|

市場調查報告書

商品編碼

1630186

透明導電膜:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Transparent Conductive Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

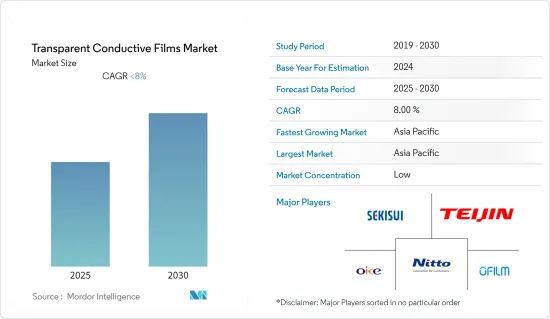

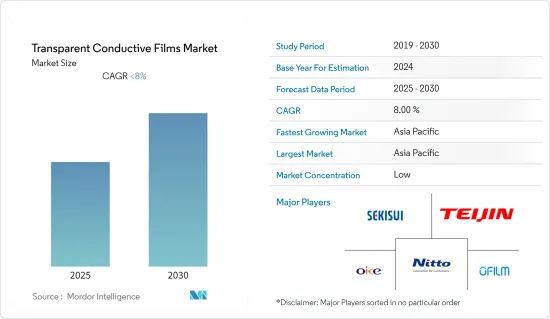

預計預測期內透明導電薄膜市場的複合年成長率將低於8%。

COVID-19 的爆發導致全球範圍內的國家封鎖、製造活動和供應鏈中斷以及生產停頓,對 2020 年的市場產生了負面影響。然而,到了2021年,情況開始好轉,市場恢復了成長軌跡。

主要亮點

- 推動市場成長的關鍵因素包括家用電子電器產業需求的增加和光電產業成長的擴大。

- 另一方面,氧化銦錫的高成本以及COVID-19對整個市場的影響所帶來的不利條件預計將阻礙所研究市場的成長。

- 透明導電薄膜生產的技術進步預計很快將為製造商提供大量機會。

- 亞太地區主導全球市場,大部分需求來自中國、韓國和日本等國家。

透明導電膜市場趨勢

玻璃上的氧化銦錫 (ITO) 佔據市場主導地位

- 氧化銦錫是一種含有不同比例的銦、錫和氧的三元組合物,根據氧含量被描述為合金或陶瓷。幾乎 45% 的銦用於製備氧化銦錫。

- 由於其光學透明性和導電性,它被廣泛用作透明導電氧化物,並且可以沉積為薄膜。

- 玻璃上的氧化銦錫透明度高,並且具有優異的導電性。從可見光區域到近紅外線區域都表現出優異的透光性。

- 玻璃上的氧化銦錫具有低微觀粗糙度、優異的表面電阻率均勻性、對紅外線波長的高反射率、優異的塗層附著力和耐磨性、低透光率等優異性能,使其成為導熱的理想材料。

- 玻璃上的氧化銦錫具有多種應用,包括 LED 和 OLED 顯示器、微結構應用、可加熱顯微鏡載玻片和醫療技術蓋玻片。我們還提供電子電路基板、觸控螢幕和觸控敏感顯示技術的光學和導電透明塗層、透明電極導電塗層、有機太陽能電池、紅外線鏡、反射式紅外線濾光片、除冰窗、有機也可以用作LED (OLED) 的陽極。

- 用於玻璃基板的 ITO 薄膜擴大用於玻璃窗以節省能源。

- 然而,不建議將氧化銦塗層持續暴露在氧氣或空氣氣氛中高於 300°F 或 150 度C的溫度下。 ITO脆且缺乏軟性,製造過程涉及高溫和真空。因此,未來幾年玻璃薄膜上ITO的需求可能會下降,因為它相對耗時且不具成本效益。

- 此外,ITO薄膜的主要材料銦是一種稀有金屬,分佈不均勻。因此,不僅存在價格上漲的風險,也存在穩定供應的風險。

- 根據日本電子情報技術產業協會(JEITA)預測,2022年全球電子資訊科技產業產值預估為34,368億美元,與前一年同期比較%。此外,預計2023年將達到3,4,368億美元,與前一年同期比較增3%。

- 在全球範圍內,對智慧型手機的需求正在顯著成長。據 Telefonaktiebolaget LM Ericsson 稱,預計 2027 年全球智慧型手機用戶數量將達到 76.9 億,高於 2021 年的 62.59 億。據信,這一因素支持了電子產品對使用透明導電薄膜的有利需求。

- 具有低薄片電阻,如金屬奈米線網格、導電聚合物、奈米碳管和石墨烯,正在積極開發以實現高速性能,預計對薄膜的需求將會很大。

中國主導亞太市場

- 以購買力平價(PPP)計算,中國是世界上最大的經濟體。然而,就名義GDP而言,它是第二大經濟強國。近年來該國經濟成長放緩,2019年GDP成長率為6%,為1990年以來該國經濟史上最慢成長。由於中國經濟的成熟以及與美國貿易緊張局勢的緊張,這一成長率正在放緩。

- 由於射出成型具有可以生產各種形狀和複雜模型的產品以適應電子產業的需求,電子產業對透明導電薄膜的需求也非常高。中國是全球最大的電子產品生產基地。中國正積極生產智慧型手機、電視、電線、電纜、可攜式運算設備、遊戲系統和其他個人設備等電子產品。

- 由於收入持續成長,中國人均可支配收入預計將上升,這將有利於中國對電子產品的需求。中等收入和高所得群體的擴大預計將推動對電子設備的需求。根據中國國家統計局的數據,家用電子電器/家用電子電器領域的銷售額預計將呈現年增率2.04%,到2025年市場規模將達到1,756.7億美元。

- 中國已啟動「中國製造2025」計畫等戰略舉措,以受益於廣泛的需求情境。根據該計劃,中國政府宣佈2030年實現產出3,050億美元的目標,滿足國內需求的80%。

- 與智慧型手機市場類似的趨勢也可以在筆記型電腦市場上看到。儘管生產轉移不像智慧型手機那麼劇烈,但許多筆記型電腦製造商正計劃將生產轉移出中國。惠普計劃將其近三分之一的產能從中國轉移到其他亞洲國家。

- 中國也希望大幅增加太陽能在其電力結構中的佔有率。預計在預測期內,該國對透明導電薄膜的需求量龐大。

- 然而,COVID-19 導致中國的電子產品需求萎縮,預計這一趨勢在預測期內和疫情後將持續下去。受這些因素影響,該行業對透明導電薄膜的需求預計將放緩。

透明導電膜產業概況

全球透明導電薄膜市場由多個全球和地區製造商細分。市場上的一些主要企業包括 Nitto Denko Corporation、OIKE &、Teijin Limited、Sekisui Nano Coat Technology 和 OFILM Group。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 家用電子電器產業需求增加

- 促進太陽能發電產業發展

- 抑制因素

- 氧化銦錫高成本

- COVID-19 疫情造成的不利情況

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 材料類型

- 玻璃上的氧化銦錫 (ITO)

- PET 上的氧化銦錫 (ITO)

- 銀奈米線

- 奈米碳管

- 導電聚合物

- 其他材料類型

- 應用領域

- 智慧型手機

- 藥片

- 筆記型電腦

- LCD 和 LED 顯示器和電視

- 穿戴式裝置

- OLED照明

- 太陽能

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Abrisa Technologies

- C3Nano

- Cambrios Technologies Corp.

- Canatu OY

- Eastman Kodak Company

- FUJIFILM corporation

- Gunze

- Hitachi Chemical Co. Ltd

- MNTech

- Nano-C

- NITTO DENKO CORPORATION

- OFILM GROUP CO., LTD.

- OIKE & Co. Ltd

- SEKISUI CHEMICAL CO.,LTD

- TDK Corporation

- TEIJIN LIMITED

- TORAY ADVANCED FILM CO. LTD

- TOYOBO Co.,LTD.

第7章市場機會與未來趨勢

- 透明導電薄膜生產技術進步

The Transparent Conductive Films Market is expected to register a CAGR of less than 8% during the forecast period.

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory.

Key Highlights

- The major factors driving the studied market's growth include increasing demand from the consumer electronics industry and augmenting growth in the photovoltaic industry.

- On the flip side, the high cost of indium tin oxide and unfavorable conditions arising from COVID-19's impact on the overall market is expected to hinder the studied market's growth.

- Technological advancements in the transparent conductive film production are expected to offer numerous opportunities for manufacturers shortly.

- Asia-Pacific dominated the global market, with most demand coming from countries such as China, South Korea, and Japan.

Transparent Conductive Films Market Trends

Indium Tin Oxide (ITO) on Glass to Dominate the Market

- Indium tin oxide is a ternary composition of indium, tin, and oxygen in various proportions, and depending upon the oxygen content, it can be described as an alloy or a ceramic. In preparation of indium tin oxide, almost 45% of indium is used.

- It is widely used as transparent conducting oxide owing to its optical transparency and electrical conductivity, and it can be deposited as a thin film.

- Indium tin oxide on glass is highly transparent and possesses excellent electrical conductivity. It offers excellent light transmittance from the visible to the near-infrared range.

- Superior properties of indium tin oxide on glass, such as low micro roughness, excellent homogeneity of the electrical surface resistance, reflection for infrared wavelengths, excellent coating adhesion and abrasion resistance, and high uniformity of optical transmittance, making it ideal for thermal conductive films.

- Indium tin oxide on glass includes various applications such as LED and OLED displays, micro structuring applications, heat-able microscope slides, and coverslips for medical technology. It can also be applied as circuit substrates for electronics, optical and conductive transparent coatings for touch screen and touch-sensitive display technology, conductive coatings for transparent electrodes, organic solar cells, infrared mirrors, reflective infrared filters, de-icing windows and anodes for organic LEDs (OLED).

- ITO thin films for glass substrates are increasingly used in glass windows to conserve energy.

- However, indium oxide coatings are not recommended for continued exposure to temperatures more than 300°F or 150°C in oxygen or air atmospheres, which may result in undesired changes in resistivity. ITO is considered brittle, lacks flexibility, and the fabrication process involves high temperatures and a vacuum. Therefore, it is relatively slow and not cost-effective, likely decreasing the demand for ITO on glass films in the coming years.

- Moreover, indium, the main material of ITO films, is a rare metal and unevenly distributed. Therefore, there is a risk in terms of stable supply, as well as the issue of increasing prices.

- According to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was estimated at USD 3,436.8 billion in 2022, registering a growth rate of 1% year on year, compared to USD 3,360.2 billion in 2021. Moreover, the industry is expected to reach USD 3,436.8 billion, with a growth rate of 3% year on year, by 2023.

- Globally, the demand for smartphones is increasing at a significant rate. According to the Telefonaktiebolaget LM Ericsson, the number of smartphone subscriptions globally was estimated to reach 7,690 million by 2027 from 6,259 million in 2021. This factor will support the favorable demand for using transparent conductive films from electronics applications.

- While there is significant work on thin metal nanowire grids, conductive polymers, carbon nanotubes, and graphene to develop transparent conducting oxides with lower sheet resistances for higher speed performance, projections still suggest a significant demand for ITO based films owing to its properties in the coming years.

China to Dominate the Asia-Pacific Market

- China is the world's largest economy in terms of PPP (purchasing power parity). However, when calculated in terms of nominal GDP, it is the second-largest economy. The country's growth slowed in the past few years, and it recorded 6% GDP growth in 2019, the slowest rate in the country's economic history since 1990. This growth rate is moderating due to the maturing of China's economy and tensions over the country's trade disputes with the United States.

- The demand for transparent conductive films from the electronics industry is also very high owing to the advantage of producing versatile shape products and complex models using injection molding that fits the electronics industry's needs. China is the largest base for electronics production in the world. China is actively manufacturing electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal devices.

- The continuous income growth resulted in a rise in the population's per capita disposable income, which is expected to benefit the demand for electronic goods in China. The expansion of the middle and high-income populations is expected to propel the demand for electronics. According to the National Bureau of Statistics of China, the revenue in the consumer electronics and household appliances segment is expected to show an annual growth rate of 2.04%, resulting in a projected market volume of USD 175,670 million by 2025.

- China embarked on strategic initiatives like the 'Made in China 2025' plan to benefit from the extensive demand scenario. Under this, the Chinese government announced its goal to reach an output of USD 305 billion by 2030 and meet 80% of its domestic demand.

- A similar trend as that in the smartphone market is also observed in the laptop market. The production shift is less drastic than that of smartphones, but many laptop manufacturers are planning to move their manufacturing bases out of China. HP is planning to move almost one-third of its capacity from China to other Asian countries.

- China is also looking to dramatically increase the proportion of solar energy in its power mix. It is expected to create a huge demand for transparent conductive films in the country during the forecast period.

- However, COVID-19 downsized the demand for electronics in China, and this trend is expected to continue even after the pandemic during the forecast period. Such factors are expected to slow down this industry's demand for transparent conductive films.

Transparent Conductive Films Industry Overview

The global transparent conductive films market is fragmented, with several global and regional manufacturers. Some key players in the market include Nitto Denko Corporation, OIKE & Co., Ltd., Teijin Limited, Sekisui Nano Coat Technology, and OFILM Group Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Consumer Electronics Industry

- 4.1.2 Augmenting Growth in Photovoltaic Industry

- 4.2 Restraints

- 4.2.1 High Cost of Indium Tin Oxide

- 4.2.2 Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Indium Tin Oxide (ITO) on Glass

- 5.1.2 Indium Tin Oxide (ITO) on PET

- 5.1.3 Silver Nanowire

- 5.1.4 Carbon Nanotubes

- 5.1.5 Conductive Polymers

- 5.1.6 Other Material Types

- 5.2 Application

- 5.2.1 Smartphones

- 5.2.2 Tablets

- 5.2.3 Laptops and Notebooks

- 5.2.4 LCD and LED Monitors and TVs

- 5.2.5 Wearable Devices

- 5.2.6 OLED Lighting

- 5.2.7 Solar Photovoltaic

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Abrisa Technologies

- 6.4.2 C3Nano

- 6.4.3 Cambrios Technologies Corp.

- 6.4.4 Canatu OY

- 6.4.5 Eastman Kodak Company

- 6.4.6 FUJIFILM corporation

- 6.4.7 Gunze

- 6.4.8 Hitachi Chemical Co. Ltd

- 6.4.9 MNTech

- 6.4.10 Nano-C

- 6.4.11 NITTO DENKO CORPORATION

- 6.4.12 OFILM GROUP CO., LTD.

- 6.4.13 OIKE & Co. Ltd

- 6.4.14 SEKISUI CHEMICAL CO.,LTD

- 6.4.15 TDK Corporation

- 6.4.16 TEIJIN LIMITED

- 6.4.17 TORAY ADVANCED FILM CO. LTD

- 6.4.18 TOYOBO Co.,LTD.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Transparent Conductive Films Production