|

市場調查報告書

商品編碼

1628831

亞太地區物聯網安全:市場佔有率分析、產業趨勢與成長預測(2025-2030)APAC IoT Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

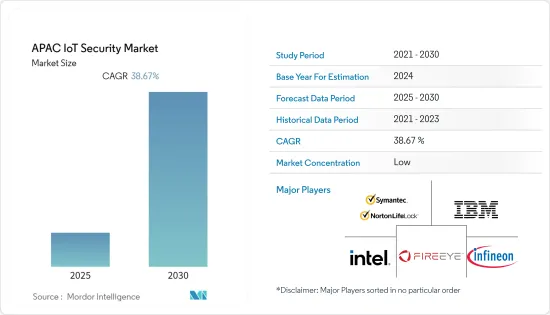

亞太物聯網安全市場預計在預測期內複合年成長率為 38.67%。

主要亮點

- 由於印度和中國等新興國家的生產成本較低,亞太地區已成為製造地,並且仍然是亞太地區物聯網安全市場的重要市場。投資計畫旨在提高成長品質、解決環境問題和化解產能過剩。該地區的汽車工業是世界上最大的汽車工業之一,預計未來五年將進一步成長。

- 印度是世界上成長最快的經濟體,產生足夠的能源是實現其發展雄心壯志以支持擴張的關鍵。該國被認為是新興工業化國家,是製造業的首選地點。印度在醫療藥品和產品的製造方面比許多國家要好得多。

- 網路攻擊者利用該地區 COVID-19 大流行造成的情況,瞄準醫院、醫療和製藥製造商以及其他企業等部門。根據IBM X-Force威脅情報指數的最新報告,亞洲去年針對金融和保險機構的攻擊數量最多,佔該產業所有攻擊的34%。

- 亞太地區是數位轉型和網路應用成長最快的地區之一,金融科技和電子商務快速成長,對網路和寬頻服務的需求不斷增加。儘管這種變化帶來了許多好處,並且在未來具有巨大的潛力,但它也為許多網路安全威脅打開了大門,從而推動了市場的成長。

- 該地區企業之間的連結性不斷增強,暴露了硬體和軟體環境中的漏洞,從而擴大了網路犯罪分子的攻擊面。這包括員工的小型個人物聯網設備,這些設備可以作為受到更嚴格保護的系統的後門。此外,一些國家正在製定資料保護和違規通知法。然而,整個亞太地區的網路安全監管仍處於發展的早期階段,往往主要關注關鍵基礎設施和受監管行業。

亞太物聯網安全市場趨勢

智慧城市與智慧家庭發展推動市場發展

政府對智慧城市、智慧建築和工業 4.0 計畫的興趣日益濃厚,推動了亞太地區對數位物聯網解決方案的需求,包括公共交通、電子政府、智慧交通管理系統和智慧電網。邊緣運算網路和物聯網系統的整合以及窄帶 (NB) 物聯網的部署,以及對 4G/LTE 和 5G 的投資增加、物聯網感測器成本的降低以及政府的支持正在推動該地區的市場成長。

- 5G 預計將加速該地區智慧家居物聯網設備的採用。中國移動國際(CMI)等公司在全球數位基礎設施方面處於領先地位,覆蓋70多個國際光纜,包括各種專有海底光纜和投資的地面光纜,網路總容量超過98Terabit每秒。向5G 過渡。我們在各大洲也持有超過 180 個海外站點,在中國境內擁有 340 個資料中心,在中國境外主要地點擁有 4 個資料中心。

- 政府對智慧城市的投資幾乎佔該地區總支出的三分之一,其次是物流、運輸和製造業。該地區各國政府正在推動「智慧城市」的實施。據新加坡政府科技局稱,去年,新加坡政府將 13% 的 ICT 支出用於加速人工智慧 (AI) 在公共部門的引入和部署,70% 用於數位服務的轉型和整合。合理化。去年的ICT支出計畫為28億美元。

- 然而,智慧家庭環境中的各種物聯網設備,例如儀表、恆溫器和娛樂設備,都受到資源限制,因此無法實施標準化的安全解決方案。因此,智慧家庭目前很容易受到安全威脅。

此外,儲存和共用個人資訊的高科技智慧型裝置的興起對該地區人們的隱私構成了嚴重威脅。現有的隱私法沒有充分解決這個問題,這可能會減緩全部區域智慧家庭市場的成長。

中國市場巨大的成長機會

- 中國物聯網安全市場的關鍵成長要素是先進技術的高採用率、網路攻擊數量的增加以及國內連網設備數量的增加。該國是物聯網部署的主要地區之一。其他因素包括該地區數位化和物聯網安全支出的增加。

- 中國工業和資訊化部發布了物聯網安全標準體系建置指南。本指南旨在概述一個框架,促進物聯網標準的開發和實施以及減輕和預防公共網路安全風險。工信部製定了一系列標準要求,包括軟體安全、存取認證、資料安全等。

- 中國移動國際 (CMI) 等公司也在建立一個生態系統,幫助產業合作夥伴利用蓬勃發展的智慧解決方案市場,最初的重點是改善消費者的智慧家庭體驗。 CMI 開發並提供國際資訊服務和解決方案,這些服務和解決方案是物聯網在主要市場快速成長的基礎。截至去年10月,CMI為20個國家和地區的100多家公司提供物聯網解決方案,主要集中在亞太地區。這將促進物聯網連接和 eSIM 平台的整合,以增強全球物聯網網路能力。

- 去年9月,中國政府通知企業加強對聯網汽車網路資料安全的監控。工業信部表示,要求企業建立資料安全管理體系,定期評估網路攻擊風險。

亞太物聯網安全產業概況

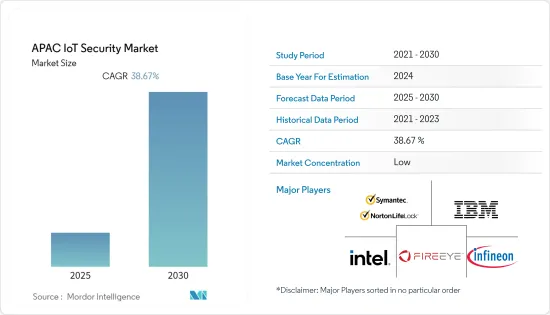

亞太物聯網安全市場由賽門鐵克公司、IBM公司、FireEye公司、英特爾公司和英飛凌科技公司等幾家主要參與者以及各種知名國際品牌、國內品牌和新參與企業組成。一些大公司越來越希望透過策略併購、技術創新和增加研發投入來擴大市場。

2022年11月,TrueVisor宣布與安全AI主導的混合雲端威脅偵測和回應解決方案供應商Vectra AI建立合作關係。 Vectra 的平台和服務包括公共雲端、SaaS 應用程式、身分識別系統以及本地和雲端基礎的網路基礎架構。此次合作將使該公司能夠透過 Truvisor 在新加坡、印尼和泰國的經銷商銷售其產品和服務。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 資料外洩增加

- 智慧城市的出現

- 市場限制因素

- 設備間的複雜性和缺乏普遍的立法

第6章 市場細分

- 按安全類型

- 網路安全

- 端點安全

- 應用程式安全

- 雲端安全

- 其他安全

- 按解決方案

- 身分和存取管理 (IAM)

- 入侵防禦系統(IPS)

- 資料遺失保護 (DLP)

- 統一威脅管理 (UTM)

- 安全與漏洞管理 (SVM)

- 網路安全取證 (NSF)

- 其他解決方案

- 按申請

- 家庭自動化

- 穿戴式的

- 製造流程管理

- 病患資訊管理

- 供應鏈運作

- 客戶資訊安全

- 其他應用

- 按最終用戶產業

- 衛生保健

- 製造業

- 公共產業

- BFSI

- 零售

- 政府機構

- 其他行業

- 按地區

- 中國

- 印度

- 日本

- 其他國家

第7章 競爭狀況

- 公司簡介

- Symantec Corporation(NortonLifeLock Inc)

- IBM Corporation

- FireEye Inc.

- Intel Corporation

- Infineon Technologies

- Trend Micro Inc.

- Sophos Group PLC

- ARM Holdings PLC

- Wurldtech Security Technologies Inc.

- Gemalto NV

第8章投資分析

第9章 市場的未來

The APAC IoT Security Market is expected to register a CAGR of 38.67% during the forecast period.

Key Highlights

- The Asia-Pacific region has surfaced as a manufacturing hub, owing to the low production costs in emerging countries such as India and China, which remain a significant market in Asia Pacific's IoT security market. Investments are being planned for the quality of growth, addressing environmental concerns, and reducing overcapacity. The region's automotive industry has emerged as one of the world's largest and is expected to grow further over the next five years.

- India is the fastest-growing economy in the world, and generating enough energy is the key to achieving developmental ambitions that support expansion. The country is regarded as a newly industrialized landscape, becoming a preferred manufacturing hub. India is far superior to many nations in manufacturing medical drugs and products.

- Cyber attackers took advantage of the conditions created by the COVID-19 pandemic in the region and targeted sectors like hospitals, medical and pharmaceutical manufacturers, and other companies. According to the latest IBM X-Force Threat Intelligence Index report, Asia saw a high volume of attacks on finance and insurance organizations last year, accounting for 34% of all attacks on this industry.

- APAC is one of the fastest-growing regions in digital transformation and internet penetration and has experienced exponential growth in financial technology and e-commerce, resulting in a rising demand for Internet and broadband services. This change has brought many benefits and has a lot of potential for the future, but it has also opened the door to a large number of cybersecurity threats, which is driving the growth of the market.

- The rise in connectivity between companies in the region has exposed vulnerabilities in hardware and software environments, giving cybercriminals greater attack surfaces to exploit. This includes employees' smaller, personal IoT devices, which can provide a potential backdoor into more well-protected systems. Further, several countries have attempted to impose data protection and breach notification laws. However, as a whole, cybersecurity regulation in Asia-Pacific is still in the early phases of development and tends to focus mainly on critical infrastructure and regulated industries.

APAC IoT Security Market Trends

Emergence of Smart City and Smart Home Developments to Drive the Market Growth

Increasing government focus on smart cities, smart buildings, and Industry 4.0 initiatives is driving the demand for digital IoT solutions in the Asia-Pacific region, such as in public transportation, eGovernment, smart traffic management systems, and smart power grids. The integration of edge-computing networks with IoT systems and narrow-band (NB) IoT deployments, along with rising investments in 4G/LTE and 5G, reduced IoT sensor costs, and governmental support, are fueling the growth of the market in the region.

- 5G is expected to accelerate the adoption of smart home IoT devices in the region. Companies such as China Mobile International (CMI) are supporting the transition to 5G with a global digital infrastructure encompassing more than 70 international cables, including various self-built submarine cables and invested terrestrial cables, with a total network capacity of over 98 terabits per second. It also has more than 180 overseas points of presence on key continents, 340 data centers in China, and four data centers that it owns in key centers outside of China.

- Government investment in smart cities accounts for almost one-third of the region's combined spending, followed by logistics, transportation, and manufacturing. Various governments in the region are promoting the adoption of "smart cities." According to the Government Technology Agency, a statutory board of the Singapore government, in the last year, the Singapore government planned to spend 13% of their ICT spending on accelerating the adoption and deployment of Artificial Intelligence (AI) for the public sector and 70% on transforming, integrating, and streamlining digital services. The planned ICT spending for the last year was USD 2.8 billion.

- However, the resource-constrained nature of various IoT devices in a smart home environment, such as meters, thermostats, and entertainment units, does not permit the implementation of standardized security solutions. Therefore, smart homes are currently vulnerable to security threats.

Also, the rise of high-tech smart devices that store and share personal information poses a serious threat to people's privacy in the region. Existing privacy laws don't do enough to deal with this problem, which could slow the growth of the smart home market in the region as a whole.

China Witnesses Significant Growth Opportunities in the Market

- The significant factors for the growth of the IoT security market in China are the high adoption of advanced technologies, increasing cyberattacks, and a growing number of connected devices in the country. The country is one of the dominant regions for IoT deployment. Other factors include the growth of digitalization and IoT security spending in the region.

- The Chinese Ministry of Industry and Information Technology published guidelines for creating a security standard system for the Internet of Things. The guidance seeks to outline a framework that will promote public network security risk mitigation and prevention, along with developing and implementing standards for the IoT. MIIT has a list of standard requirements that includes things like software security, access authentication, and data security.

- Companies such as China Mobile International (CMI) are also building an ecosystem to help industry partners capitalize on the flourishing market for smart solutions, with an initial focus on elevating the smart home experience for consumers. CMI develops and delivers international data services and solutions that lay the foundation for the rapid growth of IoT across key markets. CMI has provided IoT solutions to over 100 enterprises in 20 countries and regions, primarily in Asia Pacific, as of October last year. This can promote IoT connectivity and eSIM platform integration, enhancing IoT network capabilities around the world.

- The Chinese government informed companies last September about increased cyber-data security oversight on connected vehicles. According to the Ministry of Industry and Information Technology, the companies were asked to establish data security management systems and regularly assess risks from network attacks.

APAC IoT Security Industry Overview

The Asia-Pacific Internet of Things (IoT) Security Market is fragmented with a few major players, such as Symantec Corporation, IBM Corporation, FireEye Inc., Intel Corporation, and Infineon Technologies, as well as various established international brands, domestic brands, and new entrants that form a competitive landscape. Some major players are increasingly seeking market expansion through strategic mergers and acquisitions, innovation, and increased investments in research and development.

In November 2022, Truvisor announced a partnership with Vectra AI, a security AI-driven hybrid cloud threat detection and response solution provider. The Vectra platform and services include public cloud, SaaS applications, identity systems, and on-premises and cloud-based network infrastructure. Through the partnership, the company would be able to sell its products and services through the resellers of Truvisor in Singapore, Indonesia, and Thailand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Data Breaches

- 5.1.2 Emergence of Smart Cities

- 5.2 Market Restraints

- 5.2.1 Growing Complexity among Devices, coupled with the Lack of Ubiquitous Legislation

6 MARKET SEGMENTATION

- 6.1 Type of Security

- 6.1.1 Network Security

- 6.1.2 Endpoint Security

- 6.1.3 Application Security

- 6.1.4 Cloud Security

- 6.1.5 Other types of security

- 6.2 Solutions

- 6.2.1 Identity Access Management (IAM)

- 6.2.2 Intrusion Prevention System (IPS)

- 6.2.3 Data Loss Protection (DLP)

- 6.2.4 Unified Threat Management (UTM)

- 6.2.5 Security & Vulnerability Management (SVM)

- 6.2.6 Network Security Forensics (NSF)

- 6.2.7 Other solutions

- 6.3 Applications

- 6.3.1 Home Automation

- 6.3.2 Wearables

- 6.3.3 Manufacturing Process Management

- 6.3.4 Patient Information Management

- 6.3.5 Supply Chain Operation

- 6.3.6 Customer Information Security

- 6.3.7 Other applications

- 6.4 End-User Verticals

- 6.4.1 Healthcare

- 6.4.2 Manufacturing

- 6.4.3 Utilities

- 6.4.4 BFSI

- 6.4.5 Retail

- 6.4.6 Government

- 6.4.7 Other end-user verticals

- 6.5 Geography

- 6.5.1 China

- 6.5.2 India

- 6.5.3 Japan

- 6.5.4 Other countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Symantec Corporation (NortonLifeLock Inc)

- 7.1.2 IBM Corporation

- 7.1.3 FireEye Inc.

- 7.1.4 Intel Corporation

- 7.1.5 Infineon Technologies

- 7.1.6 Trend Micro Inc.

- 7.1.7 Sophos Group PLC

- 7.1.8 ARM Holdings PLC

- 7.1.9 Wurldtech Security Technologies Inc.

- 7.1.10 Gemalto NV