|

市場調查報告書

商品編碼

1630190

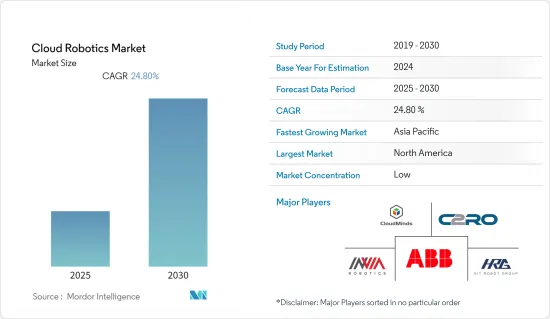

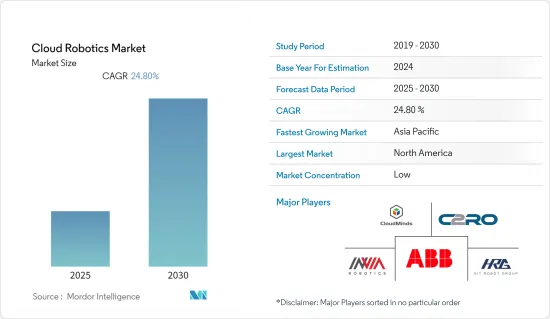

雲端機器人 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Cloud Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

雲端機器人市場預計在預測期內複合年成長率為 24.8%

主要亮點

- 在預測期內,雲端基礎的人工智慧和連接可能會顯著推動雲端機器人市場的發展。許多科技巨頭開發了廣泛使用的基於人工智慧的系統。因此,這些廠商對機器人市場的投資也將帶來新的雲端機器人解決方案的創新。

- 機器人、遠端操作、MEC 和核心雲端技術的整合有望改變各行業的業務營運、工業流程和消費者服務。雲操作以及地面和空中機器人將極大地支援專用和通用機器人領域。在後一個例子中,我們相信,隨著最終用戶使用自主和遠端操作的機器人來執行各種個人服務業務,普及率將會增加。

- 雲端機器人市場預計將產生更廣泛的機器人服務。這包括多種好處,包括更靈活的服務執行、減少操作摩擦(由於專有介面減少)以及雲端基礎的應用程式範例中的機器人即服務 (RaaS) 提高經濟效益。最初,工業和政府客戶將受益最多,其次是某些關鍵產業領域的公司。雲端機器人市場最終將只向有限數量的客戶開放。

- 機器人公司正在努力提高技術感知和理解工作環境的能力,並發展適應移動中動態操作情況的能力。這種情境察覺是透過整合感測器和機器學習來實現的。

- 智慧型設備的日益普及、頻寬的發展以及雲端流服務的興起也促進了連網機器人市場的成長。 GSMA 預測,到 2025 年,物聯網連接設備數量將達到約 251 億台,高於 2017 年的 75 億台。這為互聯機器人及其平台市場帶來了巨大的機會。

- 主要市場參與企業正在全球推出新的解決方案,增強雲端機器人市場的未來成長機會。例如,2021年2月,HPE發布了HPE Open RAN解決方案堆疊,實現了Open RAN在全球5G網路中的大規模商業實施。 HPE Open RAN 解決方案堆疊包括 HPE編配和自動化工具、特定於 RAN 的基礎設施設計以及通訊業者最佳化的設備。

- 由於許多公司因封鎖而減少了員工,並且越來越多的公司需要集中監控來控制各種工業設備,因此對雲端機器人的需求正在增加。因此,工業化程度的提高和自動化要求的提高增加了對雲端機器人的需求。此外,製造業不斷成長的需求以及醫療和化學行業對機器人和自動化解決方案快速成長的需求正在推動市場擴張。

雲端機器人市場趨勢

工業機器人需求不斷成長推動市場成長

- 隨著雲端運算、巨量資料等新技術的發展,雲端技術與機器人系統的融合將使得高效能、高複雜度的多機器人系統的設計成為可能。物聯網的滲透和機器人技術投資的增加對工業機器人技術的成長做出了重大貢獻。

- 國際機器人聯合會表示,全球機器人安裝量正在迅速恢復,使 2021 年成為機器人產業 (IFR) 歷史上最成功的一年。 “持續的自動化趨勢和持續的技術創新已將所有行業的需求推向高水準。” 」

- 此外,工業機器人的銷售也大幅回升。全球出貨量達到創紀錄的 486,800 台,與前一年同期比較成長 27%。亞洲/澳洲的需求增幅最大,安裝量成長 33%,達到 354,500 台。美洲銷量為 49,400 輛,成長 27%。在歐洲,銷量為 78,000 輛,實現了 15% 的兩位數成長。

- 由於智慧工廠系統的採用,工業機器人在過去十年中出現了巨大的需求。隨著工業機器人的發展,程式設計機器人在即時應用、準確性、穩健性、相容性等方面都達到了較高的性能水準。

- 中小型產業小批量、經濟高效的解決方案的可用性正在影響工業自動化的採用。除此之外,透過將機器人、機器和自動化設備連接到雲端,製造商可以從其自動化系統中獲得最高水準的效能和執行時間。

亞太地區實現顯著成長

- 亞太市場的推動因素是最終用戶擴大採用雲端運算以及機器人和自動化技術。該地區,特別是中國、印度和日本,擁有世界上最高的自動化採用率。

- 中國是亞太地區公有雲的最大投資者。本地IaaS市場已成為中小企業建立遊戲、視訊、行動網際網路IT資源的首選。

- 隨著下游製造業的復甦以及鋰電池、新能源汽車等產品產量的擴大,預計中國工業機器人將快速成長。

- 過去八年,中國已成為全球最大的工業機器人市場。根據工業信部發布的五年規劃,預計2021年至2025年我國機器人產業營業收入將以每年20%的速度成長。

- 對先進汽車製造的需求不斷成長正在推動美國和中國公司之間的機器人夥伴關係。這很可能有助於中國發展雲端服務並進一步開發亞太雲機器人市場。

- 該地區的主要參與企業正在投資開發機器人雲端解決方案。例如,2021年4月,達闥科技宣布完成總額超過1.53億美元的B+輪資金籌措。這家總部位於上海的服務機器人公司表示,將繼續開發住宅用的人形模型。

- CloudMinds 還聲稱正在利用雲端運算為零售、教育、醫療保健和酒店業開發服務機器人。該公司的產品包括輪式人形機器人「XR-1服務機器人」、安全機器人「Cloud Patrol」和SoftBank Robotics的人形機器人「Cloud Pepper」。這些是透過 RaaS(機器人即服務)範例提供的。

- 此外,新加坡的 ASORO 實驗室也建構了雲端運算基礎設施來產生環境的 3D 模型。這使得機器人能夠比實驗室中的電腦更快地同時定位和繪製地圖。

雲端機器人產業概況

雲機器人市場較為分散。整體而言,現有競爭對手之間的競爭是溫和的。此外,我們預期大公司和新興企業之間會進行以創新為重點的收購和合作。

- 2021 年 11 月 - 智慧自動化產品、數位解決方案、技術和業務流程管理 (BPM) 領域的全球公司 Datamatics 宣布,Western Bainoona Group (WBG) 已成功採用 Datamatics TruBot 機器人流程自動化 (RPA) 解決方案。 WBG 是中東和非洲著名的工程和建設公司。在 RPA 和物聯網 (IoT) 實施的早期階段,四個關鍵業務已數位化,實現平穩、無錯誤的資料和支付處理流程。

- 2021 年 6 月 - 慧與宣布收購 Defined AI。這家總部位於舊金山的公司使用開放原始碼機器學習 (ML) 平台提供強大且有彈性的軟體堆疊,用於訓練任何規模的人工智慧模型。透過將 Defined AI 獨特的軟體解決方案與世界領先的 AI 和高效能運算 (HPC) 服務相結合,HPE 使幾乎所有行業的 ML 工程師都能夠開發和訓練機器學習模型,資料產生更快、更準確的見解。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 利用市場促進因素和市場限制因素

- 市場促進因素

- 雲端技術的興起

- 各種最終用戶對機器人技術的採用增加

- 市場限制因素

- 安全和隱私問題

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章技術概況

第6章 市場細分

- 依產品

- 軟體

- 按服務

- 按用途

- 工業機器人

- 服務機器人

- 按最終用戶產業

- 製造業

- 軍事/國防

- 零售/電子商務

- 醫學生命科學

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Hit Robot Group Co. Ltd

- ABB Ltd

- inVia Robotics Inc.

- C2RO Cloud Robotics

- CloudMinds Technologies Co. Ltd

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Rapyuta Robotics Co. Ltd

- Tend AI Inc.

- V3 Smart Technologies PTE Ltd

第8章投資分析

第9章 市場機會及未來趨勢

簡介目錄

Product Code: 61413

The Cloud Robotics Market is expected to register a CAGR of 24.8% during the forecast period.

Key Highlights

- The cloud-based AI and connectivity are likely to significantly shape the cloud robotics market's development over the forecast period. Many technology giants have developed AI-based systems that are being widely used. Hence, the investment by these vendors in the robotics market will also innovate new solutions for cloud robotics.

- The convergence of robots, teleoperation, MEC, and core cloud technologies is poised to alter enterprise operations, industrial processes, and consumer services across various industry verticals. Cloud operations and terrestrial and aerial robots will significantly assist the purpose-built and general-purpose robotics segments. In the latter instance, mass consumerization will occur when end-users acclimate to autonomous and remote-control robots for a wide range of personal services tasks.

- The cloud robotics market will give birth to a greater range of robotics services. This is due to various variables, including significantly more flexible service execution, lower operational friction (due to fewer proprietary interfaces), and improved economics via robotics-as-a-service in a cloud-based application paradigm. Initially, industrial and government clients will profit the most, followed by enterprises in specific leading industry sectors. The cloud robotics market will eventually become available to customers in a limited capacity.

- Robotics businesses are working to improve their technology's ability to sense and understand their work settings and cultivate the ability to adjust to dynamic operational conditions on the go. This situational awareness is made possible by integrating sensors and machine learning.

- Increasing adoption of smart devices, the evolution of bandwidth, and rising cloud streaming services are also owing to the growth of the connected-robots market. The GSMA predicted that by 2025, there would be around 25.1 billion IoT-connected devices, which was 7.5 billion in 2017. This offers a massive opportunity for connected robots and their platform market.

- The key market players are globally coming up with new solutions, which enhance the future growth opportunities for the Cloud Robotic market. For instance, in February 2021, HPE announced the HPE Open RAN Solution Stack, enabling the commercial implementation of Open RAN at scale in global 5G networks. The HPE Open RAN Solution Stack contains orchestration and automation tools from HPE, RAN-specific infrastructure designs, and telco-optimized equipment.

- Lockdowns reduced the number of workforces in numerous businesses, which increased demand for cloud robotics as more and more companies need centralized monitoring to take control of diverse industrial instruments. Thus, growing industrialization and an increase in automation requirements increased the demand for cloud robotics. Furthermore, the growing need for manufacturing industries, as well as the spike in demand for robotics and automation solutions in the healthcare and chemical industries, fuel market expansion.

Cloud Robotics Market Trends

Rising Demand for Industrial Robotics to Augment the Market Growth

- With the development of cloud computing, big data, and other emerging technologies, the integration of cloud technology and robotic systems allows for designing multi-robot systems with high performance and high complexity. Growing penetration of the IoT and investments in robotics have been the major contributors to the growth of industrial robotics.

- According to the International Federation of Robotics, robot installations worldwide have recovered rapidly, making 2021 the most successful year in the robotics industry's history (IFR). "Demand reached high levels across industries due to the ongoing trend toward automation and continued technological innovation." Even the pre-pandemic record of 422,000 installations per year in 2018 was broken in 2021."

- Furthermore, Industrial robot sales have made a significant comeback. A new high of 486,800 units was shipped globally, a 27% increase over the previous year. Asia/Australia witnessed the greatest increase in demand, with installations increasing 33% to 354,500 units. With 49,400 units sold, the Americas climbed by 27%. With 78,000 units installed, Europe had a double-digit increase of 15%.

- Industrial robotics have been witnessing a huge demand over the past decade, owing to the adoption of smart factory systems. With the development of industrial robots, programmed robots have reached high-performance levels in real-time applications, accuracy, robustness, and compatibility.

- The availability of small-capacity and cost-effective solutions from small-and medium-sized industries is influencing the adoption of industrial automation. Apart from this, connecting robots, machines, and automation equipment to the cloud allow manufacturers to unlock the highest levels of performance and uptime from their automation systems.

Asia-Pacific to Witness a Significant Growth

- The market in Asia-Pacific is driven by the growing penetration of cloud computing, coupled with the incorporation of robotics and automation among the end-users. The automation adoption rate in this region, especially in China, India, and Japan, is the highest globally.

- China is the biggest spender on public cloud in the Asia-Pacific region. The local IaaS market is the first choice for small- and medium-enterprises for IT resources construction in games, video, and mobile internet.

- Industrial robots are predicted to increase rapidly in China as the downstream manufacturing sector recovers and the production of lithium batteries, new energy vehicles, and other industries expand.

- For the past eight years, China has been the world's largest market for industrial robots. According to a five-year plan released by the Ministry of Industry and Information Technology, China's robotics industry's operating revenue is predicted to rise at a 20 percent annual pace from 2021 to 2025.

- The growing demand for advanced automotive manufacturing drives robotics partnerships between the United States and Chinese companies. This may help China advance cloud services, which will likely further develop the Asia-Pacific cloud robotics market.

- The key players in this region are investing in developing robotic cloud solutions. For instance, In April 2021, CloudMinds Technology Inc. announced a Series B+ round of funding totaling more than USD 153 million. According to the Shanghai-based service robotics company, it will continue to develop humanoid models for residential use.

- It also stated that CloudMinds develops service robots for retail, education, healthcare, and hospitality that employ cloud computing. Its products include the wheeled humanoid XR-1 Service Robot, the Cloud Patrol security robot, and Cloud Pepper, a SoftBank Robotics humanoid. It has made them available through a robotics-as-a-service (RaaS) paradigm.

- Furthermore, ASORO labs of Singapore built a cloud computing infrastructure to generate a 3D model of the environment. This allows robots to perform simultaneous localization and mapping much faster than the labs' computers.

Cloud Robotics Industry Overview

The Cloud Robotics market is fragmented. Overall, the competitive rivalry among existing competitors is moderate. Moreover, acquisitions and collaboration of large companies with startups are expected, focusing on innovation.

- November 2021 - Datamatics, a global Intelligent Automation Products, Digital Solutions, Technology, and Business Process Management (BPM) Company, announced the successful adoption of its Datamatics TruBot Robotic Process Automation (RPA) Solution at Western Bainoona Group (WBG). WBG is a prominent engineering and construction firm in the Middle East and Africa (MEA). Four important activities were digitalized during the initial stage of RPA and Internet of Things (IoT) implementation to ensure a smooth and error-free data and payment processing flow.

- June 2021 - Hewlett Packard Enterprise has announced the acquisition of Determined AI. This San Francisco-based business provides a powerful and resilient software stack for training AI models at any scale using its open-source machine learning (ML) platform. HPE will combine Determined AI's unique software solution with its world-leading AI and high-performance computing (HPC) services to enable ML engineers in practically every industry to develop and train machine learning models to generate faster and more accurate insights from their data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Prominence of Cloud Technology

- 4.3.2 Increasing Adoption of Robotics across Various End Users

- 4.4 Market Restraints

- 4.4.1 Security and Privacy Concerns

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Software

- 6.1.2 Service

- 6.2 By Application

- 6.2.1 Industrial Robot

- 6.2.2 Service Robot

- 6.3 By End-user Industry

- 6.3.1 Manufacturing

- 6.3.2 Military and Defense

- 6.3.3 Retail and E-commerce

- 6.3.4 Healthcare and Life Sciences

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hit Robot Group Co. Ltd

- 7.1.2 ABB Ltd

- 7.1.3 inVia Robotics Inc.

- 7.1.4 C2RO Cloud Robotics

- 7.1.5 CloudMinds Technologies Co. Ltd

- 7.1.6 Google LLC

- 7.1.7 IBM Corporation

- 7.1.8 Microsoft Corporation

- 7.1.9 Rapyuta Robotics Co. Ltd

- 7.1.10 Tend AI Inc.

- 7.1.11 V3 Smart Technologies PTE Ltd

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219