|

市場調查報告書

商品編碼

1850244

堆垛機:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Palletizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

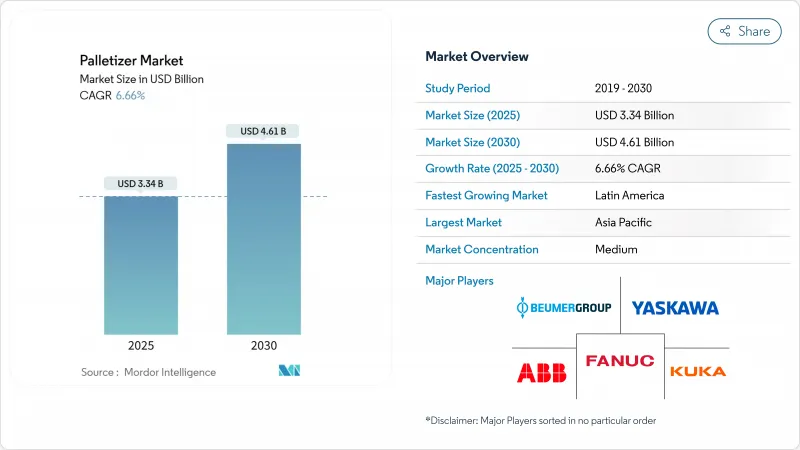

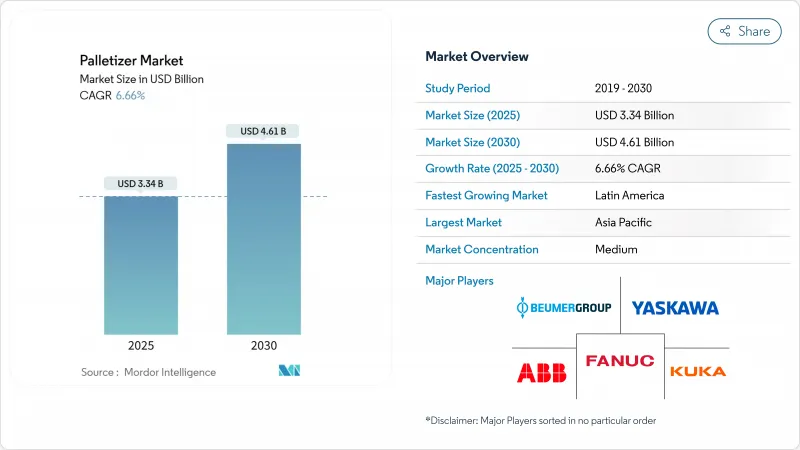

全球堆垛機市場預計到 2025 年將達到 33.4 億美元,到 2030 年將達到 46.1 億美元。

這一成長動能主要得益於托盤組裝方式從人工轉向自動化、軟體主導系統的持續轉變,這些轉變解決了勞動力短缺問題,最佳化了拖車利用率,並滿足了日益成長的電商處理容量要求。 SKU整合帶來的溢價、人工智慧賦能的托盤堆疊、降低初始成本的租賃模式的快速普及,以及協作機器人在空間受限工廠中日益成長的吸引力,都進一步推動了成長。市場競爭強度仍然適中,沒有一家公司的市佔率超過15%,但隨著區域整合商將機器人打包成訂閱和機器人即服務(RaaS)協議,價格壓力正在顯現。南美洲正在經歷最快的區域擴張,這得益於製造業回流和物流升級,以及政府的稅收優惠政策。

全球堆垛機市場趨勢與洞察

電子商務中 SKU 複雜性日益增加

目前,履約中心每年處理超過 1,800 億箱貨物,每個中心處理超過 5 萬個 SKU。高階平台可提供 30-40% 的更高利潤率,同時由於最佳化了裝載方式,減少了高達 30% 的空車廂空間,因此還能降低總運輸成本。

勞動力短缺推動倉庫自動化

中國41個工廠職位嚴重短缺,北美倉庫15-20%的空缺率,使得自動化投資回報期縮短至18個月甚至更短。目前,中型工廠每小時僅能實現100台設備的自動化,而協作系統透過將員工重新部署到更安全、更高價值的崗位,正在釋放堆垛機市場更大的潛力。

重型機械臂需要較高的初始投資。

重量超過150公斤的機械臂通常造價超過50萬美元,對於日出貨量低於500托盤的製造商來說,價格高昂,難以負擔。像Formic這樣的機器人即服務(RaaS)先驅企業正在透過每月3975美元的套餐來解決這一難題,但客製化和所有權方面仍然存在權衡取捨。

細分市場分析

到2024年,傳統機器仍將維持48%的收入成長,因為每小時處理量超過1000箱的高速生產線依賴成熟的疊層設備。然而,協作式設備將以6.2%的複合年成長率超越堆垛機市場,吸引那些佔地面積較小、渴望安全認證且無需圍欄作業的待開發區的投資。多關節臂佔據中等性能水平,兼顧吞吐量和換型靈活性,以適應混合產品系列。將疊層機與機器人揀選機結合的混合系統正在小眾飲料和個人護理用品生產單元中湧現,但成本仍然過高。

供應商透過全端生態系統實現差異化競爭:斗山的 P 系列產品與 Rocketfarm 的 Pally 軟體結合,可縮短部署時間並提高用戶自主性。隨著客戶越來越重視單一來源的課責而非僅依賴硬體,供應商將視覺、模擬和生命週期服務捆綁在一起,從而擴大了堆垛機市場的潛在機遇。

中型解決方案佔了41.2%的市場佔有率,這反映出市場對50-150公斤消費品包裝箱的偏好。然而,隨著大批量貨運商整合貨物以降低人事費用,重型堆垛機系統的市場規模預計將以7.4%的複合年成長率成長。節能伺服架構和先進的安全掃描器使得180千噸的協作機器人能夠與員工協同工作,正如Bob's Red Mill的案例所示。這些功能使得重型協作機器人的價格比中型同類產品高出40-60%,但用戶認為,減少堆高機作業次數和工傷賠償索賠是物有所值的。

重量低於 50 公斤的輕型碼垛單元適用於藥品和電子產品行業,在這些行業中,無塵室合規性和精度比蠻力更為重要。針對堆垛機市場這一細分領域的供應商,採用 10 級潔淨室和真空吸盤來保護高價商品,正經歷著穩定但緩慢的成長。

區域分析

亞太地區將佔2024年銷售額的38%,光是中國一國到2022年就將安裝全球52%的新機器人。目前,國內供應商佔據了36%的國內市場佔有率,這推動了價格分佈下降,並加速了其產品對二線工廠的滲透。日本生產了全球45%的機器人,並在393億美元(437億美元)政府供應鏈基金的支持下,已在2024年向物流、食品和製藥業撥出73.5億美元的訂單。印度的生產連結獎勵計劃正在推動汽車和學名藥工廠的自動化,但由於技能缺口,招聘仍然不均衡。

到2030年,南美洲的複合年成長率將達到8.1%,位居全球之首。巴西的食品和汽車產業正在推動托盤製造自動化,以滿足出口合規要求。墨西哥積極擁抱近岸外包趨勢,向美國市場供應免稅商品,推動了對符合北美安全標準的機器人的需求。儘管宏觀經濟波動,阿根廷的穀物加工商仍在部署堆垛機,以穩定一噸重的散裝袋,確保其在遠洋運輸中保持穩定。

北美和歐洲的成長主要由產能更新換代而非產能擴張所驅動。即將生效的歐盟法規2023/1230將促使供應商加強網路安全,並優先考慮擁有認證軟體堆疊的供應商。在美國,製造業回流計畫正在推動堆垛機市場的發展,中小製造商正在尋求靈活的協作機器人,以適應頻繁的SKU輪換,並緩解農村地區勞動力老化帶來的挑戰。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務 SKU 複雜性日益增加

- 勞動力短缺推動倉庫自動化

- 即插即用的協作機器人可提高包裝線的投資報酬率

- 快速消費品產業日益成長的永續性需求推動了機器人混合貨物碼垛技術的發展。

- 利用人工智慧驅動的視覺系統提高堆垛機的運轉率

- 將供應鏈遷回北美和歐盟以增強其韌性

- 市場限制

- 重型機械臂的初始投資較高

- 與傳統MES/WMS整合的複雜性

- 歐盟協作機器人安全評估和認證出現延誤

- 鋼材和伺服馬達的價格波動會延長投資回收期。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 定價分析

第5章 市場規模與成長預測

- 依產品類型

- 傳統堆垛機

- 高位堆垛機

- 低位堆垛機

- 機器人堆垛機

- 直角坐標/龍門座標系

- 鉸接式

- Scala

- 協作機器人(cobot)

- 混合式堆垛機

- 傳統堆垛機

- 按負載容量

- 輕型(小於50公斤)

- 中型(50-150公斤)

- 重型(超過150公斤)

- 最終用戶

- 食品/飲料

- 製藥

- 個人護理和化妝品

- 化學品

- 電子商務與第三方物流

- 其他行業

- 按銷售管道

- 直接OEM銷售

- 系統整合商

- 售後改裝與升級

- 出租/租賃

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd.

- FANUC Corp.

- KUKA AG

- Yaskawa Electric Corp.

- BEUMER Group GmbH and Co. KG

- Honeywell Intelligrated

- Krones AG

- Sidel Group

- ABC Packaging

- Schneider Packaging

- Barry-Wehmiller(BW Packaging)

- Premier Tech Chronos

- MMCI Robotics

- Columbia Machine

- Fuji Yusoki

- Brenton Engineering

- Kawasaki Robotics

- Okura Yusoki

- Regal Rexnord Automation

- Sealed Air AUTOBAG

第7章 市場機會與未來展望

The global palletizer market stands at USD 3.34 billion in 2025 and is projected to reach USD 4.61 billion by 2030, reflecting a 6.66% CAGR over the forecast period.

Momentum comes from the sustained shift away from manual pallet building toward automated, software-driven systems that resolve labor shortages, optimize trailer utilization, and meet rising e-commerce throughput requirements. Growth is reinforced by the premium that mixed-SKU, AI-enabled palletizing commands, the rapid spread of rental models that lower upfront costs, and the expanding appeal of collaborative robots in space-constrained factories. Competitive intensity remains moderate: no single player holds more than 15% revenue, yet pricing pressure surfaces as regional integrators package robots with subscription or robotics-as-a-service contracts. South America registers the fastest regional expansion as reshoring and logistics upgrades intersect with government tax incentives; meanwhile APAC maintains volume leadership due to China's scale in robot production and deployme

Global Palletizer Market Trends and Insights

Growing e-commerce SKU complexity

Fulfilment centres now handle volumes that exceed 180 billion cases yearly, with single sites processing more than 50,000 SKUs-ten times the diversity typical of legacy retail hubs.Fixed-pattern equipment cannot keep up, prompting adoption of AI-powered systems such as the Lucas Warehouse Optimization Suite, which lifts palletizing efficiency 15-20% by balancing weight, fragility, and stackability in real time. Premium platforms fetch 30-40% higher margins but still lower total shipping cost as optimized loads cut empty trailer space by up to 30%.

Labor shortages accelerating warehouse automation

Critical staffing gaps across 41 factory occupations in China and 15-20% vacancy rates in North American warehouses have compressed automation payback to under 18 months. Mid-market plants now automate runs of just 100 units per hour, unlocking a broader palletizer market as collaborative systems redeploy employees to safer, higher-value roles.

High upfront CAPEX for heavy-payload robotic arms

Installations rated above 150 kg often top USD 500,000, a hurdle for manufacturers shipping fewer than 500 pallets daily. Robotics-as-a-service pioneers such as Formic counter this barrier with USD 3,975 monthly bundles, yet tradeoffs around customisation and ownership persist.

Other drivers and restraints analyzed in the detailed report include:

- Packaging-line ROI improvements from plug-and-play cobots

- Surge in FMCG sustainability mandates favouring robotic mixed-load palletizing

- Integration complexity with legacy MES/WMS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conventional machines retained 48% revenue in 2024 as high-speed lines exceeding 1,000 cases per hour depend on proven layer devices. Yet the palletizer market sees collaborative units outpace at 6.2% CAGR, capturing greenfield investments in small-footprint sites that crave safety-certified, fence-free operation. Robotic articulated arms occupy the mid-performance tier, balancing throughput against changeover flexibility for mixed product portfolios. Hybrid systems, blending layer formers with robotic pickers, emerge in niche beverage and personal-care cells but remain cost-intensive.

Vendors differentiate through full-stack ecosystems: Doosan's P-SERIES coupled with Rocketfarm's Pally software reduces deployment time and elevates user autonomy. As customers prioritise single-source accountability over stand-alone hardware, suppliers bundling vision, simulation, and lifecycle services widen addressable opportunities inside the palletizer market.

Medium-duty solutions dominated with 41.2% share, reflecting consumer goods' bias toward 50-150 kg boxes. However the palletizer market size for heavy-duty systems is slated to expand at a 7.4% CAGR as bulk shippers consolidate loads to curb labour and freight costs. Energy-efficient servo architectures and advanced safety scanners now let 180 kg cobots operate alongside staff, as seen in Bob's Red Mill installations. These capabilities command 40-60% price uplifts compared with mid-tier peers, yet users justify the premium through reduced forklift moves and lower workers' compensation claims.

Light-duty cells under 50 kg address pharmaceuticals and electronics, where cleanroom compliance and precision trump brute force. Vendors targeting this end of the palletizer market leverage class-10-rated enclosures and vacuum grippers to protect high-value items, maintaining a stable but slower growth profile.

The Palletizer Market is Segmented by Product (Conventional Palletizer, Robotic Palletizer), by Payload Capacity (Light-Duty, Medium-Duty, and Heavy-Duty), by End-User Vertical (Food & Beverages, Pharmaceuticals, Chemicals, E-Commerce and 3PL, and More), by Sales Channel (Direct OEM Sales, System Integrators, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

APAC held 38% of 2024 revenue, with China alone installing 52% of new global robots by 2022. Domestic suppliers now secure 36% of their home market, pushing price points lower and accelerating diffusion among tier-two factories. Japan built 45% of the world's robots and channelled USD 7.35 billion in 2024 orders into logistics, food, and pharma lines, backed by a USD 39.3 billion (USD 43.7 billion) government supply-chain fund . India's Production-Linked Incentive schemes spark automation across automotive and generics plants, though adoption pockets remain uneven due to skill gaps.

South America records the strongest 8.1% CAGR trajectory to 2030 as Brazil's food and auto sectors automate pallet building for export compliance. Mexico rides near-shoring trends to supply the US market with tariff-proof goods, intensifying demand for robots certified to North American safety codes. Argentina's grain processors install palletizers that stabilise 1-tonne bulk bags for long ocean voyages despite macroeconomic volatility.

North America and Europe show measured growth driven by replacement rather than capacity additions. Upcoming Regulation (EU) 2023/1230 compels vendors to harden cybersecurity, advantaging those with certified software stacks. US reshoring programs lift the palletizer market as SMB manufacturers seek flexible cobots that accommodate frequent SKU changeovers and mitigate labour constraints in ageing rural workforces.

- ABB Ltd.

- FANUC Corp.

- KUKA AG

- Yaskawa Electric Corp.

- BEUMER Group GmbH and Co. KG

- Honeywell Intelligrated

- Krones AG

- Sidel Group

- A-B-C Packaging

- Schneider Packaging

- Barry-Wehmiller (BW Packaging)

- Premier Tech Chronos

- MMCI Robotics

- Columbia Machine

- Fuji Yusoki

- Brenton Engineering

- Kawasaki Robotics

- Okura Yusoki

- Regal Rexnord Automation

- Sealed Air AUTOBAG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing e-commerce SKU complexity

- 4.2.2 Labor shortages accelerating warehouse automation

- 4.2.3 Packaging-line ROI improvements from plug-and-play cobots

- 4.2.4 Surge in FMCG sustainability mandates favouring robotic mixed-load palletizing

- 4.2.5 AI-driven vision systems boosting palletizer uptime

- 4.2.6 Resilience re-shoring of supply chains in North America and EU

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX for heavy-payload robotic arms

- 4.3.2 Integration complexity with legacy MES/WMS

- 4.3.3 Safety-rating certification delays for cobots in EU

- 4.3.4 Volatile steel & servo-motor prices widening payback periods

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Conventional Palletizer

- 5.1.1.1 High-Level Palletizer

- 5.1.1.2 Low-Level Palletizer

- 5.1.2 Robotic Palletizer

- 5.1.2.1 Cartesian/Gantry

- 5.1.2.2 Articulated

- 5.1.2.3 SCARA

- 5.1.2.4 Collaborative (Cobot)

- 5.1.3 Hybrid Palletizer

- 5.1.1 Conventional Palletizer

- 5.2 By Payload Capacity

- 5.2.1 Light-Duty (<50 kg)

- 5.2.2 Medium-Duty (50-150 kg)

- 5.2.3 Heavy-Duty (>150 kg)

- 5.3 By End-user Vertical

- 5.3.1 Food & Beverages

- 5.3.2 Pharmaceuticals

- 5.3.3 Personal Care and Cosmetics

- 5.3.4 Chemicals

- 5.3.5 E-commerce and 3PL

- 5.3.6 Other Verticals

- 5.4 By Sales Channel

- 5.4.1 Direct OEM Sales

- 5.4.2 System Integrators

- 5.4.3 After-market Retrofits and Upgrades

- 5.4.4 Rental / Leasing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of APAC

- 5.5.5 Middle East & Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 ABB Ltd.

- 6.4.2 FANUC Corp.

- 6.4.3 KUKA AG

- 6.4.4 Yaskawa Electric Corp.

- 6.4.5 BEUMER Group GmbH and Co. KG

- 6.4.6 Honeywell Intelligrated

- 6.4.7 Krones AG

- 6.4.8 Sidel Group

- 6.4.9 A-B-C Packaging

- 6.4.10 Schneider Packaging

- 6.4.11 Barry-Wehmiller (BW Packaging)

- 6.4.12 Premier Tech Chronos

- 6.4.13 MMCI Robotics

- 6.4.14 Columbia Machine

- 6.4.15 Fuji Yusoki

- 6.4.16 Brenton Engineering

- 6.4.17 Kawasaki Robotics

- 6.4.18 Okura Yusoki

- 6.4.19 Regal Rexnord Automation

- 6.4.20 Sealed Air AUTOBAG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment