|

市場調查報告書

商品編碼

1628826

亞太地區機器視覺系統:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)APAC Machine Vision Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

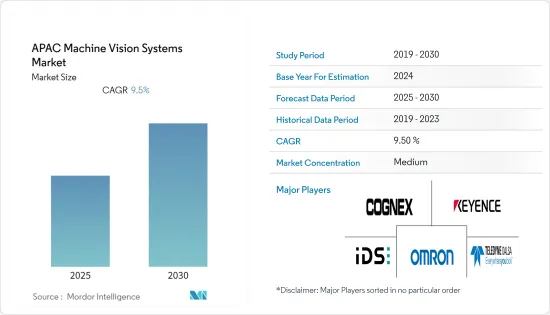

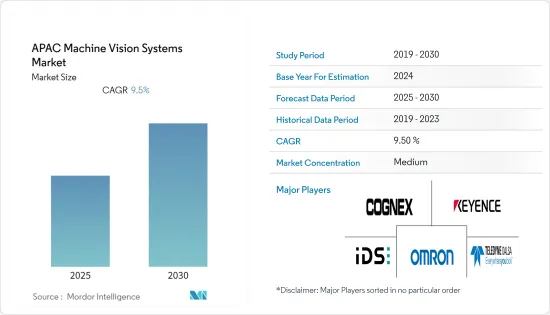

亞太地區機器視覺系統市場預計在預測期內複合年成長率為 9.5%

主要亮點

- 對自動化和工業 4.0 技術的投資增加、對安全和檢查視覺系統不斷成長的需求以及高產品創新率是推動亞太地區機器視覺系統市場成長的關鍵因素。機器視覺應用(例如用於惡劣環境中即時檢查和分級操作的存在檢測)正在成為許多行業的常態。最近的COVID-19進一步擴大了這些應用的範圍。

- 在過去的一年裡,2D機器視覺系統在全部區域獲得了廣泛的應用。然而,由於諸多限制,許多最終用戶產業已經採用了3D系統。OMRON等市場供應商擴大投資於 3D 機器視覺系統的開發。

- 此外,工業4.0帶動了機器人等在工業自動化中發揮關鍵作用的技術的發展,工業中的許多核心業務都由機器人來管理。 3D機器視覺也支援視覺引導機器人和自動屠宰等新應用。這些視覺引導機器人是 2D 和 3D 相機的組合。

- 人工智慧驅動的機器視覺正在重塑整個產業,從機器人和零售到醫療保健和製造。企業正在從整合影像感測器模組、電纜和GPU模組的AI視覺解決方案轉向可立即開發的邊緣AI智慧相機視覺系統,這減少了軟體和硬體整合工作,使AI視覺開發人員可以專注於應用開發。

亞太地區機器視覺系統市場趨勢

智慧相機基數可望大幅成長

- 由於許多最終用戶行業的高產品創新率和現有應用的增強,基於智慧攝影機的產品在業界越來越受歡迎。智慧相機也有助於機器視覺系統的設計。近年來,該領域不斷創新,包括具有更大影像感測器的模型、充當智慧相機的新興嵌入式視覺相機以及能夠執行深度學習和人工智慧任務的新型相機。

- 市場正在見證智慧相機中影像感測器解析度的提高、更快的處理器的整合、具有MIPI 介面的嵌入式視覺相機以及彩色和單色選項的可用性等創新,特別是在COVID-19 疫情爆發後,這些創新越來越受歡迎。

- 進一步的技術創新正在推動該地區的發展。例如,2021年5月,台灣邊緣運算公司凌華科技推出了採用NVIDIA全新Jetson Xavier NX模組的NEON-2000-JNX系列工業AI智慧相機。這款新型相機的高性能、小外形規格和易於開發的特點為製造、物流、零售、酒店、農業、智慧城市、醫療保健、生命科學和其他邊緣應用中的創新人工智慧視覺解決方案鋪平了道路。

- 按地區分類,由於亞太地區在全球製造業市場中佔據主導地位,並且該地區製造業和工業部門對自動化技術的投資不斷增加,預計包括智慧相機在內的機器視覺系統市場將出現強勁成長。

中國正在實現令人矚目的成長

- 由於自動化和機器人技術,中國正迅速成為機器視覺的主要市場之一。中國機器視覺產業採用了新的術語標準。此外,中國機器視覺產業聯盟(CMVU)於2020年8月公佈了《工業數位相機術語》和《工業相機鏡頭術語》標準。

- 在軟體領域顯示出巨大成長潛力的同時,研究市場的硬體領域也隨著感測器和半導體的整體發展而發展。像SONY這樣的公司在全球 CMOS 影像感測器創新以及製造自動化應用領域處於主導。

- 全國各地的製造公司都在認知到機器視覺系統的優勢,尤其是在需要準確執行檢查等冗餘任務時。它們在高速生產線和危險環境中發揮著重要作用。這些系統的顯著優勢包括提高生產率、減少機器停機時間以及更嚴格的製程控制。

- 此外,視覺引導機器人可望在電子、汽車、運輸和食品加工產業等領域取得根本性進展。由於電弧焊接、切割和碼垛應用的高需求,3D視覺引導技術主要在這些行業中佔據主導地位。

亞太地區機器視覺系統產業概況

亞太地區機器視覺系統市場競爭溫和。產品探索、研發、聯盟和收購是該地區公司為保持競爭力而採取的關鍵成長策略。

- 2021 年 8 月 - Keyence Corporation 推出 XG-X 系列可自訂視覺系統,該系統具有先進的編程介面,具有 3D 和線掃描功能,可實現高品質、高速檢測和控制。 XG-X系列透過高速、高解析度相機實現高精度偵測,為各種製造問題提供穩健的解決方案。

- 2021 年 1 月 - 康耐視公司宣布推出 In-Sight 3D-L4000 嵌入式影像處理系統。這款智慧相機配備3D雷射位移技術,使工程師能夠快速、有效且經濟高效地解決自動化生產線中的各種檢查和測試。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 對智慧工廠的需求不斷增加

- 對精確缺陷檢測的需求不斷成長

- 市場挑戰

- 實施 MV 系統的複雜性

第6章 市場細分

- 按成分

- 硬體

- 視覺系統

- 相機

- 光學和照明系統

- 影像擷取卡

- 其他硬體

- 軟體

- 硬體

- 依產品

- 基於PC

- 智慧型相機底座

- 按最終用戶產業

- 飲食

- 醫療保健/製藥

- 物流/零售

- 汽車工業

- 電子/半導體

- 其他最終用戶產業

- 國家名稱

- 中國

- 印度

- 日本

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Cognex Corporation

- Keyence Corporation

- Omron Corporation

- Basler AG

- National Instruments Corporation

- Teledyne DALSA

- Datalogic SpA

- Perceptron Inc

- Uss Vision Inc

- IDS Imaging Development Systems GmbH

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 55095

The APAC Machine Vision Systems Market is expected to register a CAGR of 9.5% during the forecast period.

Key Highlights

- The growing investment in automation and Industry 4.0 technologies, increasing need for safety and inspection vision systems, and high rate of product innovation are significant factors driving the growth of the Asia Pacific machine vision systems market. Machine vision applications like presence detection to real-time inspection and grading tasks in harsh environments are becoming standard across many industries. The recent COVID-19 has further expanded the scope of these applications.

- Over the year, the 2D machine vision system has gained significant application across the region. However, due to many limitations, many end-user industries are embracing 3D systems. Market vendors like OMRON are increasingly investing in the development of 3D machine vision systems.

- Further, Industry 4.0 fueled the development of technologies like robots playing a crucial role in industrial automation, with many core operations in industries being managed by robots. Also, 3D machine vision supports new applications, such as vision-guided robotics and automated butchering. These vision-guided robots are a combination of 2D and 3D cameras.

- Also, AI-powered machine vision is reshaping entire industries ranging from robotics and retail to healthcare and manufacturing. Companies are shifting from an AI vision solution, integrated image sensor module, cables, and GPU modules, to a ready-to-develop edge AI smart camera vision system, which reduces the effort of software and hardware integration, allowing AI vision developers to focus on application development.

APAC Machine Vision Systems Market Trends

Smart Camera-based Expected to Witness Significant Growth

- Smart camera-based products are gaining popularity in industries due to the high rate of product innovation and expansion of existing applications in many end-user industries. Also, Smart cameras have long eased the task of machine vision system design. The segment has witnessed continuous innovation in recent years, including models with larger image sensors, emerging embedded vision cameras that function as smart cameras, and new cameras capable of performing deep learning and AI tasks.

- The market witnessed innovations like image sensor resolution in smart cameras has increased, integrating much faster processors or embedded vision cameras with MIPI interfaces, and availability in color and monochrome options are increasingly witnessing in the market, which is also gaining popularity especially after the COVID-19 outbreak.

- Further innovations are driving the region. For instance, In May 2021, Taiwan-based edge computing company ADLINK Technology Inc launched the NEON-2000-JNX series, the industrial AI smart camera that incorporates NVIDIA's new Jetson Xavier NX module. The high performance, small form factor, and ease of development of the new camera pave the way for innovative AI vision solutions in manufacturing, logistics, retail, service, agriculture, smart cities, healthcare and life sciences, and other edge applications.

- Geographically, the Asia-Pacific region is expected to record significant growth in the machine vision systems market that includes smart cameras due to dominance in the global manufacturing market and growing investment in automation technologies in the regional manufacturing and industrial sectors.

China to Witness Significant Growth

- China is rapidly becoming one of the significant markets for machine vision owing to automation and robotics. In China's machine vision industry, new terminology standards have been adopted. Also, The Chinese 'Machine Vision Industry Union' (CMVU) published the standard 'Terminology for Industrial Digital Cameras' and 'Terminology for Industrial Camera Lenses' in August 2020.

- Although the software segment is showing significant growth potential, the growing development in the overall sensor and semiconductor is also bringing development in the hardware section of the studied market. Companies like Sony are leading innovation in CMOS image sensors globally, even for manufacturing automation applications.

- Manufacturing firms across the country realize the benefits of machine vision systems, mainly where redundant tasks, like inspection, should be performed with precision. These play an essential role in high-speed production lines and hazardous environments. Some of the significant benefits offered by these systems include increased productivity, reduced machine downtime, and tighter process control.

- Further, Vision-guided robots are expected to evolve radically in the region, including electronics, automotive, transportation, and food processing industries. The 3D vision-guided technology mainly dominates these industries due to the massive demand for arc welding, cutting, and palletizing applications.

APAC Machine Vision Systems Industry Overview

The Asia Pacific Machine Vision Systems Market is moderately competitive in nature. Product launches, high expense on research and development, partnerships, and acquisitions are the prime growth strategies adopted by the companies in the region to sustain the intense competition.

- August 2021 - Keyence Corporation introduced a customizable vision system XG-X series Advanced programming interface with 3D and linescan capabilities for high-quality, high-speed inspection and control. The XG-X Series provides high-speed, high-resolution cameras for high-accuracy inspection, providing robust solutions to a wide range of manufacturing problems.

- January 2021 - Cognex Corporation announced In-Sight 3D-L4000 embedded vision system. The smart camera, which features 3D laser displacement technology, enables engineers to quickly, effectively, and cost-effectively solve a variety of inspections and testing on automated production lines.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Smart Factories

- 5.1.2 Rising Demand for Accurate Defect Detection

- 5.2 Market Challenges

- 5.2.1 Complications in the Implementation of Mv Systems

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Hardware

- 6.1.1.1 Vision Systems

- 6.1.1.2 Cameras

- 6.1.1.3 Optics and Illumination Systems

- 6.1.1.4 Frame Grabber

- 6.1.1.5 Other Types of Hardware

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 Product

- 6.2.1 PC-based

- 6.2.2 Smart Camera-based

- 6.3 End-User Industry

- 6.3.1 Food and Beverage

- 6.3.2 Healthcare and Pharmaceutical

- 6.3.3 Logistic and Retail

- 6.3.4 Automotive

- 6.3.5 Electronics and Semiconductors

- 6.3.6 Other End-User Industries

- 6.4 Country

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cognex Corporation

- 7.1.2 Keyence Corporation

- 7.1.3 Omron Corporation

- 7.1.4 Basler AG

- 7.1.5 National Instruments Corporation

- 7.1.6 Teledyne DALSA

- 7.1.7 Datalogic SpA

- 7.1.8 Perceptron Inc

- 7.1.9 Uss Vision Inc

- 7.1.10 IDS Imaging Development Systems GmbH

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219