|

市場調查報告書

商品編碼

1628851

亞太地區自動化物料輸送和儲存系統:市場佔有率分析、產業趨勢和成長預測(2025-2030)Asia Pacific Automated Material Handling And Storage Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

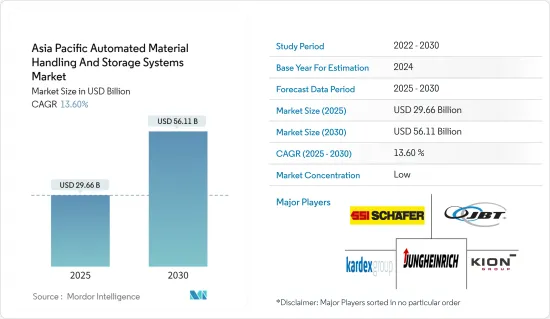

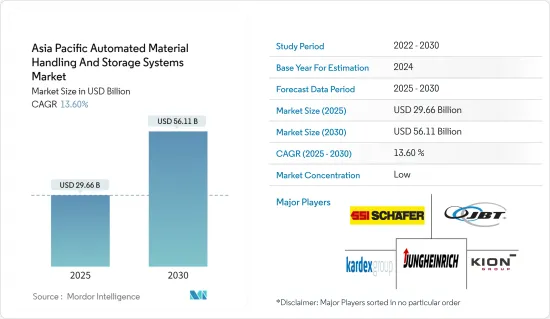

預計2025年亞太地區自動化物料輸送與儲存系統市場規模為296.6億美元,2030年達561.1億美元,預測期間(2025-2030年)複合年成長率為13.6%。

庫存單位 (SKU) 的快速成長使得批發商和經銷商難以做出明智的業務決策。這種困境凸顯了迫切需要更有效地利用勞動力、設備和技術。推動自動化物料輸送系統需求的關鍵因素包括降低成本、提高勞動效率和空間最佳化。

市場格局見證了產品類型的激增以及對更頻繁和更小交付的需求。自動化交付操作可以顯著提高組織的訂單準確性,通常可以提高幾個百分點。都市化、電子商務的激增以及技術提供者的出現正在推動亞太市場的成長。這些供應商正在加強研發力度,以提供尖端的解決方案並保持競爭力。

亞太地區正在鞏固其作為全球電子商務強國的地位。該地區零售電子商務的擴張,加上中國、印度和印尼等國家中產階級的快速成長以及對行動裝置的偏好,進一步鞏固了這一地位。尤其是中國,其零售額佔全球零售電子商務銷售額的 40%,令人震驚。亞太地區多個國家的倉庫可用土地正在減少,促使人們轉向多層設施和更高、更窄的通道。這些調整將推動對先進物料輸送系統的需求。

過去 70 年來,物料輸送發生了重大演變,機器和機器人擴大取代個別工人。這種轉變不僅重塑了產業,也刺激了企業的成長,特別是汽車產業,規模擴大了10倍。據威斯康辛州經濟發展公司稱,印度等國家在物料輸送設備方面投入了大量資金,MHE市場約佔該國施工機械產業的13%。泰國、菲律賓、越南等東南亞國家製造業快速成長,就業擴大,可支配所得增加。收入的成長,加上國際品牌意識的提高,正在推動對當地倉儲的需求。

印尼是一個正在迅速擁抱自動化的國家,機器人在工業應用中的使用顯著增加。由於日本扮演供應商和消費者的雙重角色,印尼可以從貿易活動的活性化中受益,進一步推動該地區的自動化需求。

由於 COVID-19 大流行以及由此導致的停工,全球工業格局面臨重大破壞。這些中斷包括供應鏈挑戰、原料短缺、勞動力短缺、價格波動和運輸瓶頸,所有這些都增加了生產成本並可能超出預算。

亞太地區自動化物料輸送和儲存系統市場趨勢

組裝領域證實了顯著的市場成長

- 組裝AGV 主要應用於汽車製造、車廂製造、航太和鐵路等產業。電動和混合動力汽車產量的增加將在未來幾年推動這些 AGV 的需求。這種轉變不僅提高了製造商的靈活性,還使他們能夠快速回應市場變化,同時確保安全且經濟高效的營運。

- 過去十年,隨著電動車和混合動力汽車的採用,汽車產業發生了一場革命。這種轉變顯著增加了汽車生產的複雜性。加上不斷發展的安全法規和行業標準,汽車行業對自動化的需求不斷增加。關鍵優先事項包括減少運輸過程中人為錯誤造成的產品損壞、加快工作站之間的底盤搬運速度以及促進與組裝工人的互動。有效滿足這些要求的組裝AGV已成為汽車產業自動化的基石。

- 此外,汽車業依靠自動化組裝來製造各種零件,從引擎和變速箱到燃油系統和泵浦。透過利用機器人技術和視覺技術,製造商可以建造符合人體工學的高效產品線,確保快速組裝,同時保護員工免受危險情況的影響。因此,安全問題正在推動整個汽車產業的自動化。

- 根據汽車技能發展委員會 (ASDC) 的報告《汽車產業的人力資源和技能要求 (2026)》,預計到 2026 年,印度汽車產業將僱用 4,508 萬人。這種勞動力爆炸需要重新評估目前的技能組合,並強調汽車設計、機器人、物聯網和人工智慧等領域技能提升的必要性。隨著傳統角色的發展,工業自動化的推動力不斷增強

- 為了滿足這種不斷成長的需求,許多市場參與企業正在擴大製造能力並引入新的產品線。例如,北美著名自動化工程公司Applied Manufacturing Technologies (AMT)於2024年3月宣布了其最新創新產品ROBiN。 ROBiN,名為機器人引導系統,旨在徹底改變倉庫的物料輸送,並有望提高效率和吞吐量。 AMT 的 ROBiN 因先進的物料輸送和最先進的自主移動機器人 (AMR) 而享有盛譽,有望對該行業產生重大影響。

工業 4.0 投資推動自動化和物料輸送的需求

- 世界各地都重視機場投資,因為各國都了解創造舒適的環境讓旅客可以花時間和金錢的價值。從辦理登機手續到登機,輸送機和分類系統在各種規模的機場中都很常見,可有效簡化流程並改善整體客戶體驗。許多機場現在正在與供應商合作部署自主機器人,此舉不僅提高了行李運輸效率,還降低了營運成本。例如,物流自動化專家 Vanderlande Dutch 最近與香港機場合作,開始測試自動行李車。

- 在國內航空連結性增加和人均 GDP 上升的推動下,印度和中國成為支線航空格局的關鍵參與企業。國際民航組織指出,光是亞太地區就佔國內航線的70%。

- 預測預計未來幾年中國航空市場將呈現強勁成長軌跡。特別是,中國三大航空公司——國航、南航和東航——為提升全球排名而製定了雄心勃勃的機隊擴張目標。此外,上海和北京的主要機場正積極推行重大擴建計畫。

- 根據中國旅遊出境研究院預測,到2030年,中國出境旅遊人數將達到約4億人次,佔全球出境旅遊人數的四分之一。為了應對這一激增,機場將必須實施先進的系統,這項舉措預計將在整個預測期內推動市場的積極成長。

- 相反,疫情促使許多機場部署機器人進行乘客篩檢和病毒遏制。例如,韓國仁川機場的智慧機場團隊正在利用機器人技術和自動駕駛車輛來改善行動不便乘客 (PRM) 的體驗。

亞太地區自動化物料輸送與儲存系統產業概況

亞太地區自動化物料輸送和儲存系統市場競爭激烈,主要是由於大量參與企業進入該領域。形成這種競爭的關鍵因素包括高進入障礙、企業集中度的提高以及市場滲透率的提高。市場上的一些主要參與企業包括卡迪斯集團、凱傲集團、JBT Corporation、Jungheinrich AG、Daifuku、BEUMER Group GmbH &Co.KG。

- 2024 年 2 月,全球著名鞋類和服裝品牌 Skechers USA 與主要企業的自動化倉儲和搜尋系統 (ASRS) 公司 Hi-Robotics 合作,在港區開設了一個最先進的物流中心,東京我們已經開業了。透過利用 Hy Robotics 的尖端自動化倉庫技術,Skechers 正在增強其倉庫業務、加快履約並確保準確的訂單處理。

- 2024 年 1 月,富士通有限公司和 YE DIGITAL CORPORATION 宣布開展合作,旨在解決日本物流業的勞動力短缺問題並加強永續供應鏈。此次夥伴關係將重點利用以簡化物流中心而聞名的富士通 WMS 服務,以及旨在實現倉庫業務自動化的 YE DIGITAL 的 WES MMLogiStation。除了提供WMS服務外,富士通還為新物流中心的建設和現有物流中心的業務改革提供規劃支持,並推動自動化設備的引進。透過簡化設施管理,我們的目標是促進營運自動化並提高整個物流中心的績效。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 對工業生態系的影響

- 市場促進因素

- 技術進步不斷推動市場成長

- 工業 4.0 投資推動自動化和物料輸送的需求

- 電子商務快速成長

- 市場限制因素

- 初始成本高

- 缺乏技術純熟勞工

第5章市場區隔

- 產品類型

- 硬體

- 軟體

- 服務

- 設備類型

- 移動機器人

- 自動導引運輸車(AGV)

- 自動堆高機

- 自動拖車/曳引機/標籤

- 單元貨載

- 組裝

- 特殊用途

- 自主移動機器人(AMR)

- 自動儲存和搜尋系統(ASRS)

- 固定通道

- 旋轉木馬

- 垂直升降模組

- 自動輸送機

- 腰帶

- 滾筒

- 調色盤

- 開賣

- 堆垛機

- 傳統的

- 機器人

- 分類系統

- 移動機器人

- 最終用戶產業

- 飛機場

- 車

- 飲食

- 零售/倉庫/配送中心/物流中心

- 一般製造業

- 藥品

- 小包裹

- 電子/半導體製造

- 其他

- 國家名稱

- 中國

- 日本

- 印尼

- 印度

- 澳洲

- 泰國

- 韓國

- 新加坡

- 馬來西亞

- 台灣

- 其他亞太地區

第6章 競爭狀況

- 公司簡介

- Daifuku Co. Ltd

- Kardex Group

- KION Group

- JBT Corporation

- Jungheinrich AG

- SSI Schaefer AG

- VisionNav Robotics

- System Logistics

- BEUMER Group GmbH & Co. KG

- Interroll Group

- Witron Logistik

- Kuka AG

- Honeywell Intelligrated Inc.

- Murata Machinery Ltd

- Toyota Industries Corporation

第7章 投資分析

第8章 市場機會及未來趨勢

The Asia Pacific Automated Material Handling And Storage Systems Market size is estimated at USD 29.66 billion in 2025, and is expected to reach USD 56.11 billion by 2030, at a CAGR of 13.6% during the forecast period (2025-2030).

With the rapid growth in stock-keeping units (SKUs), wholesalers and distributors are finding it difficult to make informed decisions about operations. This dilemma underscores the pressing need for more efficient labor, equipment, and technology utilization. Key factors driving the need for automated material-handling systems include cost savings, enhanced labor efficiency, and space optimization.

The market landscape is witnessing a surge in product variety and a demand for more frequent, smaller deliveries. Automated distribution operations can significantly boost an organization's order accuracy, often by several percentage points. The Asia-Pacific market's growth is propelled by urbanization, surging e-commerce sales, and a robust technology provider presence. These providers are intensifying their R&D efforts to offer cutting-edge solutions and maintain a competitive edge.

Asia-Pacific has cemented its position as a global e-commerce powerhouse. This status has been bolstered by the region's expanding retail e-commerce, driven by a burgeoning middle-income group in countries like China, India, and Indonesia, coupled with a fondness for mobile devices. Notably, China commands a staggering 40% share of global retail e-commerce sales. In several Asia-Pacific nations, the availability of warehouse land is dwindling, prompting a shift toward multi-story facilities and taller, narrower aisles. These adaptations are poised to fuel the demand for advanced material handling systems.

Material handling has witnessed a profound evolution over the past seven decades, with machines and robots increasingly replacing individual workers. This transformation has not only reshaped the industry but also fueled the growth of enterprises, notably in the automotive industry, which has seen a tenfold expansion. Countries like India are significantly investing in material handling equipment, with the MHE market, as per the Wisconsin Economic Development Corporation, capturing around 13% of the country's construction equipment industry. Southeast Asian nations, including Thailand, the Philippines, and Vietnam, are witnessing a surge in manufacturing establishments, bolstering employment and, subsequently, disposable incomes. This rise in income, coupled with a growing awareness of international brands, is spurring demand for local warehouses.

Indonesia stands out as a nation swiftly embracing automation, with a notable uptick in robotic usage for industrial applications. Given Japan's dual role as both a supplier and a consumer, Indonesia stands to benefit from heightened trade activities, further propelling the region's automation demand.

The global industrial landscape faced significant disruptions due to the COVID-19 pandemic and ensuing lockdowns. These disruptions spanned supply chain challenges, raw material shortages, labor scarcities, fluctuating prices, and shipping bottlenecks, all of which threatened to inflate production costs and exceed budgets.

APAC Automated Material Handling & Storage Systems Market Trends

Assembly Line Segment to Witness Significant Growth in the Market

- Assembly-line AGVs find their primary application in industries like automobile manufacturing, coach-building, aerospace, and railways. The rising production of electric and hybrid vehicles is set to drive the demand for these AGVs in the coming years. This shift not only enhances manufacturers' flexibility but also enables them to swiftly adapt to market changes, all while ensuring safe and cost-effective operations.

- The automotive industry witnessed a revolution in the past decade with the introduction of electric and hybrid vehicles. This transformation has significantly increased the complexity of automobile production. Coupled with evolving safety regulations and industry standards, there is a growing need for automation in the automotive industry. Key priorities include reducing product damage, often caused by human error during transit, improving the speed of chassis handling between workstations, and facilitating interaction with assembly-line workers. Assembly line AGVs, meeting these requirements effectively, have become the cornerstone of automation in the automotive industry.

- Furthermore, in the automotive industry, automated assembly lines are utilized to craft various parts, ranging from engines and gearboxes to fuel systems and pumps. Leveraging robotics and vision technology, manufacturers can create ergonomic and efficient product lines, safeguarding their workforce from hazardous conditions while ensuring swift assembly. Consequently, safety concerns are propelling automation across the automotive landscape.

- According to a report by the Automotive Skill Development Council (ASDC), titled 'Human Resource and Skills Requirements in the Automotive Sector (2026),' India is projected to employ 45.08 million individuals in the automobile industry by 2026. This surge in the workforce demands a reevaluation of the current skill set, emphasizing the need for upskilling in areas like automotive design, robotics, IoT, and AI. As traditional roles evolve, the industry is witnessing a heightened push toward automation.

- To cater to this escalating demand, numerous market players are not only expanding their manufacturing capacities but also introducing new product lines. For instance, in March 2024, Applied Manufacturing Technologies (AMT), a prominent name in North America's automation engineering, unveiled its latest innovation, ROBiN. Termed the Robotic Induction System, ROBiN aims to revolutionize material handling in warehousing, promising heightened efficiency and throughput. With a strong reputation in advanced material handling and cutting-edge autonomous mobile robots (AMRs), AMT's ROBiN is poised to make a significant impact in the industry.

Industry 4.0 Investments Driving Demand for Automation and Material Handling

- Airport investments are gaining global recognition as nations understand the value of creating welcoming environments that encourage travelers to spend both time and money. From check-in to boarding, conveyors and sortation systems, prevalent in airports of all sizes, effectively streamline the process, enhancing the overall customer experience. Many airports are now collaborating with vendors to introduce autonomous robots, a move that not only boosts luggage transfer efficiency but also trims operational costs. For example, Vanderlande Dutch, a logistics automation specialist, recently partnered with Hong Kong Airport to trial autonomous baggage handling vehicles.

- India and China, driven by increasing domestic air connectivity and rising per capita GDP, stand out as pivotal players in the regional aviation landscape. Highlighting this, the ICAO notes that the Asia-Pacific region alone accounted for 70% of domestic air travel.

- Projections indicate a robust growth trajectory for the Chinese aviation market in the coming years. Notably, China's top three airlines-Air China, China Southern, and China Eastern-have set ambitious fleet expansion goals, aiming to elevate their global rankings. Furthermore, major airports in Shanghai and Beijing are actively pursuing extensive expansion initiatives.

- According to the Chinese Tourism Outbound Research Institute, Chinese outbound visits are set to reach around 400 million by 2030, potentially constituting a quarter of all global outbound travelers. To accommodate this surge, airports must deploy advanced systems, a move that is expected to drive market growth positively throughout the forecast period.

- Conversely, the pandemic prompted many airports to deploy robots for passenger screening and virus containment. For instance, South Korea's Incheon Airport's Smart Airport team has been leveraging robotics and automated vehicles to enhance the experience for passengers with reduced mobility (PRMs).

APAC Automated Material Handling & Storage Systems Industry Overview

The Asia-Pacific market for automated material handling and storage systems is fiercely competitive, primarily due to the significant number of players in the arena. Key factors shaping this competition include high exit barriers, increasing firm concentration, and rising market penetration rates. Some of the key players operating in the market are Kardex Group, KION Group, JBT Corporation, Jungheinrich AG, Daifuku Co. Ltd, and BEUMER Group GmbH & Co. KG.

- In February 2024, Skechers USA, a prominent global footwear and apparel brand, partnered with Hai Robotics, a top player in automated storage and retrieval systems (ASRS), to inaugurate its latest distribution hub in Minato City, Tokyo, Japan. By leveraging Hai's cutting-edge automated goods-to-person technology, Skechers is enhancing its warehouse operations, accelerating fulfillment, and ensuring precise order processing.

- In January 2024, Fujitsu Limited and YE DIGITAL CORPORATION announced a collaboration aimed at tackling labor shortages and bolstering sustainable supply chains in Japan's logistics industry. The partnership focuses on leveraging Fujitsu's WMS services, known for enhancing distribution center efficiency, alongside YE DIGITAL's WES MMLogiStation, which is designed to automate warehouse operations. Fujitsu will not only provide its WMS services but also offer planning support for constructing new distribution centers and transforming operations at existing ones, aiming to ease the adoption of automated facilities. By streamlining facility management, the companies aim to drive operational automation and enhance overall distribution center performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of COVID-19 on the Industry Ecosystem

- 4.5 Market Drivers

- 4.5.1 Increasing Technological Advancements Aiding Market Growth

- 4.5.2 Industry 4.0 Investments Driving Demand for Automation and Material Handling

- 4.5.3 Rapid Growth of E-commerce

- 4.6 Market Restraints

- 4.6.1 High Initial Costs

- 4.6.2 Unavailability of Skilled Workforce

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 Equipment Type

- 5.2.1 Mobile Robots

- 5.2.1.1 Automated Guided Vehicle (AGV)

- 5.2.1.1.1 Automated Forklift

- 5.2.1.1.2 Automated Tow/Tractor/Tug

- 5.2.1.1.3 Unit Load

- 5.2.1.1.4 Assembly Line

- 5.2.1.1.5 Special Purpose

- 5.2.1.2 Autonomous Mobile Robots (AMR)

- 5.2.2 Automated Storage and Retrieval System (ASRS)

- 5.2.2.1 Fixed Aisle

- 5.2.2.2 Carousel

- 5.2.2.3 Vertical Lift Module

- 5.2.3 Automated Conveyor

- 5.2.3.1 Belt

- 5.2.3.2 Roller

- 5.2.3.3 Pallet

- 5.2.3.4 Overhead

- 5.2.4 Palletizer

- 5.2.4.1 Conventional

- 5.2.4.2 Robotic

- 5.2.5 Sortation System

- 5.2.1 Mobile Robots

- 5.3 End-user Industry

- 5.3.1 Airport

- 5.3.2 Automotive

- 5.3.3 Food and Beverage

- 5.3.4 Retail/Warehousing/Distribution Centers/Logistic Centers

- 5.3.5 General Manufacturing

- 5.3.6 Pharmaceuticals

- 5.3.7 Post and Parcel

- 5.3.8 Electronics and Semiconductor Manufacturing

- 5.3.9 Other End-user Industries

- 5.4 Country

- 5.4.1 China

- 5.4.2 Japan

- 5.4.3 Indonesia

- 5.4.4 India

- 5.4.5 Australia

- 5.4.6 Thailand

- 5.4.7 South Korea

- 5.4.8 Singapore

- 5.4.9 Malaysia

- 5.4.10 Taiwan

- 5.4.11 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Daifuku Co. Ltd

- 6.1.2 Kardex Group

- 6.1.3 KION Group

- 6.1.4 JBT Corporation

- 6.1.5 Jungheinrich AG

- 6.1.6 SSI Schaefer AG

- 6.1.7 VisionNav Robotics

- 6.1.8 System Logistics

- 6.1.9 BEUMER Group GmbH & Co. KG

- 6.1.10 Interroll Group

- 6.1.11 Witron Logistik

- 6.1.12 Kuka AG

- 6.1.13 Honeywell Intelligrated Inc.

- 6.1.14 Murata Machinery Ltd

- 6.1.15 Toyota Industries Corporation