|

市場調查報告書

商品編碼

1629757

網路附加儲存 (NAS) -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Network Attached Storage (NAS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

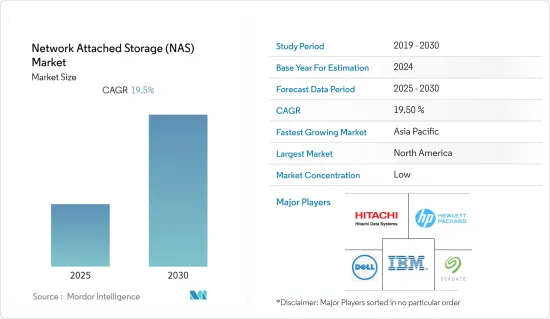

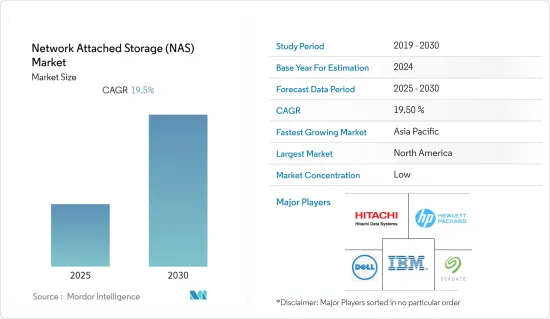

網路附加儲存市場預計在預測期間內複合年成長率為 19.5%

主要亮點

- 此外,COVID-19 大流行在許多層面上造成了前所未有的、不可預測的緊急狀態。在危機時期,資料正在幫助企業制定更好的決策流程。一致性是確保分析產生的見解有用且可操作的唯一解決方案。

- 與其他儲存類型如 DAS(直接附加儲存)和 SAN(儲存區域網路)相比,預計超過 80% 的中階市場和企業組織使用 NAS 來分層儲存。推動市場的關鍵因素包括非結構化資料的爆炸性成長、企業 IT 系統中橫向擴展 NAS 的激增以及對網路虛擬和軟體定義 NAS 的關注。

- 隨著企業環境中擴大採用 NAS 系統,供應商致力於將 NAS 轉變為成熟的資料管理解決方案,並正在為企業建立客製化的 NAS 解決方案。

- 本地 NAS 和雲端儲存的整合預計將在未來獲得關注,因為它可以輕鬆地全面管理 NAS 中的資料並在雲端備份和歸檔資料。多家供應商正在致力於將現有 NAS 系統與流行的雲端儲存服務(尤其是 Amazon S3)整合,以進行儲存配置。

- 易於訪問、相當低廉的成本和高容量是吸引企業的一些關鍵特徵。在許多情況下,它還比 DAS 具有效能優勢,特別是當多個設備需要存取儲存空間時。此外,根據網路流量因素和儲存通訊協定偏好,對於某些工作負載,NAS 可能比 SAN 更有效。

- 然而,本地NAS和雲端儲存的整合預計未來會變得流行,因為它可以完全控制NAS中的資料,並方便雲端中資料的備份和歸檔。

- 2021 年 7 月,台灣網路附加儲存 (NAS) 製造商 QNAP 宣布已解決一個嚴重的安全漏洞,該漏洞可能允許攻擊者危及其 NAS 設備的安全。 TXOne IoT/ICS 安全研究實驗室在 QNAP 的災難復原和資料備份解決方案 HBS 3 Hybrid Backup Sync 中發現了不當存取控制漏洞,編號為 CVE~2021-28809。此安全問題是由於軟體錯誤未正確限制攻擊者對系統資源的訪問,從而允許攻擊者升級權限、遠端執行命令或在未經授權的情況下讀取敏感資訊。

網路附加儲存市場趨勢

雲端採用率的提高阻礙了市場成長

- 在雲端部署這些解決方案增加了便利性,因為服務供應商負責提供最長的執行時間、資料安全性和定期更新。

- 這些網路連接儲存設備提供了一種從電腦卸載和建立資料備份的便捷方法,同時保持對檔案的遠端存取。這些設備將資訊儲存在中央位置,並使用安全、專用的 IP 位址來標記授權的現場和網路存取。這些設備提供各種方便且多功能的功能,可滿足家庭用戶和小型、中型和大型企業的需求。

- 當前的市場趨勢,例如計量收費和 SaaS 模式(其中服務供應商還負責管理資料和應用程式資訊)正在進一步推動這些解決方案的採用。

- 此外,它擴大被中小型企業採用,因為它減少了內部建設必要基礎設施所需的資本支出。這種持續的趨勢嚴重阻礙了市場的成長。

- 2020 年 1 月,QNAP 也推出了一款針對家庭用戶的新型低成本 2 碟位 NAS,支援硬體加速媒體播放。 TS-251D 可儲存高達 32TB 的資料,還可透過 PCIe 卡進一步擴展,以添加 SSD 快取和其他選項。

北美市佔率最高

- 由於早期採用了具有龐大資料儲存需求的高階分析解決方案,北美佔據了最大的市場佔有率。網路附加儲存使用乙太網路連接埠或 USB 連接到網路。這些儲存空間被分配了 IP 位址並可供最終用戶直接存取。

- 預計美國在該地區的佔有率最高。美國佔全球市場佔有率的 30%,其中專業服務、離散製造和運輸業處於領先地位。

- 在這些領域使用數位解決方案將產生大量非結構化資料,導致企業在該地區部署更多 NAS 系統以容納大量文件和使用者。

- 隨著混合雲端儲存的發展,NAS系統的採用正在迅速增加。因此,對冗餘、資料備份、可管理性和卓越資料可擴展性的需求不斷增加。筆記型電腦和智慧型手機等智慧型裝置的使用不斷增加,產生了大量資料,增加了市場需求和成長。

- IBM公司、惠普開發公司、希捷科技等市場老牌企業向儲存領域的擴張也是推動NAS市場成長的因素之一。

網路附加儲存產業概述

網路附加儲存市場高度分散。此前,NAS市場主要由大公司主導。然而,由於企業對資料儲存的需求不斷增加,許多新參與企業也進入市場,使得市場競爭更加激烈。主要開發商包括 ZyXEL Communications Corporation、Thecus Technology Corporation、Drobo Inc.、Asustor Inc.、Dell EMC、Buffalo Technology Inc.、Hewlett-Packard Development Company、Hitachi Data Systems Corporation、NetApp Inc. 和 International Business Machines (IBM)。公司、希捷科技有限公司等。

- 2021 年 3 月 - 發布日立 VSP 5,000。工作負載多功能性可支援從大型主機到容器的任何工作負載。合適的容量和服務水準。混合 NVMe 和 SAS 實施有助於最佳化效能和工作負載成本。強大的虛擬舊有系統添加了功能。快速輕鬆地升級到 NVMe 和 SCM over Fabrics (NVMe-oF)。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 非結構化資料的爆炸性成長

- 企業 IT 橫向擴展的增加

- 專注於資料中心虛擬與軟體定義NAS

- 市場限制因素

- 雲端採用率增加

- 隨著資料量的增加,成本效率降低

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章 COVID-19 對市場的影響

第6章 市場細分

- 按類型

- 擴大規模

- 橫向擴展

- 按最終用戶產業

- BFSI

- 資訊科技/通訊

- 醫療保健

- 零售

- 媒體娛樂

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- ZyXEL Communications Corporation

- Thecus Technology Corporation

- Drobo Inc.

- Asustor Inc.

- Dell EMC

- Buffalo Technology Inc.

- Hewlett-Packard Development Company

- Hitachi Data Systems Corporation

- NetApp Inc.

- International Business Machines(IBM)Corporation

- Netgear Inc.

- Seagate Technology PLC

- Synology Inc.

- QNAP Systems Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Network Attached Storage Market is expected to register a CAGR of 19.5% during the forecast period.

Key Highlights

- Further, the COVID-19 pandemic has forced an unprecedented and unpredictable state of emergency on various levels. In these times of crisis, data has been assisting enterprises with a better decision-making process. Having consistency is the only solution to ensure that the insights generated by analyses are useful and actionable.

- It is estimated that more than 80% of midmarket and enterprise organizations are using NAS for some tier of storage in exceeding capacity when compared to other storage types, such as DAS (Direct Attached Storage) and SAN (Storage Area Network). The major factors driving the market include - explosion in unstructured data, increasing the footprint of scale-out NAS in enterprise IT systems, and focus on network virtualization and software-defined NAS.

- The increasing adoption of NAS systems in enterprise environments is driving vendors toward creating customized NAS solutions for businesses aiming at NAS as a full-fledged data management solution.

- The integration of on-premise NAS with cloud storage is expected to gain traction in the future, facilitating total control over the data in the NAS and in backing up and archiving data in the cloud. Several vendors are involved in integrating the existing NAS system with the popular cloud storage services, like Amazon S3 especially, for storage provisioning.

- The ease of access, reasonably low cost, and high capacity are some of the significant features attracting the enterprise. It also provides a performance advantage over DAS in many cases, especially when multiple devices need to access storage. NAS may also be more effective than SAN for some workloads depending on network traffic factors and storage communication protocol preferences.

- The growing cloud adoption can hinder the studied market growth; however, the integration of on-premise NAS with cloud storage is expected to gain traction in the future, facilitating total control over the data in the NAS and in backing up and archiving data in the cloud.

- In July 2021, Taiwan -based network-attached storage (NAS) manufacturer QNAP announced that it had addressed a critical security vulnerability that could have enabled attackers to compromise its NAS devices' security. The improper access control vulnerability tracked as CVE -2021 - 28809 was found by the TXOne IoT/ICS Security Research Labs in HBS 3 Hybrid Backup Sync, which is QNAP's disaster recovery and data backup solution. The security issue was caused by buggy software that does not correctly restrict the attackers from gaining access to the system resources enabling them to escalate privileges, execute commands remotely, or read sensitive info without authorization.

Network-Attached Storage Market Trends

Increasing Adoption of Cloud Hindering the Growth of the Market

- The deployment of these solutions over the cloud offers greater convenience, as the service vendor is responsible for providing maximum uptime, data security, and periodic updates, thus decreasing the total cost of ownership.

- These network-attached storage devices have been providing a convenient means of offloading and creating data backups from the computers while maintaining remote access to the files. These units are storing information in a centralized location and providing access for authorized on-site and network access using secure dedicated IP addresses. These devices offer various features that are handy and versatile to meet the needs of home users and small and large businesses.

- The current market trends, including the delivery of these solutions on the pay-as-you-go model and SaaS models, wherein the service vendors also assume the responsibility of maintaining data and application information, are further driving the adoption of these solutions.

- Moreover, this mode has recorded an increase in deployment in small-/medium-scale businesses, as it cuts down the capital expenditure involved in building the required infrastructure on their premises. This continuing trend is significantly hindering the growth of the market.

- In Jan 2020, QNAP also announced its new budget-friendly two-bay NAS aimed at home users supporting hardware accelerated media playback. The TS-251D stores up to 32 TB of data and can be further expanded with a PCIe card to add SSD caching or other options.

North America to Hold Highest Share in the Market

- North America holds the largest market share due to its early adoption of advanced analytics solutions involving huge data storage requirements. They make use of Network-attached storage when it is attached to a network with the help of ethernet ports or USB. These are allocated to an IP address so that the end-user can directly access it.

- The United States is projected to hold the highest share within the region. The United States accounts for 30% of the global market share in digital transformation led by the professional services, discrete manufacturing, and transportation industries.

- The usage of digital solutions in these sectors has resulted in the generation of significant amounts of unstructured data, because of which companies are deploying more NAS systems to accommodate the high number of files and users in this region.

- The NAS systems are being adopted rapidly due to the increasing development of hybrid cloud storage. It is resulting in an increase in the demand for redundancy, data back-up, manageability, superior data scalability. The increasing use of smart devices like laptops and smartphones is creating a massive volume of data, expanding the market demand and growth.

- The presence of market incumbents, such as IBM Corporation, HP Development Company, and Seagate Technology, in the storage segment is another factor that is expected to promote the growth of the NAS market.

Network-Attached Storage Industry Overview

The network-attached storage market is highly fragmented. Earlier, the big players dominated the NAS market. However, the growing demand from enterprises for data storage is also attracting many new players into the market, making the market competitive. Some key players include ZyXEL Communications Corporation, Thecus Technology Corporation, Drobo Inc., Asustor Inc., Dell EMC, Buffalo Technology Inc., Hewlett-Packard Development Company, Hitachi Data Systems Corporation, NetApp Inc., International Business Machines (IBM) Corporation, Seagate Technology PLC, among others.

- March 2021 - HITACHI VSP 5000 was launched. It is the world's fastest NVME flash array. It has workload diversity that supports all workloads from mainframe to container. It comes with the right size capacity and service levels. It is implemented with mixed NVMe and SAS, which helps optimize performance and workload cost. Powerful virtualization adds capability to legacy systems. It is a fast and easy upgrade to NVMe and SCM over Fabrics (NVMe-oF).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of Unstructured Data

- 4.2.2 Increase in the Footprint of Scale-out in Enterprise IT

- 4.2.3 Focus on Data Center Virtualization and Software Defined NAS

- 4.3 Market Restraints

- 4.3.1 Increasing Adoption of Cloud

- 4.3.2 Cost Ineffectiveness with High Data Growth

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 IMPACT OF COVID-19 ON THE MARKET

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Scale-up

- 6.1.2 Scale-out

- 6.2 By End-user Industry

- 6.2.1 BFSI

- 6.2.2 IT and Telecom

- 6.2.3 Healthcare

- 6.2.4 Retail

- 6.2.5 Media and Entertainment

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ZyXEL Communications Corporation

- 7.1.2 Thecus Technology Corporation

- 7.1.3 Drobo Inc.

- 7.1.4 Asustor Inc.

- 7.1.5 Dell EMC

- 7.1.6 Buffalo Technology Inc.

- 7.1.7 Hewlett-Packard Development Company

- 7.1.8 Hitachi Data Systems Corporation

- 7.1.9 NetApp Inc.

- 7.1.10 International Business Machines (IBM) Corporation

- 7.1.11 Netgear Inc.

- 7.1.12 Seagate Technology PLC

- 7.1.13 Synology Inc.

- 7.1.14 QNAP Systems Inc.