|

市場調查報告書

商品編碼

1630168

虛擬安全:市場佔有率分析、產業趨勢與成長預測(2025-2030)Virtualization Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

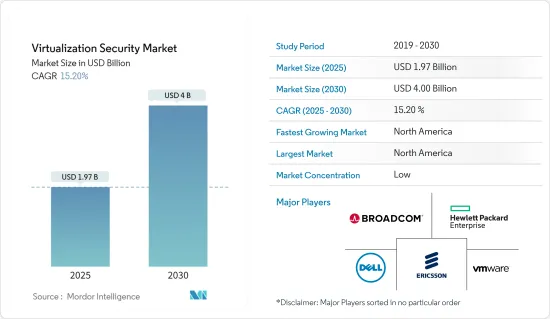

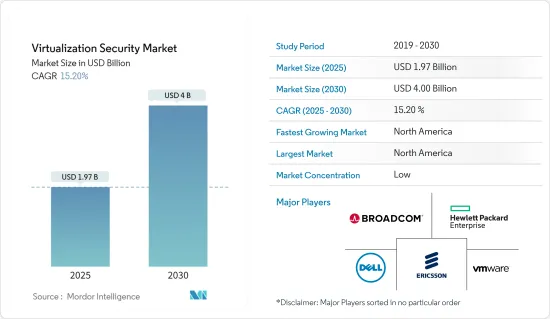

預計到 2025 年,虛擬安全市場規模將達到 19.7 億美元,預計到 2030 年將達到 40 億美元,預測期內(2025-2030 年)複合年成長率為 15.2%。

虛擬正在迅速影響 IT 和網路領域,為資料中心、企業或雲端運算投資帶來巨大的成本節約和回報。新環境很複雜,使用現有網路的虛擬方法建立新網路,並需要全新的安全方法。

伺服器負載的增加為企業帶來了許多問題。虛擬使伺服器負載管理變得更加容易,並且對組織來說既節省成本又節省時間。

虛擬減少了硬體,透過減少設備數量來提高實體安全性,最終減少資料中心的數量。因此,虛擬的採用將產生正面影響並導致虛擬安全市場的擴大。

許多因素也支持市場成長,例如提高生產力和效率的雲端安全解決方案、加密貨幣挖礦需求的增加、贖金支付的遠端存取以及主要企業活性化的研發活動。

對網路攻擊的日益擔憂、缺乏虛擬安全意識和熟練的專業人員、對駭客破壞安全層的擔憂將再次阻礙市場的成長速度。

COVID-19的爆發對虛擬安全市場的成長率產生了正面影響。這增加了對虛擬安全解決方案的需求,以保護小型企業和大型企業中的組織,以及偵測和阻止惡意軟體以降低網路攻擊和資料竊取問題的風險。

虛擬安全市場趨勢

IT 和電信預計將佔據主要市場佔有率

- 虛擬安全性可以透過在軟體中提供其功能來利用現有的安全硬體設備(例如防火牆和防毒系統)。虛擬安全還可以為資訊科技產業增添必要的安全功能。

- 市場成長的主要驅動力之一是關鍵組織資料量的不斷增加。身分詐騙案件的增加和資訊科技產業的加強正在促使產品設計者專注於新的和先進的安全技術,特別是在新興經濟體。

- 此外,使用本地軟體對於大型企業非常有用,因為它允許在企業IT基礎設施層級實施應用程式,同時提供更高的安全性。

- 網路靈活性對於通訊業者的持續成功至關重要。能夠根據客戶需求快速提高容量和效能的營運商將處於領先地位。網路需要個人化,以便領先競爭對手快速提供最好的新產品和服務,從而實現卓越的客戶滿意度。

- 電訊網路繼續包含越來越多的專有硬體設備。此外,將這些設備複雜地整合和部署到網路中以啟動新的網路服務需要額外的設備,這使得為這些設備找到容量和電源變得更加困難。這導致虛擬採用率顯著提高以及虛擬安全解決方案的大規模部署。

預計北美將在預測期內佔據主要市場佔有率

- 在美國,近年來資訊技術服務的激增顯著增加了伺服器負載。隨著IT企業之間的競爭加劇,迫切需要改進技術以獲得競爭優勢。

- 此外,組織正在將重點從基礎設施轉向資訊。成本和快速交付是組織重視的業務功能。

- 該市場的推動力是企業擴大採用多種安全措施來保護資料和系統。在預測期內,由於全國資料外洩和網路犯罪的發生率不斷增加,預計該市場將擴大。

- 此外,美國和加拿大提供虛擬解決方案的服務供應商數量不斷增加,預計將對虛擬安全市場產生重大影響。

- 隨著下一代人工智慧和機器學習解決方案的發展,該國的頂級組織和公共機構正在直接投資該技術,預計這將全部區域的虛擬安全技術製造商提供利潤豐厚的機會。

虛擬安全產業概況

虛擬安全市場是分散的,由多個大型參與者組成。目前,尚無一家公司壟斷市場佔有率。公司專注於產品創新以獲得競爭優勢。

2023 年 8 月 VMware Inc. 宣布了 VMware Cloud 的下一代演進。 VMware Cloud 為客戶提供新版本和功能,以協助最佳化、現代化和保護其組織。透過 VMware Cloud,客戶可以更快地創新、更有效率地運作、改善威脅防護並更快地從勒索軟體攻擊中復原。

2023 年 3 月,慧與同意收購 IT 營運管理公司 OpsRamp。將 OpsRamp 的混合數位營運管理解決方案整合到 HPE GreenLake 邊緣到雲端平台中,以降低在公共雲端、託管和本地營運異質、分散式、多重雲端IT基礎設施的複雜性。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

第5章市場動態

- 市場促進因素

- 快速成長的資料量推動成長

- 市場限制因素

- 初始成本高

第6章 市場細分

- 按類型

- 硬體虛擬

- 應用虛擬

- 按最終用戶應用程式

- 資訊科技與電信

- 資料中心

- 雲端服務供應商

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 墨西哥

- 巴西

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- VMware Inc.

- Broadcom Inc.

- Hewlett Packard Enterprise Development LP

- Dell Inc.

- Telefonaktiebolaget LM Ericsson

- Altor Networks

- Trend Micro Inc.

- Oracle corporation

第8章投資分析

第9章 市場機會及未來趨勢

The Virtualization Security Market size is estimated at USD 1.97 billion in 2025, and is expected to reach USD 4.00 billion by 2030, at a CAGR of 15.2% during the forecast period (2025-2030).

Virtualization has rapidly impacted the IT and network area, with enormous cost savings and returns from data centers, companies, or cloud computing investments. The new environment is complicated, and a new network has been created with virtualization approaches to existing networks, requiring an entirely new security approach.

The increased load on servers is causing a lot of problems for businesses. Virtualization makes managing your servers' load easier, which suits the organization in terms of costs and time.

Virtualization leads to hardware reductions, increasing physical security as there are fewer devices and, ultimately, fewer data centers. Therefore, adopting virtualization will have a positive impact and thus increase the market for virtualization security.

The market growth is also supported by many factors, such as cloud security solutions that improve productivity and efficiency, increased demand for crypto mining, remote access to ransom payments, and increased R&D activities carried out by key players.

Owing to the rise in concerns related to cyberattacks and a lack of awareness of virtualization security and skilled professionals, rising concerns regarding breaches in the security layers by hackers will again hamper the market growth rate.

The COVID-19 pandemic positively impacted the growth rate of the virtualization security market, owing to an increase in demand for virtualization security solutions among SMEs and large enterprises for protecting organizations and the growing need to detect and block malware to reduce the risk of cyber-attacks and data theft issues.

Virtualization Security Market Trends

IT & Telecom is Expected to Hold a Major Market Share

- Virtual security may take advantage of the functions of existing safety hardware appliances, such as firewalls and antivirus protection systems, by making them available through software. Virtualized security may also perform additional security functions essential to the information technology industry.

- One of the main drivers of market growth will be an increase in the volume of critical organizational data. The growing number of cases of identity fraud and the strengthening of the information technology industry are driving product designers to focus their efforts on new and advanced security technologies, especially in developing economies.

- Moreover, using on-premise software is helpful in large enterprises because it allows applications to be implemented at the level of an enterprise's IT infrastructure while providing greater security.

- Network flexibility is essential to the sustainable success of any telecommunications operator. The lead will be taken by operators who can quickly ramp up their capacity and performance in response to customer demands. The network needs to be personalized to deliver the best new products and services as soon as possible before the competition to achieve outstanding customer satisfaction levels.

- Telecom networks contain a continuously increasing wide array of proprietary hardware appliances. Also, the complicated integration and deployment of these appliances into networks launching a new network service requires an additional device, making finding capacity and power for those devices even more challenging. This has led to substantial adoption rates of virtualization and the massive adoption of virtualization security solutions.

North America is Expected to Hold a Major Market Share During the Forecast Period

- The server load has increased significantly due to the recent sharp increase in information technology services in the United States. Given the rising competition among IT companies, the technologies must be improved immediately to gain a competitive edge.

- Moreover, the focus of the organizations has shifted from infrastructure to information. The costs involved and shortchanging are the business functions the organizations focus on.

- Factors such as the growing adoption of numerous security measures firms take to protect their data and systems drive this market. The market is projected to increase during the forecast period, with an increasing incidence of data breaches and cybercrimes across the country.

- In addition, more service providers in the United States and Canada offering virtualization solutions are expected to impact the virtualization security market significantly.

- Developing the next generation of AI and machine learning solutions, top organizations and public authorities in this country are investing directly in technology, which is anticipated to offer remunerative opportunities for the manufacturers of virtualization security technology across the region.

Virtualization Security Industry Overview

The virtualization security market is fragmented and consists of several major players. None of the players currently dominate the market in terms of market share. Companies have been focusing on product innovation to gain a competitive advantage.

August 2023: VMware Inc. announced the next evolution of VMware Cloud, which empowers customers with new editions and capabilities that will help them optimize, modernize, and better protect their organizations. With VMware Cloud, customers innovate faster, operate more efficiently, improve threat defenses, and recover from ransomware attacks more quickly.

March 2023: Hewlett Packard Enterprise agreed to acquire OpsRamp, an IT operations management company. By integrating OpsRamp's hybrid digital operations management solution with the HPE GreenLake edge-to-cloud platform, the operational complexity of heterogeneous and dispersed multi-cloud IT infrastructures on Public Cloud, Colocations, and on-premises will be reduced.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.2.6 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Increase in Data Generated to Witness the Growth

- 5.2 Market Restraints

- 5.2.1 High Up-front Costs Involved

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware Virtualization

- 6.1.2 Application Virtualization

- 6.2 By End-user Application

- 6.2.1 IT & Telecom

- 6.2.2 Data Center

- 6.2.3 Cloud Service Providers

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Mexico

- 6.3.5.2 Brazil

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 VMware Inc.

- 7.1.2 Broadcom Inc.

- 7.1.3 Hewlett Packard Enterprise Development LP

- 7.1.4 Dell Inc.

- 7.1.5 Telefonaktiebolaget LM Ericsson

- 7.1.6 Altor Networks

- 7.1.7 Trend Micro Inc.

- 7.1.8 Oracle corporation