|

市場調查報告書

商品編碼

1629813

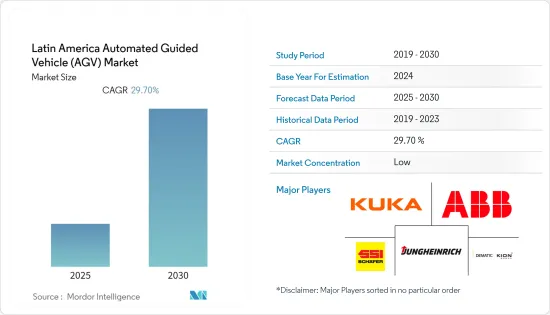

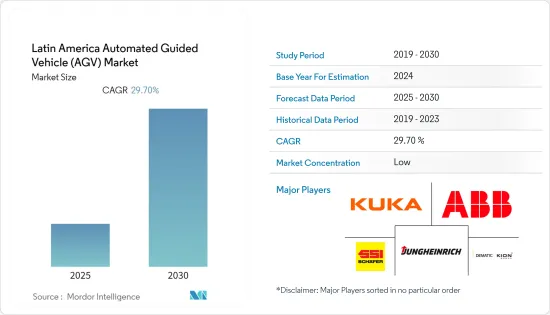

拉丁美洲自動導引運輸車(AGV) -市場佔有率分析、產業趨勢、成長預測(2025-2030 年)Latin America Automated Guided Vehicle (AGV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

拉丁美洲自動導引運輸車市場預計在預測期間內複合年成長率為29.7%

主要亮點

- 該地區具有成長潛力。然而,該地區不穩定的政治局勢預計將阻礙成長。例如,去年墨西哥、古巴、巴西都選出了新的領導人,阿根廷也即將舉行選舉。隨著尼古拉斯馬杜羅的連任,委內瑞拉繼續面臨動盪。儘管最近取得了這些進展,但巴西、哥倫比亞、墨西哥和智利等新興經濟體預計將推動多個產業的成長。

- 尤其是在汽車產業,墨西哥和巴西的汽車產量超過了俄羅斯和加拿大。

- 該地區零售業的成長正在推動倉庫自動化以最佳化流程。根據 Euromonitor 的數據,到 2022 年,拉丁美洲零售預計將達到 1.7 兆美元。

- 此外,巴西因其規模、資源豐富和有利的人口結構而成為一個前景廣闊的自動化市場。巴西的上層和中產階級人口正在迅速成長,消費率預計將提高。然而,由於人事費用的快速上升,許多經營模式可能會改變。

- 此外,與實施自動化系統相關的高初始成本和長投資回收期預計將成為預測期內市場成長的挑戰。然而,與採用此類系統相關的額外好處和客戶滿意度預計將使組織受益。

拉丁美洲自動導引運輸車(AGV)市場趨勢

零售業預計將佔據主要市場佔有率

- 電子商務佔該地區零售總額的佔有率逐年增加,倉庫自動化的需求預計將進一步增加,帶動自動導引運輸車的需求。到2020年,電子商務佔該地區零售總額的佔有率預計將超過3%。

- 巴西約佔拉丁美洲 B2C 電子商務總量的 42%。亞馬遜於2012年進入巴西,但迄今為止主要只銷售書籍。亞馬遜也增加了智慧型手機、筆記型電腦、平板電腦和配件等品類,經過幾個月的物流微調,現在它在巴西提供完整的類別。

- 2020 年 10 月,亞馬遜宣布投資 1 億美元的物流投資,在墨西哥開設新倉庫,包括在人口稠密的大都會區之外開設第一個配送中心,以提供更快的配送服務。新地點包括兩個履約中心,一個靠近北部城市蒙特雷,另一個靠近中部城市瓜達拉哈拉。此外,該公司正在向巴西擴張,最近在該國開設了第五個也是最大的履約中心,面積達 100,000平方公尺。所有這些投資預計將推動 AGV 在倉庫中的使用。

- 此外,許多墨西哥人透過電子商務購買飲料、餅乾和洗髮精等日常用品。零售市場預計在預測期內將快速成長,並有助於零售業自動化的採用。

- 此外,該地區的消費者要求更快的交貨時間,增加了 AGV 在倉庫和配送中心的應用。此外,技術進步使 AGV 變得更好、更小,成本降低以及某些地區的勞動力短缺正在推動所研究市場的成長。

巴西可望佔據較大市場佔有率

- 機器人和自動化技術的快速進步導致巴西製造業在生產過程中更多地採用機器人和技術。製造商在選擇為其製造工廠提供最有效和最盈利的結果的機器人之前,會考慮負載、方向、速度、精度、佔空比、行程和環境等因素。

- 冠狀病毒危機已經打擊了世界各地的汽車生產,但巴西受到的打擊最為嚴重。汽車製造商協會Anfave的數據顯示,2020年6月巴西汽車產量較2020年5月成長129%,但較2019年同月仍下降58%。它還預測2020年汽車產量與前一年同期比較下降45%,出口量將年減53%。

- 此外,過去十年來,電動和混合動力汽車的出現徹底改變了汽車製造。汽車生產變得更加精密和複雜。不斷變化的政府安全法規和行業標準使組裝操作變得更加複雜。

- 這創造了汽車產業對自動化的巨大需求。最大限度地減少人為錯誤導致的運輸過程中的產品損壞並提高工作站之間的底盤搬運速度(實現與組裝工人的互動)是首要任務。這些趨勢預計將推動該地區所有行業採用倉庫機器人。

- 此外,先進技術創造的設備和工藝改變了該國的食品和飲料產業。食品和飲料行業傳統上依賴人類工人來完成配送和儲存等功能,但正在開發和引入機器人來簡化流程並生產更一致的產品。

拉丁美洲自動導引運輸車(AGV)產業概況

拉丁美洲自動導引運輸車(AGV) 市場較為分散,不同地區的主要供應商也不同。市場上的領先供應商正在獲取更詳細的產品系列,以滿足客戶的不同需求。相比之下,其他供應商則在利基市場開展業務,提供客製化服務和客戶特定訂單。主要參與企業包括 Kuka Group、Schaefer Systems International Pvt Ltd、ABB Ltd 和 Jungheinrich Group。近期市場趨勢如下。

- 2020 年 9 月 - KUKA 集團推出 KR SCARA 水平關節臂機器人 AGV,該機器人結構超緊湊,但具有最大的成本效益。機器人達到500mm或700mm,循環時間短僅0.36秒或0.38秒。 KR SCARA機器人是在成本敏感的市場中推動自動化的理想選擇。

- 2020 年 8 月 - 德馬泰克宣布推出全新桌上型 (TT) 系列自動導引運輸車(AGV)。新型 TT 系列 AGV 重量不到 500 公斤,可運輸 1,500 公斤,是德馬泰克最小、最靈活的 AGV。 TT 系列 AGV 標配桌上型升降機、選配輸送機或自訂型號,並由具有自動充電功能的高性能 24 V 鋰電池供電。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 市場促進因素

- 電子商務產業快速成長

- 海事應用需要自動化以提高碼頭效率

- 市場限制因素

- 初始投資高

- 由於通訊延遲而導致即時無線控制的局限性

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場區隔

- 依產品類型

- 自動堆高機

- 自動拖車/曳引機/標籤

- 單元貨載

- 組裝

- 特殊用途

- 按最終用戶產業

- 飲食

- 車

- 零售

- 電子/電力

- 藥品

- 其他

- 國家名稱

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

第6章 競爭狀況

- 公司簡介

- KUKA Group

- Schaefer Systems International Pvt Ltd

- ABB Ltd.

- Jungheinrich Group

- Dematic Group(KION)

- Savant Automation

- Daifuku Co. Ltd

- Transbotics Corporation

- Aethon Inc.

- Toyota Material Handling International AB

- Amerden Inc.

第7章 投資分析

第8章市場的未來

The Latin America Automated Guided Vehicle Market is expected to register a CAGR of 29.7% during the forecast period.

Key Highlights

- The region holds good potential for growth. However, the precarious political situations in the region are expected to hinder the growth. For instance, in the last 12 months, Mexico, Cuba, and Brazil have elected new leaders, and Argentina is preparing for elections. Venezuela continues to face upheaval the face of Nicolas Maduro's re-election. Despite such recent developments, the region's strong economies such as Brazil, Columbia, Mexico, and Chile are expected to drive growth in various industries.

- Moreover, the region holds a significant share of automotive and food & beverage industries across the globe, especially in automotive industry countries such as Mexico and Brazil produced more vehicles than Russia and Canada.

- The growing retail industry in the region is driving organizations to automate their warehouses to optimize the process. According to Euromonitor, retail sales value in Latin America is expected to reach USD 1.07 trillion by 2022.

- Further, Brazil, which is expanding, resourceful, and demographically buoyant, is a promising market for automation. The burgeoning population of upper and middle classes in Brazil is expected to result in increased consumption rates. However, due to a rapid increase in labor costs, many business models are likely to change.

- In addition, the high initial costs and the long period of return on investment involved in the adoption of the automated systems are expected to challenge the market growth over the forecasted period. However, the added benefits and customer satisfaction associated with adopting such systems are expected to benefit the organizations.

Latin America Automated Guided Vehicle (AGV) Market Trends

Retail Industry is Expected to Hold Significant Market Share

- E-commerce share of the total retail sales from the region is expanding year on year, which is expected to increase the need for automating the warehouses even further, driving the demand for automated guided vehicles. The e-commerce share of total retail sales from the region is expected to cross 3% by 2020.

- Brazil represents about 42% of all B2C e-commerce in Latin America. Amazon, though it entered Brazil in 2012, has been only primarily dealing with books. Further, Amazon added categories, such as smartphones, notebooks, tablets, and accessories, and further fine-tuned its logistics in a few months before offering a complete product assortment in the country.

- In October 2020, Amazon announced USD 100 million logistics investment in opening new warehouses in Mexico, including its first shipping centers outside the populous capital area, to offer faster deliveries. The new sites include two fulfillment centers, one near the northern city of Monterrey and another near the central city of Guadalajara. Additionally, the company is also striving to make inroads in Brazil, where it recently opened its fifth and biggest fulfillment center in the country, with 100,000 square meters. All these investments are expected to drive the utilization of AGV in the warehouse.

- Further, many people in Mexico opting for e-commerce for their daily necessities, such as drinks, biscuits, and shampoos. The retail market is expected to experience rapid growth during the forecast period and help increase the adoption of automation in retails.

- Moreover, the consumers in the region seek shorter delivery times, increasing the application of AGV in warehouses and distribution centers. In, addition advancements in technology have made AGV's better and smaller; lower costs and shortage of labor in some places have fueled the growth of the market studied.

Brazil is Expected to Hold Significant Market Share

- Due to rapid technological advancements in robotics and automation, the manufacturing sector has witnessed increased robotics engineering and technology adoption into its production process in the country. Manufacturers consider factors such as load, orientation, speed, precision, duty cycle, travel, and environment before selecting the robot that will give the most effective and profitable results in their manufacturing plant.

- The coronavirus crisis has struck auto production around the world but hit Brazil the hardest. According to the automakers association, Anfave, Brazil's automobile production rose in June 2020 from May 2020 by 129% but remains 58% lower compared with the same month in 2019. It also expects auto production to fall by 45% in 2020 compared to a year ago, while exports will lose 53% in the same period.

- Moreover, the advent of electric vehicles and hybrid cars has revolutionized automobile manufacturing in the past decade. Automobile production has become far more sophisticated and complex. The ever-evolving government safety regulations and industry standards are further complicating the assembly line tasks.

- This has created a significant demand for automation in the automotive sector. Minimizing products damage during transit (caused by human error) and increasing the speed of handling the chassis between workstations (which would allow interaction with assembly-line workers) are receiving the utmost priority. Such trends are expected to boost the adoption of warehouse robotics across industries in the region.

- Further, advanced technology has given rise to equipment and processes that have transformed the country's food and beverage sector. The food and beverage industry has traditionally relied on human workers to handle functions like distribution and storing; robotics are being developed and implemented to streamline the process and produce more consistent output.

Latin America Automated Guided Vehicle (AGV) Industry Overview

The Latin American automated guided vehicle (AGV) market is fragmented and is home to various significant vendors depending on the location. The major vendors in the market garner a more in-depth product portfolio catering to customers' different requirements. In contrast, other vendors operate in niche segments providing customizations and customer-specific orders. Key players include Kuka Group, Schaefer Systems International Pvt Ltd, ABB Ltd., Jungheinrich Group, etc. Some of the recent developments in the market are -

- September 2020 - KUKA Group launched the KR SCARA horizontal jointed-arm robots AGV that is ultra-compact and at the same time deliver maximum cost-effectiveness. The robot reaches 500 or 700 millimeters, a short cycle time of just 0.36 or 0.38 seconds. The KR SCARA robots are ideal for pushing ahead with automation in cost-sensitive markets.

- August 2020 - Dematic has launched its new Table-Top (TT) Series of Automated Guided Vehicles (AGVs), offering high-accuracy and agile navigation for improved flexibility within the warehouse. With a unit weight of less than 500 kg and a capability to carry 1,500 kg, the new TT Series AGV is the smallest and most agile AGV in Dematic's range. TT Series AGVs are standard with a table-top lift, optional conveyor, or custom model and run on high-performance 24 V lithium batteries with automatic opportunity charging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Growth of the E-commerce Industry

- 4.2.2 Need for Automation in Maritime Applications for Improvement in Terminal Efficiency

- 4.3 Market Restraints

- 4.3.1 High Initial Investment

- 4.3.2 Limitation of Real-time Wireless Control Due to Communication Delays

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment of Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Automated Forklift

- 5.1.2 Automated Tow/Tractor/Tugs

- 5.1.3 Unit Load

- 5.1.4 Assembly Line

- 5.1.5 Special Purpose

- 5.2 By End-User Industry

- 5.2.1 Food & Beverage

- 5.2.2 Automotive

- 5.2.3 Retail

- 5.2.4 Electronics & Electrical

- 5.2.5 Pharmaceuticals

- 5.2.6 Other End-user Industries

- 5.3 Country

- 5.3.1 Brazil

- 5.3.2 Mexico

- 5.3.3 Argentina

- 5.3.4 Rest of the Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 KUKA Group

- 6.1.2 Schaefer Systems International Pvt Ltd

- 6.1.3 ABB Ltd.

- 6.1.4 Jungheinrich Group

- 6.1.5 Dematic Group (KION)

- 6.1.6 Savant Automation

- 6.1.7 Daifuku Co. Ltd

- 6.1.8 Transbotics Corporation

- 6.1.9 Aethon Inc.

- 6.1.10 Toyota Material Handling International AB

- 6.1.11 Amerden Inc.