|

市場調查報告書

商品編碼

1630170

網路應用程式防火牆:市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Web Application Firewall - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

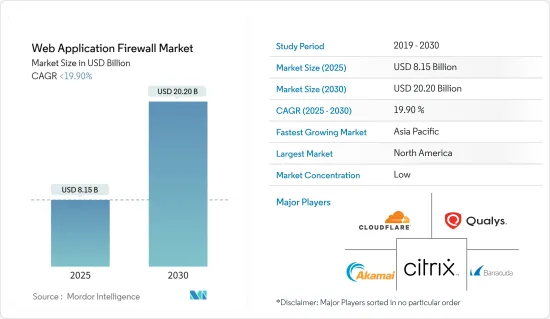

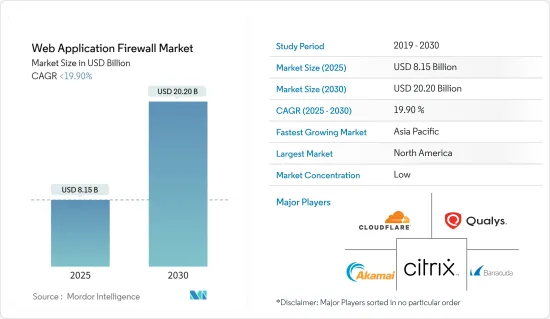

網路應用程式防火牆市場規模預計到2025年為81.5億美元,預計到2030年將達到202億美元,預測期內(2025-2030年)複合年成長率略低於19.9%。

網路竊盜和詐騙事件的增加、政府管理資料和網路安全的嚴格政策可能是市場成長背後的推動力。此外,基於網路的應用程式和服務正在改變當今商業、政府和教育中資訊交流的方式。由於資訊成本降低以及更廣泛的線上和基於網路的服務可實現內部資訊系統的更深入整合,防火牆市場變得越來越重要。

主要亮點

- 某些公司和政府法律,無論是明確的還是間接的,都強制要求採用 WAF(Web 應用程式防火牆)解決方案。例如,(PCI-DSS)是支援使用WAF的眾所周知且重要的標準。 WAF 功能以軟體或硬體形式實現,並在運行相同作業系統的設備設備或傳統伺服器上運行。

- 此外,擁有線上商務和銀行平台的組織主要使用 WAF 來確保業務安全並保護敏感的消費者資料。防火牆在醫療保健領域的越來越多的使用再次推動了市場的發展。 WAF 使用支援 Wi-Fi 的裝置和其他相關裝置來防止未授權存取關鍵醫療網路和電子病患資訊。

- 另一方面, 網路應用程式防火牆面臨兩大挑戰:成本和效能。這些工具監視應用程式層的所有傳入和傳出訊息,因此效能通常是一個問題。每個通訊協定(例如 HTTP 和 SMTP)都有代理程序,並且可能需要很長時間才能支援新的網路應用程式和通訊協定。

- 由於特殊情況,過去兩年,COVID-19 增加了對網路應用程式防火牆解決方案的需求。例如,許多公司將安全工作重點放在在家工作系統的端點保護上。此外,企業安全團隊需要更多資源來解決多個線上應用程式安全問題,從而增加了對可靠的網路應用程式防火牆的需求。

網路應用程式防火牆(WAF) 市場趨勢

雲端基礎的成長顯著

- 網路應用程式防火牆市場的發展是由雲端基礎技術的日益接受以及社交媒體平台的使用所推動的。雲端技術現已廣泛應用於各行各業,為企業提供經濟高效的安全解決方案。

- 雲端基礎的WAF 解決方案以軟體包形式提供,其中包含全面的威脅防禦技術堆疊,可針對惡意軟體、網路釣魚、勒索軟體和新興網路威脅等漏洞提供最佳防禦。即使使用者未連接到 VPN,雲端基礎的WAF 解決方案也能保護和保護您的網路 (VPN)。 WAF 提供的服務包括機器人識別和執行、存取控制、快取、威脅情報、API 安全、病毒偵測和分散式阻斷服務 (DDoS) 緩解。

- 雲端處理實現了可以隨時隨地操作的模型。此外,雲端的採用允許組織整合互補的基礎設施技術(例如軟體定義的邊界),以創建持久且安全的系統。因此,擴大使用雲端基礎的解決方案正在推動網路應用程式防火牆市場佔有率的不斷成長。

- 雲端基礎的服務的使用不斷成長,導致 WAF 解決方案的數量不斷增加,預計將在預測期內推動全球網路應用程式防火牆市場規模。此外,越來越多的合規性要求和安全法(PCI DSS)和(GDPR)正在推動全球產業的發展。

預計亞太地區對網路應用程式防火牆市場的需求將非常巨大。

- 在亞太地區,澳洲、中國、印度和日本是雲端採用率不斷提高的領先經濟體,BYOD 作為成長動力越來越受歡迎。隨著遠端和行動工作的興起以及 BYOD 趨勢,駭客正在使用私人電子郵件將目標從少數員工擴展到整個網路。隨著企業繼續向雲端策略遷移,對加密和電子郵件歸檔解決方案等新技術和創新技術的需求不斷成長,以加強網路安全。

- 此外,隨著員工地點的多樣性不斷擴大,公司正在投資強大的安全措施,推動亞太地區網路安全防火牆的成長。全部區域人口成長和生活水準提高也推動了雲端和 BYOD 技術的發展。因此,雲端和 BYOD 技術的成長預計將在未來幾年創造對網路安全防火牆的巨大需求,並預計將進一步推動亞太地區的市場。

- 由於嚴格的法律規範和 GDPR 等資料保護法,亞太地區的需求預計將以更快的速度成長。此外,雲端運算、物聯網和 5G 等技術的日益普及需要該地區創新的安全解決方案。

- 新興國家網路使用量的增加正在增加安全解決方案的採用。此外,設備無線網路的擴展所帶來的資料敏感度的提高使得網路安全性成為任何組織的關鍵要素。這些是推動亞太地區市場需求的一些關鍵因素。

網路應用程式防火牆(WAF) 產業概述

網路應用程式防火牆是一個分散的市場。目前,Web應用攻擊的數量越來越多,為玩家創造了新的空間,而現有的玩家被細分為小型、中型和大型企業等商業企業。對於中小型企業來說,競爭對手之間的敵意很高。主要參與者包括 Akamai Technologies Inc.、F5 Networks Inc.、Barracuda Networks Inc. 和 Imperva, Inc.。

- 2023 年 4 月 - Akamai Technologies, Inc. 宣布推出 Prolexic 網路雲端防火牆。這項新的 Akamai Prolexic 功能可讓客戶定義和管理存取控制清單 (ACL),同時 Akamai雲端基礎的 DDoS 防護平台可在攻擊到達應用程式、資料中心和麵向網際網路的基礎設施之前阻止攻擊,從而保證網路邊緣的安全。

- 2023 年 4 月 - Barracuda Networks 宣布與 Ingram Micro 在沿岸地區建立經銷合作夥伴關係。此次合作將使英邁國際能夠向阿拉伯聯合大公國、科威特、卡達、阿曼、巴林、也門和巴基斯坦的經銷商提供梭子魚整體電子郵件、應用雲端、網路和資料安全解決方案。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈分析

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場動態

- 市場促進與市場約束因素介紹

- 市場促進因素

- 網路竊盜、間諜活動、故意破壞和詐騙等網路攻擊增加

- 技術進步以及物聯網在各種最終用戶應用中的日益採用

- 市場限制因素

- 一體機WAF實施成本高

第6章 市場細分

- 按成分

- 解決方案

- 硬體設備

- 虛擬設備

- 雲端基礎

- 服務

- 諮詢

- 支援與維護

- 培訓和教育

- 專業服務

- 系統整合

- 解決方案

- 按組織規模

- 小型企業

- 主要企業

- 按行業分類

- BFSI

- 零售

- 資訊科技/通訊

- 政府/國防

- 衛生保健

- 能源/公共產業

- 教育

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 世界其他地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭狀況

- 公司簡介

- Akamai Technologies, Inc.

- Barracuda Networks, Inc.

- Cloudflare, Inc.

- Citrix Systems, Inc.

- Qualys, Inc.

- F5 Networks, Inc.

- Imperva, Inc.

- Fortinet, Inc.

- Penta Security Systems Inc.

- Radware Ltd.

- Trustwave Holdings, Inc.

- Nsfocus Information Technology Co., Ltd.

- Sophos Group PLC

第8章投資分析

第9章 市場機會及未來趨勢

The Web Application Firewall Market size is estimated at USD 8.15 billion in 2025, and is expected to reach USD 20.20 billion by 2030, at a CAGR of less than 19.9% during the forecast period (2025-2030).

Rising cyber theft and fraud incidents and rigorous government policies governing data and cyber security will likely drive market growth. Furthermore, web-based apps and services have changed the nature of information distribution and exchange in today's business, government, and educational sectors. The firewall market is becoming increasingly crucial for the deeper integration of internal information systems because of the low cost of information and the wide range of online and web-based services.

Key Highlights

- Whether expressly or indirectly, specific enterprise and government laws necessitate the adoption of a WAF (Web Application Firewall) solution. For example,(PCI-DSS) is a renowned and significant standard that supports the use of WAF. WAF functionality may be implemented in software or hardware and operate on an appliance device or a conventional server running the same operating system.

- Furthermore, organizations with online commerce and banking platforms primarily use WAFs to safeguard their operations and protect sensitive consumer data. Again, the rising use of firewalls in healthcare is driving the market. WAFs prevent unauthorized access to critical healthcare networks and electronic patient information using Wi-Fi-enabled equipment and other related devices.

- On the other hand, web application firewalls confront two significant challenges: cost and performance. Performance is typically challenging with these tools since they monitor all incoming and outgoing information at the application layer. Each protocol, such as HTTP and SMTP, has its proxy program, and it might take a long time for new network applications and protocols to receive support.

- Due to unusual conditions, the COVID-19 outbreak increased demand for web application firewall solutions during the last two years. Many firms, for example, centered their security efforts on endpoint protection for work-from-home systems. Furthermore, enterprise security teams needed more resources to address multiple online application security concerns, increasing the demand for a reliable web application firewall.

Web Application Firewall (WAF) Market Trends

Cloud-Based to Witness Significant Growth

- Web application firewall market development is being driven by the increased acceptance of cloud-based technologies as well as the use of social media platforms. All industries now widely use cloud technology, providing corporations with cost-effective security solutions.

- Cloud-based WAF solutions are available as software packages that comprise a comprehensive stack of threat prevention technologies that provide the best defense against vulnerabilities such as malware, phishing, ransomware, and new cyber threats. Cloud-based WAF solutions safeguard and protect the network (VPN) even when users are not connected to their VPN. Among the services they offer are bot identification and enforcement, access control, caching, threat intelligence, API security, virus detection, and Distributed Denial of Service (DDoS) mitigation.

- Cloud computing enables the model to operate from anywhere and at any time. Furthermore, cloud deployment allows organizations to integrate supplemental infrastructure technologies such as software-defined perimeters to construct durable and highly secure systems. As a result, the growing usage of cloud-based solutions propels the expansion of the web application firewall market share.

- The growing use of cloud-based services has increased the number of WAF solutions, which is expected to boost the global web application firewall market size throughout the forecast period. Furthermore, the growing number of compliance requirements and security laws (PCI DSS) and (GDPR) propel the global industry.

Asia Pacific Region Expected Significant Demand for Web Application Firewall Market

- Australia, China, India, and Japan are the leading economies in Asia Pacific due to the rising adoption of cloud, and BYOD is gaining popularity as a growth driver. With the proliferation of remote and mobile work and the BYOD trend, hackers have heightened their target from a few employees to the entire network with the help of private emails. As enterprises continue to make strategic shifts to the cloud, they have raised the demand for new and innovative methods, such as encryption and email archiving solutions, to enhance the security of their networks.

- Additionally, as the diversity in the employees' whereabouts continues to expand, the companies are investing in robust security measures, driving the growth of the APAC network security firewalls. The growing population across the region and living standards are also bolstering cloud and BYOD technology development. Thus, the growth of cloud and BYOD technology is expected to create a significant demand for network security firewalls in the coming years, which is further anticipated to drive the market in APAC.

- The demand is expected to grow at a faster pace owing to the stringent regulatory framework and data protection laws like local GDPR; Asia-Pacific is attributed to increasing investments in cyber security by organizations. Also, the increasing adoption of technologies like cloud computing, IoT, and 5G calls for innovative security solutions in the region.

- The growing internet usage in developing countries increases the adoption of security solutions. Further, due to improved data susceptibility brought on by the expansion of the wireless network for devices, network security has become a crucial component of every organization. These are some of the critical factors in the Asia Pacific region that have boosted the market demand.

Web Application Firewall (WAF) Industry Overview

The web application firewall is a fragmented market. Currently, the number of web application attacks is increasingly creating new spaces for the players, and the existing players are segmented into business enterprises as small, medium, and large sectors. The high rivalry is among small and medium players, which the competitive rivalry is high in the market. Key players are Akamai Technologies Inc., F5 Networks Inc., Barracuda Networks Inc., Imperva, Inc., etc.

- April 2023 - Akamai Technologies Inc. launched its Prolexic Network Cloud Firewall. This new Akamai Prolexic ability allows customers to define and manage their access control lists (ACLs) while providing greater flexibility to secure their network edge, where Akamai's cloud-based DDoS protection platform stops attacks before they reach applications, data centers, and internet-facing infrastructure.

- April 2023 - Barracuda Networks Inc. announced a distribution arrangement with Ingram Micro for the Gulf area. Through this partnership, Ingram Micro will be able to provide Barracuda's whole range of email, application cloud, network, and data security solutions to resellers in the UAE, Kuwait, Qatar, Oman, Bahrain, Yemen, and Pakistan.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Rising Instances of Web Attacks, Such as Cyber Theft, Espionage, Vandalism, and Fraud

- 5.2.2 Technological Advancement and Increasing Penetration of IoT Across Various End-user Applications

- 5.3 Market Restraints

- 5.3.1 High Cost of Deployment for Appliance-based WAF

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.1.1 Hardware Appliances

- 6.1.1.2 Virtual Appliances

- 6.1.1.3 Cloud-Based

- 6.1.2 Services

- 6.1.2.1 Consulting

- 6.1.2.2 Support and Maintenance

- 6.1.2.3 Training and Education

- 6.1.2.4 Professional Services

- 6.1.2.5 System Integration

- 6.1.1 Solutions

- 6.2 By Organization Size

- 6.2.1 Small and Medium-Sized Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Industry Vertical

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 IT and Telecommunications

- 6.3.4 Government and Defense

- 6.3.5 Healthcare

- 6.3.6 Energy and Utilities

- 6.3.7 Education

- 6.3.8 Other Industry Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.4.1 Latin America

- 6.4.4.2 Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Akamai Technologies, Inc.

- 7.1.2 Barracuda Networks, Inc.

- 7.1.3 Cloudflare, Inc.

- 7.1.4 Citrix Systems, Inc.

- 7.1.5 Qualys, Inc.

- 7.1.6 F5 Networks, Inc.

- 7.1.7 Imperva, Inc.

- 7.1.8 Fortinet, Inc.

- 7.1.9 Penta Security Systems Inc.

- 7.1.10 Radware Ltd.

- 7.1.11 Trustwave Holdings, Inc.

- 7.1.12 Nsfocus Information Technology Co., Ltd.

- 7.1.13 Sophos Group PLC