tableau Software Inc.)

- 6.1.9 Birst Inc.

- 6.1.10 Capgemini Group

- 6.1.11 Kinaxis Inc.