|

市場調查報告書

商品編碼

1628792

法國塑膠包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)France Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

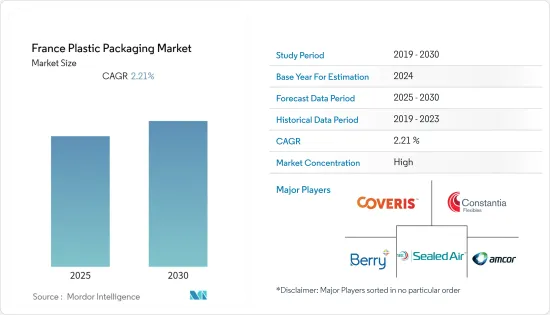

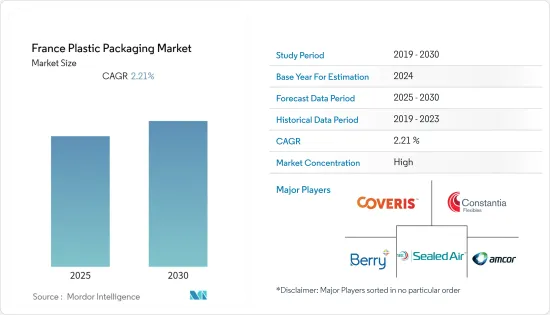

法國塑膠包裝市場預計在預測期內複合年成長率為2.21%

主要亮點

- 硬質塑膠在食品包裝中的使用繼續受到移動性和便利性日益成長的趨勢的嚴重影響。此外,行動消費的增加和份量控制的需求也推動了寶特瓶的使用。此外,在預測期內,熱飲料可能仍然是軟包裝材料利用的主要驅動力。在預測期內,對女性用衛生產品的需求不斷成長可能會推動軟包裝的成長。

- 此外,推動硬質塑膠在國內各行業使用的主要特性是其經濟性、韌性、便攜性和重量輕。軟包裝的擴張也受到其經濟性、對不同形狀和尺寸的適應性以及易於封閉的推動。

- 國內對塑膠使用的法規日益嚴格預計將影響國內塑膠包裝市場。例如,2020年12月,法國眾議院通過一項法律,從2040年起禁止使用所有一次性塑膠製品和包裝,以及一系列加強再利用和回收的措施。除了2040年的最後期限外,多位環保人士表示,要實現從2021年開始消除塑膠杯、盤子、刀叉餐具和吸管的目標,需要更快的速度,而不是原計劃的2020年。

- 在日本,塑膠的使用和禁止的環境是複雜的。環境部2021年10月11日宣布,法國將從2022年1月起禁止幾乎所有水果和蔬菜使用塑膠包裝,以減少塑膠垃圾。據估計,37%的水果和蔬菜以包裝形式出售,此舉預計每年將消除超過10億件不必要的塑膠包裝。

- 此外,各個最終用戶產業及其客戶對塑膠使用的日益擔憂也影響了塑膠的使用。例如,國內化妝品供應商熱衷於解決行業的塑膠問題,因此正在為領先企業開發永續的解決方案。

- 此外,法國最近禁止大多數水果和蔬菜使用塑膠包裝。今年6月底,聖女果、芸豆、桃子等產品將全面禁用塑膠包裝。到年終,菊苣、蘆筍、洋菇以及某些沙拉和香草將不再以塑膠包裝出售。到 2026 年 6 月,將不再使用塑膠來銷售覆盆子、草莓和其他精緻漿果。

- 由於 COVID-19 的爆發,食品和飲料公司製定了對策和實際計劃,以降低風險並準備應對冠狀病毒的影響。這些計劃包括建立一個由來自業務各個方面的人員組成的多學科危機應對團隊,以識別、評估和管理所出現的風險。此外,俄羅斯-烏克蘭戰爭影響了整個包裝生態系統。

法國塑膠包裝市場趨勢

輕質包裝的採用增加可能會推動市場成長

- 根據 Custom-Pak 對以替代品(紙/板、玻璃、鋼、鋁、紡織品、橡膠、軟木等)取代塑膠的影響的研究,替代品平均重 4.5 倍。替代品需要更多的材料生產來製造相同類型的包裝。

- 為了採購更多的回收塑膠,三得利還將投資法國新興企業公司 Calbios,該公司開發了將聚合物分解為單體的技術,使它們更容易在飲料瓶等新型硬質塑膠包裝中重複使用。它還將投資歐洲主要市場,以支持國家存款返還計劃的實施。我們也努力確保塑膠包裝被歸類為 100% 本地可回收。

- 此外,在所有類型的塑膠中,PET的使用被認為最適合生產輕瓶和容器。 PETRA 表示,PET 是一種透明、堅固且輕質的塑膠,廣泛用於包裝食品和飲料,尤其是方便尺寸的軟性飲料、果汁和水。在英國銷售的幾乎所有單份和 2 公升瓶裝碳酸飲料和水都是由 PET 製成的。

- 塑膠更輕、更堅固,比玻璃更容易運輸。運輸塑膠瓶和容器比玻璃消耗更少的燃料,因此消費量的能源更少,碳排放也更低。

- 此外,對可回收輕質塑膠包裝產品不斷成長的需求也促進了市場的發展。一些包裝公司正致力於推出輕質包裝產品,以涵蓋更廣泛的客戶群。例如,塑膠包裝解決方案公司 Greiner Packaging 去年 2 月宣布將於 3 月 8 日至 10 日參加在法國雷恩舉行的 CFIA。格瑞納包裝公司的創新開發正在徹底改變紙板和塑膠組合的可回收性。以前,完全依賴消費者的角色來確保廢棄物正確分類。然而,使用 K3(R)r100,紙板杯和塑膠杯在運往回收設施的途中會自動分離。這是一種理想的回收包裝解決方案。

- K3 將薄塑膠杯與易於拆卸的外紙板包裝結合在一起。塑膠仍然是食品包裝材料的首選,因為它可以保護食品、延長保存期限並減少食品廢棄物。除了可回收之外,用於製造 K3 杯的塑膠有時也由再生材料(如 rPET)製成。 K3杯子比相同尺寸的直接印刷杯子可節省高達50%的塑膠。

- 此外,根據歐盟統計局的數據,去年法國塑膠包裝生產指數為99.1,比前一年增加1.6件。大流行的強勁復甦意味著該國對塑膠包裝用品的需求增加,導致人們越來越偏好輕質包裝。

個人護理品預計將大幅成長

- 該地區的社會人口變化將影響化妝品及相關產品對天然成分的需求。該地區的人口老化正在增加對具有抗衰老和其他活性特性的天然成分的需求。

- 隨著許多護膚品牌面臨日益激烈的競爭,包裝供應商正在為品牌提供各種方法來區分其設計,以提供便利、易於使用和先進的功能。護膚品有多種包裝選擇,以適應不同的產品形式和配方。例如,Nerd 護膚使用塑膠和其他材料製成的瓶子、管子、罐子和滴管。

- 一些品牌選擇效仿其他行業,透過使用消費後再生 PET 來減少一次性塑膠消費量。例如,Aveda 目前使用 100% 消費後回收 PET 來製造護膚和美髮寶特瓶、罐子和甘蔗基生質塑膠。

- 多個政府機構表示,歐洲塑膠原物料價格上漲是主要因素。 Virgin Plastics的產能目前正在籌建中,預計將降低原生樹脂的價格,同時也對再生樹脂價格構成壓力。

- 此外,法國美容產品製造商正在透過社群媒體活性化促銷力度,這也鼓勵並增加了線上網站的購買量。例如,這裡是過去一年法國個護領域網路商店的銷售額排名,依照電商年度淨銷售額排序。去年,法國個人護理和美容產品跨國零售商絲芙蘭在法國的個人護理產品銷售額達2.454億美元。網路商店Nocibe.fr 位居第二,銷售額為 1.931 億美元。

- 去年 8 月,Sephora.fr 吸引了超過 500 萬訪客,成為法國客流量最大的網路商店。排名第二的是德國香水和化妝品公司 Douglas 的子公司 Nocibe.fr,網站流量為 370 萬次。每個品牌的產品銷售都包括廣泛的塑膠包裝產品,塑膠包裝產品產生了可觀的銷售。

法國塑膠包裝產業概況

法國塑膠包裝市場趨於整合,少數公司佔較大佔有率。由於法國地區對塑膠包裝的需求大幅成長,市場高度集中,Amcor plc、Coveris Management GmbH、Berry Global Inc.、Sealed Air Corporation 和 Constantia Flexibles International GmbH 等大公司進駐。每家公司都持續參與新產品的開發,為新產品的進入創造了障礙。

2023 年 1 月,Berry 位於法國拉熱內特的工廠獲得了 RecyClass 認證,滿足了包裝中可回收性和可回收成分的可靠聲明的需求。該公司正致力於從線性經濟向循環經濟轉型,以實現歐盟到 2030 年使所有塑膠可回收和可重複使用的目標。這些發展循環經濟的措施使得各行業的製造商在其塑膠包裝解決方案中公開並展示回收和再生材料的使用變得越來越重要。

2022 年 2 月,Coveris 在法國 Montfaucon 投資了一家工廠。最近,該公司改進了設備,購買了一台擠出機,以增加工業收縮罩和拉伸罩的產量。這項投資是為了滿足對可回收和可再生的軟包裝日益成長的需求。 Coveris的5層共擠技術擠出機旨在提高含有可回收材料的拉伸和收縮罩的生產能力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 更多採用輕量化包裝方法

- 增加環保包裝和再生塑膠

- 市場挑戰

- 原料(塑膠樹脂)價格上漲

- 政府法規和環境問題

- 俄烏戰爭對市場的影響

- 全球塑膠包裝市場概況

第6章 市場細分

- 按包裝類型

- 軟質塑膠包裝

- 硬質塑膠包裝

- 依產品類型

- 瓶子和罐子

- 托盤/容器

- 小袋

- 包包

- 薄膜包裝

- 其他產品類型

- 按行業分類

- 食物

- 飲料

- 衛生保健

- 個人護理和家居產品

- 其他最終用戶

第7章 競爭格局

- 公司簡介

- Amcor Plc

- Coveris Management GmbH

- Berry Global Inc.

- Constantia Flexibles International GmbH

- Wipak Group

- Sonoco Products Company

- Sealed Air Corporation

- Tetra Laval International SA

- Silgan Holdings Inc.

- Industrial Packaging Solutions

第8章投資分析

第9章 市場未來展望

The France Plastic Packaging Market is expected to register a CAGR of 2.21% during the forecast period.

Key Highlights

- The usage of rigid plastics in food packaging continues to be significantly influenced by the rising trend toward mobility and convenience. Additionally, the use of PET bottles is driven by the rise in on-the-go consumption and the demand for portion control. Further, hot beverages would continue to be the primary driver of flexible packaging material utilization during the projection period. Increased demand for feminine hygiene products would drive flexible packaging growth through the forecast period.

- Moreover, the main attributes driving the use of rigid plastics across industries in the country are their affordability, toughness, portability, and low weight. The expansion of flexible packaging is also driven by its affordability, adaptability to various forms and sizes, and simplicity of closing.

- The increasing regulations in the country against the use of plastic are anticipated to affect the market for plastic packaging in the country. For instance, in December 2020, the French Parliament's lower chamber passed a law to ban all single-use plastic products and packaging after 2040 and a raft of measures to ramp up reuse and recycling. Various environmentalists complained that the 2040 deadline, plus targets for ending the use of plastic cups, plates, cutlery, and straws, starting in 2021 instead of 2020, as initially planned, needs to be faster.

- The country has been witnessing a mixed environment for the use and ban of plastic. The environment ministry said on October 11, 2021, that France will ban plastic packaging for nearly all fruit and vegetables from January 2022 to reduce plastic waste. According to estimates, 37% of fruits and vegetables are sold packaged, and it is anticipated that the move will stop more than one billion unnecessary plastic packaging items from being produced annually.

- Further, the growing concerns regarding the use of plastics across various end-user industries and among their customers are affecting the use of plastics. For instance, the cosmetic vendors in the country are keen on tackling the industry's plastic problem; hence, they are developing sustainable solutions for major players.

- Moreover, recently, France banned plastic packaging for most fruits and vegetables. By the end of June this year, plastic packing for cherry tomatoes, green beans, and peaches will be prohibited. Endives, asparagus, mushrooms, certain salads, and herbs will no longer be sold in plastic packaging by the end of next year. By June 2026, plastic will no longer be used to market raspberries, strawberries, and other delicate berries.

- Owing to the COVID-19 outbreak, Food & Beverage companies developed response actions and practical plans to mitigate their risk and prepare to deal with the coronavirus's effects. These plans included establishing an interdisciplinary crisis response team of personnel from all aspects of the business to identify, assess, and manage the risk presented. Further, the Russia-Ukraine war had an impact on the overall packaging ecosystem.

France Plastic Packaging Market Trends

Increase in Adoption of Light-Weight Packaging may Drive the Market Growth

- Custom-Pak's study on the ramifications of replacing plastic with alternatives (such as paper and paperboard, glass, steel, aluminum, textile, rubber, and cork) found that substitutes are, on average, 4.5 times heavier. The alternatives require substantially more material output to create the same type of packaging.

- Suntory is also investing in Carbios, a French startup that developed the technology that breaks down polymers into monomers, making them easy to reuse in new rigid plastics packaging, such as drinks bottles, in order to source more recycled plastics. It will also invest in supporting the implementation of national deposit-return schemes across its key European markets. It will also work to ensure that its plastic packaging is classed as 100% recyclable in the region.

- Moreover, of all the types of plastic, it is believed that using PET will help manufacture the lightest bottle and containers. According to PETRA, PET is a clear, strong, and lightweight plastic that is widely used for packaging food and beverages, especially convenience-sized soft drinks, juices, and water. Virtually all single-serving and 2-liter bottles of carbonated soft drinks and water sold in the United Kingdom are made from PET.

- Plastic is lightweight and tough, making it much more suitable for transportation than glass. Shipping of plastic bottles and containers consumes less fuel than that of glass, expending less energy and leaving a smaller carbon footprint.

- Furthermore, the growing demand for recyclable, lightweight plastic packaging products contributes to the market's development. Several packaging companies are focusing on introducing light packaging products to gain a broad customer base. For instance, Greiner Packaging, a plastic packaging solution company, stated in February of last year that the company would participate in the CFIA in Rennes, France, from March 8-10. An innovative development from Greiner Packaging is revolutionizing the recyclability of cardboard-plastic combinations. Making sure that waste was sorted correctly used to be fully reliant on consumers playing their part. But now with K3(R) r100, the cardboard wrap and theplastic cup separate all by themselves on the way to the recycling facility. This makes the packaging solution ideal for recycling

- K3 combines a thin plastic cup with an easily removed exterior cardboard wrap. Because plastic protects, increases shelf life, and decreases food waste, it remains the best packaging material for food goods. In addition to being recyclable, the plastic used to produce K3 cups may also be made from recycled materials like rPET. The K3 cup can save up to 50% more plastic than a directly printed cup of the same size.

- Moreover, according to Eurostat, last year, the production volume index of the manufacture of plastic packing goods in France was recorded at 99.1, which increased by 1.6 units from the previous year. The significant recovery from the pandemic represents the increased demand for plastic packaging goods in the country, leading to the growing preference for lightweight packaging.

Personal Care is Expected to Witness Significant Growth Rates

- Socio-demographic changes in the region affect the demand for natural ingredients for cosmetics and related products. The region's aging population is increasing the demand for natural ingredients with active properties, such as anti-aging.

- Many skincare brands face increased competition, and the packaging suppliers provide brands with ways to differentiate designs that deliver convenience, ease of use, and advanced capabilities. A broad range of options is available for packaging skin care products to accommodate different product formats and formulations. For example, Nerd Skincare uses bottles, tubes, jars, and droppers in plastic and other materials.

- Some brands choose to reduce their single-use plastic consumption by using post-consumer recycled PET, following the suit of other industries. Aveda, for instance, is now using 100% post-consumer recycled PET in 85% of its skin care and hair styling PET bottles, jars, and bioplastic from sugarcane.

- Multiple government agencies cited that prices of plastic materials in Europe increased, with a significant contributor. With virgin plastics production capacity being in the current pipeline, this would place pressure on virgin resin prices downward and also on recycled resin prices.

- Also, the growing promotional activities of beauty product manufacturer in France through social media has boosted and increased purchasing through online websites. For example, the statistic presents a ranking of the top online stores in France in the personal care segment in the last year, sorted by annual net e-commerce sales. Last year, a significant market shareholding player, Sephora, a French multinational retailer of personal care and beauty products, generated USD 245.4 million via selling products from the personal care segment in France. The online store Nocibe.fr was ranked second with a revenue of USD 193.1 million.

- With more than five million visits in August last year, Sephora.fr garnered the highest traffic to its website among selected French online stores for beauty and personal care products. In second place came Nocibe.fr, a German perfume and cosmetics company Douglas subsidiary, with 3.7 million website visits. The brands' product sales include a wide range of plastic packaging products, generating significant sales from plastic packaging products.

France Plastic Packaging Industry Overview

The France Plastic Packaging Market is consolidated owing to a few players holding significant shares. As the demand for plastic packaging has been increasing significantly in the France region, the market is highly concentrated with the presence of major players like Amcor plc, Coveris Management GmbH, Berry Global Inc., Sealed Air Corporation, and Constantia Flexibles International GmbH, among others. The companies are involved in developing new products consistently, creating a barrier to new entrants.

In January 2023, the Berry factory in La Genete, France, received RecyClass certification to fulfill the demand for credible claims regarding recyclability and recycled content in packaging. The company is working to shift from a linear to a circular economy to meet the EU goal of having all plastic recyclable and reused by 2030. These measures to develop circularity make it more and more critical for manufacturers in all sectors to be open about recycling and using recycled material in their plastic packaging solutions and to prove it.

In February 2022, Coveris invested in its facilities in Montfaucon, France. Recently, the business bought an extruder to improve its equipment and increase the production of shrink and stretch hoods for industrial uses. The investment is meant to satisfy the rising demand for recyclable and recycled flexible packaging materials. The five-layer coextrusion technology extruder from Coveris is intended to boost the plant's capability for producing stretch and shrink hoods, including those made of recyclable materials.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight Packaging Methods

- 5.1.2 Increased Eco-friendly Packaging and Recycled Plastic

- 5.2 Market Challenges

- 5.2.1 High Price of Raw Material (Plastic Resin)

- 5.2.2 Government Regulations & Environmental Concerns

- 5.3 Impact of Russia-Ukraine War on the Market

- 5.4 Overview of the Global Plastic Packaging Market

6 MARKET SEGMENTATION

- 6.1 By Packaging Type

- 6.1.1 Flexible Plastic Packaging

- 6.1.2 Rigid Plastic Packaging

- 6.2 By Product Type

- 6.2.1 Bottles and Jars

- 6.2.2 Trays and containers

- 6.2.3 Pouches

- 6.2.4 Bags

- 6.2.5 Films & Wraps

- 6.2.6 Other Product Types

- 6.3 By End-User Vertical

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Healthcare

- 6.3.4 Personal Care and Household

- 6.3.5 Other End-User Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Plc

- 7.1.2 Coveris Management GmbH

- 7.1.3 Berry Global Inc.

- 7.1.4 Constantia Flexibles International GmbH

- 7.1.5 Wipak Group

- 7.1.6 Sonoco Products Company

- 7.1.7 Sealed Air Corporation

- 7.1.8 Tetra Laval International SA

- 7.1.9 Silgan Holdings Inc.

- 7.1.10 Industrial Packaging Solutions