|

市場調查報告書

商品編碼

1850124

美國塑膠包裝:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)US Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

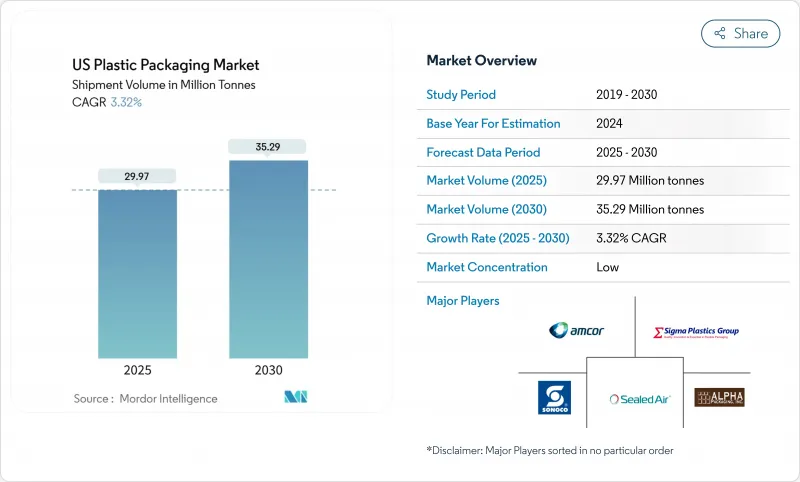

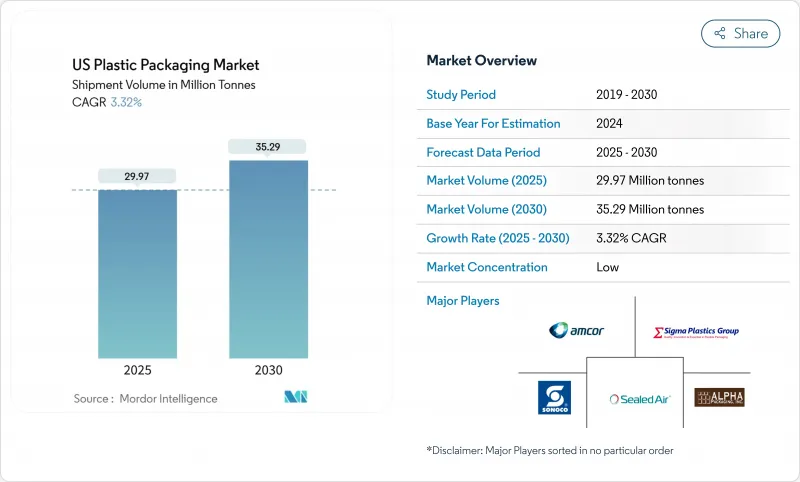

預計到 2025 年,美國塑膠包裝市場規模將達到 2,997 萬噸,到 2030 年將達到 3,529 萬噸,複合年成長率為 3.32%。

需求韌性主要得益於電子商務小包裹的擴展、食品飲料便捷包裝形式的普及,以及品牌商致力於在其核心庫存產品中整合25%的消費後回收(PCR)樹脂。加州SB 54法案和華盛頓州《再生資源法案》等監管框架正在加速設計向更輕薄、單一材料複合材料和繫繩式封口的轉變。 FDA批准的rPET、rHDPE和rLLDPE的採用正在逐步縮小供應缺口。此外,美國塑膠包裝市場正透過塑膠模塑商在2023年新增1,646台機器人來提高生產效率和產量比率。

美國塑膠包裝市場趨勢與洞察

美國消費品品牌迅速採用可回收的單一材料包裝袋

聚乙烯和聚丙烯的單一材料複合材料正在取代曾經阻礙回收的混合基材薄膜。加工商現在提供符合美國《 2025年塑膠公約》設計目標的耐熱高阻隔包裝袋,直接向品牌所有者傳達「可回收」的聲明。 DNP印尼公司針對零食和寵物食品推出的單一材料包裝的商業化應用,在維持阻隔性能的同時,簡化了產品生命週期末期的處理流程。零售商要求其規格與傳統鋁箔包裝相同,測試數據證實了兩者氧氣透過率相當,從而實現了廣泛的SKU轉換。美國塑膠包裝市場的包裝團隊正在將捲材寬度最佳化與材料減量相結合,以降低單位產品的薄膜消費量。

美國小包裹網路公司發現,電子商務對輕型防護郵件的需求激增

小包裹托運商持續減少不必要的填充物,對可回收的薄型郵寄包裝袋越來越感興趣,這種包裝袋既能降低體積重量費用,又能確保產品完整性。亞馬遜已將其三分之一的美國境內小包裹替換為紙質包裝,自該計畫啟動以來,已減少了150億個塑膠空氣枕。該公司的試點工廠正在檢驗每分鐘超過250個包裹的生產線速度,為自動化樹立了新的標竿。競爭對手正努力達到華盛頓州回收法規定的含30%消費後回收材料(PCR)的單一材料低密度聚乙烯(LDPE)氣泡郵寄包裝袋的性能水準。美國塑膠包裝市場的加工商正在投資高功率吹膜塔和自動化分切系統,以應對每日小包裹量的激增。

擴大州級一次性塑膠禁令,以減少某些類型的包裝

加州SB54法案規定,到2032年,該州銷售的原生塑膠包裝必須減少25%,並要求生產商在2025年前加入生產者責任組織。新澤西州、科羅拉多和緬因州也頒布了類似的強制規定,這使得全國性品牌面臨複雜且分散的合規環境。儘管成本更高,加工商仍在積極地從產品目錄中剔除PS泡殼和PVC泡殼,轉而使用PETG和塗層紙板等替代品。監管的不確定性推高了長期供應合約的風險溢價,並抑制了美國塑膠包裝市場的可自由支配資本支出,因為各公司都在等待統一的聯邦指導方針訂定。

細分市場分析

到2024年,軟包裝將占美國塑膠包裝市場的54.14%,複合年成長率(CAGR)為4.98%。每增加一個軟包裝袋,其聚合物用量將比硬包裝袋減少60-70%,從而降低運輸排放和倉儲佔用空間。電商巨頭更青睞可折疊成立方體的扁平包裝袋,體積僅為瓦楞紙箱的十分之一,進一步降低了倉儲成本。各大品牌正在採用近紅外線(NIR)可讀油墨,使軟包裝袋能夠在材料回收設施中高效分揀,從而提高淨回收率。同時,「智慧」包裝袋正在嵌入RFID和NFC標籤,實現從填充到消費者掃描的全過程視覺化。

硬質塑膠在飲料、藥品和家用化學品領域仍發揮關鍵作用,但其成長速度已放緩至2.1%的複合年成長率。輕質高密度聚乙烯(HDPE)瓶的樹脂用量將比2023年的設計減少12%,但跌落強度和口感中性等性能指標限制了樹脂用量的進一步降低。華盛頓州的再生材料含量法要求瓶子製造商確保穩定的再生高密度聚乙烯(rHDPE)供應,鼓勵他們共同投資建造內部清洗生產線。美國塑膠包裝市場的競爭主要圍繞著紮帶蓋展開,這種蓋帽既方便又能減少浪費,並且符合即將訂定的瓶蓋密封性要求。

聚乙烯在2024年仍將維持45.54%的軟包裝市場佔有率,這得益於其寬廣的加工窗口和完善的路邊回收基礎設施。美國食品藥物管理局(FDA)核准100%再生線性低密度聚乙烯(rLLDPE)用於零嘴零食包裝,這為食品安全合規鋪平了道路,並使全國零售商能夠推出「循環」自有品牌產品。研發團隊正在採用茂金屬催化劑,以更小的線徑實現更高的衝擊強度,從而節省8-10%的樹脂用量。隨著共擠出技術能夠適應再生顆粒的差異性而不影響薄膜的透明度,美國軟塑膠基軟包裝市場規模持續擴大。

「其他材料」類別將以6.34%的複合年成長率成長,主要成長動力來自可堆肥PLA共混物、纖維素基薄膜和二氧化矽塗層紙。消費品牌正在試用源自甘蔗的生物基聚乙烯(bio-PE),這種材料具有相似的機械性能和更低的碳足跡。雙向拉伸聚丙烯(BOPP)仍然是光面零嘴零食和糖果甜點包裝紙的必備材料,但新型清漆系統無需金屬化即可提供符合單一材料回收指南的阻隔性能。樹脂供應商和薄膜加工商之間的夥伴關係將加快資格確認週期,縮短新配方的上市時間。

美國塑膠包裝市場按材料類型(硬質塑膠(聚乙烯(PE)、聚丙烯(PP)等);軟質塑膠(聚乙烯(PE)、雙軸延伸聚丙烯(BOPP)等))、包裝類型(硬質塑膠包裝、軟質塑膠包裝)、最終用途產業(食品、食品飲料、製藥等)和包裝技術(擠出、熱成型等)進行細分。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 美國小包裹網路公司發現,電子商務對輕型防護郵件的需求激增

- 美國消費品品牌迅速採用可回收的單一材料包裝袋;《塑膠公約》的目標是2025年後。

- 已調理食品和即食食品市場成長,需要阻隔性軟性薄膜

- 藥品低溫運輸的擴展推動了專用硬質容器和泡殼薄膜的應用。

- 企業對25%消費後回收材料(PCR)含量的承諾推動了對再生PET和再生HDPE瓶的需求。

- 投資先進的數位印刷技術,為小型企業品牌快速客製化。

- 市場限制

- 加強國家層級的一次性塑膠禁令,並減少某些包裝形式。

- 聚烯樹脂價格因頁岩氣原料價格波動而波動

- 消費者轉向使用紙張和鋁製品的永續性替代品

- 資本密集的化學回收基礎設施限制了塑膠供應。

- 供應鏈分析

- 貿易情境分析(基於相關HS編碼)

- 美國當前的回收趨勢

- 監理展望

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依材料類型

- 硬質塑膠

- 聚乙烯(PE)

- 聚丙烯(PP)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚氯乙烯(PVC)

- 聚苯乙烯(PS)和發泡聚苯乙烯(EPS)

- 其他材料類型

- 軟質塑膠

- 聚乙烯(PE)

- 雙軸延伸聚丙烯(BOPP)

- 流延聚丙烯(CPP)

- 其他材料類型

- 硬質塑膠

- 按包裝類型

- 硬質塑膠包裝

- 瓶子和罐子

- 瓶蓋和封口

- 托盤和泡殼

- 其他產品類型

- 軟質塑膠包裝

- 小袋

- 包包

- 薄膜和包裝

- 其他產品類型

- 硬質塑膠包裝

- 按最終用途行業分類

- 食物

- 飲料

- 製藥

- 化妝品和個人護理

- 家用和工業化學品

- 寵物食品和動物護理

- 其他終端用戶產業

- 透過包裝技術

- 射出成型

- 吹塑成型

- 擠壓

- 熱成型

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor plc

- Sealed Air Corp.

- Sonoco Products Co.

- Sigma Plastics Group Inc.

- ProAmpac LLC

- Constantia Flexibles

- Alpha Packaging Inc.

- Centor Inc.(Gerresheimer)

- Silgan Holdings Inc.

- Bericap Holdings

- Plastipak Holdings Inc.

- Coveris Holdings SA

- Printpack Inc.

- AptarGroup Inc.

- Pactiv Evergreen Inc.

- Novolex Holdings LLC

- Sabert Corp.

- Genpak LLC

- Mondi plc

第7章 市場機會與未來展望

The United States plastic packaging market size is 29.97 million tonnes in 2025 and is projected to reach 35.29 million tonnes by 2030, exhibiting a 3.32% CAGR.

Demand resilience comes from e-commerce parcel expansion, food and beverage convenience formats, and brand owner commitments to integrate 25% post-consumer recycled (PCR) resin into core stock-keeping units. Regulatory frameworks such as California SB 54 and Washington State's recycled-content law are accelerating design shifts toward lighter gauges, mono-material laminates, and tethered closures. Adoption of FDA-cleared rPET, rHDPE, and rLLDPE has begun closing the feed-stock gap, while robotics installations-1,646 new units added by plastics molders in 2023-are streamlining throughput and raising quality yields within the United States plastic packaging market.

US Plastic Packaging Market Trends and Insights

Rapid Adoption of Recyclable Mono-Material Pouches by US CPG Brands

Mono-material polyethylene and polypropylene laminates are replacing mixed-substrate films that once obstructed recycling streams. Converters now deliver heat-resistant, high-barrier pouches that comply with the U.S. Plastics Pact 2025 design targets, giving brand owners a straightforward route to "recycle-ready" claims. DNP Indonesia's commercial roll-out of mono-material snack and pet-food packs demonstrates how barrier performance can be maintained while simplifying end-of-life processing. Retailers request specification parity with legacy foil structures, and test data confirm comparable oxygen-transmission rates, enabling broad SKU conversion. Packaging teams within the United States plastic packaging market are synchronizing material down-gauging with roll-stock width optimization to shrink film consumption per unit.

Surging E-Commerce Demand for Lightweight Protective Mailers in the US Parcel Network

Parcel shippers continue to eliminate unnecessary void fill, driving interest in thin-gauge, curbside-recyclable mailers that cut dimensional-weight fees while preserving product integrity. Amazon has shifted one-third of its U.S. outbound parcels to paper-based alternatives, eliminating 15 billion plastic air pillows since program inception. The company's pilot plants validate line speeds exceeding 250 parcels per minute, setting new benchmarks for automation. Competitors are matching performance with mono-material LDPE bubble mailers containing 30% PCR, as mandated by Washington's recycled-content law. Converters positioned within the United States plastic packaging market are investing in high-output blown-film towers and automated wicketing to address the spike in daily parcel volumes.

Escalating State-Level Single-Use Plastics Bans Reducing Certain Packaging Formats

California SB 54 mandates a 25% reduction in virgin plastic packaging sold within state borders by 2032, and producers must join a Producer Responsibility Organization by 2025. Similar mandates in New Jersey, Colorado, and Maine create a fragmented compliance map that raises complexity for nationwide brands. Converters are pre-emptively retiring PS clamshells and PVC blisters from their catalogs, turning to PET G and coated paperboard alternatives even when cost of goods rises. The regulatory uncertainty embeds risk premiums into long-term supply contracts, curbing discretionary capital spend within the United States plastic packaging market as firms await harmonized federal guidelines.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Ready-to-Eat and On-the-Go Foods Requiring High-Barrier Flexible Films

- Corporate Commitments to 25% PCR Content Boosting Demand for rPET and rHDPE Bottles

- Consumer Shift Toward Paper and Aluminum Alternatives for Sustainability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible formats delivered 54.14% of United States plastic packaging market share in 2024 and are marching ahead at a 4.98% CAGR. Each new pouch replaces rigid counterparts with 60-70% less polymer, reducing freight emissions and warehouse footprints. E-commerce giants favor flat mailers because they collapse to one-tenth the inbound cube of corrugated boxes, slashing storage overhead. Brands now employ near-infrared (NIR) readable inks so flexibles sort efficiently at material-recovery facilities, improving real recycling rates. Meanwhile, "smart" pouches embed RFID or NFC tags, providing end-to-end visibility from filler to consumer scanning events.

Rigid plastics still account for essential roles in beverages, pharmaceuticals, and household chemicals, yet growth lags at 2.1% CAGR. Lightweight HDPE bottles use up to 12% less resin than 2023 designs, but performance thresholds on drop strength and taste neutrality limit further down-gauging. Washington State's recycled-content law compels bottle makers to secure stable rHDPE streams, prompting co-investment in in-house wash lines. Competition within the United States plastic packaging market now revolves around tethered caps that comply with forthcoming closure-retention mandates, merging convenience and litter reduction.

Polyethylene retained a 45.54% share of flexible volumes in 2024, supported by its broad processing window and robust curbside collection infrastructure. FDA approval for 100% rLLDPE content in snack wrappers confirms food-safety compliance pathways, allowing national retailers to launch "circular" private labels. Development teams adopt metallocene catalysts that provide higher dart impact at reduced gauge, contributing to resin savings of 8-10%. The United States plastic packaging market size for PE-based flexibles will continue scaling as co-extrusion technology accommodates recycled pellet variability without compromising film clarity.

The "other materials" category advances 6.34% CAGR, propelled by compostable PLA blends, cellulose-based films, and silicium-oxide coated papers. Consumer brands experiment with bio-PE derived from sugarcane that offers equivalent mechanical properties and a lower carbon footprint. BOPP remains indispensable for glossy snack and confectionery overwraps, yet new varnish systems deliver metallization-free barrier performance aligned with mono-material recycling guidelines. Partnerships between resin suppliers and film converters accelerate qualification cycles, shortening time-to-market for emerging formulations.

The United States Plastic Packaging Market is Segmented by Material Type ((Rigid Plastic(Polyethylene (PE), Polypropylene (PP) and More) Flexible Plastic (Polyethylene (PE), Biaxially Oriented Polypropylene (BOPP) and More)), Packaging Type (Rigid Plastic Packaging, Flexible Plastic Packaging), End-Use Industry (Food, Beverage, Pharmaceutical, and More) and Packaging Technology (Extrusion, Thermoforming, and More)

List of Companies Covered in this Report:

- Amcor plc

- Sealed Air Corp.

- Sonoco Products Co.

- Sigma Plastics Group Inc.

- ProAmpac LLC

- Constantia Flexibles

- Alpha Packaging Inc.

- Centor Inc. (Gerresheimer)

- Silgan Holdings Inc.

- Bericap Holdings

- Plastipak Holdings Inc.

- Coveris Holdings SA

- Printpack Inc.

- AptarGroup Inc.

- Pactiv Evergreen Inc.

- Novolex Holdings LLC

- Sabert Corp.

- Genpak LLC

- Mondi plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging E-commerce Demand for Lightweight Protective Mailers in US Parcel Network

- 4.2.2 Rapid Adoption of Recyclable Mono-Material Pouches by US CPG Brands Post-2025 Plastics Pact Targets

- 4.2.3 Growth of Ready-to-Eat and On-the-Go Foods Requiring High-Barrier Flexible Films

- 4.2.4 Pharmaceutical Cold-Chain Expansion Driving Specialty Rigid Containers and Blister Films

- 4.2.5 Corporate Commitments to 25 % PCR Content Boosting Demand for rPET and rHDPE Bottles

- 4.2.6 Investments in Advanced Digital Printing Enabling Short-Run Customization for SME Brands

- 4.3 Market Restraints

- 4.3.1 Escalating State-Level Single-Use Plastics Bans Reducing Certain Packaging Formats

- 4.3.2 Volatility in Polyolefin Resin Prices Linked to Shale Gas Feedstock Swings

- 4.3.3 Consumer Shift Toward Paper and Aluminum Alternatives for Sustainability

- 4.3.4 Capital Intensity of Chemical Recycling Infrastructure Limiting rPlastics Supply

- 4.4 Supply-Chain Analysis

- 4.5 Trade Scenario Analysis (under relevant HS codes)

- 4.6 Current Recycling Trends in United States

- 4.7 Regulatory Outlook

- 4.8 Technological Outlook

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Threat of New Entrants

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Bargaining Power of Suppliers

- 4.9.4 Threat of Substitute Products

- 4.9.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Material Type

- 5.1.1 Rigid Plastic

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Polypropylene (PP)

- 5.1.1.3 Polyethylene Terephthalate (PET)

- 5.1.1.4 Polyvinyl Chloride (PVC)

- 5.1.1.5 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.1.1.6 Other Material Types

- 5.1.2 Flexible Plastic

- 5.1.2.1 Polyethylene (PE)

- 5.1.2.2 Biaxially Oriented Polypropylene (BOPP)

- 5.1.2.3 Cast Polypropylene (CPP)

- 5.1.2.4 Other Material Types

- 5.1.1 Rigid Plastic

- 5.2 By Packaging Type

- 5.2.1 Rigid Plastic Packaging

- 5.2.1.1 Bottles and Jars

- 5.2.1.2 Caps and Closures

- 5.2.1.3 Trays and Clamshells

- 5.2.1.4 Other Product Types

- 5.2.2 Flexible Plastic Packaging

- 5.2.2.1 Pouches

- 5.2.2.2 Bags

- 5.2.2.3 Films and Wraps

- 5.2.2.4 Other Product Types

- 5.2.1 Rigid Plastic Packaging

- 5.3 By End-use Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Pharmaceutical

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Home and Industrial Chemicals

- 5.3.6 Pet Food and Animal Care

- 5.3.7 Other End-use Industry

- 5.4 By Packaging Technology

- 5.4.1 Injection Molding

- 5.4.2 Blow Molding

- 5.4.3 Extrusion

- 5.4.4 Thermoforming

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Amcor plc

- 6.4.2 Sealed Air Corp.

- 6.4.3 Sonoco Products Co.

- 6.4.4 Sigma Plastics Group Inc.

- 6.4.5 ProAmpac LLC

- 6.4.6 Constantia Flexibles

- 6.4.7 Alpha Packaging Inc.

- 6.4.8 Centor Inc. (Gerresheimer)

- 6.4.9 Silgan Holdings Inc.

- 6.4.10 Bericap Holdings

- 6.4.11 Plastipak Holdings Inc.

- 6.4.12 Coveris Holdings SA

- 6.4.13 Printpack Inc.

- 6.4.14 AptarGroup Inc.

- 6.4.15 Pactiv Evergreen Inc.

- 6.4.16 Novolex Holdings LLC

- 6.4.17 Sabert Corp.

- 6.4.18 Genpak LLC

- 6.4.19 Mondi plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment