|

市場調查報告書

商品編碼

1629807

歐洲分類系統市場:市場佔有率分析、產業趨勢、成長預測(2025-2030)Europe Sortation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

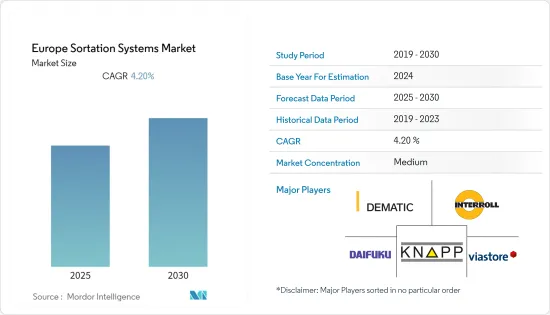

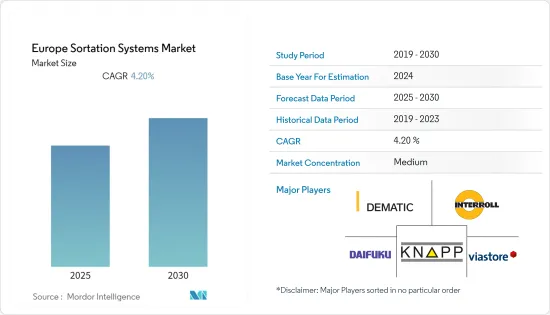

歐洲分類系統市場預計在預測期間內複合年成長率為 4.2%

主要亮點

- 人們對採用自主機器人技術在訂單履約中心執行分類功能越來越感興趣,背後有幾個因素。隨著都市化的快速發展和庫存單位 (SKU) 的增加,經銷商和批發商做出合理的業務決策在技術上變得越來越困難。這一因素推動了對勞動力、設備和技術的更創新使用的需求。推動自動化物料輸送系統需求的主要因素是降低成本、勞動效率和空間限制。

- 由於對自動化的日益關注,市場上的供應商正在贏得分類系統的新訂單。例如,2022年2月,西門子物流訂單契約,為GLS位於馬德里的新物流中心設計和整合小包裹分類技術。因此,全球物流和倉儲的擴張正在推動市場成長。

- 倉庫、配送中心和零售商必須找到方法來組織分類流程,並更快、更經濟地處理不同的包裹。因此,倉庫、配送中心和零售商必須升級其現有的分類系統,以準確地分類大量包裹。

- COVID-19 大流行促使倉庫營運商考慮加快自動化和機器人實施的時間表。成功實施該技術的企業已經證明,它可以透過減少工人互動和提高生產力來滿足電子商務日益成長的需求,從而創造更安全的工作。近幾個月電子商務的激增改善了該地區的分類市場。

- 隨著電子商務貨運量的飆升,UPS 和 DHL 等航運公司已宣布對其歐洲業務進行投資。例如,2021 年 9 月,UPS 在布拉格開設了新的分類設施,擴大了其歐洲網路。據 UPS 稱,新設施是其最近完成的 20 億美元多年歐洲投資計畫的一部分,該計畫旨在擴展整個歐洲的 UPS 網路。

歐洲分類系統市場趨勢

郵政和小包裹業務預計將推動市場成長

- 在當今競爭激烈的環境中,產品可用性的提高、交貨頻率的增加以及對較小貨物的需求正在推動分類過程的自動化。英國批發和零售業未來幾年的自動化程度可能會有所提高。隨著企業尋求勞動力密集程度較低的業務,預期的勞動力短缺也強化了物流自動化的理由。由於高需求和進一步的市場成長機會,自動化物流供應商的前景一片光明。

- 據歐盟委員會稱,2021 年 11 月,歐洲郵政服務向所有歐洲公民提供基本的郵政和小包裹服務,並提高了單一小包裹跨境投遞服務的海關透明度。不過,他也強調,數位化正在改變國內郵政和小包裹服務市場,隨著消費者需求和期望的變化,為郵政業者創造新的機會。這些措施正在推動該地區對郵政和小包裹分揀系統的需求。

- 該地區的組織專注於創新新的分類系統。例如,皇家郵政於 2022 年 7 月在北愛爾蘭推出了第一台自動小包裹分揀機。該機器每天能夠處理 157,000 個小包裹,可滿足每天增加的隔夜小包裹需求。本機器使用智慧型系統,結合輸送機和掃描技術對包裹進行分類以便運輸。這台機器安裝在北愛爾蘭紐敦修道院的郵政中心,每小時可分揀多達 7,500 個小包裹。分揀後,小包裹將透過皇家郵政網路發送至當地的投遞辦公室。我們可以處理任何形狀和尺寸的小包裹,有些重量可達 20 公斤。

- 2022 年 6 月,匈牙利領先的小包裹分類中心 Magyar Posta 透過 Leonardo 的新型分揀系統提高了投遞能力。這是物流業最新的國際里程碑,證實了匈牙利業者對李奧納多能力的信心。 20年來,兩家公司建立了牢固的合作關係。該系統將於2023年交付,每年能夠處理1億個小包裹,合約包括2031年的技術支援。

- 德國是擁有熟練製造業的領先經濟體之一。該國致力於利用自動化技術來提高製造生產力,其工業4.0計劃證明了這一點,該計劃旨在分配資源和資金來建造更多智慧工廠。

- 德國分類系統市場的成長也得益於分揀系統領域的全球領導者西門子郵政物流和包裹機場物流的存在。這些公司已成功進入國際市場,並以穩健的成長率提高了全部區域對分類技術的認知。

預計英國將佔據最大的市場佔有率

- 分類中心的概念可以追溯到 2013 年,當時亞馬遜首次在英國推出分類中心。在實現所需處理能力的同時大幅降低營運成本後,其他電子商務產業在英國領先其他主要國家採用了相同的概念。

- 由於電子商務的蓬勃發展,整個歐洲的宅配正在經歷巨大的成長,特別是在英國和德國等國家。由此帶來的小包裹量的增加給許多宅配業者和郵政公司帶來了重大挑戰。對宅配產品不斷成長的需求可能會推動送貨小包裹分類和管理自動化的引入。

- 組織正在採取策略性方法來滿足消費者的需求。例如,LAC 物流為各種分類產品提供全套設備。該公司主要關注零售商和物流公司服務的郵政/快捷郵件市場中小包裹、小包裹和盒子等各種產品數量的顯著成長。

- 隨著電子商務的成長,英國分揀系統市場受到該地區航空業的推動。英國四個主要機場已宣布擴建計劃,以實現旅客數量的創紀錄成長。例如,蓋特威克機場宣布了五年內 11 億歐元的新投資計劃,目標是到 2023 年將旅客人數增加約 5,300 萬人次。

- PSI Technologies 專注於食品和飲料產業。該公司了解 24/7 營運的獨特要求,因此可以將計劃維護保持在最低限度。該公司提供從基於顏色的食品分選到高速分配和填充系統的一切產品。該公司的產品廣泛應用於整個食品和飲料生態系統。

- 2022年6月,AsendiaManagement SAS在其希斯洛小包裹處理中心成功安裝了一台自動分類機器人和六台新的貼標機器人,並於2022年5月開始全面運作。這個新的自動化系統將顯著提高零售商、電子商務品牌和其他客戶的小包裹處理能力,使他們能夠每小時處理多達 7,200 個小包裹,並運作。該公司為這些改進投入了 250 萬歐元的資本投資。

歐洲分類系統產業概況

歐洲分類系統市場分散且競爭激烈。產品推出、高研發成本、聯盟和收購是公司維持激烈競爭的主要成長策略。

- 2021 年 8 月 - 范德蘭德與物流服務供應商Bleckmann 合作測試最新的倉庫管理創新。這種直覺的系統減少了培訓時間並提高了操作員的表現。

- 2021 年 3 月 - 法孚為 DHL Express Italy 提供了新的小包裹處理和分類解決方案。 2021 年 3 月,DHL Express Italy 在義大利北部的米蘭馬爾彭薩機場開設了新的樞紐、門戶和服務中心。法孚作為 DHL Express Italy 的合作夥伴,設計了基於專有技術的解決方案,以滿足客戶的要求。 DHL Express Italy 採用法孚的交叉帶技術,快速且精準。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 對提高訂單準確性和增加 SKU 的需求不斷成長

- 人們對人事費用和工業自動化的擔憂日益加劇

- 電子商務成長

- 市場限制因素

- 安裝和維護成本高

- 即時技術挑戰和對技術純熟勞工的需求

- 技術簡介

- 自動分揀實施概述(優點、實施、實施後和實施前的挑戰、可用性(提供自動分揀實施的供應商清單)、設計、工具和其他規範方面的技術演進)

第6章 市場細分

- 按最終用戶

- 小包裹

- 飛機場

- 飲食

- 零售

- 藥品

- 其他最終用戶

- 按國家/地區

- 英國

- 法國

- 義大利

- 德國

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- TGW Systems Inc.

- Interroll Holding AG

- Dematic Corp.(KION Group)

- Daifuku Co. Ltd

- Viastore Systems Gmbh

- Bastian Solutions Inc.

- Murata Machinery Ltd

- Fives Group

- Vanderlande Industries Nederland BV

- Beumer Group GmbH

- Honeywell Intelligrated

- Siemens AG

- KNAPP AG

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 57248

The Europe Sortation Systems Market is expected to register a CAGR of 4.2% during the forecast period.

Key Highlights

- Several factors are driving the growing interest in the adoption of autonomous robotics technology to perform sorting functions in order fulfillment centers. With the rapid urbanization and growth in stock-keeping units (SKUs), distributors and wholesalers are finding it technically challenging to make the right decisions for their operations. This factor is driving the need for a more innovative way of using labor, equipment, and technology. Key factors driving the need for an automated material handling system are cost savings, labor efficiency, and space constraints.

- Vendors in the market are gaining new orders for sortation systems due to increased focus on automation. For instance, in February 2022, Siemens Logistics received a contract from GLS Spain to design and integrate parcel sorting technology in GLS's new logistics center in Madrid. Therefore, the expansion of logistics and warehouses worldwide is driving the market's growth.

- Warehouses, distribution centers, and retailers must find ways to organize their sorting processes and handle different packages in less time and cost-effectively, as ineffective sorting wastes time and effort, thus damaging business profits. Therefore, warehouses, distribution centers, and retailers must upgrade their existing sorting systems to accurately sort large volumes of packages.

- The COVID-19 pandemic resulted in warehouse operators considering accelerating their schedules for adopting automation and robotics. Successful implementations demonstrated that these operators created safer jobs by reducing worker interactions and increasing productivity to meet the growing demand for e-commerce. The surge in e-commerce over the past few months has improved the sortation market in the region.

- Shipping companies such as UPS and DHL announced investments in their European operations due to a surge in e-commerce shipments. For instance, in September 2021, UPS opened a new sorting facility in Prague, expanding its European network. According to UPS, the new facility is part of its recently completed USD 2-billion multi-year European investment plan to expand the UPS network across Europe.

Europe Sortation System Market Trends

The Post and Parcel Segment is Expected to Drive the Market's Growth

- The increasing number of available products and the demand for more frequent and smaller deliveries in today's competitive environment are automating the sorting processes. The UK wholesale and retail sector has a high chance of automation in the next few years. The predicted labor shortage is also strengthening the case for logistics automation as firms seek to make their operations less labor-intensive. High demand and opportunities for further market growth have resulted in a positive outlook among automated logistics suppliers.

- According to the European Commission, in November 2021, the European Postal Service made basic post and parcel services accessible to all European citizens and increased tariff transparency for cross-border delivery services for single parcels. However, it also highlighted the way digitization is transforming the domestic market for postal and parcel services, creating new opportunities for postal operators amid changing consumer needs and expectations. Such initiatives are boosting the demand for post and parcel sortation systems in the region.

- Organizations in the region are focused on innovating new sorting systems. For instance, in July 2022, Royal Mail launched the first automatic parcel sorter in Northern Ireland. Capable of processing 157,000 packages per day, the machine can help meet the growing demand for overnight packages per day. This machine is an intelligent system that combines conveyor belts and scanning technology to sort packages for shipping. Installed at the Postal Center in Newtown Abbey, Northern Ireland, the machine sorts up to 7,500 parcels per hour. It dispatches them via the Royal Mail network to local delivery offices. It can handle parcels of any shape and size, with some packages weighing up to 20 kg.

- In June 2022, Magyar Posta, Hungary's leading parcel sorting center, increased its distribution capacity with Leonardo's new sorting system. This is the latest international milestone in the logistics industry and confirms the Hungarian operator's trust in Leonardo's capabilities. They have had a solid cooperation for two decades. The system will be delivered by 2023 and can process up to 100 million parcels per year, and the contract includes technical support until 2031.

- Germany is one of the largest economies with a skilled manufacturing industry. As evidenced by the Industry 4.0 initiative (which aims to allocate resources and funding to build more intelligent factories), the country has a growing interest in using automation technology to improve manufacturing productivity.

- The growth of the sortation systems market in Germany can also be supported by the presence of the global leaders in sortation systems, Siemens Postal and Parcel Airport Logistics. These companies have made successful installations across international markets and are increasing awareness about sortation technology across regions with solid growth rates.

United Kingdom is Expected to Hold the Largest Market Share

- The concept of a sortation center dates back to 2013 and was first introduced by Amazon in the United Kingdom. After recording significant savings in operating costs while achieving the required throughput, other e-commerce industries adopted the same concept in the United Kingdom before other major countries.

- Due to the e-commerce boom, parcel delivery is experiencing tremendous growth across Europe, mainly in countries such as the United Kingdom and Germany. The resulting increase in parcel volume is a significant challenge for many courier and postal companies. The increasing demand for delivered products may boost the adoption of automation in sorting and managing shipping packages.

- Organizations are taking strategic approaches according to consumers' requirements. For instance, LAC Logistics offers a complete range of equipment for all sorted commodities. The company mainly focuses on the significant increase in the volume of various products, such as parcels, packets, and boxes, in the postal/express delivery market served by retailers and logistics companies.

- Along with e-commerce growth, the market for sortation systems in the United Kingdom is driven by the region's aviation industry. Four leading UK airports announced expansion plans to record passenger growth. For instance, Gatwick Airport announced a new EUR 1.1 billion investment plan over five years, aiming to increase passenger numbers by around 53 million by 2023.

- PSI Technologies excels in the food and beverage industry. The company understands the unique requirements of 24/7 operations, thus minimizing planned maintenance. It offers color-based food sorting to high-speed dispensing and filling systems. Its products are widely used throughout the food and beverage ecosystem.

- In June 2022, AsendiaManagement SAS successfully installed automated sorting robots and six new labeling robots at its parcel processing center in Heathrow, which became fully operational in May 2022. The new automated system has significantly increased parcel throughput for retailers, e-commerce brands, and other customers, reaching speeds of up to 7,200 parcels per hour and allowing sites to operate 24/7. The company invested its CAPEX of EUR 2.5million in these improvements.

Europe Sortation System Industry Overview

The European sortation systems market is fragmented and highly competitive. Product launches, high expenses on R&D, partnerships, and acquisitions are the prime growth strategies adopted by companies to sustain the intense competition.

- August 2021 - Vanderlande partnered with Bleckmann, a logistic service provider, to test its latest warehousing innovation, which aims to improve the manual sortation of batch-picked items to orders. This intuitive system can also reduce training time and increase operator performance.

- March 2021 - Fives provided DHL Express Italy with a new parcel handling and sorting solution. In March 2021, DHL Express Italy inaugurated the new Hub, Gateway, and Service Center at the Milan Malpensa Airport in northern Italy. As a partner of DHL Express Italy, Fives designed the solution based on proprietary technologies to meet customers' requirements. DHL Express Italy selected Fives' cross belt technology due to its high speed and accuracy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Improving Order Accuracy and SKU Proliferation

- 5.1.2 Increasing Concerns About Labor Costs and Industrial Automation

- 5.1.3 Growth in E-commerce

- 5.2 Market Restraints

- 5.2.1 High Deployment and Maintenance Costs

- 5.2.2 Real-time Technical Challenges and the Need for Skilled Workforce

- 5.3 Technology Snapshot

- 5.3.1 Overview of Automated Sorter Induction (Advantages, Adoption, Challenges Post-adoption and Pre-adoption, Availability (List of Vendors Offering Automated Sortation Induction), Technological Evolution in Terms of Design, Tools, and Other Specifications)

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Post and Parcel

- 6.1.2 Airport

- 6.1.3 Food and Beverages

- 6.1.4 Retail

- 6.1.5 Pharmaceuticals

- 6.1.6 Other End-user Industries

- 6.2 By Country

- 6.2.1 United Kingdom

- 6.2.2 France

- 6.2.3 Italy

- 6.2.4 Germany

- 6.2.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TGW Systems Inc.

- 7.1.2 Interroll Holding AG

- 7.1.3 Dematic Corp. (KION Group)

- 7.1.4 Daifuku Co. Ltd

- 7.1.5 Viastore Systems Gmbh

- 7.1.6 Bastian Solutions Inc.

- 7.1.7 Murata Machinery Ltd

- 7.1.8 Fives Group

- 7.1.9 Vanderlande Industries Nederland BV

- 7.1.10 Beumer Group GmbH

- 7.1.11 Honeywell Intelligrated

- 7.1.12 Siemens AG

- 7.1.13 KNAPP AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219