|

市場調查報告書

商品編碼

1630188

液壓幫浦:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Hydraulic Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

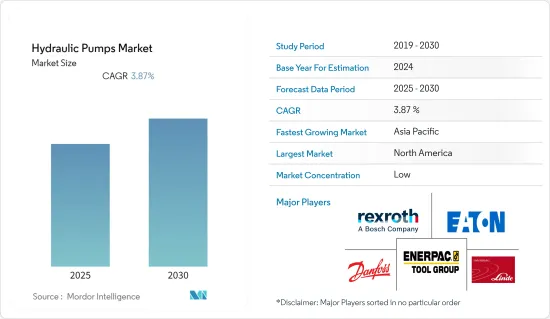

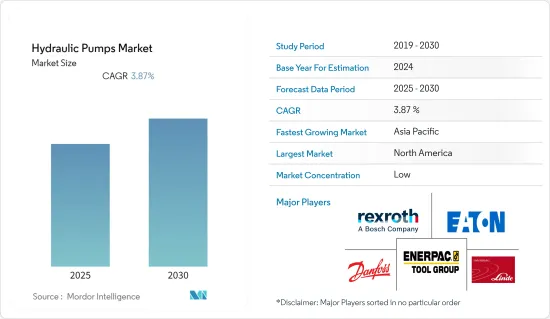

預計液壓泵市場在預測期內的複合年成長率為 3.87%。

主要亮點

- 全球能源消耗不斷成長推動了石油和天然氣行業的投資,預計這將對液壓泵市場產生積極影響。在終端用戶細節中,石油和天然氣業務正在快速擴張。此外,由於頁岩礦床的發現,北美等地石油和天然氣產業的投資不斷成長預計將推動未來市場的成長。

- 此外,液壓泵也用作汽車的動力來源。由於經濟狀況改善、汽車貸款利率較低以及對技術先進和節能汽車的關注,全球汽車銷售正在成長。汽車製造商正在韓國、泰國、墨西哥和印度等國投資建廠。

- 此外,旨在減少二氧化碳排放和提高節能意識的政府立法正在增加市場對設備的需求。OEM正在增加研發支出,以滿足市場對無磨損、無腐蝕泵和適當潤滑日益成長的需求。

- 液壓齒輪幫浦的維護成本相對較高,導致營運費用增加,這限制了企業購買新幫浦的能力,因此可能成為阻礙市場成長的限制因素。

- 汽車是液壓泵大規模應用的另一個領域,例如為汽車提供能源產出。隨著電動車(EV)的最新發展趨勢以及汽車製造中機器人的不斷引入,調查市場的範圍正在進一步擴大。中國曾經是主要製造商之一,但由於最近的美國貿易戰和COVID-19的爆發,包括汽車在內的許多製造企業將被迫轉移到印度和越南等其他南亞國家。

液壓幫浦市場趨勢

齒輪泵浦的成長

- 齒輪泵預計將在石油和天然氣行業的貨物裝卸應用中取代離心式幫浦。離心式幫浦無法輸送老化油田或非常規來源所生產的重質原油。因此,優選齒輪幫浦。

- 此外,齒輪泵預計將在石油和天然氣行業的裝卸應用中取代離心式幫浦。老化油田和非常規來源生產的原油較重,無法使用離心式幫浦送。因此,優選齒輪幫浦。

- 齒輪幫浦逐漸過渡到耐火液壓油是業界最近流行的趨勢。由於工作量龐大,經常發生線路爆管,增加火災風險。這種情況導致了對標準和品質的更高要求。

- 對於給定的排氣量,齒輪泵是最輕的並且可以承受污垢損壞。此外,齒輪幫浦的使用壽命最短,但由於更換成本低廉,因此比其他幫浦更頻繁地更換。

- 液壓齒輪泵比活塞泵和葉片泵便宜,因為它們的設計和製造相對簡單。因此,當資金成本較低時,這是一個不錯的選擇。為此,許多市場參與企業將目光投向了亞太地區對價格敏感的市場。

北美將經歷最高的成長

- 該地區的石油和天然氣行業正在強勁成長,增加了對液壓泵的需求。據美國能源情報署稱,乾天然氣產量將從 2021 年 10 月的每天 951 億立方英尺增加到去年 12 月的每天 975 億立方英尺。

- 由於頁岩氣資源的原料成本較低,石油、天然氣和化學工業正在推動投資,預計將提高液壓泵的產量。食品和飲料、水和污水行業的投資預計也將持續。

- 美國汽車工業處於技術創新的前端。最新的研發舉措正在改變產業,以更好地應對 21 世紀的機會。該國是世界上最大的汽車市場之一,擁有超過 13 家主要汽車製造商。

- 此外,該地區該設備的市場也受到 CAFE(綜合汽車排放要求)等法規和排放標準的進一步推動。製造商已簽訂各種協議來開發智慧可變流量油泵和水泵以滿足這些新標準。這些產品使引擎能夠符合最新的排放氣體標準,並且每個泵浦安裝可節省 1-5% 的燃油。

液壓幫浦產業概況

液壓泵市場分散,供應商為所有工業部門(包括農業、石油和天然氣、石油等)開發最新的液壓泵硬體。

- 2022 年 9 月 - 派克漢尼汾公司宣布,美國已為 B-52H Stratofortress 的液壓系統選擇派克的 AP15V 引擎驅動泵 (EDP)。 Parker AP15V EDP(也稱為世界泵浦)將為飛機液壓系統動力來源直至 2050 年代。 World Pump 重量減輕 10%,並提供最高的馬力重量比。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 政府法規和對二氧化碳排放的認知推動市場成長

- 市場限制因素

- 整個使用壽命期間的高維護成本是市場成長的挑戰

第6章 市場細分

- 按類型

- 齒輪

- 葉片

- 活塞

- 按行業分類

- 石油和天然氣

- 飲食

- 用水和污水

- 發電

- 建造

- 化學

- 其他行業(農業、汽車、礦業等)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Bosch Rexroth Ltd

- Eaton Corporation

- Danfoss Power Solutions

- Enerpac Tool Group

- Linde Hydraulics

- Dynamatic Technologies Ltd

- HYDAC International GmbH

- Parker Hannifin Corporation

- Kawasaki Heavy Industries Ltd

- Daikin Industries Ltd

- Bucher Hydraulics GmbH

- KYB Corporation

- Shimadzu Corporation

- Permco Inc.

第8章投資分析

第9章 市場機會及未來趨勢

簡介目錄

Product Code: 61382

The Hydraulic Pumps Market is expected to register a CAGR of 3.87% during the forecast period.

Key Highlights

- Investments in the oil and gas sector are being driven by a rise in global energy consumption, which is anticipated to have a favorable effect on the hydraulic pump market. Out of all the end-user details, the oil and gas business is expanding quickly. Additionally, the expansion of investments in the oil and gas sector in places like North America is anticipated to fuel future market growth due to the finding of shale deposits.

- Additionally, hydraulic pumps are used in automobiles to produce the energy needed to power them. Global auto sales are rising due to improving economic conditions, cheap auto loan rates, and a greater emphasis on technologically advanced and fuel-efficient vehicles. Automobile producers are investing in setting up factories in nations including South Korea, Thailand, Mexico, and India.

- Moreover, government laws aimed at reducing CO2 emissions and growing awareness of energy conservation have increased market demand for the equipment. The OEMs are increasing their R&D spending in response to the increase in market demand for wear- and corrosion-free pumps and appropriate lubrication.

- As the hydraulic gear pumps have relatively high maintenance costs that lead to increased operating expenses limiting the firm's ability to purchase the new pumps, hence can act as a restraining factor that hampers the market growth.

- Automotive is another sector where hydraulic pumps find massive applications, like energy generation, to run vehicles. With the recent trend of electric vehicles (EV) and the growing robot adoption in automotive manufacturing, the studied market scope is further expanding. Although China was one of the major manufacturers, the recent US-China trade war and COVID-19 outbreak forced many manufacturing companies, including automotive, to shift to other South Asian countries like India and Vietnam.

Hydraulic Pumps Market Trends

Gear pumps to Witness the Growth

- In the oil and gas industry, gear pumps are also anticipated to take the place of centrifugal pumps for loading and unloading applications. Centrifugal pumps cannot move the heavier crude oil generated from aged oil fields and unconventional sources. Gear pumps are therefore preferred.

- Moreover, Gear pumps are expected to replace centrifugal pumps in the oil and gas industry for loading and unloading applications. As the crude oil produced from aging oil fields and unconventional sources is getting heavier, centrifugal pumps cannot pump them. Hence, gear pumps are preferred.

- The progressive switch to fire-resistant hydraulic fluids in gear pumps is a recent trend gaining popularity in the industry under study. Due to the tremendous workload, lines frequently burst, which raises the fire risk. Such occurrences have increased higher standards and quality demand.

- For a given displacement, gear pumps are the lightest and can withstand dirt damage. Additionally, gear-type pumps have the shortest service lives, yet they are changed out more frequently than the others due to their affordable replacement costs.

- Due to their relatively straightforward design and manufacturing, hydraulic gear pumps are less expensive than piston and vane pumps. As a result, they are a good option when capital expenses are low. Due to this, numerous market participants have set their sights on the Asia-Pacific region's price-sensitive market.

North America to Witness the Highest Growth

- The oil and gas industry is witnessing robust growth in the region, strengthening the need for hydraulic Pumps. According to the US Energy Information Administration, dry natural gas production will increase from 95.1 billion cubic ft per day in October 2021 to 97.5 billion cubic ft per day by December last year.

- The oil, gas, and chemical sectors are encouraged to invest thanks to lower feedstock costs caused by natural gas from shale resources, which is anticipated to push the hydraulic pump mt. It is expected that investments will continue in the food, beverage, water, and wastewater industries.

- The US automotive sector is at the innovation forefront. Latest research and development initiatives are transforming the industry to better respond to the opportunities of the 21st century. The country is one of the largest automotive markets in the world and is home to over 13 major auto manufacturers.

- Also, the market for this equipment in the region is further driven by regulations and emission standards, like Combined Automotive Fleet Emissions Requirements (CAFE). Manufacturers have entered into various agreements to develop intelligent variable flow oil and water pumps to meet these new standards. These products will enable the engine to be emissions-compliant with the latest standards and will also provide fuel savings in the range of 1-5% per pump installation.

Hydraulic Pumps Industry Overview

The Hydraulic Pumps Market is fragmented, with suppliers developing the newest hydraulic pump hardware to serve all industry verticals, such as agriculture, oil & gas, petroleum, and others.

- September 2022 - Parker Hannifin Corporation announced the US air force's selection of Parker to supply its AP15V engine-driven pump (EDP) for the hydraulic system of the B-52H Stratofortress. The Parker AP15V EDP, also known as the World Pump, will help power the aircraft's hydraulic system through the 2050s, whereas the World Pump is 10% lighter, delivering the highest horsepower-to-weight ratio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Regulations and Awareness Towards CO2 Emission is Driving the Market Growth

- 5.2 Market Restraints

- 5.2.1 High Maintenance Cost Over the Entire Lifespan is Challenging the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Gear

- 6.1.2 Vane

- 6.1.3 Piston

- 6.2 By End-user Vertical

- 6.2.1 Oil and Gas

- 6.2.2 Food and Beverage

- 6.2.3 Water and Wastewater

- 6.2.4 Power Generation

- 6.2.5 Construction

- 6.2.6 Chemicals

- 6.2.7 Other End-user Verticals (Agriculture, Automotive, Mining, etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bosch Rexroth Ltd

- 7.1.2 Eaton Corporation

- 7.1.3 Danfoss Power Solutions

- 7.1.4 Enerpac Tool Group

- 7.1.5 Linde Hydraulics

- 7.1.6 Dynamatic Technologies Ltd

- 7.1.7 HYDAC International GmbH

- 7.1.8 Parker Hannifin Corporation

- 7.1.9 Kawasaki Heavy Industries Ltd

- 7.1.10 Daikin Industries Ltd

- 7.1.11 Bucher Hydraulics GmbH

- 7.1.12 KYB Corporation

- 7.1.13 Shimadzu Corporation

- 7.1.14 Permco Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219