|

市場調查報告書

商品編碼

1628806

智慧燃氣:市場佔有率分析、產業趨勢、成長預測(2025-2030)Smart Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

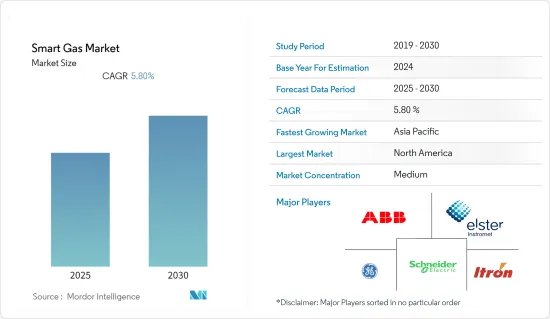

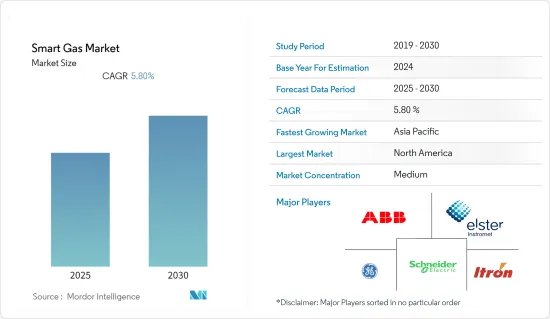

智慧燃氣市場預計在預測期內複合年成長率為 5.8%

主要亮點

- 減少能源損失和加強能源安全的日益成長的需求被認為是市場成長的關鍵驅動力。由於最終用戶數量不斷增加,在這個市場上驗證無詐欺資料仍然很困難。

- 許多地區不斷提高的天然氣滲透率和製定的眾多監管政策應被視為市場的成長機會。最近,歐洲推出了許多智慧燃氣表來為消費者省錢。

- 然而,與智慧型系統相關的安裝成本的增加預計將限制市場的成長。智慧型系統比大多數服務供應商和使用者安裝的標準設備相對昂貴。這些系統使用數位組件和連接系統進行操作和資料傳輸,增加了儀器、感測器和分析儀等解決方案的成本。

- 此外,與實施智慧燃氣解決方案相關的整合挑戰阻礙了這些系統的採用。這些系統必須支援整合到現有環境中。

- 新冠肺炎 (COVID-19) 疫情後,歐洲、北美和亞太地區住宅、商業和工業用途的智慧燃氣成長強勁。預計在預測期內將進一步擴大。

智慧燃氣市場趨勢

商業和工業應用顯著增加

- 智慧燃氣市場的商業最終用戶是小型企業,需要類似住宅的燃氣消耗流量和壓力。天然氣價格可能會根據商業空間的位置和可用性而有所不同。

- 商務用燃氣的成本通常高於住宅使用的成本,這進一步增加了企業採用智慧燃氣表等智慧燃氣解決方案的興趣。商業公司也在推動採用,智慧電錶非常位置安裝在通訊和網路基礎設施較好的地區。

- 工業通常消費量大量天然氣,其用途不同於發電,因為它是製造過程中不可或缺的一部分。化工廠、化肥廠等工業以天然氣為核心生產原料。

- 這些產業中的監控和控制功能是透過PLC和SCADA介面功能存在的。隨著各行業逐步邁向工業5.0和物聯網的不斷發展,智慧燃氣市場預計在預測期內將出現正成長。能源成本和天然氣消費量高的產業應該是這個市場的早期採用者。

- 英國商業、能源和工業戰略部的數據顯示,2021 年,主要能源供應商在英國各地的非住宅建築中安裝了 4,500 個智慧燃氣表,與前一年同期比較成長約 162%。

歐洲預計將佔很大佔有率

- 由於各種監管政策導致智慧燃氣市場的積極發展,預計歐洲在預測期內將顯著成長。由於在現有基礎設施的支持下同時推出電錶,英國目前在歐洲擁有最大的單一國家佔有率。

- 據歐盟委員會稱,到2024年,歐洲將安裝約2.25億個智慧電錶和5,100萬個燃氣智慧表,潛在投資為470億歐元(5.02億歐元)。

- 歐盟委員會也預測,到 2024 年,近 77% 的歐洲消費者將擁有智慧電錶。歐盟委員會也預測,到 2024 年,約 77% 的歐洲消費者將擁有智慧電錶。

- 此外,根據英國商業、能源和工業戰略部的數據,2021 年,主要電力和天然氣供應商為英國住宅用戶安裝了約 340 萬個智慧電錶。其中,安裝電力智慧表約202萬個,瓦斯智慧表安裝約142萬個,比上年增加約16%。因此,這些因素正在推動該地區的智慧燃氣市場。

智慧燃氣產業概況

智慧燃氣市場競爭溫和,有幾家主要公司進入該市場。從市場佔有率來看,目前少數大公司佔據市場主導地位。然而,全行業分析的進步導致新參與企業增加了他們在市場中的存在,從而擴大了企業發展。

- 2022 年 6 月 - ABB 印度公司宣布將實現 THINK Gas 網路的業務自動化,THINK Gas 是印度城市燃氣發行業務中發展最快的公司之一。此外,該公司表示,它提供的數位解決方案可以最大限度地提高龐大城市燃氣網路的效率、可用性和可靠性。在分散式位置合併多個遠端終端。

- 2022 年 1 月 - Itron, Inc. 獲得加拿大測量部的型式核准,確保其 Intelis 家用超音波燃氣表符合加拿大超音波表 PS-G-06 臨時規範。據該公司稱,這是第一款獲得加拿大測量局核准的內置截止閥的超音波燃氣表。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 有利的政府法規

- 減少碳足跡和能源安全的需要

- 市場限制因素

- 由於用戶數量增加導致資料不規則

- 高資金投入

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按設備

- 自動抄表(AMR)電錶

- 高級儀器基礎設施 (AMI) 儀表

- 燃氣表通訊模組

- 按解決方案

- 監控/資料採集 (SCADA)

- 地理資訊系統(GIS)

- 企業資產管理(EAM)

- 行動工作人員管理 (MWM)

- 儀表資料分析

- 氣體洩漏檢測

- 儀表資料管理 (MDM)

- 按服務

- 系統整合

- 專案管理

- 安裝

- 按最終用戶

- 住宅

- 商業/工業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- ABB Ltd.

- Elster Group GmbH

- General Electric Company

- Itron, Inc.

- Schneider Electric SE

- Oracle Corporation

- Sensus

- CGI Inc.

- Aclara Technologies LLC

- Aidon Oy

- Capgemini SA

- Badger Meter

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 54806

The Smart Gas Market is expected to register a CAGR of 5.8% during the forecast period.

Key Highlights

- The increasing need to reduce energy losses and increase energy security are considered significant drivers for the market's growth. Due to the growing number of end-users, collating the data with no irregularities stays challenging in this market.

- Grown gas adoption and numerous regulatory policies rolled out in many areas should be perceived as a growth opportunity for the market. Recently, the EU rolled out many smart gas meters for consumers to save usage expenses for them.

- However, the increased installation costs associated with smart systems are predicted to restrain the market growth. Smart systems are comparatively more costly than the standard equipment installed by most service providers and users. Since these systems use digital components and connectivity systems, allowing them to operate and transmit data, hence, increasing the expense of the solutions like the metering equipment, sensors, analyzers, etc.

- Also, integration challenges involved with deploying smart gas solutions are restraining the adoption of these systems. These systems need help in integration into the existing environments.

- There is a significant growth of smart gas post-COVID-19 in Europe, North America, and Asia Pacific regions for domestic, commercial, and industrial purposes. It is expected to see more over the forecasted period.

Smart Gas Market Trends

The Commercial and Industrial Application to Increase Significantly

- The commercial end-users in the smart gas market are small businesses whose gas consumption requires gas flows and pressure similar to that of the residential segment. The prices for the gases might vary according to the location of the commercial spaces and their availability.

- The cost of the gases for commercial use is generally higher than that for domestic use, further motivating businesses to adopt smart gas solutions like smart gas meters. Commercial enterprises also support the adoption, preferably located in areas with better communication and network infrastructure suitable for smart meter installation.

- Industries generally have a high gas consumption volume, where the applications may vary from their power generation uses and are an essential component for the manufacturing processes. Industries, such as chemical and fertilizer plants, have gases used as core raw materials for production.

- Monitoring and control features in these industries are present through PLC and SCADA interface features. With the sectors slowly transitioning toward industry 5.0 and increasing IoT, the smart gas market is expected to have a positive growth over the forecast period. Industries with high energy costs and gas consumption are supposed to be the early adopters in the market.

- According to UK Department for Business, Energy and Industrial Strategy, the giant energy suppliers had 4.5 thousand smart gas meters installed in non-residential buildings around Great Britain in 2021, which shows an increase of roughly 162 % compared to the previous year.

Europe Expected to Hold a Significant Share

- Europe is expected to show significant growth during the forecast period, owing to the various regulatory policies that led to the positive development of the smart gas market. The United Kingdom currently accounts for the most significant single country share in Europe due to the simultaneous roll-out of energy meters supported by current infrastructure.

- According to the European Commission, around 225 million smart meters for electricity and about 51 million meters for gas will be rolled out in the EU by 2024, representing a potential investment of EUR 47 billion( USD 50.2 billion).

- In addition, the European Commission also stated that by 2024, it is expected that almost 77% of European consumers will have a smart meter for electricity. About 44% of the consumers will have one for gas.

- Moreover, according to UK Department for Business, Energy and Industrial Strategy, in 2021, significant electricity and gas suppliers installed around 3.4 million smart meters for residential users in Great Britain. Out of which, approximately 2.02 million smart electricity meters and about 1.42 million smart gas meters were installed, an increase of roughly 16% compared to the previous year. Therefore such factors are driving the market for smart gas in the region.

Smart Gas Industry Overview

The Smart Gas Market is moderately competitive and includes several significant players. Regarding market share, some of the major players currently dominate the market. However, with the advancement in analytics across the industry, new players are increasing their market presence, thereby expanding their business footprint across emerging economies.

- June 2022 - ABB India announced the company would automate operations across THINK Gas's entire network, which is one of India's fastest-growing companies in the city gas distribution business. In addition, the company stated it would deliver a digital solution to maximize its expansive city gas network's efficiency, availability, and reliability. It will incorporate multiple remote terminals across distributed locations.

- January 2022 - Itron, Inc. announced that the company's Intelis residential ultrasonic gas meter had received type approval from Measurement Canada, assuring it complies with PS-G-06 provisional specifications for ultrasonic meters in Canada. As the company states, it is the first ultrasonic gas meter with an internal shutoff valve approved by Measurement Canada.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Favorable Government Regulations

- 4.2.2 Need for Reduction Carbon Footprint and Energy Security

- 4.3 Market Restraints

- 4.3.1 Irregularities in Data Due to Increased Number of Users

- 4.3.2 High Capital Expenditure

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Devices

- 5.1.1 Automatic Meter Reading (AMR) Meters

- 5.1.2 Advanced Metering Infrastructure (AMI) Meters

- 5.1.3 Gas Meter Communication Modules

- 5.2 By Solutions

- 5.2.1 Supervisory Control and Data Acquisition (SCADA)

- 5.2.2 Geographical Information System (GIS)

- 5.2.3 Enterprise Asset Management (EAM)

- 5.2.4 Mobile Workforce Management (MWM)

- 5.2.5 Meter Data Analytics

- 5.2.6 Gas Leak Detection

- 5.2.7 Meter Data Management (MDM)

- 5.3 By Services

- 5.3.1 System Integration

- 5.3.2 Program Management

- 5.3.3 Installation

- 5.4 By End-user

- 5.4.1 Residential

- 5.4.2 Commercial & Industrial

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle-East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd.

- 6.1.2 Elster Group GmbH

- 6.1.3 General Electric Company

- 6.1.4 Itron, Inc.

- 6.1.5 Schneider Electric SE

- 6.1.6 Oracle Corporation

- 6.1.7 Sensus

- 6.1.8 CGI Inc.

- 6.1.9 Aclara Technologies LLC

- 6.1.10 Aidon Oy

- 6.1.11 Capgemini SA

- 6.1.12 Badger Meter

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219