|

市場調查報告書

商品編碼

1629772

中東和非洲的氣霧罐:市場佔有率分析、產業趨勢和成長預測(2025-2030)Middle East and Africa Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

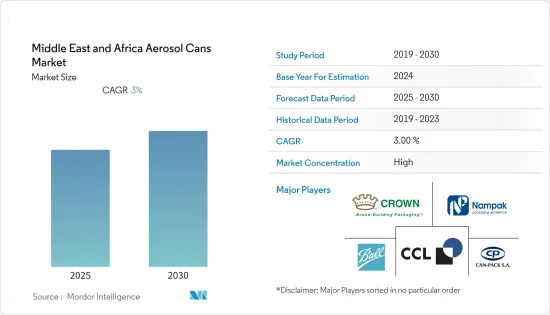

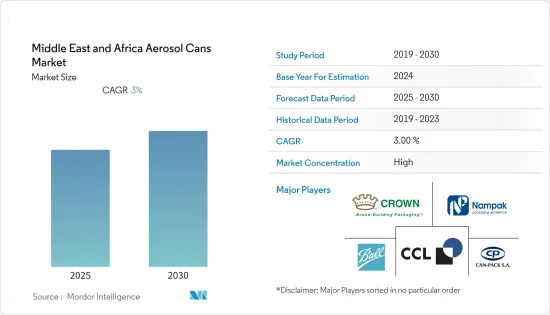

中東和非洲氣霧罐市場預計在預測期內複合年成長率為 3%

主要亮點

- 氣霧罐具有許多優點,包括剛性、穩定性和阻隔性。用於存放保存期限較長的產品和遠距運輸。中東和非洲地區主要首選鋼製和鋁製氣霧罐。這些材料具有柔軟、輕質等重要特性,使製造商能夠節省與物流相關的成本。

- 此外,隨著環境問題的增加,氣霧罐因對環境影響較小而比塑膠或玻璃容器更受青睞。氣霧罐的高回收性是該地區研究市場的關鍵促進因素之一。同時,經濟狀況和罐頭食品的低價仍然是市場驅動力。

- 該地區金屬罐的消費量也很大,推動了氣霧罐市場的發展。 2020年11月,清潔地球宣佈建立清潔地球氣溶膠回收系統,到2020年終該系統將處理1,300萬個氣溶膠罐。

- 此外,環保組織的努力和社交媒體上的高知名度提高了該地區用戶的認知,大多數公民現在意識到了對環境的影響,並正在採取措施解決這些問題。消費者要求產品包裝對環境影響較小。雖然許多用戶不再使用塑膠,但對回收產品的需求卻在增加。這對金屬包裝氣霧罐產品產生了很高的需求。

- 此外,金屬氣霧罐也用於除臭劑、刮鬍泡以及其他化妝品和個人保健產品。密封氣霧罐用於維持產品質量,從而延長其保存期限。

氣霧劑罐在中東和非洲的市場趨勢

醫藥產業佔最大市場佔有率

- 氣霧罐在醫藥產品中用於包裝止痛藥、防腐劑、鼻耳衛生用品、複合維生素、驅蟲劑、麻醉劑、抗菌噴霧劑、抗生素軟膏、肺噴霧、創傷護理。製藥工業的特點是各種由鋁、鋼和錫製成的氣霧罐。

- 此外,由於氣霧罐在各種製藥應用(包括止痛噴霧)中的使用越來越多,該地區氣霧罐行業的幾家主要企業都致力於為製藥行業提供服務。

- 此外,骨骼疾病、關節炎和關節疼痛的增加,對家庭療法的依賴增加,以及由於COVID-19 大流行而減少前往醫院的次數,顯著影響了我正在研究的區域中止痛噴霧劑的使用量的增加。噴霧劑需求的增加表現為對相同包裝的金屬罐的需求增加。

- 例如,CCL 提供符合該地區政府法規、配方相容且保存期限長的藥用氣霧罐。該公司提供從 2 盎司到 28 盎司以上的各種尺寸。

- 此外,該地區是製藥業各種發展的發源地,在全球佔有重要的市場佔有率。這間接影響了主要關注氣霧罐的包裝產業。

南非佔最大市場佔有率

- 氣霧罐是用來盛裝油漆和清漆的防溢容器。由於鋼和鋁的特性,該罐還提供了設計靈活性,允許創新,特別是在產品差異化方面。

- 此外,氣霧罐用於噴漆,在南非市場也逐漸受到歡迎。噴漆被用作繪畫材料和住宅繪畫的一部分。疫情迫使人們待在室內,間接鼓勵他們自己進行各種維修活動,包括噴漆和傳統繪畫,導致氣霧罐的需求增加。

- 此外,氣霧罐還可用於油漆、被覆劑和黏合劑。在南非,它傳統上用於各種規模的組織,包括各種規模的小型、中型和大型企業,有或沒有襯裡。除了為油漆和其他高密度材料提供防潮和防銹包裝外,氣霧劑包裝還有助於控制產品溫度。氣霧罐的進步包括抗紫外線蓋子,有助於延長產品的保存期限。

- 例如,Mauser Packaging Solutions 在南非提供帶有灰色或金色環氧酚醛內襯的氣霧罐,以及可選的鎖環以改善罐的密封性。氣霧罐用於建築、工業化學品、石化、潤滑油、汽車、油漆和油墨/染料行業。

- 此外,空氣清淨機現在可以裝在氣霧罐中,這是一項重大創新。由於人們被迫限制在家中的活動,空氣清淨機的使用量激增。各大家居用品公司都將重點放在空氣清淨機上,間接帶動了氣霧罐的需求。安裝在氣霧罐中的「球系統」技術的創新正在引起氣霧罐製造商的注意。

中東和非洲氣霧罐產業概況

中東和非洲氣霧罐市場是一個價格敏感的市場,由幾個主要參與者高度整合。此外,市場供應商正在致力於永續性和產品增強,以獲得市場佔有率和盈利。近期市場發展趨勢如下:

- 2021 年 8 月 - Hikma Pharmaceuticals PLC 在沙烏地阿拉伯推出採用新型氣霧罐包裝的 KLOXXADO鼻噴霧8 毫克。

- 2020 年 9 月 - Moroccanoil 在摩洛哥推出兩款新型 Light as Air 氣霧罐噴霧劑,罐裝讓頭髮豐盈 50%,並具有 72 小時的提拉效果。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 化妝品產業需求不斷擴大

- 氣霧罐的可回收性

- 市場挑戰

- 替代包裝的競爭加劇

- 市場機會

- 新興國家具有高成長潛力

第5章 COVID-19對中東和非洲氣霧罐產業的影響

第6章 市場細分

- 按材質

- 鋁

- 鋼罐

- 其他材料

- 按最終用戶產業

- 化妝品和個人護理(除臭劑、止汗劑、髮膠噴霧、造型慕絲等)

- 家庭使用

- 藥品/動物用藥品

- 油漆/清漆

- 汽車/工業

- 其他最終用戶產業

- 按國家/地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 南非

- 卡達

- 科威特

- 摩洛哥

- 其他中東和非洲

第7章 競爭格局

- 公司簡介

- Crown Holdings inc.

- Ball Corporation

- CCL Industries

- Can-Pack SA

- Nampak Ltd

- Mauser Packaging Solutions

- Saudi Can Co. Ltd.

- Tecnocap SpA

- Saudi Arabian Packaging Industry WLL(SAPIN)

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 56427

The Middle East and Africa Aerosol Cans Market is expected to register a CAGR of 3% during the forecast period.

Key Highlights

- Aerosol cans provide many benefits, such as rigidity, stability, and high barrier properties. They are used to store goods that have a longer shelf life and be transported for long distances. In the MEA region, aerosol cans made up of steel and aluminum are mostly preferred. These materials have significant properties, such as being softer and lightweight, due to which the manufacturers can save costs associated with logistics.

- Furthermore, with the increasing environmental concerns, there has been a preference for aerosol cans over plastic and glass containers, owing to their low environmental impact. The high recyclability of aerosol cans is one of the significant drivers for the market studied in the region. At the same time, economic conditions and the low price of canned goods also remain the key drivers for the market studied.

- The region is also witnessing significant consumption of metals cans, driving the market for aerosol cans. In November 2020, Clean Earth announced its Clean Earth Aerosol Recycling System to process 13 million aerosol cans by the end of 2020.

- Moreover, initiatives by environmental groups and high exposure to social media have resulted in increased awareness among the users in this region, with most of the population now being aware of the environmental impact and willing to take action to counter these issues. Consumers are demanding to package products that cause lower environmental impact. Many users are abandoning plastic usage while the demand for recycled products is growing. This is creating a high demand for metal packaged aerosol can products.

- Further, metal aerosol cans are used for deodorants, shaving foams, and other cosmetic and personal care products. The airtight aerosol cans are used to retain the product quality, thus providing a longer shelf life.

MEA Aerosol Cans Market Trends

Pharmaceutical Sector Accounts for the Largest Market Share

- Aerosol cans are used in pharmaceuticals to pack analgesics, antiseptics, nasal and ear hygiene, vitamin complex, repellents, anesthetics, anti-bacterial sprays, antibiotic ointments, pulmonary sprays, and wound care, among others. The pharmaceuticals industry is marked with various aerosol cans made up of aluminum, steel, and tin.

- Moreover, multiple major key players in the aerosol can industry in the region are indulging in catering to the pharmaceutical industry, with the increased usage of aerosol cans in various medicinal uses, including pain-relieving sprays.

- Further, the increase in bone disorders, arthritis, and joint pain coupled with the increased dependency on home remedies and less preference for rushing to the hospitals due to the COVID 19 pandemic significantly impacted the increase of the usage of pain-relieving sprays in the studied region. The increased demand for sprays characterizes the rise in demand for metal cans for the same packaging.

- For instance, CCL offers pharmaceutical aerosol cans that are compliant with the Government regulations in the region and are formulation compatible alongside offering a long shelf life. The company provides a wide range of sizes, varying from 2 ounces to more than 28 ounces.

- Further, the region is marked with various developments in the pharmaceutical industry and holds a significant market share globally, with major pharmaceutical companies operating from the area. This has indirectly impacted the packaging industry with a considerable focus on aerosol cans.

South Africa Accounts for the Largest Market Share

- Aerosol cans are used for paints and varnishes in spill-proof containers. The cans also provide flexibility in designing due to the characteristic nature of steel and aluminum, allowing innovations for the differentiation of products, among others.

- Moreover, Aerosol cans are used for spray painting, slowly garnering traction in the South African market. Spray paints are used as art supplies and as a part of residential painting. The pandemic has forced people to stay at home, which indirectly has encouraged people to take up various renovation activities on their own, including spray paints and conventional painting, which has imparted to the increase in demand for aerosol cans.

- Further, Aerosol paint cans are used for paints, coatings, adhesives. They have been traditionally used by all sizes of organizations, including small, medium, and large manufacturers in various sizes, with and without linings in South Africa. The aerosol packaging helps in the temperature control of the products alongside offer moisture-resistant and rust-resistant packaging for paints and other dense materials. Advancements in aerosol paint cans include UV-resistant lids that help in the extension of the shelf life of the product.

- For instance, Mauser Packaging Solutions offers aerosol paint cans in South Africa with gray or gold epoxy phenolic linings and optional locking rings to enhance the sealing of the cans. The aerosol paint cans find usage in the construction, industrial chemicals, petrochemicals and lubricants, automotive and paints, and inks and dyes industries.

- Further, Air-refreshers are also packaged in aerosol cans and have gone through significant innovations. With people being forced to restrict movements in their homes, the usage of air-refreshers has taken a surge. Major companies dealing with household products focus on air refreshers, indirectly driving the demand for aerosol cans. The innovation of 'ball-in-system' technology attached to the aerosol cans is notable among air refresher manufacturers.

MEA Aerosol Cans Industry Overview

The Middle East and African aerosol cans market is highly consolidated with a few significant players as the market is price sensitive; hence sustaining in the market is demanding. Further, vendors in the market are driven by sustainability and product enhancements to capture the market share and profitability. Some of the recent developments in the market are:

- August 2021 - Hikma Pharmaceuticals PLC has launched KLOXXADO nasal spray 8mg in a new aerosol can packaging in Saudi Arabia, and it would also be available globally.

- September 2020 - Moroccanoil has launched two new light-as-air sprays in aerosol cans in Morocco that provide up to 50% fuller hair with a 72-hour lift.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growing Demand from the Cosmetic Industry

- 4.4.2 Recyclability of aerosol cans

- 4.5 Market Challenges

- 4.5.1 Increasing Competition from Substitute Packaging

- 4.6 Market Opportunities

- 4.6.1 Emerging economies offer high growth potential

5 IMPACT OF COVID-19 ON THE MIDDLE EAST AND AFRICA AEROSOL CAN INDUSTRY

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Aluminum

- 6.1.2 Steel-tinplate

- 6.1.3 Other Materials

- 6.2 By End-User Industry

- 6.2.1 Cosmetic and Personal Care (Deodorants/Antiperspirants, Hairsprays, Hair Mousse, and Others)

- 6.2.2 Household

- 6.2.3 Pharmaceutical/Veterinary

- 6.2.4 Paints and Varnishes

- 6.2.5 Automotive/Industrial

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 Egypt

- 6.3.4 South Africa

- 6.3.5 Qatar

- 6.3.6 Kuwait

- 6.3.7 Morocco

- 6.3.8 Rest of the Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Crown Holdings inc.

- 7.1.2 Ball Corporation

- 7.1.3 CCL Industries

- 7.1.4 Can-Pack SA

- 7.1.5 Nampak Ltd

- 7.1.6 Mauser Packaging Solutions

- 7.1.7 Saudi Can Co. Ltd.

- 7.1.8 Tecnocap SpA

- 7.1.9 Saudi Arabian Packaging Industry WLL (SAPIN)

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219