|

市場調查報告書

商品編碼

1629803

微波設備:市場佔有率分析、產業趨勢、成長預測(2025-2030)Microwave Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

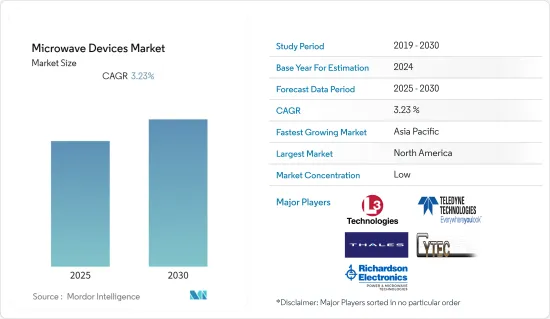

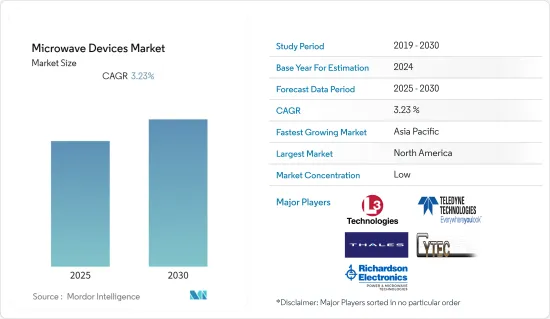

預計微波設備市場在預測期內複合年成長率為 3.23%

主要亮點

- 此外,2018 年總合發射了 88 顆衛星,高於 2016 年的 85 顆衛星。衛星發射的增加促進了頻率發射塔和衛星等微波設備的使用,以傳輸和接收資料訊號。

- 例如,2018年4月,泰雷茲阿萊尼亞航太公司為歐洲太空總署(ESA)生產的Sentinel-3B衛星發射並成功入軌。該衛星配備了SRAL(合成孔徑雷達高度計)和MWR(微波輻射計),並提供測量以確定海洋、海冰和陸地水體的地形。這將有助於改善海洋和大氣預報。

- 此外,由於越來越關注物聯網等互聯技術的採用,基本客群不斷擴大,預計也將在未來幾年推動市場成長。這種成長的特點是低訊號損失和高頻率範圍的最佳性能。

- 然而,高昂的製造成本和技術改進的研發費用是預測期內阻礙市場成長的因素。

微波設備市場趨勢

太空探勘提供成長潛力

- 太空探勘已經從太空梭任務和國際太空站之旅發展到無人火星任務和太空旅行的可能性。為了跟上太空探勘的發展,微波作為太空船追蹤和通訊系統唯一的交流電來源,非常適合無線傳輸更寬頻寬的訊號。

- 此外,美國太空總署還宣布計劃於 2024 年成為第一位登陸月球的女性,這是其阿爾忒彌斯計畫的一部分,該計畫的目標是在 2030 年代將人類帶到火星表面。

- 於是,由美國太空總署噴射推進實驗室主導的深空光纖通訊計劃誕生了。它的目標是開發雷射通訊,以提高未來人類探勘太陽系的連接速度。為此,噴射推進實驗室正在研究深空光收發器和地面接收器的實現技術,使資料速率超過Ka波段的10倍。

- 此類太空計劃預計將為市場帶來光明的前景,並有望為太空探勘提供巨大的機會。

北美佔主要佔有率

- 由於擴大採用寬頻資料鏈路和地面雷達等尖端技術以及完善的工業基礎設施,北美佔據了主要市場佔有率。

- 此外,由於人口老化需要具有成本效益的醫療設施,北美地區的醫療保健服務支出正在增加,從而推動了對成像系統等微波產品的需求。

- 此外,2019 年 6 月,科特蘭空軍基地的空軍研究實驗室推出了一種名為戰術高功率微波作戰反應器 (THOR) 的武器。它利用看不見、聽不見的電磁波來立即使無人機失靈。未來美國在世界各地的軍事基地都計劃部署它。

- 因此,微波裝置在北美的應用將會增加,進而帶動全球市場。

微波裝置產業概況

由於來自世界各地的公司的存在,微波設備市場競爭非常激烈。主要供應商包括 L3 Technologies、Thales Group、Teledyne Technologies, Inc、Cytec Corporation 和 Richardson Electronics, Ltd。政府在國防、太空和通訊領域的巨額支出預計將為全球微波設備帶來新的機遇,而反過來可能加劇公司之間的競爭。介紹一下最近的一些趨勢:

- 2019 年8 月- Communications &Power Industries LLC (CPI) 簽訂協議,收購SATCOM Technologies,後者是通用動力公司(General Dynamics) 旗下子公司通用動力任務系統公司(General Dynamics Mission Systems, Inc.) 的天線系統業務。該業務將補充 CPI 現有的政府、軍事和商業應用通訊產品組合。

- 2019 年 5 月 - API Technologies Corp 被 AEA Investors LP 的附屬公司收購。此次收購增強了 AEA Investor 在高性能射頻和微波訊號調節以及電磁頻譜管理解決方案方面的產品系列和基本客群。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進與市場約束因素介紹

- 市場促進因素

- 安全軍事通訊的需求不斷成長

- 通訊業微波裝置的快速商業化

- 市場限制因素

- 微波裝置技術成本高

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按用途

- 空間/通訊

- 醫療保健

- 防禦

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他領域

第6章 競爭狀況

- 公司簡介

- L-3 Communications

- API Technologies(AEA Investors LP)

- Thales Group

- Electron Energy Corporation

- CableFree

- Teledyne Technologies

- Toshiba Corporation

- Communications & Power Industries LLC

- Cytec Corporation

- TMD Technologies Ltd.

- Richardson Electronics Limited

第7章 投資分析

第8章 市場機會及未來趨勢

The Microwave Devices Market is expected to register a CAGR of 3.23% during the forecast period.

Key Highlights

- Moreover, in 2018, there was a total of 88 satellites launched, an increase from the 85 satellites launched in 2016. The increasing launch of satellites is promoting the use of microwave devices, such as frequency emitting towers and satellites, for sending and receiving data signals.

- For instance, in April 2018, the Sentinel-3B satellite, built by Thales Alenia Space for the European Space Agency (ESA), was successfully launched and orbited. This satellite is featured with SRAL (Synthetic-aperture Radar ALtimeter), and MWR (Microwave Radiometer), which provides measurements to determine the topography of oceans, sea ice and bodies of water on land. This would help to improve oceanographic and atmospheric forecasts.

- Further, growing customer base owing to increasing focus towards implementation of connected technology such as IoT is anticipated to boost the market growth in upcoming years as well. This growth is characterized by optimum performance, in terms of low signal loss and high-frequency range.

- However, high production cost, and research and development expenses to improve technology are few factors which is reatraing the market to grow during the forecast period.

Microwave Devices Market Trends

Space Exploration Offers Potential Growth

- Space exploration has evolved from shuttle missions and trips to the International Space Station to unmanned missions to Mars and the possibility of space tourism. In response to such evolution of space exploration where spacecraft's tracking and communications systems are the only means with which to interact, microwaves are suitable for wireless transmission of signals of having larger bandwidth.

- Further, NASA announced plans to put the first woman on the moon in 2024 as part of the Artemis program and the program also aims to put human beings on the surface of Mars by the 2030s.

- Hence, it has led to the Deep Space Optical Communications project, led by NASA's Jet Propulsion Laboratory. This aims to develop laser communications to boost connectivity speeds for future human exploration of the solar system. In response to this, Jet Propulsion Laboratory is working on technologies for the implementation of a deep-space optical transceiver and ground receiver that will enable data rates greater than 10 times the current state-of-the-art deep-space RF system (Ka-band, a type of microwave ) for a spacecraft with similar mass and power.

- Such space projects are expected to have a positive outlook on the market and it is expected that will provide an immense opportunity in the space exploration.

North America Holds the Majority Share

- Owing to the rise in the implementation of the latest technologies such as broadband data links, and surface radars, and the existence of well-established industrial infrastructure, North America holds the major market share.

- Moreover, the spending on healthcare services in the North American region is growing, owing to the aging population that requires and demands cost-effective medical facilities, increasing the demand for microwave products such as imaging systems.

- Further, in June 2019, The Air Force Research Laboratory at Kirtland Air Force Base unveiled a weapon named Tactical High Power Microwave Operational Responder, or THOR. It is capable to disable an unmanned aerial vehicle in a fraction of second through invisible and inaudible electromagnetic wave. U.S. military bases across the globe is going to deploy this in the coming future.

- Therefore, the application of microwave devices in the North America is going to increasing, which in return will boost the market globally.

Microwave Devices Industry Overview

The microwavedevices market is competitive in nature, owing to the presence of global players. Some of the key vendors areL3 Technologies,Thales Group,Teledyne Technologies, Inc,Cytec Corporation andRichardson Electronics, Ltd.Huge expenditure by the governments on defense , space communication sector is expected to open new opportunities for microwave devices globally which in return will increase the competition among players.Product launches, high expense on research and development, partnerships and acquisitions, etc. are the prime growth strategies adopted by these companies to sustain the intense competition. Some of the recent developments are:

- August 2019 -Communications & Power Industries LLC (CPI) has entered into an agreement to purchase SATCOM Technologies, the antenna systems business of General Dynamics Mission Systems, Inc., a business unit of General Dynamics.This business would complement CPI's existing portfolio of communications products for government, military, and commercial applications.

- May 2019 -API Technologies Corp has been acquired by an affiliate of AEA Investors LP. This acquisition would enhance the product portfolio and customer base of the AEA investors in terms of high-performanceRF and microwave signal conditioning and electromagnetic spectrum management solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Demand for Secured Military Communication

- 4.3.2 Rapid Commercialization of Microwave Devices in the Telecommunication Industry

- 4.4 Market Restraints

- 4.4.1 High Technological Cost of Microwave Devices

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Space & Communication

- 5.1.2 Medical

- 5.1.3 Defense

- 5.1.4 Others (Commercial)

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 L-3 Communications

- 6.1.2 API Technologies (AEA Investors LP)

- 6.1.3 Thales Group

- 6.1.4 Electron Energy Corporation

- 6.1.5 CableFree

- 6.1.6 Teledyne Technologies

- 6.1.7 Toshiba Corporation

- 6.1.8 Communications & Power Industries LLC

- 6.1.9 Cytec Corporation

- 6.1.10 TMD Technologies Ltd.

- 6.1.11 Richardson Electronics Limited