|

市場調查報告書

商品編碼

1629810

拉丁美洲自動儲存和搜尋系統:市場佔有率分析、行業趨勢和成長預測(2025-2030)Latin America Automated Storage and Retrieval System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

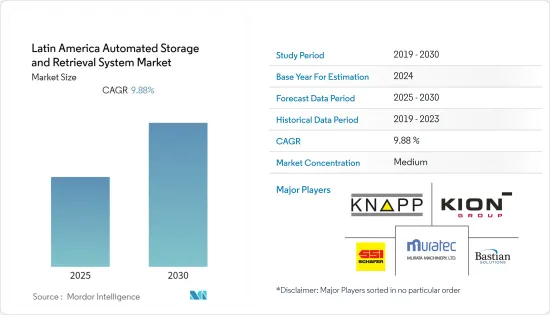

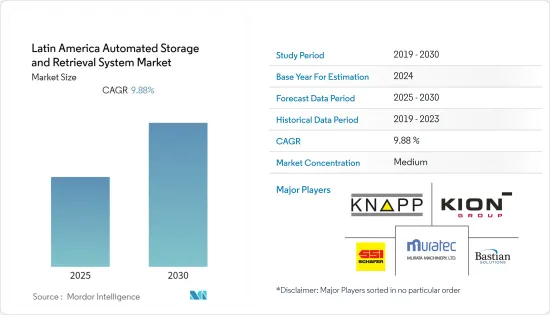

拉丁美洲自動化儲存和搜尋系統市場預計在預測期內複合年成長率為 9.88%

主要亮點

- 拉丁美洲國家正在轉型為快速成長的新興經濟體。在中國設有製造工廠的公司正在將部分生產轉移到墨西哥和巴西,以降低供應鏈風險並服務美國市場。

- 此外,自動化正在徹底改變該地區的倉儲業務,使公司能夠降低管理成本,並以一致性和準確性提高生產力。人工智慧在實現這一目標方面發揮著關鍵作用。線上零售商正在盡一切努力減少向客戶交付產品所需的時間。

- 許多汽車和電子製造商正在投資新技術以降低成本並提高效率。例如,倉庫機器人市場的知名供應商 Mecalux 在其大陸工廠(墨西哥)安裝了一台自動箱子堆垛機機,以及其他輸送系統和行李進出點的電腦化操作。預計在預測期內,起重機作為此類補充解決方案的使用案例將會增加。

- 拉丁美洲市場成長的主要驅動力是都市化的加速、電子商務銷售的增加以及技術提供者的強大存在。這些公司投資研發活動並提供創新解決方案以保持競爭力。

- 此外,憑藉幾乎為零的市場進入障礙和高度發展的工業基礎,墨西哥已發展成為美國自動化的最大買家。拉丁美洲靠近歐洲和北美,這有助於零件供應商的出現,並影響了對適合此類需求的 AS/AR 系統的需求。

拉丁美洲自動搜尋系統市場趨勢

汽車產業可望佔據較大市場佔有率

- 巴西和哥倫比亞的汽車產業正在經歷積極的轉型。此外,巴西和阿根廷簽署了汽車領域的自由貿易協定。兩國將逐步取消汽車業的貿易關稅。這些預計將為汽車行業引入自動化,並為該地區的 AS/RS 鋪平道路。

- 此外,Festo 等組織正在準備向墨西哥和中美洲出貨的戰略地點。費斯托最近發布新聞稿稱,其辛辛那提工廠地理位置優越,毗鄰機場,並且有能力支持墨西哥的預期成長,正在成為公認的汽車行業中心。

- 冠狀病毒危機已經打擊了世界各地的汽車生產,但巴西受到的打擊最為嚴重。汽車製造商協會Anfave的數據顯示,2020年6月巴西汽車產量較2020年5月成長129%,但較2019年同月仍下降58%。它還預測2020年汽車產量與前一年同期比較下降45%,出口量將年減53%。

- 此外,過去十年來,電動和混合動力汽車的出現徹底改變了汽車製造。汽車生產變得更加精密和複雜。不斷發展的政府安全法規和行業標準使組裝操作變得更加複雜。

- 這創造了汽車產業對自動裝置的巨大需求。最大限度地減少人為錯誤導致的運輸過程中的產品損壞,並提高工作站之間的底盤搬運速度以允許與組裝工人的互動是首要任務。這些趨勢預計將推動該地區所有行業採用倉庫機器人。

預計墨西哥將佔較大市場佔有率

- 千禧世代人口的成長和可支配收入的增加為亞馬遜等零售商創造了許多推出新產品線的機會,並對先進的倉儲設備產生了巨大的需求。在這些高吞吐量倉庫中,AMR 可以幫助提高效率並減少勞動力挑戰。

- 2020 年 10 月,亞馬遜宣布投資 1 億美元在墨西哥開設新倉庫,其中包括人口稠密的大都會區以外的第一個配送中心,以提供更快的配送服務。新地點包括兩個履約中心,一個靠近北部城市蒙特雷,另一個靠近中部城市瓜達拉哈拉。此外,該公司正在向巴西擴張,最近在該國開設了第五個也是最大的履約中心,面積達 100,000平方公尺。所有這些投資預計將加速 ASRS 在倉庫中的使用。

- 此外,許多巴西人透過電子商務購買飲料、餅乾和洗髮精等日常用品。零售市場預計將在預測期內快速成長,並有助於零售業擴大採用自動化。

- 此外,先進技術正在創造正在改變該國食品和飲料行業的設備和流程。食品和飲料行業傳統上依賴人力來完成配送和儲存等功能,但正在開發和引入機器人來簡化流程並生產更穩定的產品。

- 在食品自動化中,必須對機器進行適當消毒,以避免產品污染並保護消費者免受食物中毒。目前的自動化趨勢證實了新技術的發展,可以為墨西哥某些加工食品的生產提供端到端自動化。

拉丁美洲自動倉儲與搜尋系統產業概況

由於初始投資較高,拉丁美洲的自動化儲存和搜尋系統市場適度集中。一些大公司主導市場,例如 KION GROUP AG、Bastian Solutions, LLC、SSI Schaefer AG、Murata Machinery Ltd. 和 KNAPP AG。這些擁有壓倒性市場佔有率的大公司正致力於擴大海外基本客群。這些公司利用策略合作措施來擴大市場佔有率並提高盈利。然而,隨著技術進步和產品創新,中小企業正在透過贏得新契約和開拓新市場來增加其市場佔有率。

- 2020 年 9 月 - KUKA AG 推出水平關節臂機器人 KR SCARA,該機器人極其緊湊,具有最佳成本績效。機器人的運行距離為 500 毫米或 700 毫米,循環時間短,僅 0.36 或 0.38 秒。 KR SCARA機器人是在成本敏感市場中推動自動化的理想選擇。

- 2020 年 8 月 - Geek+Inc. 繼美國和墨西哥之後,擴展其第一個南美洲計劃。該公司宣布透過第一個機器人計劃向南美洲擴張,為該國最大的超級市場沃爾瑪智利提供智慧物流解決方案。沃爾瑪智利將Geek+AMR帶到南美,升級供應鏈業務。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

第5章市場動態

- 市場促進因素

- 日益重視職業安全

- 人們對人事費用的擔憂日益加劇

- 市場限制因素

- 對熟練勞動力的需求以及對人工替代的擔憂

- COVID-19 對市場的影響

第6章 市場細分

- 依產品類型

- 固定通道法

- 輪播(水平輪播+垂直輪播)

- 垂直升降模組

- 按最終用戶產業

- 飛機場

- 車

- 飲食

- 一般製造業

- 小包裹

- 零售業

- 其他

- 按國家/地區

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

第7章 競爭格局

- 公司簡介

- Murata Machinery Ltd.

- KNAPP AG

- Bastian Solutions, LLC

- KION GROUP AG

- Schaefer Systems International Pvt Ltd

- Hanel Storage Systems

- Flex Inc.

- Kubo systems

- Automation Logistics Corporation

- Beumer Group

第8章投資分析

第9章市場的未來

The Latin America Automated Storage and Retrieval System Market is expected to register a CAGR of 9.88% during the forecast period.

Key Highlights

- Latin American nations have transformed themselves into a set of fast-growing, emerging economies. Companies with manufacturing plants in China are moving some production to Mexico and Brazil to reduce supply chain risk and serve the American market.

- Moreover, automation has revolutionized the warehouse business in the region, thereby helping companies reduce overhead costs and increase productivity with consistency and accuracy. Artificial intelligence plays a significant role in achieving this. Online retailers are making every effort to reduce the time it takes to deliver products to customers.

- Many automotive and electronic companies are investing in new technologies to reduce their cost and attain efficiency. For instance, Mecalux, a prominent vendor in the warehouse robotics market, installed automated stacker cranes for boxes in Continental's plant (Mexico), along with other conveyor systems and computerized operations at cargo entrance and exit. Such use cases of cranes as a complementing solution are expected to increase over the forecast period.

- The primary driving forces for the growth of the Latin America regional segment are the rising urbanization, rising e-commerce sales, and the significant presence of technology providers. These players invest in research and development activities to offer innovative solutions to stay competitive.

- Further, with virtually zero market access barriers and a highly developed industrial base, Mexico has evolved to become the largest purchaser of automation from the United States. The proximity of the Latin American region with Europe and North America has helped the emergence of component suppliers, impacting demand for AS/AR systems suited for such needs.

Latin America Automated Storage & Retrieval System Market Trends

Automotive is Expected to Hold Significant Market Share

- The automotive industry is undergoing a positive transition in Brazil and Columbia. Moreover, Brazil and Argentina signed a free trade agreement for the automotive sector. Both the countries will gradually phase out trade tariffs for each other in the automotive industry. These are expected to bring automation to the automotive industry, thus paving the way for AS/RS in this region.

- Further, organizations like Festo are preparing strategic locations for shipments to Mexico and Central America. Recently, Festo published a news release stating that a facility in Cincinnati, which is strategically close to the airport and could support the expected growth in Mexico, is becoming a recognized hub for the automotive industry.

- The coronavirus crisis has struck auto production around the world but hit Brazil the hardest. According to the automakers association, Anfave, Brazil's automobile production rose in June 2020 from May 2020 by 129% but remains 58% lower compared with the same month in 2019. It also expects auto production to fall by 45% in 2020 compared to a year ago, while exports will lose 53% in the same period.

- Moreover, the advent of electric vehicles and hybrid cars has revolutionized automobile manufacturing in the past decade. Automobile production has become far more sophisticated and complex. The ever-evolving government safety regulations and industry standards are further complicating the assembly line tasks.

- This has created a significant demand for automation in the automotive sector. Minimizing products damage during transit (caused by human error) and increasing the speed of handling the chassis between workstations (which would allow interaction with assembly-line workers) are receiving the utmost priority. Such trends are expected to boost the adoption of warehouse robotics across industries in the region.

Mexico is Expected to Account For Significant Market Share

- The expanding millennial population and the increase in disposable incomes create many opportunities for retailers like Amazon to introduce new product lines, creating a considerable need for advanced warehouse facilities. In such high throughput warehouses, AMRs can help scale up the efficiencies and mitigate labor challenges.

- In October 2020, Amazon announced USD 100 million logistics investment in opening new warehouses in Mexico, including its first shipping centers outside the populous capital area, to offer faster deliveries. The new sites include two fulfillment centers, one near the northern city of Monterrey and another near the central city of Guadalajara. Additionally, the company is also striving to make inroads in Brazil, where it recently opened its fifth and biggest fulfillment center in the country, with 100,000 square meters. All these investments are expected to drive the utilization of ASRS in the warehouse.

- Further, many people in the country opting for e-commerce for their daily necessities, such as drinks, biscuits, and shampoos. The retail market is expected to experience rapid growth during the forecast period and help increase the adoption of automation in retails.

- Moreover, advanced technology has given rise to equipment and processes that have transformed the country's food and beverage sector. The food and beverage industry has traditionally relied on human workers to handle functions like distribution and storing; robotics are being developed and implemented to streamline the process and produce more consistent output.

- In food automation, it is essential to ensure properly sanitized machinery to avoid product contamination, resulting in consumers contracting foodborne illnesses. The current trend of automation has witnessed the development of new technologies that can provide end-to-end automation for the production of certain processed foods in Mexico.

Latin America Automated Storage & Retrieval System Industry Overview

The Latin American automated storage and retrieval system market is moderately concentrated due to higher initial investments. It is dominated by a few significant players like KION GROUP AG, Bastian Solutions, LLC, SSI Schaefer AG, Murata Machinery Ltd., and KNAPP AG. With a prominent share in the market, these significant players are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market presence by securing new contracts and tapping new markets.

- September 2020 - KUKA AG launched the KR SCARA horizontal jointed-arm robots that are ultra-compact and at the same time deliver maximum cost-effectiveness. The robot reaches 500 or 700 millimeters, a short cycle time of just 0.36 or 0.38 seconds. The KR SCARA robots are ideal for pushing ahead with automation in cost-sensitive markets.

- August 2020 - Geek+ Inc is expanding with its first South American project, following the US & Mexico deployments. The company announced its expansion into South America with its first robotics project, providing intelligent logistics solutions to Walmart Chile, the largest supermarket chain in the country. Walmart Chile brought Geek+ AMRs to South America, upgrading its supply chain operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emphasis on Workplace Safety

- 5.1.2 Increasing Concerns about Labor Costs

- 5.2 Market Restraints

- 5.2.1 Need for Skilled Workforce and Concerns over Replacement of Manual Labor

- 5.3 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Fixed Aisle System

- 6.1.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 6.1.3 Vertical Lift Module

- 6.2 By End-User Industries

- 6.2.1 Airports

- 6.2.2 Automotive

- 6.2.3 Food and Beverage

- 6.2.4 General Manufacturing

- 6.2.5 Post and Parcel

- 6.2.6 Retail

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 Mexico

- 6.3.2 Brazil

- 6.3.3 Argentina

- 6.3.4 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Murata Machinery Ltd.

- 7.1.2 KNAPP AG

- 7.1.3 Bastian Solutions, LLC

- 7.1.4 KION GROUP AG

- 7.1.5 Schaefer Systems International Pvt Ltd

- 7.1.6 Hanel Storage Systems

- 7.1.7 Flex Inc.

- 7.1.8 Kubo systems

- 7.1.9 Automation Logistics Corporation

- 7.1.10 Beumer Group