|

市場調查報告書

商品編碼

1851574

石英晶體振盪器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Quartz Crystal Oscillators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

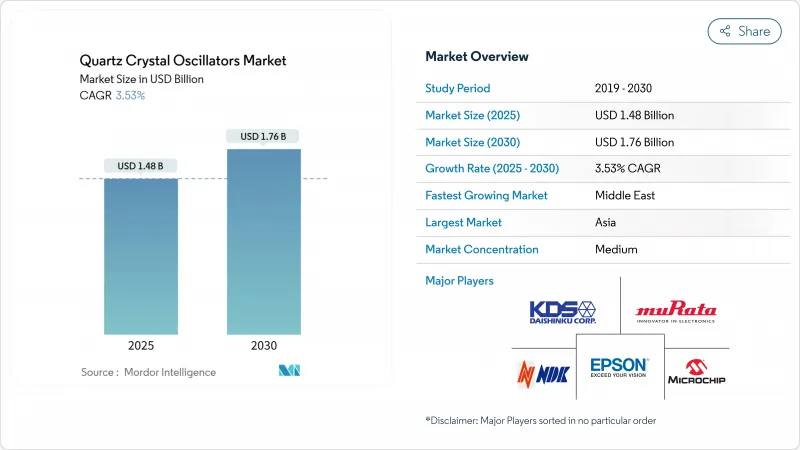

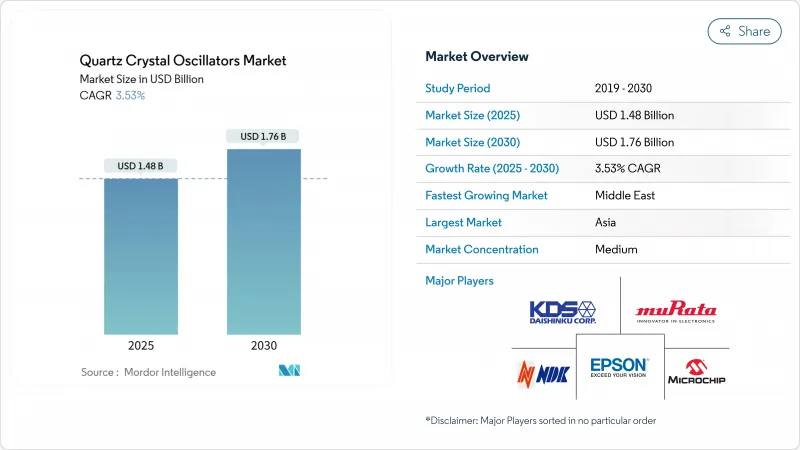

預計到 2025 年,石英晶體振盪器市場收入將達到 14.8 億美元,到 2030 年將達到 17.6 億美元。

由於智慧型手機、5G 基地台和低地球軌道衛星等對精確授時解決方案的需求不斷成長,複合年成長率保持在 3.53% 的穩定水準。

在相位雜訊、功耗和啟動時間方面,石英晶體持續優於其他競爭技術。亞太地區半導體晶圓廠的擴張、汽車電氣化的加速以及超大規模資料中心向400/800G光鏈路的遷移是推動其發展的主要因素。同時,高純度石英晶體的供應鏈衝擊以及來自微機電振盪器的競爭雖然減緩了其發展速度,但並未在高精度細分市場取代現有技術。

全球石英晶體振盪器市場趨勢及洞察

5G基地台的普及將增加對高度穩定定時的需求。

ITU-T G.8272.1 等規範規定了 ±30 ns 的精度限制,而像 Rakon 這樣的供應商正在研發小型化的 OCXO,使其能夠在 GNSS 訊號遺失時保持工作。在密集的城市環境中,每個小型基地台節點現在都整合了自己的高精度光源,隨著僅使用宏基地台的部署方式逐漸被分散式天線系統取代,對高精度光源的需求也日益成長。像 Oscilloscope OSA 5430 這樣的架構將光原子參考整合到面向未來的 5G 定時架構中,進一步凸顯了石英晶體的重要性,因為在皮秒級抖動容差至關重要的應用中,石英晶體尤為重要。

ADAS 和自動駕駛電子設備需要低抖動時鐘來源

L3級自動駕駛增加了感測器融合和即時運算的負載,這些負載必須滿足汽車乙太網路亞奈秒的反應時間要求。 Skyworks和SiTime的低抖動振盪器符合AEC-Q100和ISO 26262標準,能夠承受超過20g的振動峰值,並在常運作模式下達到低於1µW的功耗。 TDK預測電動車產量將成長27%,這意味著隨著區域ECU取代分散式架構,每個底盤的定時節點數量也將隨之增加。 PCIe連接的集中式處理器需要RMS相位雜訊低於100fs的時脈源。

基於MEMS的矽振盪器的出現將淘汰入門級SPXO。

SiTime及其幾家競爭對手目前已開始出貨可編程MEMS時鐘,這些時鐘能夠承受50,000g的衝擊,並在125 度C的高溫下工作。銷售量正蓬勃發展,SiTime累計2024年營收將達到1.44億美元,比過去十年成長七倍,這表明此類產品在對成本敏感的設計中得到了廣泛應用。然而,高性能石英晶體振盪器市場仍以具有0.18 ps rms相位雜訊、3 mA電源電流和低於100 μs啟動時間的晶體為主。

細分市場分析

到2024年,SPXO將佔石英晶體振盪器市場佔有率的36.9%,這反映出其在大眾電子產品中的廣泛應用。隨著5G無線網路、工業4.0閘道器和ADAS模組等產品將熱穩定性置於物料清單成本之上,TCXO預計將以每年4.2%的速度成長。 VCXO在光連接模組佔有一席之地,其市場規模需求與56Gbps以上鎖相環的精度直接相關。

隨著亞ppb級穩定性從核心網路轉移到邊緣節點, NDK、 Epson和Racon等公司正競相降低OCXO的功耗。 Epson的OG7050CAN比傳統裝置體積縮小85%,功耗降低56%,為OCXO滲透到機架式基頻單元鋪平了道路。同時,FCXO架構正在量子電腦測試平台中湧現,這些平台需要10⁻¹⁴的短期穩定性,而標準元件無法達到這項要求。由此導致的結果是,市場仍保持分散狀態,同時專業供應商也獲得了可觀的利潤。

隨著智慧型手機、穿戴式裝置和物聯網感測器尋求與自動拾取放置線相容的回流焊接元件,表面黏著技術封裝將在 2024 年佔收入的 81.7%。大型真空 0.5 毫米高的 SPXO 是體積效率的產業標竿。

由於國防航空電子設備和嚴苛環境機械設備更傾向於使用通孔元件,以取代能夠承受反覆熱循環的插座式元件,通孔元件的複合年成長率持續維持在3.7%。大型振盪器(也包括高階OCXO所必需的加熱控制腔)雖然市佔率較小,但盈利豐厚。供應商之間的差異化如今主要體現在電鍍化學和無鉛可焊性上,這些參數能夠保護汽車和鐵路號誌系統等設計壽命超過15年的應用市場。

石英晶體振盪器市場報告按電路類型(簡單封裝晶體振盪器 (SPXO)、溫度補償晶體振盪器 (TCXO) 及其他)、安裝類型(表面黏著技術及其他)、晶體切割方式(AT切割及其他)、最終用戶(家用電子電器、通訊與網路及其他)和地區進行細分。市場預測以美元計價。

區域分析

到2024年,亞太地區將佔全球營收的45.6%,其中中國、日本和韓國的晶片產量佔全球70%以上,也是全球頂級振盪器製造商的所在地。 SEMI預測,2025年該地區的晶圓開工量將成長7%,從而帶動測試測量台和光刻機上時序元件的普及。 NDK和Epson等傳統日本供應商憑藉其本地石英礦和垂直整合的工廠,繼續保持亞皮秒級抖動性能的領先地位。

北美正受惠於超大規模資料中心的建設和蓬勃發展的航太業。 RTX公司預計2024年營收將達到807億美元,為國防計畫提供支持,這些計畫要求為飛彈導引和安全通訊有效載荷提供抗輻射石英晶體振盪器。儘管宏觀經濟成長放緩,但德國的工業4.0措施和法國製造業的復興仍在推動成長。

中東目前市場佔有率較小,但隨著阿拉伯聯合大公國和沙烏地阿拉伯的營運商加快5G和智慧城市網路建設,預計到2030年,該地區將以3.9%的複合年成長率成為成長最快的地區。國家多元化將推動半導體組裝計畫的發展,並增加分離式時序元件的需求。拉丁美洲和非洲在5G普及方面相對滯後,因為4G仍佔據主導地位,且電子產品生產能力有限。但小型基地台的密集化和物聯網農業試點計畫表明,石英晶體振盪器市場的需求正在成長,這將支撐全球石英晶體振盪器市場的銷售成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 5G基地台的普及將增加對高度穩定定時的需求。

- ADAS 和自動駕駛電子設備需要低抖動時鐘來源

- 穿戴式裝置小型化趨勢推動了SMD和μ-Package晶體矽的採用。

- 工業4.0在棕地工廠的實施推動了工業級TCXO的應用

- 衛星衛星群將OCXO部署擴展到低地球軌道有效載荷

- 資料中心光連接模組向 400/800G 遷移推動低相位雜訊 VCXO 的發展

- 市場限制

- 基於MEMS的矽振盪器的出現將淘汰入門級SPXO。

- 高純度合成石英供應鏈的價格波動

- 設計週期超過3-5年會限制供應商的快速更換。

- 戰略航太零件出口管制

- 產業生態系分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭的激烈程度

第5章 市場規模與成長預測

- 依電路類型

- 簡易封裝晶體振盪器(SPXO)

- 溫度補償晶體振盪器(TCXO)

- 電壓調節器晶體振盪器(VCXO)

- 頻率控制晶體振盪器(FCXO)

- 恆溫晶體振盪器(OCXO)

- 其他電路類型

- 按安裝類型

- 表面貼裝

- 通孔

- 水晶切割

- AT 切割

- BT Cut

- SC 切割

- 最終用戶

- 消費性電子產品

- 電訊和網路

- 工業自動化和物聯網

- 汽車(ADAS、資訊娛樂系統、電動車動力傳動系統)

- 航太/國防

- 醫療和保健設備

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 南美洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Nihon Dempa Kogyo Co., Ltd.(NDK)

- Epson Device Corporation

- Daishinku Corp.(KDS)

- Murata Manufacturing Co., Ltd.

- Microchip Technology Inc.(Microsemi/Vectron)

- TXC Corporation

- Rakon Ltd.

- SiTime Corporation

- Epson Toyocom

- River Eletec Corp.

- Siward Crystal Technology

- Hosonic Electronic Co., Ltd.

- CTS Corporation

- NDK Quartz(Asia)

- Bliley Technologies

- KYOCERA Crystal Device

- Integral Petrovsky Plant

- Fortune Semiconductor

- ICM(International Crystal Mfg.)

- Euroquartz Ltd.

第7章 市場機會與未來展望

Quartz crystal oscillators market size revenue reached USD 1.48 billion in 2025 and is forecast to climb to USD 1.76 billion by 2030, reflecting a steady 3.53% CAGR as demand for precise timing solutions spreads from smartphones to 5G base-stations and low-earth-orbit satellites.

The measured growth underscores a maturing yet resilient landscape in which quartz continues to outperform rival technologies on phase-noise, power consumption and start-up time. Expansion of semiconductor fabs in Asia-Pacific, accelerated electrification of vehicles, and migration of hyperscale data-centres to 400/800 G optical links are the principal catalysts. At the same time, supply-chain shocks in high-purity quartz and mounting competition from MEMS oscillators moderate the trajectory yet fail to displace the incumbent technology in high-precision niches.

Global Quartz Crystal Oscillators Market Trends and Insights

Proliferation of 5G Base-Stations Elevating High-Stability Timing Demand

The shift from 4G frequency-only synchronisation to 5G's time-division-duplex architecture imposes UTC-traceable phase accuracy within +-1.5 µs, compelling operators to deploy ePRTC-grade OCXOs and TCXOs in radio heads and grandmasters.Specifications such as ITU-T G.8272.1 prescribe +-30 ns limits, encouraging vendors like Rakon to miniaturise OCXOs able to holdover during GNSS loss. Each small-cell node in dense urban layouts now embeds its own precision source, multiplying unit demand as macro-only roll-outs give way to distributed antenna systems. Solutions such as Oscilloquartz OSA 5430 integrate optical atomic references to future-proof 5G timing architectures, reinforcing quartz relevance where picosecond-level jitter tolerance is mandatory.

ADAS and Autonomous Driving Electronics Requiring Low-Jitter Clock Sources

Level-3 autonomy increases sensor fusion and real-time compute loads that must align to sub-ns windows over automotive Ethernet. Skyworks and SiTime have qualified low-jitter oscillators to AEC-Q100 and ISO 26262 standards, delivering power budgets below 1 µW for always-on domains while surviving vibration peaks above 20 g. TDK forecasts 27% electric-vehicle production growth, implying a parallel expansion in timing nodes per chassis as zonal ECUs replace distributed architectures. Centralised processors linked by PCIe demand clock sources with RMS phase-noise under 100 fs, a threshold still favouring quartz in high-reliability settings.

Emergence of MEMS-Based Silicon Oscillators Cannibalising Entry-Level SPXO

SiTime and a handful of rivals now ship programmable MEMS clocks that withstand 50,000 g shocks and operate up to 125 °C, benefits that resonate in smart-phones, action cameras and industrial IoT . Unit absorption escalated after SiTime posted USD 144 million revenue in 2024, up seven-fold in a decade, indicating broad acceptance in cost-sensitive designs. Yet quartz retains supremacy where 0.18 ps rms phase-noise, 3 mA supply current and sub-100 µs start-up dominate the specification sheet, sustaining the Quartz crystal oscillators market at the high-performance end.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturisation Trend in Wearables Fuelling µ-Package XTAL Adoption

- Industry-4.0 Retro-fits in Brown-Field Plants Boosting Industrial-Grade TCXO Uptake

- Price Volatility in High-Purity Synthetic Quartz Supply Chain

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SPXOs held 36.9% of the Quartz crystal oscillators market in 2024, reflecting their ubiquity in mass-market electronics. TCXOs, while accounting for a smaller slice today, are projected to expand 4.2% annually as 5G radios, Industry 4.0 gateways and ADAS modules place thermal-stability above BOM cost. VCXOs uphold a niche in optical interconnects where the Quartz crystal oscillators market size requirement ties directly to phase-locked loop accuracy at 56 Gbps and above.

NDK, Epson and Rakon race to shrink power draw in OCXOs so that sub-ppb stability migrates from core networks to edge nodes. Epson's OG7050CAN, 85% smaller than legacy devices yet delivering 56% lower power, signals a pathway for OCXO penetration into rack-mounted base-band units . Meanwhile, FCXO architectures surface in quantum-computing testbeds that demand 10-14 short-term stability unattainable by standard cuts. The resulting mix preserves the fragmented character of the Quartz crystal oscillators market while enabling specialist suppliers to capture outsized margins.

Surface-mount packages accounted for 81.7% revenue in 2024 as smartphones, wearables and IoT sensors pursue reflow-solderable components compatible with automated pick-and-place lines. The Quartz crystal oscillators market continues shifting toward chip-scale and µ-package footprints, with Daishinku's 0.5 mm-high SPXOs setting industry benchmarks in volumetric efficiency.

Through-hole formats still chart a 3.7% CAGR because defense avionics and harsh-environment machinery favour socketed replacements that survive repeated thermal cycling. Large-body oscillators also host heater-regulated chambers indispensable for high-end OCXOs, sustaining a profitable if narrow segment. Supplier differentiation now hinges on plating chemistry and lead-free solderability, parameters that protect installed bases across automotive and rail signalling where design lifecycles exceed 15 years.

The Quartz Crystal Oscillator Market Report is Segmented Into Circuit Type (Simple Packaged Crystal Oscillator (SPXO), Temperature-Compensated Crystal Oscillator (TCXO), and More), Mounting Type (Surface Mount, and More), Crystal Cut (AT-Cut and More), End-User (Consumer Electronics, Telecom and Networking and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 45.6% of 2024 revenue as China, Japan and South Korea manufactured more than 70% of global chips and housed tier-one oscillator makers. SEMI projects wafer starts in the region to climb 7% in 2025, translating into incremental pull-through for timing devices across test-and-measurement benches and lithography steppers. Japan's heritage suppliers such as NDK and Epson exploit local quartz mines and vertically integrated fabs to retain leadership in sub-pS jitter performance.

North America benefits from hyperscale data-centre build-outs and a vibrant aerospace sector. RTX recorded USD 80.7 billion sales in 2024, underlining defense programmes that specify rad-hard quartz oscillators in missile guidance and secure communication payloads. Europe advances industrial-automation and electric-vehicle ecosystems that favour TCXO deployments for deterministic networking; Germany's Industry 4.0 initiatives and France's manufacturing revitalisation create tailwinds despite macroeconomic slowdowns.

The Middle East, while currently holding a modest slice, registers the fastest 3.9% CAGR to 2030 as operators in the United Arab Emirates and Saudi Arabia fast-track 5G and smart-city grids. National diversification drives semiconductor assembly programmes that in turn consume discrete timing parts. Latin America and Africa lag broader adoption because 4G still predominates and electronics production remains limited, yet small-cell densification and IoT agriculture pilots hint at incremental demand that sustains global volume growth within the Quartz crystal oscillators market.

- Nihon Dempa Kogyo Co., Ltd. (NDK)

- Epson Device Corporation

- Daishinku Corp. (KDS)

- Murata Manufacturing Co., Ltd.

- Microchip Technology Inc. (Microsemi/Vectron)

- TXC Corporation

- Rakon Ltd.

- SiTime Corporation

- Epson Toyocom

- River Eletec Corp.

- Siward Crystal Technology

- Hosonic Electronic Co., Ltd.

- CTS Corporation

- NDK Quartz (Asia)

- Bliley Technologies

- KYOCERA Crystal Device

- Integral Petrovsky Plant

- Fortune Semiconductor

- ICM (International Crystal Mfg.)

- Euroquartz Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of 5G Base-Stations Elevating High-Stability Timing Demand

- 4.2.2 ADAS and Autonomous Driving Electronics Requiring Low-Jitter Clock Sources

- 4.2.3 Miniaturisation Trend in Wearables Fueling SMD and µ-Package XTAL Adoption

- 4.2.4 Industry-4.0 Retro-fits in Brown-Field Plants Boosting Industrial-Grade TCXO Uptake

- 4.2.5 Satellite Mega-Constellations Expanding OCXO Deployment in LEO Payloads

- 4.2.6 Data-Centre Optical Interconnect Migration to 400/800 G Driving Low-Phase-Noise VCXO

- 4.3 Market Restraints

- 4.3.1 Emergence of MEMS-Based Silicon Oscillators Cannibalising Entry-Level SPXO

- 4.3.2 Price Volatility in High-Purity Synthetic Quartz Supply Chain

- 4.3.3 Design-in Cycles Exceeding 3-5 Years Limiting Rapid Vendor Switching

- 4.3.4 Regulatory Export Controls on Strategic Aerospace Components

- 4.4 Industry Eco System Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Circuit Type

- 5.1.1 Simple Packaged Crystal Oscillator (SPXO)

- 5.1.2 Temperature-Compensated Crystal Oscillator (TCXO)

- 5.1.3 Voltage-Controlled Crystal Oscillator (VCXO)

- 5.1.4 Frequency-Controlled Crystal Oscillator (FCXO)

- 5.1.5 Oven-Controlled Crystal Oscillator (OCXO)

- 5.1.6 Other Circuit Types

- 5.2 By Mounting Type

- 5.2.1 Surface-Mount

- 5.2.2 Thru-Hole

- 5.3 By Crystal Cut

- 5.3.1 AT-Cut

- 5.3.2 BT-Cut

- 5.3.3 SC-Cut

- 5.4 By End-User

- 5.4.1 Consumer Electronics

- 5.4.2 Telecom and Networking

- 5.4.3 Industrial Automation and IoT

- 5.4.4 Automotive (ADAS, Infotainment, EV Powertrain)

- 5.4.5 Aerospace and Defense

- 5.4.6 Medical and Healthcare Devices

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Nihon Dempa Kogyo Co., Ltd. (NDK)

- 6.4.2 Epson Device Corporation

- 6.4.3 Daishinku Corp. (KDS)

- 6.4.4 Murata Manufacturing Co., Ltd.

- 6.4.5 Microchip Technology Inc. (Microsemi/Vectron)

- 6.4.6 TXC Corporation

- 6.4.7 Rakon Ltd.

- 6.4.8 SiTime Corporation

- 6.4.9 Epson Toyocom

- 6.4.10 River Eletec Corp.

- 6.4.11 Siward Crystal Technology

- 6.4.12 Hosonic Electronic Co., Ltd.

- 6.4.13 CTS Corporation

- 6.4.14 NDK Quartz (Asia)

- 6.4.15 Bliley Technologies

- 6.4.16 KYOCERA Crystal Device

- 6.4.17 Integral Petrovsky Plant

- 6.4.18 Fortune Semiconductor

- 6.4.19 ICM (International Crystal Mfg.)

- 6.4.20 Euroquartz Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment