|

市場調查報告書

商品編碼

1630165

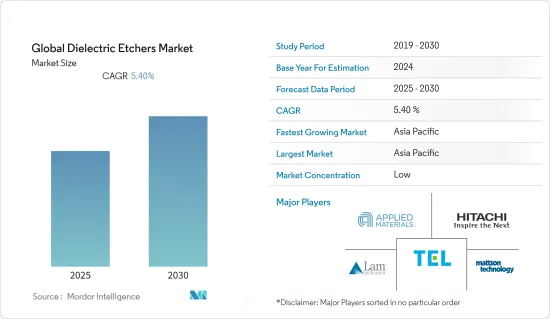

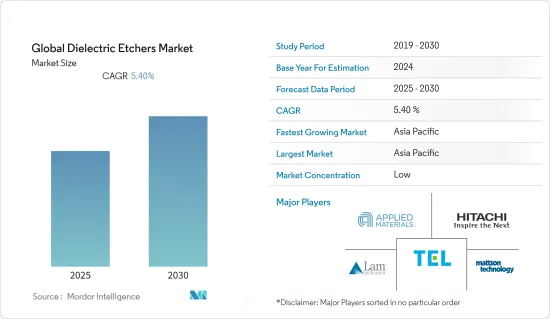

全球電介質蝕刻市場:市場佔有率分析、產業趨勢、成長預測(2025-2030)Global Dielectric Etchers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

全球介電蝕刻市場預計在預測期內複合年成長率為 5.4%

主要亮點

- 對神經型態晶片的需求不斷成長推動了 Etcher 市場對人工智慧、資料處理和分析的需求不斷成長是影響全球神經型態晶片創新和採用的關鍵因素。蝕刻技術有助於選擇性地去除晶圓上的塗層和材料以創建晶片特徵。這些程序需要透過難以去除的材料組合來創建越來越小、越來越複雜的特徵。

- 全球電介質蝕刻市場的最新趨勢是 3D IC 的出現。對消費量高速運算設備的需求不斷成長,大大推動了對3D晶片堆疊的需求。航太、汽車和醫學等領域對電子設備小型化的需求日益成長,推動了對介電蝕刻的需求,介電蝕刻可以以0-10奈米甚至原子級精度改變結構。

- 蝕刻方法還可以創建高、高長寬比的特徵,例如矽通孔 (TSV),從而實現晶片封裝和電子機械系統整合 (MEMS)。例如,Lam Research 的電漿蝕刻系統提供了建造精密結構所需的高性能和生產率,從高而窄到短而寬,直到幾埃的尺寸。

- 2021 年 5 月,應用材料公司宣布推出三款新材料工程解決方案,可實現 DRAM 擴展以及晶片性能、功耗、面積、成本和上市時間 (PPACt) 的最佳化。 DRAM 製造商正在使用應用材料公司開發的一種低介電常數材料 Black Diamond 來解決邏輯互連的可擴展性問題。

- COVID-19 的爆發在 2020 年初嚴重擾亂了供應鏈和生產。對於半導體製造商來說,影響更為嚴重,他們是半導體蝕刻設備的主要最終用戶。人手不足迫使半導體供應鏈中的許多參與者縮減或關閉業務。該產業面臨高虧損和需求增加,導致供應鏈出現巨大缺口。由於擔心汽車等關鍵產業對晶片的需求下降,病毒最初的傳播導致代工廠關閉並降低了運轉率。儘管半導體鑄造廠最初預測,隨著需求的增加,產量下降導致全球半導體短缺。

介質蝕刻市場趨勢

神經型態晶片的需求推動電介質蝕刻市場

- 神經型態晶片是受生物大腦處理能力啟發的資料處理器,可實現快速、低功耗的學習和數百萬個神經元的能力。這種晶片的尺寸夠小,可以移動,應用範圍很廣。

- 此外,基於人工智慧的新興企業的數量正在日益增加。人工智慧支援的技術需要神經型態晶片進行處理。因此,對人工智慧、資料處理和分析的需求不斷成長是影響全球神經型態晶片創新和採用的關鍵因素,預計這將推動電介質蝕刻市場。

- 對人工智慧、資料處理和分析的需求不斷成長是推動神經型態晶片在全球範圍內採用的關鍵因素,從而產生了對電介質蝕刻的需求。此外,先進智慧型設備的物聯網應用的快速技術升級預計也將增加對技術先進的半導體的需求。因此,介電蝕刻的需求預計將大幅增加。

- 由於全球經濟的數位轉型,DRAM 的需求量很大。物聯網正在邊緣添加大量運算設備,導致傳輸到雲端進行處理的資料量呈指數級成長。業界正在尋求讓 DRAM 運行速度更快、功耗更低、尺寸更小、成本更低的進步,推動市場成長。

- 智慧型手機和消費性電子市場中需要半導體 IC 的其他應用正在推動對電介質蝕刻的需求。此外,隨著物聯網(IoT)設備數量的增加,半導體產業旨在投資該技術以生產更多創新產品。

亞太地區佔比較大

- 全球整合設備製造商(IDM),包括高通、博通、NVIDIA、聯發科、蘋果和AMD,都採用了無晶圓廠經營模式。無晶圓廠經營模式使公司能夠將利潤集中在新技術的研發上,同時保持維持銷售所需的高產量。

- 台積電、聯華電子、DB Hitek 和中芯國際等組織利用代工廠根據客戶要求和產量生產晶片組。這些鑄造廠大多位於中國、台灣和韓國。

- 原子層蝕刻 (ALE) 是一種複雜的蝕刻工藝,可在淺層結構中提供出色的深度控制。隨著裝置特徵尺寸的減小,對 ALE 的需求增加,以達到提高性能所需的精度。

- 製造尖端微電子裝置需要高保真圖案轉移(蝕刻)。隨著特徵尺寸縮小到 10 nm 以下,並且新設備使用超薄 2D 材料,原子級精度變得更加重要。這導致對原子層蝕刻(ALE)的需求增加,該技術克服了原子級傳統(連續)蝕刻的限制。

- 台積電是蘋果A系列晶片的獨家製造商。該晶片組採用名為 A13 的 7 奈米晶片組製造。汽車電子產業在亞太地區也非常活躍,為市場成長提供了充足的機會。

介質蝕刻產業概況

全球介電蝕刻市場競爭非常激烈。市場高度集中,各種規模的公司林立。所有主要公司都佔有重要的市場佔有率,並致力於擴大其在全球的消費群。該市場的主要企業包括Applied Materials Inc.、Hitachi High-Technologies Corporation、Lam Research Corporation、Tokyo Electron、Mattson Technology, Inc.和Advanced Micro-Fabrication Equipment Inc.。公司正在透過建立多個夥伴關係關係和投資新產品發布來擴大市場佔有率,以在預測期內獲得競爭優勢。

- 2022 年 7 月 - Tokyo Electron 和 IBM 合作開發先進的正面 3D 晶片堆疊,無需玻璃晶圓底座並簡化流程。 IBM 和 Tokyo Electron 發現了一種為 3D 晶片製造創建矽載體晶圓的方法,沒有任何缺點。該製程使用新的 300 毫米模組進行了演示,該公司稱這是首款 300 毫米等級的 3D 堆疊矽晶片晶圓。 IBM希望其對3D晶片堆疊技術的重大投資能簡化半導體生產流程,為全球晶片短缺帶來一線希望。

- 2022 年 6 月 - Lam Research 與 SK Hynix 合作,利用乾燥抗蝕劑極紫外線技術提高 DRAM 生產成本效率。 Ram 的創新乾燥抗蝕劑製造技術是用於製造先進 DRAM 晶片的兩個關鍵製程步驟的開發工具。這種乾抗蝕劑技術由 LAM 於 2020 年推出,可提高極紫外光 (EUV) 微影的產量比率、解析度、生產率和生產率,而極紫外光 (EUV) 微影是下一代半導體製造的關鍵技術。在材料層面,Ram 的乾式抗蝕劑技術解決了 EUV微影術的最大挑戰,並實現了先進記憶體和邏輯的經濟有效的擴展。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 全球對神經型態晶片的需求

- 3D IC 的出現

- 電子設備的小型化

- 市場挑戰/限制

- 初始成本增加

第6章 市場細分

- 按類型

- 濕蝕刻

- 乾蝕刻

- 原子級蝕刻 (ALE)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他領域

第7章 競爭格局

- 公司簡介

- Applied Materials, Inc.

- Hitachi High-Technologies Corporation

- Lam Research Corporation

- Tokyo Electron Limited

- Mattson Technology

- Advanced Micro-Fabrication Equipment Inc.

- Jusung Engineering

- Oxford Instruments

- SEMES Co. Ltd.

- ULVAC, Inc.

第8章投資分析

第9章市場的未來

The Global Dielectric Etchers Market is expected to register a CAGR of 5.4% during the forecast period.

Key Highlights

- An increase in demand for neuromorphic chips will drive the market for etchers. The rising demand for artificial intelligence, data processing & analytics is a major factor influencing the innovation & adoption of neuromorphic chips across the globe. Etch techniques aid in creating chip features by eliminating coatings and materials put on the wafer selectively. These procedures entail producing increasingly small and intricate features with difficult-to-remove material combinations.

- The latest trend in the global dielectric etchers market is the emergence of 3D ICs. With the increasing demand for faster computing devices that consume less amount of energy will significantly drive the demand for 3D chip stacking. The growing need for miniaturizing electronic devices in fields such as Aerospace, Automotive & Medical sectors will drive the demand for dielectric etchers, which are capable of altering structures to a precision of 0 - 10 nm & even at an atomic level.

- Etch methods also produce tall, high-aspect-ratio features, like through-silicon vias (TSVs), which allow chip packaging and micro-electromechanical system integration (MEMS). For instance, Lam Research plasma etch systems provide high-performance and high-productivity capabilities required to build precise structures, ranging from tall and narrow, short and wide, to a few angstroms in size.

- In May 2021, Applied Materials, Inc. announced three new materials engineering solutions that enable its memory customers three new options to scale DRAM and optimize chip performance, power, area, cost, and time to market (PPACt). DRAM manufacturers use black diamond, a low-k dielectric material developed by Applied Materials, to solve logic interconnect scalability problems.

- The outbreak of COVID-19 significantly disrupted the supply chain and production during the initial phase of 2020. The impact was more severe for semiconductor manufacturers, the major end users for semiconductor etch equipment. Due to labor shortages, many players in the semiconductor supply chain had to reduce or even suspend their operations. The industry was riddled with a high deficit and increasing demand, which led to a significant supply chain gap. The initial spread of the virus led to the shutting down or reduction of foundry capacity utilization, fearing the decreasing demand for chips across major sectors, like the automotive. Diminished output led to a global shortage of semiconductors as demand increased, despite the initial estimates by semiconductor foundries.

Dielectric Etchers Market Trends

Demand for Neuromorphic Chip to Boost Dielectric Etchers Market

- A neuromorphic chip is a data processor inspired by biological brain processing ability to achieve high-speed & low power learning and constructed with capabilities of millions of neurons. The size of these chips is small enough to go mobile, and applications are broad.

- Besides, AI-based startups are increasing day by day. The technologies enabled by AI require neuromorphic chips for processing. Therefore, the rising demand for artificial intelligence, data processing & analytics is a major factor influencing the innovation & adoption of neuromorphic chips across the globe, which in turn is expected to drive the market for dielectric etchers.

- The rising demand for artificial intelligence, data processing, and analytics is a significant factor that drives the adoption of neuromorphic chips worldwide, thereby creating the need for dielectric etchers. Moreover, rapid technological upgradation of Internet of Things applications for advanced intelligent devices is also anticipated to boost the demand for technologically advanced semiconductors. This, in turn, is predicted to create significant demand for dielectric etching in the market.

- DRAM is in high demand due to the global economy's digital transition. The Internet of Things creates significant additional computer devices at the edge, resulting in an exponential rise in data that is transported to the cloud for processing. The industry needs advancements that would allow DRAM to scale down in size and cost while running at greater speeds and consuming less power, which drives the market growth.

- Smartphones and other applications in the consumer electronics market that require semiconductor ICs drive the demand for dielectric etcher. Furthermore, as the number of Internet of Things (IoT) devices grows, the semiconductor industry aims to invest in this technology to produce more innovative products.

Asia Pacific Region to Hold a Significant Share

- Integrated Device Manufacturers (IDM) such as Qualcomm, Broadcom Ltd., Nvidia, MediaTek, Apple, AMD, etc. across the globe are adopting fabless business model, where the organization will design the chipset layout and outsource the manufacturing to chipset manufacturers such as TSMC, UMC & SMIC. The fabless business model helps organizations to concentrate their efforts on investing profits in research and development of new technologies while maintaining the high production volumes needed to maintain sales.

- Organizations such as TSMC, UMC, DB Hitek, SMIC, etc. utilize their foundries to produce the chipset according to the specifications and volumes requirement of the customers. A major share of these foundries operates from China, Taiwan & South Korea.

- Atomic layer etching (ALE) is a sophisticated etching process that provides superior depth control on shallow structures. As device feature size shrinks, ALE becomes increasingly necessary to attain the accuracy required for enhanced performance.

- The production of advanced microelectronic devices requires high-fidelity pattern transfer (etching). As features drop to sub-10nm sizes and new devices use ultra-thin 2D materials, atomic-scale accuracy becomes more important. This raised the demand for atomic layer etching (ALE), a technique that overcomes the limits of traditional (continuous) etching at the atomic level.

- TSMC has been Apple's exclusive manufacturer of Apple's A-series chips. This chipset will be fabricated using a 7-nanometer chipset called A13. Besides, with automotive electronics industry flourishing exceedingly in the region, Asia-Pacific is providing a plethora of opportunities for market growth.

Dielectric Etchers Industry Overview

The Gloabl Dielectric Etchers Market is very competitive in nature. The market is highly concentrated due to the presence of various small and large players. All the major players account for a large share of the market and are focusing on expanding their consumer base across the world. Some of the significant players in the market are Applied Materials Inc., Hitachi High-Technologies Corporation, Lam Research Corporation, Tokyo Electron, Mattson Technology, Inc., Advanced Micro-Fabrication Equipment Inc., and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

- July 2022 - Tokyo Electron and IBM collaborated for the latest front 3D chip stacking that removes the need for a glass wafer base, streamlining the process. IBM and Tokyo Electron, however, have found a way to enable silicon carrier wafers for 3D chipmaking without the drawbacks. This process was demonstrated using a new 300mm module, which the companies say is the first 3D stacked silicon chip wafer at the 300mm level. IBM hopes that the considerable investments in 3D chip stacking technology can help streamline the production process of semiconductors and offer a silver lining to the global chip shortage.

- June 2022 - Lam Research collaborated with SK Hynix to enhance DRAM production cost efficiency with dry resist Extreme Ultraviolet technology. Lam's innovative dry resist fabrication technology is a development tool for two key process steps for producing advanced DRAM chips. This technology introduced by LAM in 2020, dry resist, extends the yield, resolution, productivity, and of EUV (Extreme Ultraviolet) lithography, a pivotal technology in producing next-generation semiconductors. At the material level, Lam's dry resist technology addresses EUV lithography's biggest challenges, enabling cost-effective scaling for advanced memory and logic.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Global Demand of Neuromorphic Chip

- 5.1.2 Emergence of 3D ICs

- 5.1.3 Miniaturizing Electronic Devices

- 5.2 Market Challenge/Restraint

- 5.2.1 Higher Initial Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Wet Etching

- 6.1.2 Dry Etching

- 6.1.3 Atomic Level Etching (ALE)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Applied Materials, Inc.

- 7.1.2 Hitachi High-Technologies Corporation

- 7.1.3 Lam Research Corporation

- 7.1.4 Tokyo Electron Limited

- 7.1.5 Mattson Technology

- 7.1.6 Advanced Micro-Fabrication Equipment Inc.

- 7.1.7 Jusung Engineering

- 7.1.8 Oxford Instruments

- 7.1.9 SEMES Co. Ltd.

- 7.1.10 ULVAC, Inc.